Automotive Supply Chains:

Severely Disrupted but Not Broken

Thomas Feltmate, Senior Economist | 416-944-5730

Date Published: November 8, 2021

- Category:

- U.S.

- Commodities & Industry

Highlights

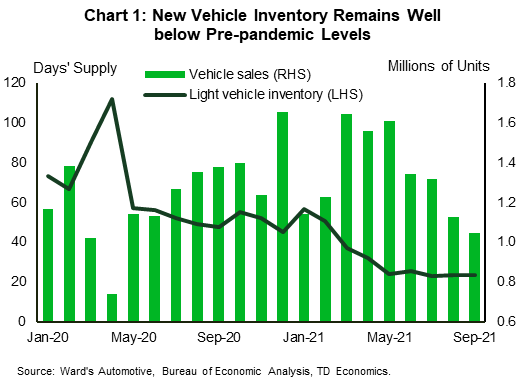

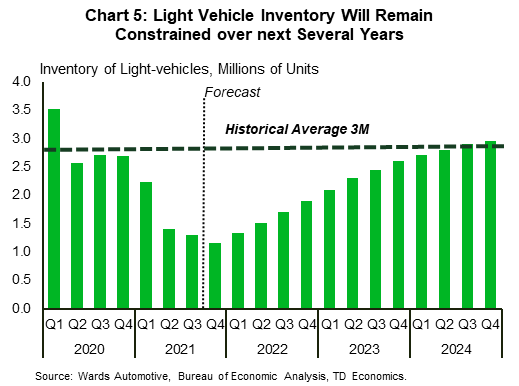

- Global auto supply chains have been hit by a series of disruptions over the past year, significantly hindering production, and leaving markets grossly undersupplied. At present, US dealership inventories sit at just over 1 million units (or 25 day’s supply) – less than a third of its pre-pandemic level.

- Semiconductor shortages have had a healthy hand in weighing on this year’s production, though it hasn’t been the only disruption. Cyclical factors including labor shortages and port disruptions have also played a role and will likely continue to provide some headwind moving into 2022. The evolving power crisis in China and its potential impact on global aluminum production bears close watching over the coming months, as it could significantly derail any assumed production rebound in 2022.

- The pandemic has put a spotlight on the flaws of existing supply chain structures and how automakers had previously managed inventory. Moving forward, it seems likely that North American automakers reorient supply chains to have more domestic focus – allowing for more visibility from end-to-end – and perhaps look to stockpile some critical parts to hedge against future supply-demand disruptions.

- The growing popularity of EVs offers North American automakers a unique opportunity to organically reorient supply chains to lessen foreign dependence in favor of more domestic production. Combined federal assistance from Biden’s proposed spending bill (allocating $555B in consumer EV incentives) and infrastructure plan (allocating $7B to buildout America’s charging infrastructure) are meaningful first steps. However, more government support will likely be required to assist automakers in retooling assembly lines, funding research investment projects and training a growing worker base.

The ongoing health crisis has had a profound impact on the global economy. The automotive industry has been no exception. What started as a largely demand-side shock – induced by stay-at-home orders and forced business closures – has since manifested in severely disrupted global supply chains, sending shockwaves through every facet of the automotive production process. As a result, global production has fallen precipitously through 2021, leaving markets grossly undersupplied.

At present, dealership inventory of new light vehicles in the US sits at just over 1 million units (or roughly 25 days’ supply), which is less than a third of where market supply sat prior to the pandemic (Chart 1). Sales have suffered tremendously, particularly through the third quarter of this year – averaging just 13.3 million (annualized) units – as limited model selection, soaring prices and reduced incentives have pushed many consumers to the sidelines. This is happening at a time when consumer demand could very easily support sales north of 17 million.

The ongoing supply issues have led to a resurfacing of the age-old question of whether it makes economic sense for automakers to continue to operate in a globally integrated supply chain. In the fog of war, when lost revenue estimates for this year alone are well over $200 billion (US), it seems like a no-brainer for North American automakers to “re-shore” overseas production. However, the calculus isn’t quite so simple. Reshoring today’s manufacturing jobs comes with tremendous upfront cost, both from a monetary and operational standpoint. Drawing on historical experience shows that some of the biggest issues with reshoring manufacturing jobs in today’s environment include finding not only the appropriate number of workers, but also those with the right technical skills. The US (along with many other advanced economies) has developed a generational skills deficiency in many important technical areas, making it particularly costly for companies to hire and train new workers. Even abstracting from the labor deficiencies, producing within North America has undoubtedly become costlier under the new North American Trade Agreement (US-Mexico-Canada Trade Agreement).

This is not to say that we won’t see more reshoring of automotive related manufacturing jobs over the next decade. The pandemic has certainly poked many holes in the globally integrated “Just-In-Time” (JIT) manufacturing model. A key pillar for automakers in the post-COVID world will likely center around optimizing supply chain integration in an effort to minimize future production interruptions, particularly during times of severe demand-supply imbalances. This will involve moving some back-end processes of the supply chain closer to home, which will ultimately mean a reshoring of some jobs. However, minimizing production costs will remain the other key pillar which necessitates that some parts of the supply chain remain in low-cost geographies.

Text Box: Geopolitical Tensions Also Playing A Role

Happening in the background, are mounting geopolitical tensions between the US and China. Prior to the pandemic, the Trump Administration began to tightly regulate sales of semiconductors to Huawei Technologies, ZTE and other Chinese firms. In response, those companies began stockpiling microchips that were essential in producing certain consumer electronics, including 5G smart phones. At that same time, American manufactures were cut off from receiving microchips produced by China’s Semiconductor Manufacturing International Corporation. This helped further exacerbate the microchip sourcing issues of North American automakers.

Semiconductor Shortage: How Did We Get Here?

The pandemic has certainly had a healthy hand in causing multiple disruptions across the semiconductor supply chain, but COVID hasn’t been the only culprit. Indeed, the initial trigger to this year’s disruptions can be traced back to the very beginning of the pandemic. In response to a collapse in vehicle sales, automakers significantly cut their production quotas in an effort to keep inventories lean. Part of this meant slashing future orders of semiconductors. At the same time, demand for consumer electronics spiked – as millions of individuals were forced to work from home. Microchip producers pivoted to meet the surging demand from electronic manufacturers, helping to partially offset the decline from automakers. By the third quarter of last year, demand for vehicle sales rebounded, as social restrictions around the world were gradually eased. As vehicle production began to ramp-up to meet demand, automakers immediately ran into trouble sourcing semiconductors, as microchip producers were already committed to supplying consumer electronic manufactures.

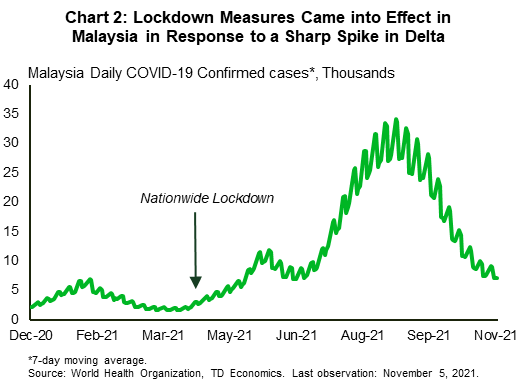

Supply of microchips to automakers remained tight through the remainder of 2020 and into this year. Then two unrelated events, first an ice storm in Texas, then a fire at the Renesas Naka 3 facility in Japan, significantly hindered front-end wafer fabrication for microcontrollers. By June, another issue within the supply chain – this time on the back-end – had surfaced. The disruption was entirely concentrated in Malaysia – who accounts for 13% of annual automotive semiconductor production – and was the direct result of the Malaysian government enforcing strict lockdown measures in response to a spike in Delta variant cases (Chart 2). While the initial lockdown was set to expire in late-June, measures were later extended through August, and have been gradually relaxed as case counts have trended lower since late-summer.

It is expected a return to full operational capacity won’t happen until late-October/early-November. However, the damage has already been done. The back-end supply issues have without question been the most disruptive of all the idiosyncratic events over the last year. Through the several months of plant closures, a significant backlog of orders has accumulated, that will take well into 2022 to clear. In fact, one major microchip producer recently said that demand-supply imbalances may stretch into 2023. And that’s under the most optimistic scenario of assuming no other external shocks.

Where Does This Leave Automakers & Consumers?

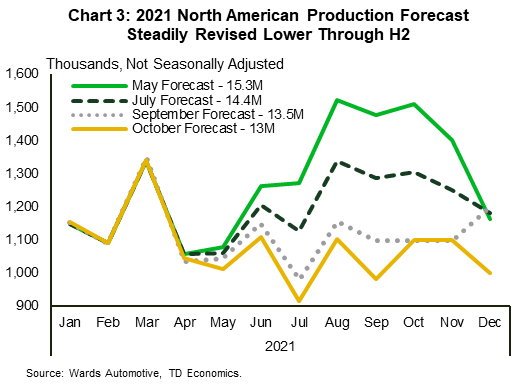

This leave automakers caught in the crosswinds. In fact, production forecasts for 2021 have already been slashed several times this year, with cuts now being extended through October. As it currently stands, North American production is expected to fall as low as 13 million units for the year as a whole – more than 2.5 million lower than what was forecasted at the beginning of the year (Chart 3). Coming on the heels of last year’s pandemic driven 13.2 million, it’s perhaps no surprise that the North American market has become so grossly undersupplied.

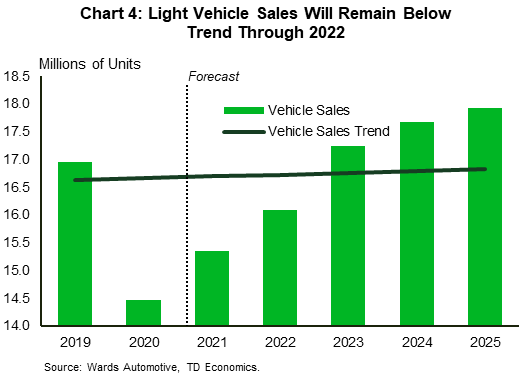

While the effect on sales was relatively muted through the first half of this year – averaging 16.8 million (SAAR) units – the steady drawdown in inventories through the second half of 2020 and into this year was certainly raising flags of caution. By the time the third quarter rolled around, the impact on sales was devastating, getting progressively worse as we moved through the quarter – implying a weak hand-off into year-end. Our current estimate has sales edging modestly higher through the fourth quarter, likely averaging somewhere around 13.5 million units, bringing the annual total for the year to just 15.1 million (Chart 4).

Production constraints will spill over into 2022, likely having the most meaningful impact through the first half of the year. However, things remain very much in flux, and the balance of risks that headwinds persist even longer remain skewed to the downside. While it is expected that the semiconductor supply issues could begin to ease through the second half of the year, there is no shortage of other potential headwinds that could also weigh on the automotive recovery in 2022. Cyclical factors including labor constraints and port backlogs have played a healthy role in slowing production over the past year and are likely to carry over into 2022. Indeed, the Biden Administration has taken steps over the last several weeks to easing the port backlog by allowing for round the clock operations at both the Port of Los Angeles and Long Beach terminals – who account for 40% of freight entering the US. So far, the new measures have proved futile, as the extended hours haven’t necessarily translated to more container ships being moved – a result of labor shortages on the trucking side and limited warehouse storage space. Further steps including daily fines levied on carriers whose containers linger for more than the given timeline came into effect on November 1st, which should help to ease some of the backlog over the coming weeks.

With respect to the ongoing labor shortages, the issues appear to be two-fold. Legacy pandemic related support measures that have remained in place through much of the recovery have likely kept some workers out of the labor force. Indeed, the enhanced unemployment benefits program that had been in effect since March 2020 expired at the end of last month, though additional supports including rental assistance and the childhood tax credit will remain in place through 2022. The other issue is more subtle in nature and relates to the degree of hesitancy among some employees returning to work, particularly given the unknowns on vacancy longevity. The hope is these fears will be gradually assuaged over the coming months as increasingly more people become vaccinated – helping to further reduce the spread of the virus – and the CDC further expands eligibility for COVID-19 booster vaccinations.

However, of all the cyclical forces, perhaps the most notable is the evolving power crisis across parts of China, which is leading to a global shortage of magnesium – an essential raw material in the production of aluminum alloy. China accounts for roughly 85% of annual global magnesium production, with a disproportionate chunk coming from a small area within the Shaanxi Province. Last month, the local government ordered 35 of the 50 operating magnesium smelters to stop production until year-end, while ordering the other 15 to significantly curb production by at least 50%. The problem has been made all the worse by the fact that magnesium is particularly difficult to store, as it typically starts to oxidize after about 90 days, meaning there exists only a small stockpile at any given time. Given the size of the production cuts, the price of magnesium increased by as much as 75% last month.

North American aluminum producers have already warned clients that they have been unable to secure the appropriate amount of magnesium required to meet current aluminum demand for 2022. While producers are currently working to source the key input from alternative sources, supply remains incredibly scarce. At the time of writing, no North American automaker had publicly announced any production cuts to 2022 quotas, as they are likely waiting to see if the matter resolves itself. Either way, the situation certainly bears close watching over the coming months, as the potential impacts to 2022 production could be catastrophic.

Even in the most optimistic scenario where semiconductor supply constraints abate through the second half of next year and the potential aluminum shortage issue is resolved, the market is likely to remain very tightly supplied. Demand remains exceptionally high for certain vehicles that are in the shortest supply, particularly SUVs, CRVs and pick-up trucks, which means they will continue to be snatched up as soon as they hit showroom floors. As a result, dealership inventory will remain very lean through next year, keeping sustained pressure on vehicle prices (Chart 5).

Return to Status Quo?

Looking beyond 2022, perhaps the biggest unknown is how automakers will respond to making the production process more agile in the face of future disruptions. Low hanging fruit seems to surround re-thinking the current Just-In-Time (JIT) supply management system that many automakers have followed over the last several decades. In its most basic form, JIT is an inventory management method where goods are received from suppliers only as they are needed, hence minimizing waste and warehouse storage costs. The framework proved to be hugely beneficial for car makers in recent decades, as it kept production costs low, helping to maximize profits in what has become a very competitive market. However, as the supply chains became more global, automakers increasingly relied on single partner suppliers, making them far more vulnerable to external shocks.

Cracks really began to show through the global financial crisis, when numerous auto suppliers went bankrupt. Automakers were left scrambling, as suddenly they were unable to source key input parts. While many vowed to change production processes in the aftermath of 2008-2009, most returned to the status quo. The recession had brought several automakers to the brink, so once the economic recovery took hold, the focus was squarely on getting vehicles back to market the quickest and cheapest way possible.

However, this time is likely different. The pandemic has put a glaring spotlight on the limitations of the JIT framework and just how devastating an impact it can have when things go wrong. In the years ahead, we’ll likely see automakers move to a more “Just-In-Case” (JIC) inventory management supply system, where inventory of some critical parts (i.e., semiconductors, batteries, etc.) are stockpiled. In circumstances where it might be cost prohibitive to stockpile, automakers are likely to setup parallel supply chains allowing them to easily change source providers in the event of a shock.

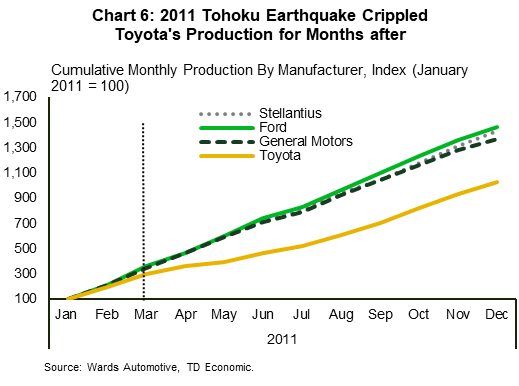

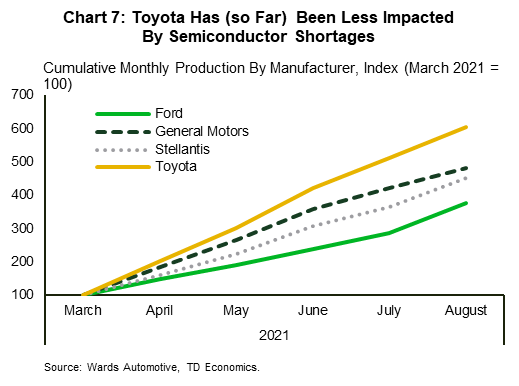

Interestingly, this strategy had already been adopted by Toyota nearly a decade ago. The change was brought about following the 2011 earthquake in northern Japan, which disproportionately hit Toyota’s suppliers, including Renesas Electronics Corp. – a key chip supplier for the automaker (Chart 6). The chip maker was knocked offline for several months, sending reverberations through Toyota’s entire supply chain, and significantly weighing on its production for the next six months. In the aftermath, Toyota invested heavily in gaining a better insight of its entire supply chain, in effort to identify the most “at-risk” inputs. The automaker came up with 1,500 parts that it deemed critical for its production process and put in place specific controls to not only secure alternative suppliers but to also stockpile inventory. In addition, Toyota has developed a system to monitor both its direct and feeder suppliers, helping to ensure the automaker stays well ahead of future shortages.

Fast forward nearly a decade later, and the changes made back in 2011 are still paying dividends today. Toyota’s ability to carefully manage its supply chain has helped to minimize production disruptions through not only this year’s semiconductor shortage, but also during the earlier stages of the pandemic. (Chart 7). In the years to follow, it seems inevitable that other automakers will adopt similar supply chain management practices in attempt to minimize the impact from future demand-supply disruptions.

Possibility of Re-shoring Manufacturing Jobs?

For North American automakers, rethinking supply chains could mean bringing some production closer to home – a “re-shoring” of manufacturing jobs. This is particularly true for some of the more critical components (e.g., semiconductors, battery, etc.), which are currently built overseas. A re-shoring of some of this production could allow automakers to setup inventory warehouses closer to assembly plants, which would still allow for lean production operations, while also reducing some of the existing risks present in a globally integrated supply chain.

While sound in theory, there are many hurdles’ automakers will need to overcome. Perhaps the most obvious is addressing the current skills gap in America. Manufacturing jobs have become increasingly more advanced in recent decades, requiring candidates to have a sound background in Science, Technology, Engineering & Mathematics (STEM). Unfortunately, current education systems aren’t appropriately preparing students for today’s careers in STEM. On top of that, there has been a gradual decline in technical education programs across public high schools in recent decades. Not only has this eliminated student’s ability to gain meaningful “hands-on” experience, but it has also helped create a stigma around manufacturing jobs.

In recent years, automakers have begun to take proactive steps to address the growing skills gap by offering training courses at select post-secondary technical schools. The programs are fully funded by automakers and give students both the technical and hands-on experience required to work in the automotive industry. Paid internships are sometimes offered as well, helping to create an easy pipeline for students to land a job after graduating.

These initiatives have certainly helped automakers backfill entry level positions which are created through “natural churn” in the labor force, as more senior employees change jobs or even retire. However, current efforts will need to be significantly enhanced over the coming years if the intent is to re-shore a significant number of new manufacturing jobs. Even abstracting from these structural changes and assuming a status-quo to day-to-day operations, the industry is likely facing a significant shortfall of skilled workers over the next decade, as increasingly more baby boomers retire. In fact, a 2015 Deloitte study estimated that by 2025 the US would need to fill over 3.5 million manufacturing jobs –two-thirds the result of baby boomers retiring – but nearly 2 million would likely go unfilled because of the growing skills gap.

Much will need to be done over the coming years to help turn the tide. More STEM related initiatives starting as early as grade school would help build interest in STEM trades at a younger age, helping to create a more direct pipeline for future workers. Aside from grassroots initiatives, automakers will also have to cast the net much further, offering training and apprenticeship programs across significantly more colleges and technical schools. Government support through subsidies and direct financial aid could help keep education costs affordable for students while also reducing some of the cost burden for automakers.

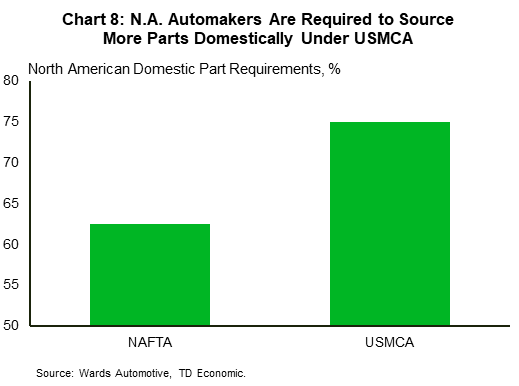

Even outside of the growing skills gap and existing labor shortages, North American automakers face another difficult hurdle with reshoring – the US-Mexico-Canada Trade Agreement. The new trade agreement unambiguously makes it more expensive for North American automakers to produce domestically. New trade conditions require that 45% of vehicle content be made by domestic workers earning at least $16 per-hour and that 75% of vehicle parts are made domestically (up from 62.5% under NAFTA) are already making the production of some vehicles cost prohibitive (Chart 8). Layering on new supply chain structures and a gradual reshoring of some parts manufacturing will only add further to production costs. Over the medium-term, this will likely result in automakers discontinuing production of certain models (mostly sedans) which have become both less desirable by the consumer and have the smallest profit margin.

Electric Vehicles the Spark Reshoring Needs?

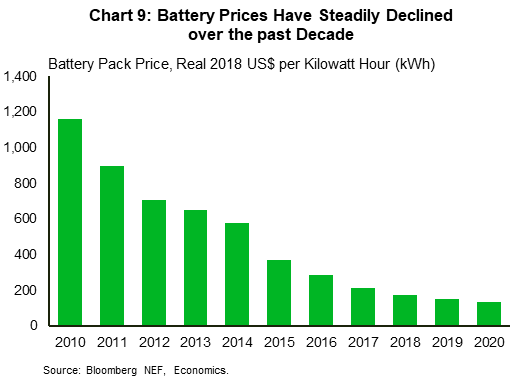

EVs popularity has steadily grown over the last decade, though sales have so far been concentrated among more affluent households. This is likely to change over the coming years. Alongside further enhancements in battery technology, EV prices are expected to continue to decline over the next several years, and potentially reach parity with comparable internal combustion engine (ICE) models by as early as 2025 (Chart 9). Achieving price parity will go a long way in broadening consumer demand across the income spectrum, and in turn, providing a huge boost to EV sales. This will be required if the sales targets laid out by both the US and Canadian governments will be achieved over the next decade.

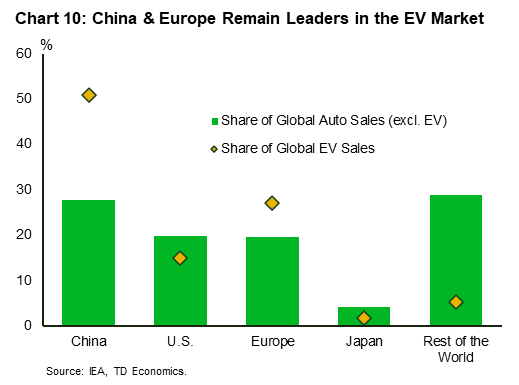

The growing popularity of EVs offers automakers a unique opportunity to completely reorient supply chains to lessen foreign dependence in favor of more domestic production. To date, North America has fallen behind other major global competitors, including China and the EU, both in terms of EV assembly and components production. Proactive government policies and investments focused on building domestic supply chains and markets have allowed China and the EU to dominate the EV manufacturing space. While there’s still plenty of runway left for domestic automakers to catch-up, time is somewhat of the essence. Allowing other nations to continue to gain ground while North American automakers stand idle runs the risk of domestic producers becoming increasingly more reliant on importing key components, such as batteries, for decades to come.

Government intervention is perhaps the bluntest tool that could offer the most effective results. From the consumer side, that would include widening the scope of existing federal and state & local EV incentives to lower the entry level price for EVs and thereby spark further demand (Chart 10). On this front, we have seen some encouraging developments. Biden’s proposed $1.75T spending bill allocates $555B to be used for consumer EV subsidies, which could lift individual tax credits to $12,500 – up from the current $7,500. Significant investments in building out EV charging infrastructure, especially outside of the major urban centers, will also be required before a meaningful move towards electrification occurs. Biden’s recently passed $1T infrastructure bill allocates $7B in charging network investments, which are expected to be used over the next five-year period. The investment is estimated to bring 250,000 new charging stations to the US – representing a five-fold increase from today’s operating level.

On the supply side, targeted government incentives and direct manufacturing supports will also be needed so automakers can retool existing assembly lines, construct new manufacturing facilities, and develop a largely domestic EV supply chain. Perhaps the most important component of all hinges on whether North America can emerge as a leading global battery manufacturer. Here too we have seen some encouraging developments. Significant investment commitments have already been made across both Canada and the US in recent years, which could bring North American output capacity as high as 400 gigawatt hours (GWh) by 2030. While this is still well short of what expected demand will be by the end of the decade (closer to 500GwWh), it is likely that we’ll see significantly more investments made over the medium term. This is particularly true given Canada’s unique position of having an abundance of many of the key materials required in the production of lithium-ion batteries (i.e., cobalt, nickel, lithium and graphite). With Canada having attracted two substantial cell manufacturing investments in just the last few months, it now stands well positioned to becoming the cornerstone of North American cell production. Not only that, but history has shown that once cell manufacturing capacity is established, the rest of the component manufacturing tends to follow. USMCA will allow manufactures to setup on either side of the border without having to worry about paying duties. This should allow manufacturers to strategically station production facilities to optimize supply chain integration.

While still early days, the recent moves on battery production alongside a number of sizeable investment commitments made by automakers offer some encouraging signs that North America is trying to become a more meaningful player in the global EV market. If done properly, automakers can gain better control of their supply chains, by establishing a more domestic presence that allows for a higher degree of visibility from top to bottom. Such moves would help insulate North American automakers from future external shocks, while also creating millions of good paying middle-class jobs for decades to come.

Conclusion

The ongoing health crisis has touched almost every facet of the global economy in one way or another, and the automotive industry has been no exception. Supply chains have become severely disrupted over the past year, as the global microchip shortage has sent shockwaves through the entire automotive production process. As a result, global production has fallen precipitously through the year, leaving markets grossly undersupplied.

The supply chain issues have led to a resurfacing of an age-old problem of whether it makes economic sense for North American automakers to continue to operate in a globally integrate supply chain. While the knee jerk reaction might be to assume that automakers reorient their entire supply chain to have a purely domestic focus, this is unlikely to happen. Not only would this be less cost effective, but it will also create an operational nightmare. Both the US and Canada are currently facing a generational labor shortage of skilled trades workers, making it near impossible to re-shore some of the jobs that other countries have spent decades building a competitive advantage in.

A more likely outcome is a hybrid approach. Low hanging fruit seems to be doing away with the JIT manufacturing model in favor of JIC. This would mean automakers would start carrying some inventory of critical parts to hedge against unforeseen disruptions. In doing so, they will likely look to re-shore some aspects of the parts production process to not only gain better oversight but also ensure closer proximity to its suppliers. For those back-end processes that remain overseas, automakers should consider establishing parallel supply chains such that alternative suppliers would be available in the event of a disruption along the supply chain.

The road ahead still presents many challenges, but the transition to EVs offers a unique opportunity for North American automakers to organically reorient supply chains to have a more domestic focus. Government intervention will be required to not only facilitate stronger consumer uptake, but to also reduce the cost burden for manufacturers to reconfigure assembly lines, fund research investment projects, and train a growing worker base. Such moves would help insulate North American automakers from future external shocks, while also creating millions of good paying middle-class jobs for decades to come.

References

- Bloomberg, Canada Poised To Become Battery Leader In North America, October 2021

https://www.bloomberg.com/news/newsletters/2021-10-19/canada-poised-to-become-battery-leader-in-north-america

- Bloomberg, How Toyota Steered Clear of The Chip Shortage Mess, April 2021

https://www.bloomberg.com/news/articles/2021-04-07/how-toyota-s-supply-chain-helped-it-weather-the-chip-shortage

- Center for American Progress, Electric Vehicle Should Be a Win for American Workers, September 2020

https://www.americanprogress.org/issues/economy/reports/2020/09/23/489894/electric-vehicles-win-american-workers/

- Deloitte, The Skills Gap in U.S. Manufacturing 2015 and Beyond, 2015

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/manufacturing/us-pip-the-manufacturing-institute-and-deloitte-skills-gap-in-manufacturing-study.pdf

- Financial Times, China’s Magnesium Shortage Threatens Global Auto Industry, October 2021

https://www.ft.com/content/1611e936-08a5-4654-987e-664f50133a4b

- IHS Markit, Major Revision For lobal Light Vehicle Forecast, Production Impacted Well Into 2022, September 2021

https://ihsmarkit.com/research-analysis/major-revision-for-global-light-vehicle-production-forecast.html

- Harvard Business Review, Today’s Businesses Need to be Agile and Flexible, Starting with Supply Chains, April 2021

https://hbr.org/sponsored/2021/08/todays-businesses-need-to-be-agile-and-flexible-starting-with-supply-chains

- Harvard Business Review, Bringing Manufacturing Back to the US Is Easier Said Than Done, April 2020

https://hbr.org/2020/04/bringing-manufacturing-back-to-the-u-s-is-easier-said-than-done

- Wards Automotive, USMCA Putting Cost Control Pressures on U.S. Automakers, November 2020

https://www.wardsauto.com/industry-news/usmca-putting-cost-control-pressure-us-automakers.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: