Choppy Waters for the Barrel - Crude Oil Update

Marc Ercolao, Economist | 416-983-0686

Date Published: May 6, 2025

- Category:

- US

- Commodities & Industry

Highlights

- Crude oil markets have turned convincingly bearish over the past couple of months, with the balance of risks still pointing to more downside.

- OPEC+ decided to accelerate output hikes for a second consecutive month, adding to global oil oversupply fears.

- President Trump’s direct and ongoing targeting of China continues to add uncertainty to oil markets. Global oil demand expectations are grinding lower as recession fears continue to mount.

- Slowing U.S. shale growth, ongoing geopolitical risks, and more accommodative U.S. monetary policy are other forces pushing and pulling on the near-term oil outlook.

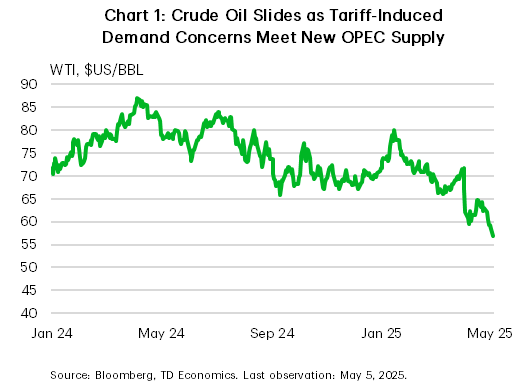

Oil prices continue to be pressured lower as erratic U.S. trade policy weighs on global economic growth at the same time that OPEC+ is boosting global oil supply. The price for WTI crude has shed over 20% since early last month to almost $55/bbl (Chart 1), the lowest level in over four years. With the oil outlook shifting more bearish since our March economic update, we’ve trimmed our 2025 WTI forecast to an average of $62/bbl (previously $67/bbl), before prices likely regain some slight traction in 2026. Canadian benchmark prices (WCS) are facing similar fortunes, though tightening differentials to WTI suggest some relative outperformance in heavy, sour crude markets.

Even at this juncture, we see the balance of near-term risks around our baseline forecast tilted to the downside, especially with the deepest impact of the trade war expected over the next six months. Moreover, the downward revision to the 2025 price outlook masks a sharp uptick in volatility of late in line with other risk assets. The current $55-60/bbl trading range is likely to remain in place until markets receive more clarity around the tariff picture and OPEC supply plans for the second half of the year.

OPEC+ Production Policy Shift; U.S.-China Tariff Tensions Paving Bearish Oil Path

OPEC+ Unwinding Past Production Cuts

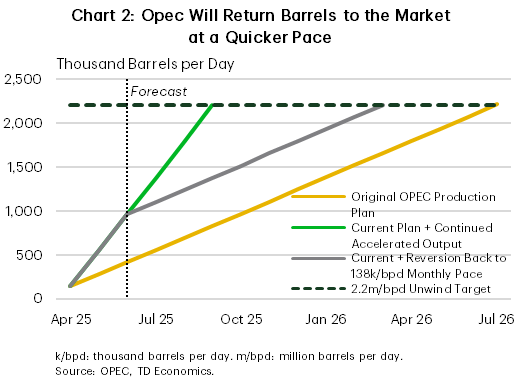

OPEC+ is bringing barrels back to the market at a faster clip than previously anticipated. At their May 3rd meeting, OPEC agreed to another accelerated production hike of 411k barrels per day (bpd) in June. For reference, the group’s original plan laid out in March called for a 138k/bpd monthly output increase, unwinding the 2.2 million/bpd in past production cuts over an 18 month span. That pace was tripled to 411k/bpd for the month of May at a meeting one day after Trump’s reciprocal tariff announcement on April 2nd. All told, nearly 1 million/bpd of cut easing is expected in just a three month window. What’s more, sustaining this pace of output production would put the group on track to unwind past cuts almost one-year earlier than originally planned (Chart 2), though guidance past the June production decision has not been given.

The decision to accelerate production to this degree comes at a peculiar time given the souring outlook for global economic growth and an already weak oil pricing environment. Saudi Arabia, the de-facto leader of the oil cartel, reported that it’s able to sustain today’s lower oil prices and have no intention of boosting markets with further output cuts. The shift in thinking represents a major change for the oil giant, who for several years was targeting triple-digit oil prices. The group is moving onto the offensive and is now looking to recapture market share that’s been ceded to U.S. shale and other major producers. The Saudi’s may also be trying to enforce quota discipline, especially on overproducing members like Kazakhstan and Iraq.

U.S.-China Tariff Tensions

Trump’s direct and ongoing targeting of China continues to add uncertainty to oil markets. At the same time, various surveys and activity monitors peg U.S. recession odds at around 50%, a figure poised to increase in the absence of global trade-related improvements. This has prompted the three major oil watching agencies–OPEC, IEA, and EIA–to trim their oil demand forecasts over the past several months. These demand estimates range from 1.3 million/bpd on the high end (OPEC) to 730k/bpd on the low end (IEA).

In the case of China, a prolonged trade war could shave another 200-300k/bpd off an already modest ~700k/bpd growth projection in oil demand, putting further pressure on global balances and prices. China’s petrochemicals sector would bear the brunt of this hit given its heavy fuel usage. On the U.S. side, oil demand growth directly impacted by tariffs could see a dent of 150k/bpd spread over various sectors.

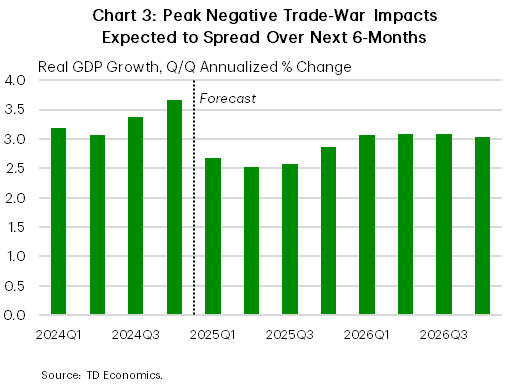

As it stands, the U.S. has imposed a punishing 145% tariff of Chinese imports (with some carve outs), with China responding to the tune of 125% on U.S. goods. Both sides appear open to de-escalate trade disputes, though no material progress has been made. To reflect current developments, we’ve downgraded our 2025 real GDP growth forecasts for both the U.S. and China, with the outlook susceptible to further downward revisions. In our base-case, we expect peak trade-war impacts to spread over the next 6 months (Chart 3), keeping oil demand and prices suppressed before slightly improving thereafter.

Oil Markets to Face Larger Surplus

Prior to Trump’s inauguration and OPEC’s stance shift, oil markets were expected to be fairly balanced throughout 2025 with the potential to dip into slight surplus territory (100-200k/bpd) over the second half of 2025. The pending surplus may now be pushed significantly higher as a result of OPEC’s expedited production plans and the ongoing trade war–to potentially over 1 million/bpd–with oversupply extending into 2026. OPEC has communicated that they can pause or reverse course on the decision to ramp up output, but we only see that as a likely outcome if oil prices fall under $50/bbl on a sustained basis combined with a build in global inventories.

Other variables outlined in the remainder of this report will act as push-pull counterforces for the oil market in the near term.

A U.S. Shale Boom? Not So Fast

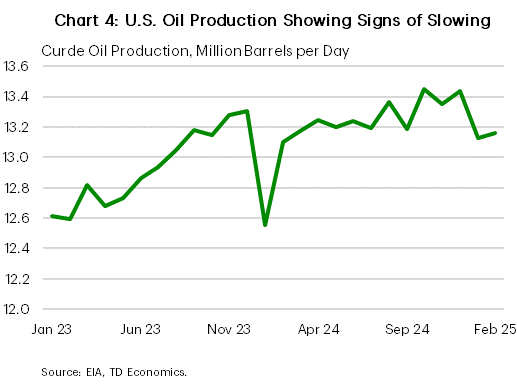

The current macro backdrop will likely stifle Trump’s plans to boost oil production. Indeed, drilling in the U.S. shale patch will not be the same as it’s been in past years. U.S. oil production growth in 2023 came in at a nearly 1 million/bpd, while growth in 2024 averaged an impressive 13.2 million/bpd. However, production in January and February 2025 slowed to ~13.1 million/bpd, the lowest level in a year (Chart 4), pointing to potential troubles over the coming months.

Our 2025 U.S. annual supply forecast calls for a modest increase of 250-300k/bpd, but this now faces downside risk. For one, the per-barrel breakeven price for new well drilling likely exceeds current prices, especially once corporate dividend payments and debt-servicing costs are included. In fact, a recent Dallas Federal Reserve Survey found that some oil producers need an average price of $65/bbl to profitably drill in key regions. If oil prices fail to strengthen in the near-term, the argument for even slower U.S. production growth in 2025 becomes stronger. In a recession scenario, we’d expect U.S. shale growth to flatline or even outright contract, which could limit negative price impacts by offsetting some of the increased production from OPEC.

Canadian Oil – Down But Certainly Not Out

Canada’s energy sector is not immune to the current economic headwinds, but it is still decently positioned for continued output growth and increased capital spending, albeit at a more moderate pace. Last year, the increase in pipeline egress via the Transmountain Pipeline Expansion (TMX), helped boost total Canadian oil production growth to around 250k/bpd, or 5% year-on-year (y/y). Current guidance from key oil producers Alberta, Saskatchewan, and Newfoundland points to cumulative Canadian production growth of a more modest 2%, or around 100k/bpd, slightly below historical levels.

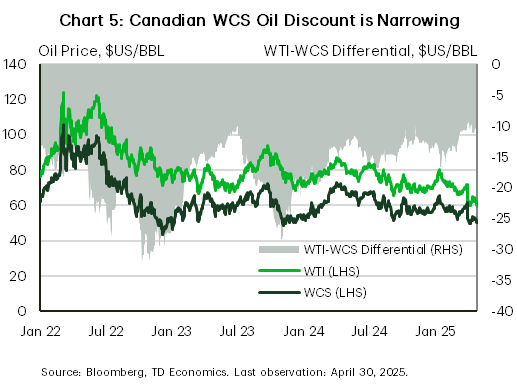

Canada’s energy sector has been a target of Trump’s tariffs, with a 10% tariff rate being applied on non-compliant USMCA energy exports. Presumably, given the nature of energy extraction, the majority of Canadian oil exports will be classified as USMCA-compliant and receive a tariff exemption. Even with the persistent threat of tariffs, WCS prices have performed surprisingly well. In recent weeks, the discount to WTI prices has narrowed to under $10/bbl, almost $5/bbl better than historical averages (Chart 5). This narrowing reflects better pipeline capacity, more demand for heavy crudes, and a likely pricing-out of tariff risk. Combined with a recent strengthening of the Canadian dollar, the narrowing spread should help offset the revenue blow from lower WTI prices. Canadian producers will still face difficulties in production planning, especially if U.S. demand begins to ease, but a lower breakeven advantage–estimated at under $50/bbl–should keep activity moving in the oil patch.

Geopolitics–A Mixed Bag for Supply Risk

Geopolitical risk continues to linger as US lawmakers push for severe sanctions on Russia and continued crackdowns on Iranian and Venezuelan oil. The Trump administration is leveraging sanctions as a means to negotiate and ink global trade and peace deals. This matters, as targeted jurisdictions export oil in quantities large enough to materially sway global oil balances in either direction should sanctions be enforced or eased.

A U.S.-Iran nuclear deal is front and center, with active negotiations under way. Though some minor progress has reportedly been made, Trump recently doubled down on his “maximum pressure” policy against Iran, stating that any country purchasing oil or petrochemical products from Iran would be subject to secondary sanctions. For now, this would negatively impact China, the largest importer of Iranian oil, and exacerbate the trade war with the U.S. It is still too early to know the final outcome, but in the event of a successful negotiation, the presumed easing of Iranian oil export sanctions is enough to cap any pricing gains especially with added uncertainty elsewhere in the market.

Meanwhile, sanctions on Russian oil are in a state of flux. Former President Biden imposed hefty sanctions on Russian oil exports before leaving office, which negatively impacted oil export flows from the region. These sanctions remain in force, but the Trump Administration appears to be more lenient on its enforcement – evidenced by the almost half of Russia vessels on the U.S. blacklist regularly routing oil to key Chinese and Indian buyers. With all of that said, President Trump is considering more and stiffer sanctions against Russia if they don’t cooperate in peace talks, which could remove significant quantities of Russian oil from markets if enforced.

More Accommodative U.S. Monetary Policy May Help

Investors remain cautious amid rising price volatility and the direction of US monetary policy. On the former, oil prices have swung $15/bbl since “Liberation Day”, one of the largest one-month price swings since the early stages of the 2022 Russia-Ukraine war. While volatility is likely to remain the watchword in the coming months, our assumption of some clarity around tariffs and stability by H2-25 should help to improve sentiment and financial flows, likely helping prices gain slight traction.

Meanwhile, the sharp increase in U.S. inflation expectations and larger-than-expected tariffs have the Federal Reserve (Fed) concerned about the lasting impacts to inflation. At the same time, the outlook for U.S. economic growth has deteriorated relative to our mid-March forecast. We’ve modified our Fed call to include an additional interest rate cut, where we now expect a total of three cuts in 2025. On the margin, more accommodative monetary policy could offer a positive counterbalance to a near-term softening U.S. oil demand.

More accommodative monetary policy has partly informed our view of a gradually weakening USD over the coming quarters. Conventionally, oil prices and the USD are inversely related–a stronger dollar would make oil (priced in dollars) cheaper for buyers in other currencies since you’d need fewer U.S. dollars to purchase the barrel, and vice versa. This relationship has been more tenuous in recent years due to various factors including geopolitical events, supply disruptions, and economic cycles. In any event, the weaker dollar may cushion some of the impact to falling oil prices.

Beyond this, broader near-term oil demand and OPEC+ market strategy concerns are creating lots of oil & gas capital investment uncertainty. Indeed, we forecast aggregate U.S. business investment to contract in the second and third quarters of this year, as general tariff uncertainty imparts capital spending weakness across all sectors.

Bottom Line

Oil markets have soured as OPEC-driven oversupply concerns are bumping head-to-head with a weakening demand backdrop and tariff uncertainty. Given these risks, there is still potential for prices to move downward from current levels before global conditions begin stabilizing later this year. Like most risk assets in the new Trump-world, oil markets are in for a bumpy ride, but an abrupt shift in demand or supply-side policy could push the oil narrative in a more positive direction.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: