U.S. Business Debt:

Navigating the Risks Amidst a Cloudy Outlook

James Marple, Associate Vice President | 416-982-2557

Brett Saldarelli, Economist

Date Published: September 15, 2022

- Category:

- US

- Financial Markets

Highlights

- Fostered by low interest rates and government support programs, the global pandemic brought an increase in U.S. business debt. Despite the increase in leverage, corporate balance sheets have strengthened and firms appear well positioned to navigate the moderating economic backdrop.

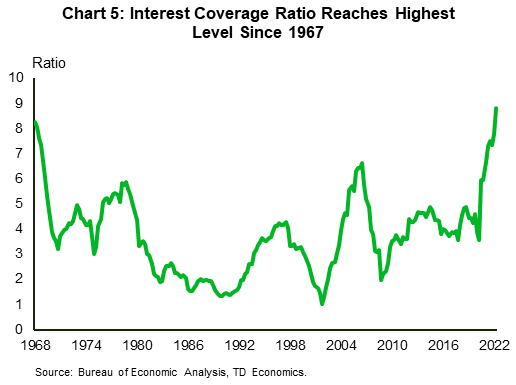

- Corporate borrowing costs have increased over the course of this year alongside the federal funds rate and government bond yields, but strong earnings growth puts companies in a good position to deal with higher interest rates. The interest coverage ratio is currently at its highest level since 1967.

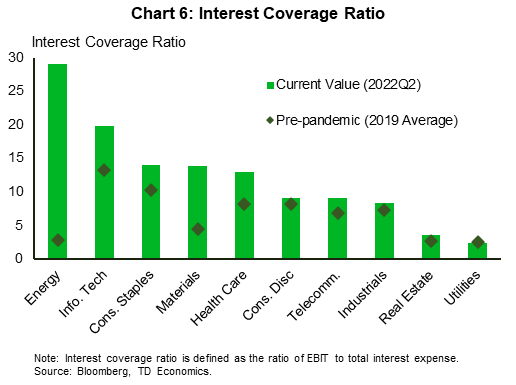

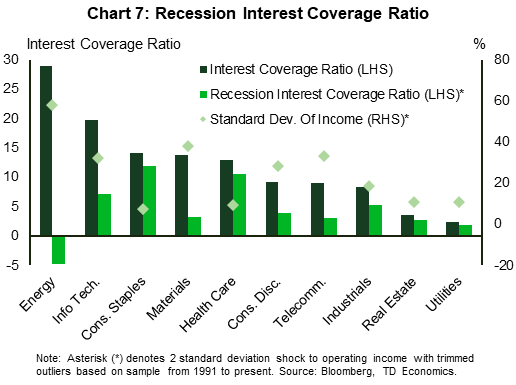

- The increase in the interest coverage ratio is evident across industries. Still, some industries are more vulnerable to a downturn than others. Businesses in energy, materials, and consumer discretionary sectors could see outsized declines in earnings in the event of an economic downturn, making servicing debt more difficult.

- Leveraged loans are another source of risk. Rates on these loans increase in lockstep with the federal funds rate and the close to 400 basis points of increase over the course of this year will create challenges for borrowers.

With inflation at its highest rate in forty years, the Federal Reserve is aggressively tightening monetary policy. From a starting point at the zero lower bound at the start of the year, the Federal Reserve has so far raised interest rates by 225 basis points (bps). Another outsized 75 basis point hike is likely next week, and a federal funds rate of 4.0% by the end of this year is likely.

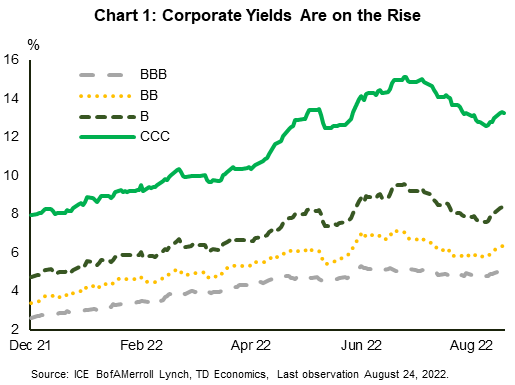

The increase in policy rates and expectations for more to come has been transmitted to Treasury yields and private borrowing costs. Bond yields have pulled back recently, but the 10-year Treasury is up 190 bps since the beginning of the year. With spreads over Treasuries widening, corporate bond yields are up even more. The AAA yield has increased by 224 bps and the BBB yield has risen by 285 bps (Chart 1). More notable increases are apparent in the non-investment grade space. CCC and single-B yields have increased by 713 bps and 375 bps respectively since the beginning of the year.

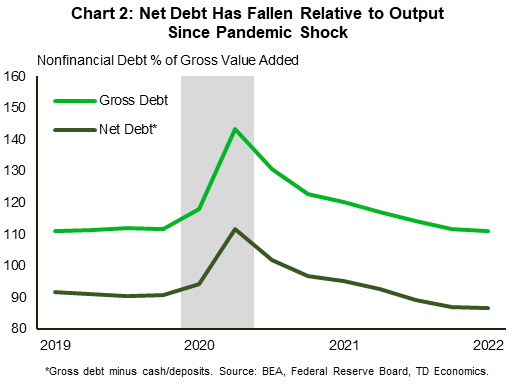

The swift rise in interest rates alongside a slowing economy has raised concerns about the ability of companies to service their debts. There will be pockets of weakness, especially in sectors most sensitive to a negative turn in the business cycle, but the overall business sector is starting from a position of strength. Firms increased borrowing during the pandemic, but also raised their stockpiles of cash. Subtracting cash from gross debt, total “net debt” relative to business output is lower today than it was prior to the pandemic (Chart 2). With the strong rebound in economic activity over the past year, the ratio of earnings to interest costs, known as the interest coverage ratio, is at its most favorable level since the late 1960s.

With the Fed in tightening mode, the downside risks to the economic outlook are high over the next year. Fortunately, the vast majority of corporate debt is long-term and will not mature for three more years. The exception to this is the leveraged loan market where debt is variable and rises alongside Fed rate hikes.1 This market is likely to face the most difficulty over the next year, however, it is relatively small compared to the overall level of corporate debt. Bond issuance is likely to continue to fall and investment to pull back as financial conditions tighten further, but the corporate sector as a whole is in a good position to weather the storm.

Debt Grew Quickly at Outset of Pandemic, but so did Cash

Corporate borrowing has increased over the last several years as low interest rates and government support programs encouraged firms to take on debt. Since the end of 2019, gross debt of nonfinancial businesses has risen by 19.3% (or 7.3% annually). Debt growth was especially swift in the first half of 2020, facilitated by the Paycheck Protection Program (PPP), which provided small businesses with government-backed loans that would allow them to maintain payrolls and service financial obligations.

A key feature of the PPP program was that loans would be forgiven if businesses could show that 60% of the funds were used to maintain payrolls (among other things). As of June 2022, over 90% of all loans under the PPP have been forgiven.2 As a result of loan forgiveness, corporate debt growth slowed to a crawl in the second half of 2020. With the strong rebound in economic activity over the same period, the ratio of gross debt to gross value added (business sector output) fell from a pandemic high of 143% in the second quarter of 2020 to 112% in the second quarter of 2022, which is consistent with the level experienced prior to the pandemic at the end of 2019.

At the same time that firms were adding to debt they were also increasing their holdings of cash. In fact, deposits of nonfinancial firms outgrew gross debt by a significant margin. As a result, outside of the plunge in economic activity at the outset of the pandemic, net debt relative to output did not show any meaningful increase over the course of the last several years and is also on par with pre-pandemic levels.

Rising Rates Will Slow New Issuance, but Most Companies Have Locked in Rates

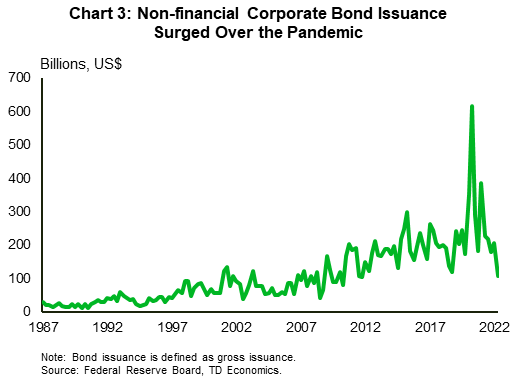

Corporate bond issuance surged in the second quarter of 2020 as companies took advantage of historically low interest rates (Chart 3). The pickup in issuance over this period lowered the average interest cost faced by firms. At the same time, the average maturity of corporate debt (including financial companies) rose during the pandemic. In April of 2022, it hit to 18.1 years on a twelve-month moving average basis, up from under 16 years a year ago.

While some firms will face higher interest rates when they refinance their debt this year and next, examining the total stock of debt maturing through 2026, almost 70% of debt is scheduled to mature between 2025 and 2026.3 Moreover, 85% of the corporate debt that is maturing over the next two years is investment grade. The bulk of non-investment grade debt is scheduled to mature between 2025 and 2026. The longer maturities mean that the impact of the rising rate environment will be relatively small for most companies over the next two years.

Earnings Have Risen Well Faster than Interest Costs

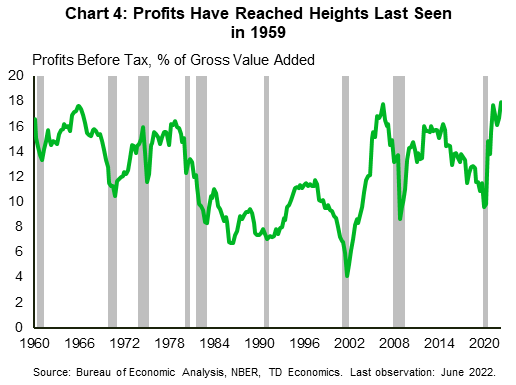

Despite the pandemic, the corporate sector has fared very well over the past two and a half years. From the end of 2019 to the second quarter of 2022, earnings rose 90.3% (or 29.3% annualized). Pre-tax corporate profits relative to value added are now at the highest level in over 60 years (Chart 4).

Interest expenses, on the other hand, have been much more benign and had been trending downwards since 2017 before edging higher in the first half of 2021. Relative to earnings and output, interest expenses are near historical lows. As a result, the interest coverage ratio – the ratio of earnings to interest costs, is at its highest level since the late 1960’s (Chart 5). The increase in the interest coverage ratio means firms have additional financial capacity to meet their debt obligations in the event of an economic downturn.

Earnings Volatility Gives Insight into Which Sectors Are Most at Risk

The story at the aggregate level is true across sectors. Looking at data by sector for the largest 500 publicly traded companies, most sectors have experienced a swift increase in the interest coverage ratio from their pre-pandemic levels, with energy, materials, health care, and information technology leading the way (Chart 6). Increases have primarily been driven by strong growth in earnings, but lower interest expenses relative to pre-pandemic levels have helped.

The strong starting position could change rapidly in the event of an economic downturn. Profits are more volatile than output and tend to decline more rapidly than the economy in recession. Over the past 70 years, economic recessions have resulted in an average drawdown of corporate profits of approximately 20% (two standard deviations from the mean).

The vulnerability of businesses to economic downturns also varies across sectors. When we take the average and standard deviation of earnings for each sector over the last 30 years and layer on a two standard deviation shock, we can see which sectors are likely to see the biggest swing in their interest coverage ratio in the event of a recession (Chart 7). Due to higher volatility in earnings, the energy, materials, consumer discretionary, information technology, and telecom sectors could experience a rapid decline in their interest coverage ratios in the event of a recession.

Bottom Line

Elevated debt is not a new story for the U.S. economy. The good news is that over the past two years, corporate earnings and cash holdings have outpaced debt growth, increasing companies’ available financial resources to service their debt obligations. As a result, the interest coverage ratio has increased from pre-pandemic levels across all industries providing an additional buffer.

Interest rates have increased swiftly from the beginning of the year, but, outside of the leveraged loan market, the rising rate environment will have a more limited impact on maturing corporate bonds as the lion’s share will not be maturing over the next two years.

Should the economy fall into recession, some businesses will be more vulnerable than others. Given their greater earnings volatility, firms operating in energy, materials, and consumer discretionary sectors may face the greatest difficulties in servicing their debt.

All told, while the evolving economic backdrop will increase challenges for the U.S. business sector, it is starting from a relative position of strength, which should help it to ride out the storm.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: