U.S. Dollar Strength to Continue Until Inflation Beast is Quelled

Brett Saldarelli, Economist | 416-542-0072

Date Published: July 5, 2023

- Category:

- US

- Financial Markets

Highlights

- The U.S. dollar had an incredible run throughout much of 2022 as the Federal Reserve embarked on its historic rate hiking cycle to curtail the worst bout of inflation in forty years.

- With inflation pressures proving more persistent than anticipated, global central banks are poised to continue their rate hiking campaigns and keep policy rates higher for longer.

- The cumulative tightening of central banks will slow global economic activity, with the most deleterious effects in Europe, where central banks will remain in tightening mode for longer. Heightened uncertainty and relative U.S. economic outperformance is likely to push the trade-weighted dollar higher over the remainder of this year.

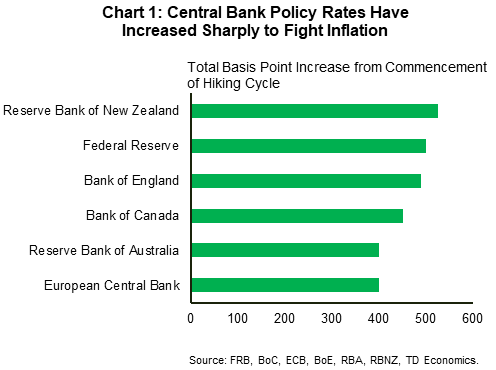

After a slow response to accelerating inflation, central banks have spent the last two years playing catch up with rapid increases in policy rates. The Federal Reserve has been one of the most aggressive, raising the federal funds rate from the zero lower bound to a range of 5.0%-5.25%, before pausing in June (Chart 1).

The Fed’s front-loaded rate increase led to hefty gains in the U.S. dollar against most major currencies over the course of last year. However, as other central banks caught up, the trade-weighted dollar retreated and has spent most of this year moving sideways.

This may be about to change. The swift actions of global central banks have started to show progress in bringing down inflation, but the job is not yet done. Wringing the remaining inflation out is likely to require a meaningful weakening in economic growth, with countries facing the stickiest price growth paying the highest costs. As recession fears mount, American economic outperformance in combination with the dollar’s safe-haven status is likely to lead to newfound U.S. dollar strength over the second half of this year.

Central Banks’ Job is Not Quite Done

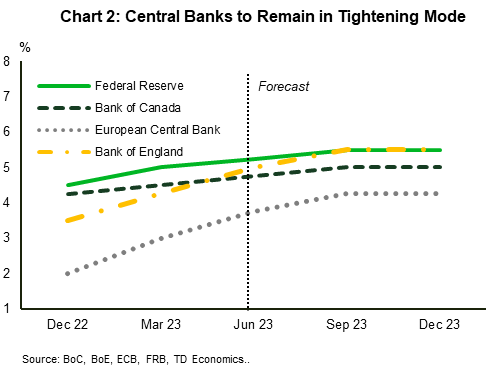

Central banks are poised to remain in tightening mode for the remainder of the year, with relatively more hikes in store from central banks in Europe and the UK, which have made slower progress on curtailing price pressures (Chart 2).

The Fed’s aggressive rate hikes to date mean it is close to the end of its journey. After pausing in June, the Federal Reserve is likely to raise the federal funds rate just one more time. This is as much a testimony to the resilience of economic activity in the face of higher interest rates as it is to stubborn inflation. Activity in several interest-rate sensitive sectors, most notably the U.S. housing sector, has accelerated in recent months.

Elsewhere, after pausing its rate hiking campaign in March, the Bank of Canada (BoC) surprised financial markets with a 25-basis point (bps) hike in June, responding to higher-than-anticipated inflation. The BoC is likely to administer one additional rate hike, though a pullback in inflation in May makes this a close call.

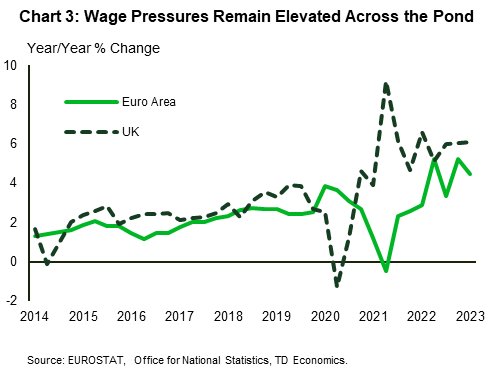

Across the pond, inflation in both the UK and euro area has proven to be more persistent than in North America with much of the retreat in the headline number coming from falling energy prices. Policy makers face an additional obstacle in curtailing price pressures with wage growth remaining elevated (Chart 3).

All this points to the European Central Bank (ECB) and the Bank of England (BoE) continuing their tightening campaigns longer than either the Fed or the BoC. We expect three additional rate hikes from the ECB, while the BoE will continue to be the most aggressive central bank even after surprising markets with a 50-bps hike at its June meeting.

Cloudy Economic Outlook Will Benefit the Greenback

With central banks at different points in their fight against inflation, the impact of additional tightening is likely to vary across countries. Economies that have been more resilient to the cumulative effects of central bank tightening and made the most progress in reducing inflation, are better positioned to withstand additional rate hikes.

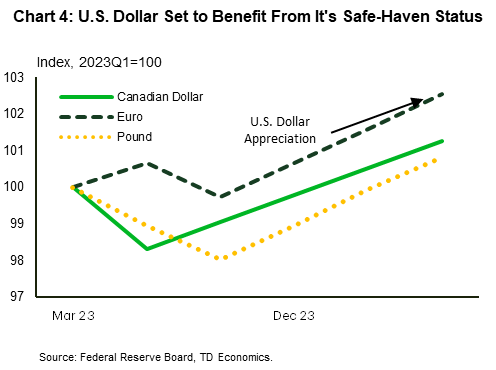

The euro area is starting from a position of weakness, with real GDP having contracted in the final quarter of 2022 and the first quarter of 2023. While higher energy costs strained consumers wallets earlier this year, higher borrowing costs will exert further drag on economic growth. The euro area faces additional headwinds through trade channels as concerns over the economic recovery in China – one of its main trading partners, continue to mount. The uncertainty surrounding the euro area is likely to be reflected in a period of near-term weakness in the euro against the U.S. dollar (Chart 4).

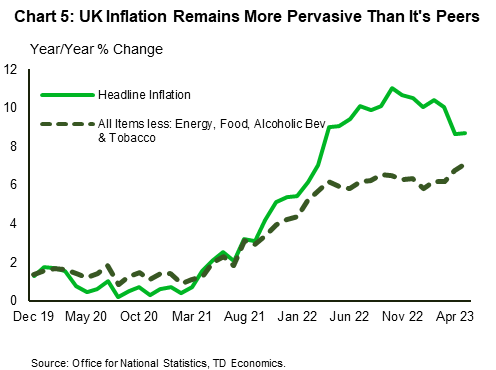

The story in the UK is also dour, with inflation remaining more pervasive than its peers and underlying price pressures reaching their highest levels since 1992 (Chart 5). Economic growth has slowed markedly and is expected to remain muted as the BoE pushes forward with additional rate hikes. The economy could face additional headwinds from rising mortgage costs that could put further stain on consumers. All told, softening economic growth in the UK will likely spell near-term downside risk for the pound against the dollar.

The Canadian dollar (CAD), meanwhile, looks set to extend the trend of near-term weakness against the dollar. While the aggressive actions of the BoC cushioned the CAD’s slide against the greenback, heightened global uncertainty and flight-to-safety flows are likely to benefit the U.S. dollar against the loonie over the next year.

Bottom Line

The performance of the dollar over much of 2022 was a classic case of textbook economics where relatively higher U.S. interest rates bolstered the dollar. While the dollar retreated from its 2022 highs as other central banks joined the fight against inflation, the higher interest rate environment has created headwinds for the global economy that are unlikely to abate any time soon. In this environment of heightened global uncertainty, flight-to-safety inflows are likely to push the dollar higher. Only once economic uncertainty abates is the dollar likely to see some reversal.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: