US Automotive Outlook:

Navigating the Uncertain Road Ahead

Thomas Feltmate, Director & Senior Economist | 647-983-5499

Date Published: April 20, 2022

- Category:

- U.S.

- Commodities & Industry

Highlights

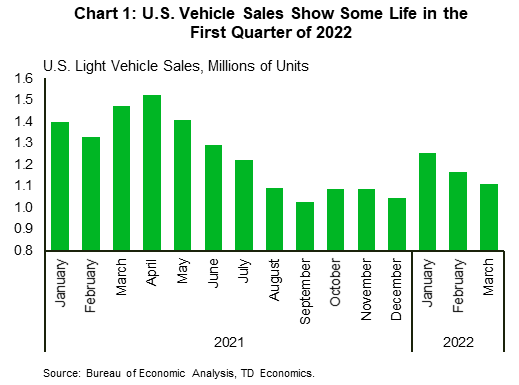

- US vehicle sales have started the year off on a slightly more upbeat note, rising to 14.1M (annualized) units in Q1 – the strongest pace of sales since the second quarter of last year.

- While it was previously expected that supply pressures would start to ease in the second half of this year, the ongoing Russia-Ukraine conflict in combination with the recent COVID related lockdowns across China now cast a shadow over the outlook.

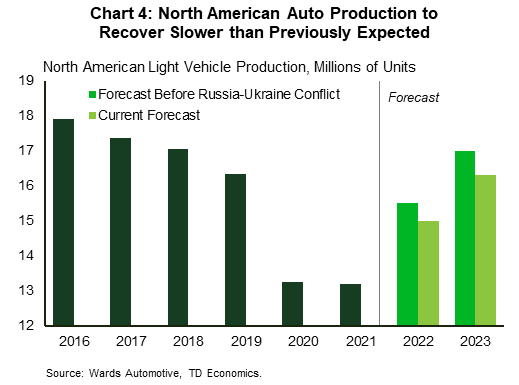

- Accordingly, we have lowered our auto production and sales forecast. North American production is now expected to be 15M (previously 15.5M) in 2022 and 16.3M (previously 17M) in 2023, while US sales are likely to average 15M and 16.8M in 2022 and 2023, respectively.

- The Russia-Ukraine conflict may also slow electric vehicle market penetration over the near-to-medium-term. Over 20% of class 1 nickel – vital in the production of lithium-ion batteries – currently comes from Russia. Removing it from the global supply could further delay the rollout of new EV models and lead to more persistent price pressures.

US vehicle sales have started the year off on a relatively upbeat note, averaging 1.18M units per-month, or 14.1 million (annualized) through the first three months of the year (Chart 1). This is up nearly 10% from the previous quarter and marks the strongest pace of sales activity since the second quarter of last year, prior to the semiconductor shortages tightening its grip on global auto production.

Unfortunately, there are still plenty of headwinds for the industry to contend with over the coming year that will likely continue to restrain sales activity. Semiconductor shortages remain a key risk to the auto production outlook, and the recent geopolitical tensions stemming from the Russia-Ukraine conflict has only made the situation more dire. Ukraine is a meaningful global supplier of neon gas, which is an essential input used in the wafer fabrication process of semiconductors. Removing Ukraine’s supply for an extended period of time spells trouble for an industry already battered by persistent supply chain issues. Adding to the uncertainty are the series of lockdowns recently imposed across major urban centers of China, as authorities try and curb the country’s worst COVID outbreak in over two years.

The combination of forces has injected considerable uncertainty into the near-to-medium term outlook, which has led us to markdown both our 2022 and 2023 North American production forecast to 15M units (from 15.5M) and 16.3M (from 17M), respectively. Accordingly, the sales outlook has also been revised lower, as weaker production will keep inventories lower for longer and likely exert more pressure on prices over the near-term.

No Shortage of Production Risks

While last year was plagued with persistent supply chain disruptions that heavily weighed on the global production of goods and led to a surge in inflationary pressures, 2022 was supposed to be the year of normalization. Indeed, many indicators were showing signs of improvement towards the end of last year. Everything from reduced plant closures across Asia, easing energy shortages, and even improved port capacity in the US were all meaningful signs that the worst of the supply chain disruptions were likely to be left behind in 2021. Unfortunately, that has not been the case.

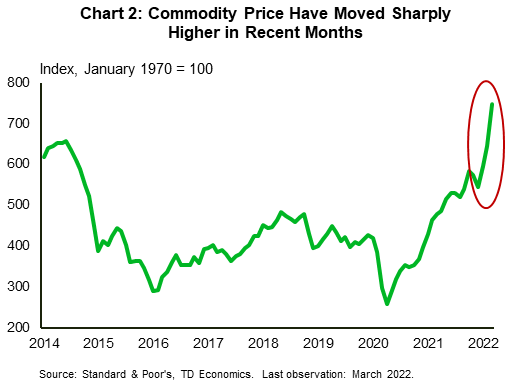

The recent invasion of Ukraine by Russian forces has led to a sharp increase in commodify prices, as NATO and other supporting nations have imposed punitive economic sanctions on Russia (Chart 2). Higher commodity prices will not only hit manufacturers through increased input costs, but also consumers as some of these costs will ultimately be passed on.

Outside of higher cost pressures, we are also already seeing material impacts to supply chains – particularly through Europe. Ukraine is an instrumental part of the auto supply chain, as it has developed a degree of specialty in manufacturing wire harnessing – a vital set of parts used to bundle multiple kilometers of car wiring. Due to its proximity to neighboring countries and high skilled lower-cost workforce, auto suppliers have invested heavily in centralizing wire harnessing manufacturing in Western Ukraine in recent years. In fact, prior to the war, it was estimated that the industry had employed nearly 60,000 Ukrainian workers across more than 30 plants. However, since the escalation of conflict, wire harnessing production has been significantly impacted, leading to several European automakers including BMW, Volkswagen, Porsche, Mercedes, and Ford to all stop production.

North American automakers have remained somewhat insulated from the wire harnessing issues, as most of its production is done domestically. However, Ukraine is also a key global supplier of neon gas, which is a critical component used in the wafer fabrication process of semiconductors. Estimates have suggested that Ukraine produces around 50% of the global supply of neon gas, 75% of which is directly used in the manufacturing of semiconductors. While the looming shortage has potential dire impacts for an industry already trying to play catch-up, semi-producers have so far downplayed the risks, citing both well-diversified supply chains and strategic reserves of neon gas that could last anywhere from 3-months to a year. This may be true in normal times, however, the persistent supply chain disruptions through 2021 had already created a significant backlog of orders for semi-producers. In fact, prior to the Russia-Ukraine war, analysts were already predicting that it would take until at least the second half of 2022 to clear the existing backlog stemming from automakers and electronic manufacturers, let alone keep up with growing demand. Layering on an additional shock – even if some of the major producers remain well insulated – certainly skews the balance of risks against supply pressures easing this year to the downside.

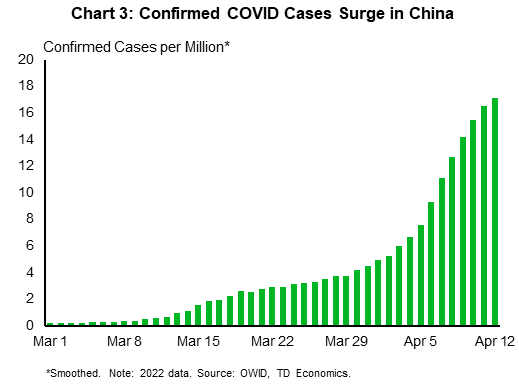

Adding to the uncertainty is the recent resurgence of COVID across China, which has already resulted in temporary lockdowns across major production and financial hubs including Hong Kong, Shenzhen and most recently, Shanghai (Chart 3). The lockdowns have already had a measurable impact on the Chinese economy, with both manufacturing and service sector PMIs for March falling sharply into contractionary territory. With Shanghai’s lockdown extending into April, more pain will likely be felt over the near-term. Moreover, given China’s importance in the global supply chain – particularly for machinery and electronic manufacturing – the knock-on effects from even these brief lockdowns will send reverberations through the global economy, leading to ongoing production disruptions over the coming months.

In light of the mounting downside risks, we have had to revise our view on North American auto production. We are now forecasting that production will be closer to 15M units in 2022, which is still an improvement from 2021 levels of 13M, but still well below what is required to meet demand, let alone replenish depleted inventories. Provided supply constraints ease through 2023, we look for production to normalize to something akin to 2019 levels of 16.3M units (Chart 4).

Where Does This Leave Sales?

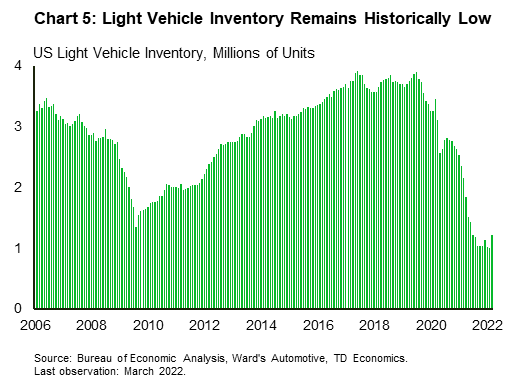

Sales will also be slower to recover, as restrained production will keep the market supply constrained over the coming years. This is exactly the narrative we’ve seen play out over the latter half of last year. As inventories plummeted to historical lows of around 1M units, monthly sales very closely tracked production. In fact, March sales data showed that of the new vehicles that arrived on dealership lots, nearly 60% of them sold within 10 days, while the average time a new vehicle spent on the lot was just 18 days – down from 54 in March 2021. This is not necessarily surprising, as inventory shortages have created so many holes in the market – particularly among SUV/CRVs – that buyers are either pre-ordering or in some cases, outright purchasing the vehicle before it even shows up on the lot.

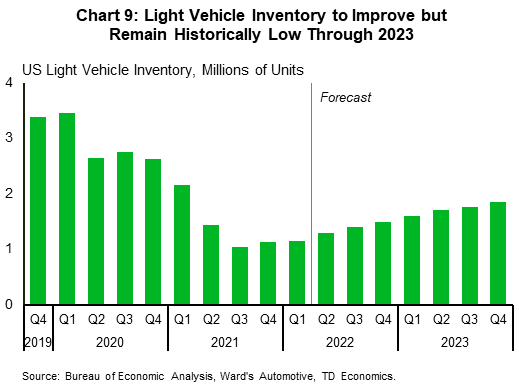

Having said that, March inventory data has shown some glimmers of hope. Dealership inventory ticked higher in recent months, rising to 1.2M units (or 27 days’ supply) which is up by nearly 200,000 units compared to 2021 year-end levels (Chart 5). Indeed, we are still well below pre-pandemic inventory level, which was closer to 2.8M, though any incremental increase is a welcome development, as it likely hints at some near-term upside to sales.

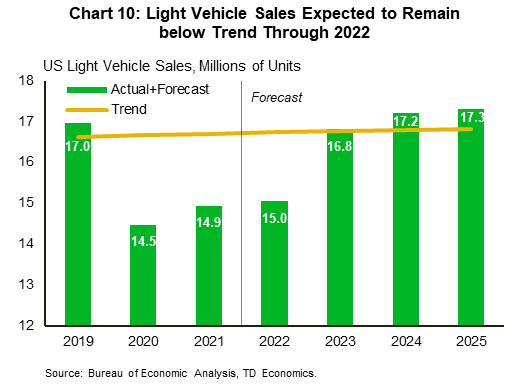

We know there remains considerable pent-up demand in the market, particularly as sales have undershot trend in each of the last two years and will likely do so again in 2022. This is happening at a time when underlying economic conditions could very easily support a far higher level of sales – likely somewhere in the low 17M range.

Gas Prices Weighing on Sales?

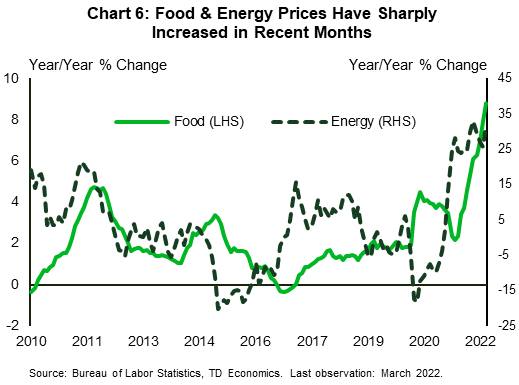

Outside of the direct impact on production, the Russia-Ukraine conflict is also hitting US consumers through higher food and energy costs (Chart 6). Our estimates suggest that higher gasoline prices alone are likely going to cost the average American an additional $1,250 over the course of the year. Embedded in this forecast is an assumption that the price of oil peaks in the second quarter before gradually coming in thereafter, reflecting some easing in the current risk premium. In recent weeks, we’ve already seen some softening in the risk premium, following both the US and International Energy Agency commitments to release emergency oil reserves in an effort to provide some relief to recent price pressures.

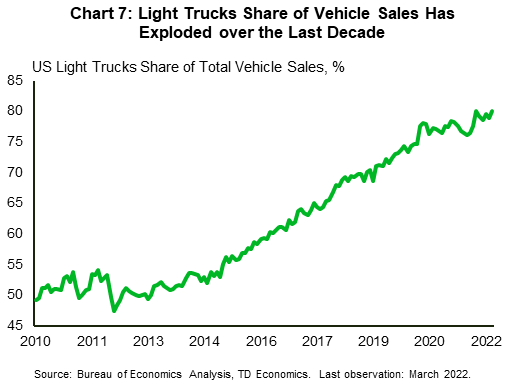

Outside of eroding day-to-day purchasing power, empirical estimations suggest that higher gasoline prices may also have a direct impact on sales. Regression analysis done over a sample extending back to the early-1990’s show that a 10% increase in gasoline prices could reduce sales by as much as 1%. Based on those estimates, and using our gasoline forecast, which assumes a near 30% increase in prices through 2022, suggests that higher gas prices alone could shave upwards of 400,000 units from 2022 sales. However, that’s not the full story. As we truncate the sample size and do the same estimations over increasingly shorter time periods, gasoline prices become less important. In fact, if the regression is estimated over just the last decade, gasoline prices become completely irrelevant, providing little to no explanatory power. One explanation for this could be that because fuel efficiency has increased so drastically in recent decades, consumers have become less sensitive to price changes, simply because they’re not needing to fill-up as much. This seems to be corroborated by the fact that light-trucks share of total vehicle sales has exploded over the last decade, and even reached a new all-time high in March, despite gas prices moving sharply higher (Chart 7). Suffice it to say, that should gasoline prices remain within reasonable bounds of what we have forecasted, the impact to sales will likely be quite small.

How About Higher Interest Rates?

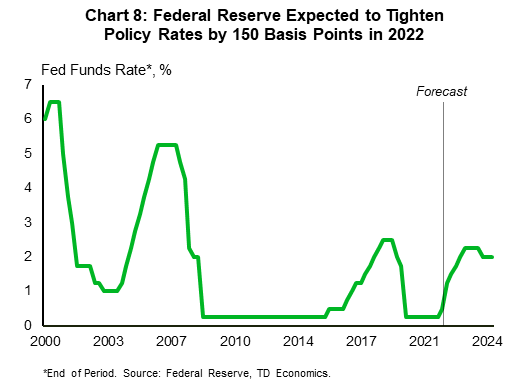

The same can’t be said for interest rates. The estimated elasticity between vehicle sales and financing rates has remained relatively constant over time, with a 100-basis point (bps) increase in interest rates reducing sales by as much as 5%. Our current baseline forecast calls for 175bps of tightening from the Federal Reserve this year alone, which will likely push-up on financing costs by roughly the same amount. Indeed, this is a significant upgrade to our rate outlook relative to our December 2021 forecast, where we had assumed a more modest 75bps of tightening from the Fed in 2022 (Chart 8).

However, the persistent pressures on inflation alongside tightening labor market conditions have shown that more restrictive monetary policy is required to cool the economy. Just how restrictive, remains a question of debate. The median consensus among voting members at the FOMC now assumes a total of seven rate hikes this year, followed by three more next year. Under these projections, the Fed funds rate is expected to get up to 2.8% by the end of 2023 – 25bps higher than what we’re currently expecting. Even still, using our slightly more conservative path for the policy rate and assuming the full extent of rate increases are passed through to higher financing costs, the additional tightening embedded in our forecast is expected to shave as much as 500,000 units from the 2022 projection.

However, the persistent pressures on inflation alongside tightening labor market conditions have shown that more restrictive monetary policy is required to cool the economy. Just how restrictive, remains a question of debate. The median consensus among voting members at the FOMC now assumes a total of seven rate hikes this year, followed by three more next year. Under these projections, the Fed funds rate is expected to get up to 2.8% by the end of 2023 – 25bps higher than what we’re currently expecting. Even still, using our slightly more conservative path for the policy rate and assuming the full extent of rate increases are passed through to higher financing costs, the additional tightening embedded in our forecast is expected to shave as much as 500,000 units from the 2022 projection.

This has already been built into our forecast, as has the downgrade to the production outlook. Where there remains some uncertainty is to the extent increased price pressures will eventually act as deterrent for some buyers. According to JD Power estimates, the average transaction price climbed to $43,737 in March – up over 17% from year-ago levels! Given the current demand-supply mismatch, the average incentive spend has also slipped to a historic low of just 2.3% of the manufacturer’s suggest retail price, which is down over 5 percentage points (pp) from last March.

Perhaps the only saving grace for today’s buyers is the fact that they are benefiting from having more equity in their existing vehicle, as prices in the used market have also experienced significant appreciation over the last year. This is leading to higher trade-in values, providing some offset from soaring prices, rising rates, and reduced incentives. However, the average monthly payment is still up more than $70 relative to last March, and currently sits at $658 per-month.

When Will Price Pressures Start to Ebb?

Over the near-term, we expect current price pressures to be sustained, given the current demand-supply mismatch. Based on recent CPI data, new vehicle prices appear to have crested at 12.5% year-on-year in recent months. However, the recent uptick in new vehicle inventories does provide some hope that increasing supply could provide a bit of relief over the remainder of the year. Indeed, this is what our current forecast assumes, with inventories gradually improving through 2022 – reaching 1.5M units by year-end, which will likely lead to prices peaking in Q2. Prices are expected to drift lower thereafter, but will remain elevated as inventories aren’t expected to normalize to pre-pandemic levels until the end of 2024 (Chart 9).

Putting this altogether, we expect sales to likely come in around 15M units this year, which will mark yet another year of below trend sales activity. By our calculations, the pandemic is likely to have resulted in over 5 million forgone sales over the last three years. Earlier in the pandemic, we had assumed that as economic conditions normalized and supply constraints eased, that most (if not all) of these delayed purchases would ultimately be pulled through. However, it now seems more plausible that a significant portion will likely be lost, as the combination of higher interest rates and elevated prices result in some demand destruction. Sales are expected to increase to 16.8M – a level consistent with trend – in 2023, before overshooting trend for a few years thereafter, helping to absorb anywhere between 1M-2M units of the pandemic related losses (Chart 10).

What Does This Mean for EVs?

Could the prospect of higher gasoline prices facilitate a stronger uptake of electric vehicles over the coming years? In ‘normal’ times, that seems very plausible. However, because EVs are so much more semiconductor intensive than comparable gasoline models – often requiring twice as many semiconductors – model rollouts have been significantly delayed over the past year. That being said, anecdotal evidence has shown EV demand having significantly increased in light of the recent energy shock, though due to supply constraints, delivery times range anywhere from 6-months to one year.

This alone is likely enough to discourage some buyers, particularly in North America where other concerns including range anxiety and entry level cost remain major deterrents for many consumers. With respect to the former, the Biden Administration has set forth a plan to make significant investments in charging infrastructure over the coming years. As part of its $1T infrastructure bill passed last year, $5B has been allocated over the next five years through its National Electric Vehicle Infrastructure (NEVI) program to help states create a network of EV charging stations across the US, with a strong emphasis along the Interstate Highway System. An additional $2.5B in funding has also been allocated in the form of state grants, to ensure adequate EV charging access across rural and disadvantaged communities. In total, the Biden Administration estimates that the cumulative spend will result in 500,000 new charging points by 2030 – a five-fold increase from today’s levels. This is meaningful and will go a long way in assuaging consumer fears of range anxiety.

On the consumer incentive side, things have been less encouraging. Under the Build Back Better Plan, the Biden Administration had allocated $555B to top-up the existing EV subsidy program through to 2026. Under the new plan, the Federal EV tax credit would remain at $7,500, though there would be additional sweeteners of up to $5,000 for those EVs that have a US manufactured battery ($500) and are built at a US plant that runs under a union-negotiated collective bargaining agreement ($4,500). The proposal also removes the existing tax credit cap on manufactures, which as it currently stands, phases out the $7,500 tax credit once the manufacturer reaches 200,000 in sales. Both Tesla and GM have already reached the cap, while Nissan and Toyota are very close – likely hitting it by this summer.

While the enhanced EV incentives would go a long way in broadening the consumer base in the years ahead, the spending bill has to first be enacted. And this is where things start to look a bit more grim. Since failing to make it through the Senate in December, negotiations on the Build Back Better Plan have completely stalled. The belief among Democrats is there’s still overwhelming support for many aspects of the $1.75T in proposed spending, so we’ll likely see a more trimmed down version – focusing mainly on the climate initiatives – resurrected over the coming months. However, even its fate is somewhat unclear. Inflationary pressures have only gotten worse since the end of last year, making it all the more difficult to find further support for another spending bill in today’s environment. With midterm elections in November, time is of the essence. Failure to pass a spending bill by November, runs the risk of the bill completely dying, as history has shown that the White House typically loses seats in both the House and Senate during midterms.

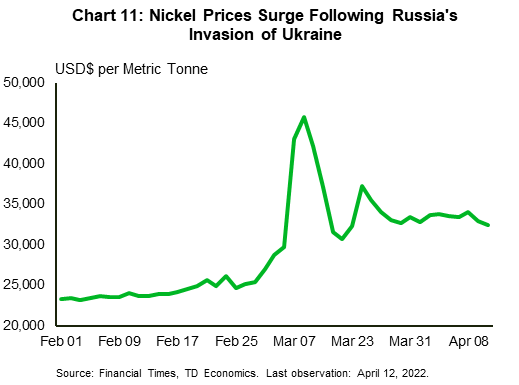

The Russia-Ukraine conflict has also injected some uncertainty into the EV outlook, and what it could potentially mean for vehicle prices and battery design going forward. Nickel is a critical component in the manufacturing of lithium-ion batteries, as its use has proven to significantly increase the energy density of the battery – allowing for longer vehicle travel range. Currently, over 20% of the global supply of class 1 nickel comes from Russia. However, the combination of Western sanctions and the threat that Russia may withhold exports of certain commodities has led to a recent surge in nickel prices – at one point having increased by more than four-fold (Chart 11). We have since seen some giveback from the early-March highs, though future prices today are still well above where they were at the beginning of the year.

According to a study done by McKinsey, only 7% of today’s nickel production is used in the manufacturing of EV batteries. By far, most is used in the production of stainless steel (73%) or other alloys. However, ambitious initiatives undertaken across North America and Europe to dramatically accelerate the electric vehicle transition over the coming years are expected to significantly increase nickel demand. Based on current trends, the market was already expected to be grossly undersupplied, and this was before the invasion of Ukraine. To date, no specific sanctions on Russian nickel have been announced. However, the recent move by the US to revoke Russia’s ‘favored nation’ trade status has meant that all imported goods will now be hit with a 32% tariff – up from 3%. On its own, this does not bode well for a reshoring of battery manufacturing to US soil. To combat the potential negative implications, the Biden Administration has invoked Cold War powers to boost domestic production and mining of some of the key minerals required for EV batteries. The decision adds lithium, nickel, cobalt, graphite, and manganese to a list of items covered by the 1950 Defense Production Act, allowing mining companies to access $750M to fund production at current operations, productivity and safety upgrades and feasibility studies. While a step in the right direction, the executive order does little to expedite the current mining process. However, many believe that this is a steppingstone for Congress to allocate increasingly more funding in the years ahead to encourage stronger domestic production of critical minerals required for EV batteries. Encouragingly, the US is not going to be doing this alone. Canada has also recently announced that they would be spending $3B ($3.8B CAD) over the next eight years to accelerate the production and processing of these critical minerals. The combined moves demonstrate that governments on both sides of the border are committed to not only the transition to zero emission vehicles, but also North American battery independence.

While we are still in early days, the recent events have dealt a potential setback to decarbonizing passenger vehicle transportation. Higher prices and a slower rollout of new models will likely slow the pace of EV adoption over the near-to-medium-term. However, we expect the industry to adapt over the coming years, through sourcing alternative suppliers of clean class 1 nickel, developing domestic capacity for producing and mining critical minerals, and further innovations in battery chemistry which may limit the dependence on nickel.

Conclusion

While we had previously hoped that auto production would normalize to pre-pandemic levels by year-end, the recent invasion of Ukraine and ongoing supply disruptions across China have forced us to revisit that view. Given Ukraine’s global importance as a primary supplier of neon gas, the impact to semiconductor production could be meaningful, creating a new headwind for the automotive industry. As a result, we have lowered our North American auto production forecast for both 2022 to 15M units (previously 15.5M) and 2023 to 16.3M (previously 17M). Accordingly, our US sales forecast has also been revised lower, and is now expected to be 15M in 2022. At this level, sales will be roughly on par with last year but still well below the pace required to meet replacement demand and a growing population – closer to 16.8 million units.

By the end of 2022, it is estimated that the pandemic would have resulted in over 5 million units of lost sales – some of which are likely to pulled through in the years ahead. However, increased cost pressures, and higher interest rates will likely lead to some demand destruction, limiting the number of pandemic related losses that will eventually be recouped.

The situation in Ukraine remains very fluid, and the resulting impacts to both semiconductor supply chains, and the automotive industry are still not fully understood. While it is hoped that production disruptions will abate through the second half of next year, much of that hinges on chipmakers’ ability to find alternative suppliers of neon gas. Failure to do so will only exacerbate already strained supply chains and further restrain both auto production and sales.

References

- Government of Canada, Budget 2022: A Plan to Grow Our Economy and Make Life More Affordable https://budget.gc.ca/2022/home-accueil-en.html

- McKinsey & Company, How Clean Can the Nickel Industry Become, September 2021 (https://www.mckinsey.com/industries/metals-and-mining/our-insights/how-clean-can-the-nickel-industry-become)

- The White House – Briefing Room Statements & Releases, Securing a Made in America Supply Chain for Critical Minerals, February 22nd, 2022 https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/

- The White House – The Build Back Better Framework https://www.whitehouse.gov/build-back-better/

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: