Are Stablecoins a Risk to Financial Market Stability?

Vikram Rai, Senior Economist | (416)-923-1692

Date Published: June 1, 2022

- Category:

- US

- Financial Markets

Highlights

- Crypto assets have grown rapidly over the last two years but remain small relative to other assets.

- The market for crypto assets initially appeared very segmented from traditional markets, but during the 2020-2021 period, crypto assets showed higher correlations with stock markets.

- The expanding crypto market creates spillovers to other asset markets and the wider economy. Moreover, efforts to mitigate risk for crypto asset holders seems to necessarily involve increasing the linkages between crypto and traditional asset markets.

Background

A frequent client question these days centers on the array of crypto assets popping up in the news. What’s the distinction between cryptocurrencies and stablecoins, and what’s their ability to upend financial market stability? These issues are especially pressing as crypto assets show several times more volatility than the movements experienced by the S&P500.

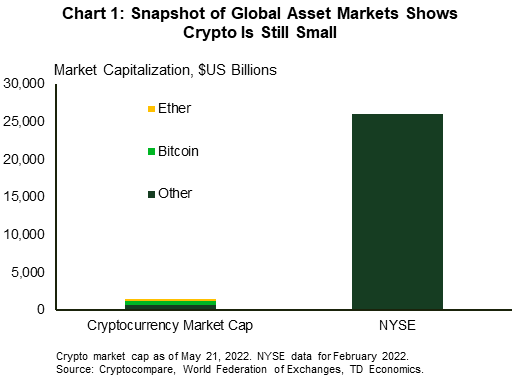

Cryptocurrencies are digital or virtual assets that are secured by some form of cryptography and use distributed ledger (e.g., “blockchain”) technology. Or, simply put, they are not reliant on a central authority to underpin its value or existence and is difficult to counterfeit or duplicate. The most famous of these is Bitcoin, which currently has a market capitalization of around US$ 540 billion. It is also the largest cryptocurrency within an overall market with a cap of an estimated US$ 3 trillion at its peak in November 2021.1 Crypto assets have declined in value substantially since reaching that peak, to around $US 1.3 trillion.2

This may seem large, but crypto assets still pale in comparison to other asset classes, such as stocks listed on the New York Stock Exchange (Chart 1). More broadly, the market capitalization of all publicly listed domestic companies was $93 trillion in 2020, according to the World Bank, making crypto assets around 1-2% of equity assets despite their tremendous growth over 2020 and 2021.

Crypto-assets: what sets them apart?

Although cryptocurrencies are a tradeable digital asset or can be a medium of payment, they have been highly volatile, as both investor enthusiasm for these assets and their relative supply have fluctuated greatly since their inception. Their high volatility is potentially an impediment to their use as a store of value or payment method.

Enter stablecoins, the asset meant to offer protection from this volatility in the crypto ecosystem. Stablecoins are designed, as their name suggests, to offer a stable medium of exchange. By design, their value is pegged to an external reference -- typically, the US dollar. These assets offer a method of storing value on crypto exchanges and facilitate trading in other cryptocurrencies.

Terra, which garnered a lot of attention in the public discourse in recent weeks following its stunning loss in value, is an example of a stablecoin. It was not, however, the largest stablecoin. Tether, currently the largest, has a market capitalization of around $76 billion. The next largest stablecoin, USD Coin, has a market cap of $52 billion. At its peak, the market cap of Terra was around $18 billion, which would have placed it in the top ten of crypto assets overall by market cap.

The events surrounding Terra in recent weeks bring to the fore the risks to financial markets from stablecoins and crypto assets more broadly. In this note, we provide an overview of some of these risks. Our focus is not on the risk to investors in crypto assets or other stablecoins specifically, but ways in which those risks could spill over to other assets.

For stablecoins, confidence is key

Many analogies can be made between stablecoins and assets in the traditional financial system. One way to think about stablecoins is that they are like a currency issued by a country trying to maintain a fixed exchange rate, or a peg to the dollar. We know from experience with exchange rate pegs that the simplest way for an issuer to maintain a peg is to hold as reserves assets equal to the currency in circulation. This way, the issuer can always promise to be able to honour the fixed exchange rate. Indeed, this sort of collateralization is how Tether, the largest stablecoin, is structured.

If the defining feature of stablecoins is “convertibility at par,” that is, that they can always be exchanged for a fixed value, then a few other comparisons come to mind.

We also have money market funds, which typically invest their holdings into highly rated short-term debt and maintain convertibility at par, paying very low interest. Investors generally treat money market funds as near cash equivalent. The promise of convertibility at par is supported by a belief that the funds are invested in only the most stable assets. However, unlike money market funds, stablecoin issuers and exchanges do not always disclose what assets they use as collateral.

Convertibility at par, that is, that you can always take out exactly what you put in, is the defining feature of bank deposits – but unlike bank deposits, there is no insurance for deposit holders. If a crypto exchange or stablecoin issuer is unable to offer convertibility at par to all those seeking redemption, asset holders would simply take losses. This risk is low if there is liquidity in the market, but it grows as more investors are motivated to seek redemption. This is akin to the time before bank deposits were insured, where a loss of confidence would spark a “run on bank deposits”. Depositors would redeem their deposits en masse and the result before deposit insurance was frequent bank failures.

Confidence is thus the key in managing redemption risk and maintaining convertibility at par. If investors have confidence in the peg, then the risk of redemptions exceeding what is offered by other investors or the issuer itself is low. If investors lose confidence, the asset can quickly spiral to having no value.

Crypto risks less theoretical now

The collateral approach to gaining confidence employed by Tether and other stablecoins still leaves some questions and sources of risk. For example, in mid-2021, Tether appeared to be an oversized player in the commercial paper market, leading some to question as to whether those assets could be sold without deflating their price.

The other approach taken by stablecoins is to use an algorithm to modify its supply to ensure it maintains a stable value. But because the unbacked crypto-asset has no intrinsic value, this type of algorithmic scheme relies heavily on confidence. This was roughly the premise behind Terra, which collapsed in value earlier in May.

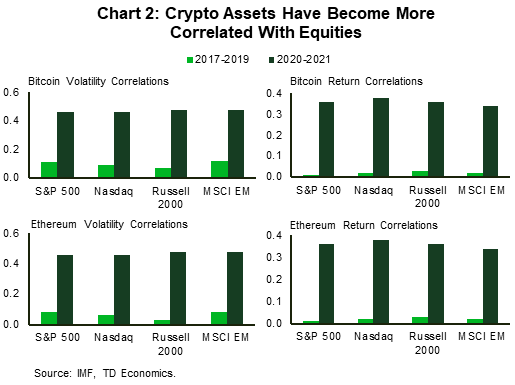

This offers a glimpse of the inherent risk of a crypto asset, but if what happens in these markets stays in these markets, it is not a source of risk for the broader financial system or economy. But as crypto assets grew in size and popularity, it does appear that crypto market returns and volatility have become more correlated with equity markets in recent years (Chart 2). Bitcoin and Ethereum, the two largest crypto assets by market cap, showed a higher correlation with equity markets over 2020 and 2021 than they had before. While this trend may not hold up in 2022, it shows the potential for what happens in crypto markets to have an impact on asset classes.3

Further heightening these risks is that stablecoins are used as collateral for leveraged trading in other crypto assets. A collapse in the value of a stablecoin then has at least two direct, negative effects – the issuer must sell whatever assets were being used to back the stablecoin to support its value, and the retail investor who is struggling to meet their margin requirement may also have to liquidate their balance sheet.

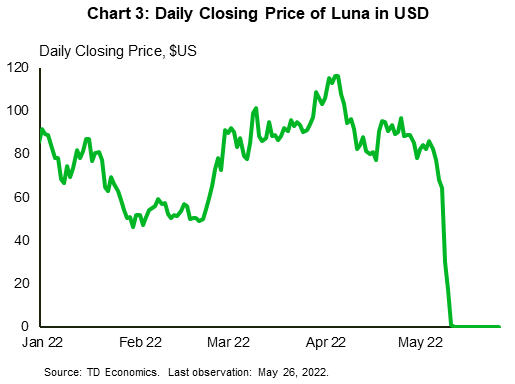

This hypothetical sequence of events played out to some extent when Terra collapsed in value earlier in May. Its sister cryptocurrency, Luna, which was meant to adjust as needed to provide a stable value for Terra, collapsed in price on May 11, as shown in Chart 3, and it appears there were some spillovers to other asset markets.4

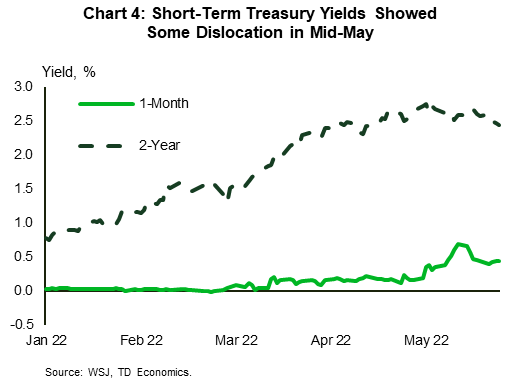

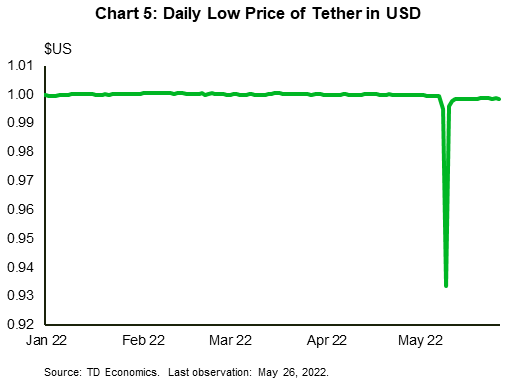

In Chart 4, we compare the yield on “off-the-run” or already outstanding Treasury bills with a 1-month maturity to two-year Treasury yields. These are the Treasury bills closest to maturing. During this time, some commentators noted that the dislocation in mid-May in 1-month Treasury bills wasn’t reflected in longer term yields, as would normally be the case if it were related to changing expectations for monetary policy. For short-term yields, that is usually the driving factor, and its absence in this case suggests some factor specific to these near-cash markets was at play.5 It is possible that some of the efforts to maintain the pegs of both Terra and the larger Tether during this period had an impact on the price of short-term treasury bills. In Chart 5, we see that Tether briefly lost its peg during intra-day trading meaningfully around the same time.

How is possible that such a small market might have noticeable spillovers to larger markets? We would make two observations. The first is that, in the event of a panic-driven run on a stablecoin like we observed with Terra, an enormous share of the stablecoin in circulation is affected; in fact, likely all of it is. In comparison, the market for Treasury bills is generally liquid, but outstanding short-term bills that are soon to mature do not always have high trading volume. It is therefore possible to see these spillovers. The second is that there is a sentiment factor and secondary effects. Investors may sour on other assets during a run that hurts their net worth. Knock-on effects from this point become possible, especially when the stablecoins were used for leveraged trading. The loss of net worth can force investors to sell other assets to meet their cash needs.

If this event were to be repeated in the future, particularly in the event of an even larger stablecoin, there is real risk that this would lead to broader market volatility and economic harm.

We would also note at this point that efforts by crypto-asset issuers to buttress the asset class necessarily increase linkages to the traditional financial system, either by drawing in more retail investors, often with leveraged exposure, or by issuing crypto-assets backed by assets in the traditional financial system, as is the case with Tether today.

Conclusion

Recent years have seen extraordinary growth in the size of crypto markets, and especially rapid growth of stablecoins. These markets have always been volatile and risky, but their small size has offered some comfort that they may remain segmented from other markets. Their rapid growth in size, complexity, and in linkages with other asset classes makes this increasingly likely. Going forward, efforts within these markets to supply assets that manage risks for their holders will, if successful, increase their spillovers to other asset classes. Given this, it is no surprise that the US Federal Reserve is currently undertaking a review of the risks surrounding cryptocurrencies and stablecoins, and that Treasury Secretary Janet Yellen has called for crypto markets to be regulated. We expect that there will continue to be significant attention from investors and regulators alike for the crypto market.

End Notes

- https://www.imf.org/en/Publications/global-financial-stability-notes/Issues/2022/01/10/Cryptic-Connections-511776

- https://coinmarketcap.com/charts/

- https://www.imf.org/en/Publications/global-financial-stability-notes/Issues/2022/01/10/Cryptic-Connections-511776

- In brief, the premise of the algorithmic stablecoin Terra was that one Terra could always be exchanged for a quantity of its sister cryptocurrency, Luna, equal in value to one US dollar. The algorithmic component relied on the value of Luna adjusting to maintain the par relationship. Needless to say, this mechanism required investors to have confidence in Luna having value at all.

- https://www.bloomberg.com/news/articles/2022-05-12/crypto-stress-is-feeding-the-wider-selloff-in-global-markets?

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: