Highlights

- Elections matter for the economy, but financial markets are likely to be particularly attuned to the current election cycle given America’s unsustainable fiscal trajectory.

- Vice President Harris is campaigning on higher taxes for the wealthy and corporations, paired with progressive spending and tax breaks targeted at the middle-class.

- Conversely, Trump is promising to lower corporate taxes, reduce regulation, increase trade protectionism, and tighten border security.

- The make-up of Congress will determine how much of the future President’s agenda can be implemented. A divided Congress will likely force the next President to make significant concessions relative to their current platform proposals.

- Neither candidate’s platform appropriately addresses America’s growing fiscal burden, leaving both the economy and financial markets vulnerable in the event of an economic downturn.

American voters are weeks away from electing the 47th president, choosing between Democratic Vice President Kamala Harris or former Republican President Donald Trump.

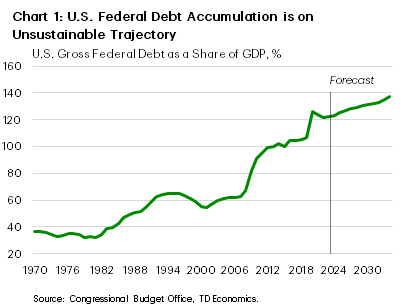

Electing Harris will mean an extension of the ideology and policy position of the past four years into the next. A second Trump presidency is likely to sustain lower taxes, increase trade protectionism, lessen regulation, and tighten border security. Both candidates have a proven track record of passing major domestic policy initiatives while serving in the White House. Under the previous Trump administration, a major overhaul of the tax system led to significant cuts to both personal and corporate tax rates. Under President Biden, Harris helped orchestrate the American Rescue Plan – a $1.9 trillion post-pandemic stimulus package – along with key infrastructure and climate initiatives. Unfortunately, each administration’s most notable successes have also come with hefty price tags and have helped to put the U.S. on an unsustainable fiscal trajectory (Chart 1).

As a result, investors will view both candidates’ fiscal plans through the lens of how it will impact America’s growing debt burden. A Trump administration would likely focus on reducing regulations and further cuts to taxes to stimulate growth and increase revenue. Meanwhile, Vice President Harris supports raising taxes on both the wealthy and corporations to offset tax breaks and spending initiatives for the lower-and-middle-income households. Other economically relevant campaign issues that are likely to garner attention include tariffs and trade policy, immigration & border security as well as energy, environmental and antitrust regulations.

Of course, each candidate’s ability to pass new legislation will be determined by the make-up of Congress. With all 435 seats in the House to be contested, and 34 Senate seats up for grabs, there is a rare chance that all three chambers are flipped, resulting in a divided government – something that hasn’t occurred since 1953. This would be a break from the last three first-time elected presidents (i.e., Obama, Trump, and Biden) who entered the White House with full control of both the House and Senate.

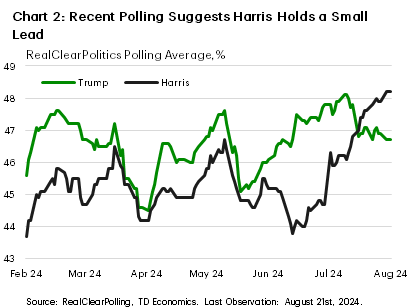

Recent polling shows that Democratic support has turned higher following President Biden’s decision to withdraw, with Harris now holding a very slight lead over Trump in the national polls (Chart 2). However, the race remains incredibly tight across the battleground states, with Trump holding slim leads in Arizona, North Carolina, and Georgia, while Harris remains ahead in Nevada, Wisconsin, and Michigan.

But considering the tight margins and the inaccuracy of polls in the past, nothing is set in stone.

Until the election results are known, we can shed some light on how the major highlights of each candidate’s platform could impact the economic outlook.

Harris Plan: Higher Taxes on Corporations & Wealthy, Paired with Progressive Spending and Tax Breaks for Middle Class

Not surprisingly, a Harris-Walz administration would hew closely to the principles and policies of the Biden-Harris administration. The cornerstone of the economic plan hinges on redistributing resources from corporations and high-income earners to lower-and-middle-income individuals. At this point, the specifics on how Harris will distinguish her policy platform from Biden have only been partially released, but campaign sources have noted that she is “not going to stray far from Biden on substance”. Given the Democrats had already voted on their 2024 platform a few days before Biden withdrew from the presidential race, and they did not make any changes following Vice President Harris’s endorsement, it seems likely that Harris’s broader campaign initiatives will align closely to Biden’s. This suggests that many of the proposed changes to the tax structure included in the 2025 Biden-Harris budget are likely to still be in play. This would include allowing some provisions of the 2017 Tax Cuts & Job Act (TCJA) to expire, while also making changes to the existing tax code to raise taxes on both corporations and high-income earners.

At this point, Harris has publicly committed to increasing the corporate tax rate to 28% (from 21%) and maintaining the current tax structure for all earners under $400k. With respect to capital gains, Harris has proposed increasing the top tax rate to 33% – up from today’s top long-term tax rate of 23.8% – but this would only apply to those individuals earning over $1 million. She would also implement Biden’s “billionaire tax”, which would require taxpayers with net wealth over $100 million to pay a minimum tax on their unrealized gains from assets such as stocks, bonds and privately held companies. Conversely, further tax breaks for lower-and-middle-income workers would come in the form of renewing the 2021 expanded Child Tax Credit (CTC) back to the criteria used in the 2021 American Rescue Plan (ARPA) and introducing a new CTC of up to $6,000 per-child for families with children under the age of one.

Reverting to the expanded CTC would mean the maximum tax credit would again increase to $3,600 for children under the age of 6, and $3,000 for children aged 6 to 18 from today’s maximum credit of $2,000 per-child. The tax credit would also be fully refundable – an enhancement from the current CTC, which is only partially refundable. This new provision would benefit low-income earners the most. Under current law, families who owe little or no income tax can claim a maximum benefit of $1,400 per-child. Under a fully refundable structure, these families would be eligible to claim the maximum amount, in some cases doubling the current benefit. Past research done by the Department of Treasury claimed the expansion of the CTC under the ARPA helped to lift more than 5 million children above the poverty line.

Harris also said that she would expand the Earned Income Tax Credit for workers without children, raising the maximum credit to as much as $1,500 – up from its current maximum of $600 – and has also committed to eliminating taxes on tips for hospitality and service workers.

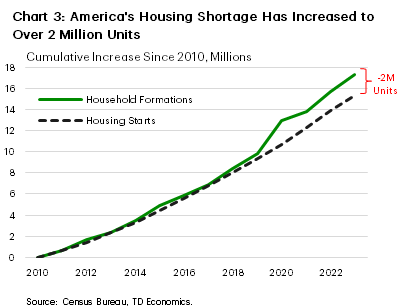

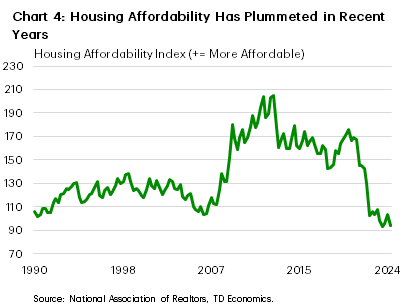

The Vice President’s economic plan also attempts to address America’s housing shortage (Chart 3) and ongoing affordability challenges (Chart 4), by introducing a new tax incentive for building starter homes as well as creating a housing ‘innovation fund’ totaling $40 billion. The latter is intended to assist local governments in addressing housing shortages, and to support “innovative” methods of construction financing, while also allowing certain federal lands to be eligible for repurposing for new housing developments. Harris’s platform suggests that these changes could bring three million additional units over the coming four years.

For first-time homebuyers, Harris has pledged $25,000 in downpayment assistance with more generous support for first-generation homebuyers. Combined, these measures are more lucrative than what Biden campaigned on, which included a $25,000 downpayment assistance for 400,000 first-generation homebuyers and $10,000 in assistance for first-time buyers. Lastly, Harris has taken aim at investors and landlords, saying she would remove tax benefits for investors who buy large numbers of single-family rental homes, while also banning algorithm-driven price-setting tools for landlords to set rents. Table 1 provides a high-level overview of each of the policies that Harris has so far committed to and how they compare to Biden’s proposals.

From a revenue standpoint, there are several other items included in the Biden-Harris budget that Harris has yet to endorse (or in some cases, provide enough detail) but will likely need to in order to make good on her campaign promise of “reducing the deficit and strengthening America’s fiscal health”. Perhaps the most notable change would be allowing the TCJA tax break for income earners over $400,000 to sunset, raising the effective tax rate from 37% to 39.6%. It’s also likely that high income earners could see an increase in both the net investment income tax (NIIT) and Medicare payroll tax rate. Under current law, taxpayers are subject to a 3.8% NIIT on investment earnings above $250,000 and an additional 0.9% Medicare tax (on top of the usual 2.9% Medicare payroll tax). According to the Biden-Harris’s budget, both the NIIT and the Medicare payroll tax rates would increase to 5% for individuals earning over $400,000.

For corporations, a number of provision changes have been proposed. Outside increasing the corporate tax rate, Harris may also support increasing the corporate alternative minimum tax (CAMT) from its current rate of 15% up 21%. CAMT was first introduced as part of the 2022 Inflation Reduction Act (IRA) and was meant to specifically target larger corporations reporting significant income on their financial statements despite paying little to no federal income tax. However, because of the relatively high-income threshold – only applying to businesses with average earnings of $1 billion or more calculated over a three-year period – along with other categorial exemptions, the Joint Committee of Taxation estimates that CAMT applies to fewer than 150 corporations and generates an estimated $222B per-year. So even if the CAMT rate were increased, the additional increase in revenue would be relatively small.

Another tax provision that was first introduced in the IRA that could see further changes is the share buyback tax. Under current law, publicly traded corporations pay an excise tax of 1% of the fair value of stock repurchased from shareholders. The Biden-Harris budget proposed quadrupling the tax rate, and it seems likely that Harris would also support some increase in the excise tax from current levels.

In total, estimates done by the Committee for a Responsible Federal Budget suggest that the tax credits and spending under Harris’s proposed plan would cost $2.1 trillion over the next decade. However, this is only accounting for those measures announced to date. Should Harris propose further policy initiatives over the coming weeks, that will only add to price tag. Table 2 shows the associated costs of each of the policy measures announced while the rows highlighted in grey show policies that Biden has supported but have not yet been endorsed by Harris. Should Harris move to endorse all the additional policy initiatives, the estimated costs of her fiscal plan would essentially double. Assuming Harris’s approach to increasing revenue largely aligns to the Biden-Harris budget, this would suggest that the deficit increases by $2.3 trillion less than the Congressional Budget Office’s (CBO) current baseline forecast, which is assumed to increase by $22 trillion over the next decade. However, these estimates are done on a static basis and do not reflect any macroeconomic feedback. Estimates done by other organizations who use a dynamic model have shown that the combination of higher corporate tax rates and increased taxation on the wealthy result in a slightly slower pace of economic growth over the next decade, resulting in an even smaller reduction to the deficit.

Trump Plan: Reduce Taxes & Regulation, Increase Protectionism & Border Security

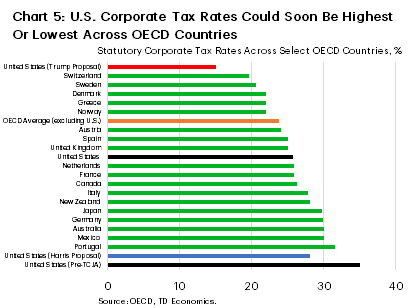

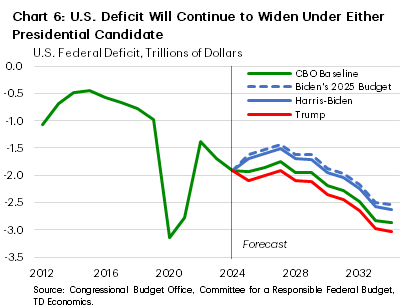

A key campaign promise from Trump is to make permanent all the provisions of the TCJA which are set to expire at the end of 2025. In addition, Trump has committed to reducing the corporate tax rate down to 15%, but only for companies who produce products in America – putting the U.S. at the lower end of the spectrum when compared against other OECD economies (Chart 5). At this point, the Trump campaign has not released details on how the rate would be structured or enforced, making any cost or economic projections specific to this campaign promise highly uncertain. Estimates done by the Tax Foundation and Committee for a Responsible Federal Budget suggest that fully extending TCJA and reducing the corporate tax rate for eligible corporations would reduce revenues by as much as $4.2 trillion over the next decade. The impact to the deficit would be even larger (+$300B) should Trump extend the corporate tax break to all U.S. corporations. However, both changes are pro-growth in nature which means they would generate some offsetting revenue. The net or “dynamic” effect would result in the deficit widening by an additional $3.5 trillion (Chart 6).

As a revenue offset, Trump has proposed imposing a universal 10 percent tariff on all imported goods to the U.S., and potentially raising tariffs on Chinese goods as high as 60 percent. Assuming in-kind retaliation from all trading partners, the Tax Foundation estimates that the net effect would likely offset the entire economic benefit of the major tax cuts, potentially resulting in a small net drag on output and job creation. Moreover, the tax revenues raised from the tariffs would not be enough to cover the full cost of extending TCJA, leading to an even larger increase in the deficit over the next decade.

Our own analysis shows that even if the U.S. were to follow through on only leveraging a 10% tariff on its trading partners, it could lower growth by as much 1.5% over the coming years and lead to a 0.5 percentage point increase in the unemployment rate. However, these estimates come with considerable uncertainty, and are largely dependent on the extent of retaliation and how global financial markets view the shift toward more protectionist type trade policies. Our analysis assumes that all countries retaliate with a similar increase in tariffs leading to a pronounced “risk-off” response to the tit-for-tat tariffs, resulting in a widening in credit spreads, spike in the VIX and roughly 20% sell-off in U.S. equities – all happening over a short two-quarter timeframe. This feeds though the confidence channel and is the primary source of economic drag.

Former President Trump has also campaigned on a significant shift in U.S. energy policy, with a stronger emphasis on fossil fuels, extensive regulatory rollbacks and scaling back of renewable energy polices. To boost U.S. oil and natural gas production, Trump has proposed ending Biden’s delays in federal drilling permits and leases on federal lands, freeing up more public land for energy development and speeding up the approval process for new natural gas pipelines. Trump has also said he would roll back two of the previous administrations’ hallmark climate and infrastructure policy initiatives, including the IRA and Infrastructure Investment & Jobs Act (IIJA). However, both the IRA and IIJA were laws passed by Congress, so changing or repealing them would require approval from both chambers and couldn’t be done through an executive order. Even under a Republican sweep, this could prove difficult given that Republican states have been major beneficiaries from both pieces of legislation in recent years.

But that doesn’t rule out the possibility of a partial repeal, particularly for the IRA. Under this scenario, low hanging fruit would include capping and/or shortening the duration of availability for some of the tax credit incentives, eliminating the individual EV tax credit, as well as reversing regulations on emission standards.

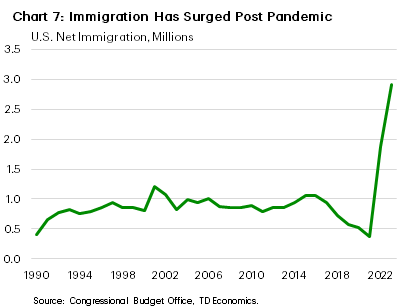

Lastly, former President Trump has also campaigned on tighter border security. According to the 2024 GOP Platform, this will be done by “sealing the border” and “carrying out the largest deportation operation in American history”. The extent to which the Trump administration would be able to follow through on this commitment will be highly dependent on the make-up of Congress. But history has shown that Trump is not afraid to tighten controls at the border. Through Obama’s second-term, annual immigration averaged 1.0 million per-year. However, immigration steadily fell through Trump’s presidency, reaching a nadir of around 600 thousand in 2019 – the slowest annual pace of growth since 1990.

Both Trump & Biden-Harris Administration Have Tightened Trade Stance

Between 2018 and 2019, the Trump administration-imposed tariffs on thousands of products valued at approximately $380 billion. The Biden administration has kept nearly all the Trump tariffs, and earlier this year, announced tariff increases on an additional $20 billion of Chinese goods, including semiconductors, electric vehicles, critical minerals and steel & aluminum imports. While the recent moves by Biden administration are small in nature, they symbolize a growing desire across both administrations to protect American industries, particularly against China. However, the two administrations favor different visions on how to strengthen America’s competitiveness over the long run.

For example, Trump favors a protectionist approach of unilaterally increasing tariffs in attempt to yield concessions from trading partners, with a specific emphasis on China. In contrast, the Biden-Harris administration has supported working with allies and investing domestically to put the U.S. on a stronger footing to compete with China in faster growing industries such as clean energy and semiconductor manufacturing.

It’s also worth noting that while Harris’s views on trade generally align to Biden’s, her past record has shown to be a bit more protectionist in nature. While serving as a Senator, Harris voted against both the United States-Mexico-Canada Trade Agreement in 2020 and the Trans-Pacific-Partnership which was spearheaded by the Obama administration. In both cases, Harris cited environmental concerns and that the agreements didn’t do enough to protect American workers. All of this suggests that Harris could go even further than Biden on further integrating trade and climate policy, and potentially take a tougher stance on China to better level the playing field.

A more meaningful deportation effort could come with significant economic repercussions. The increase in immigration in recent years has helped to drive a faster rebalancing in the labor market, particularly among industries that are more reliant on foreign workers (i.e., agriculture, construction, leisure & hospitality, and some aspects of manufacturing). Any sudden outflow of foreign workers risks undoing some of the past progress, resulting in tighter labor conditions and potentially higher labor costs, all of which could slow the ongoing disinflationary process.

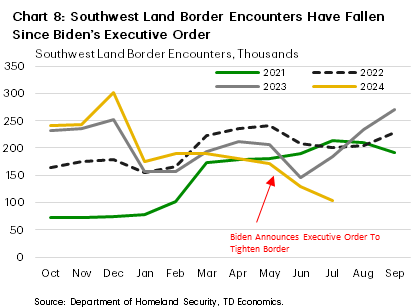

Even under a Harris led administration, tighter border security and lower immigration flows are inevitable. Estimates done by the CBO have shown that U.S. immigration surged post-pandemic (Chart 7). Data released by the Department of Homeland Security suggests that a significant share of the increase has been due to individuals seeking asylum and/or other forms of humanitarian parole as well as an increase in illegal crossings. The Biden administration has already made moves to significantly tighten border security enforcement efforts at the Southwest border, recently announcing new measures that will prevent migrants who cross the border illegally from seeking asylum, which is already showing to have led to a meaningful reduction in border crossings (Chart 8). With Biden’s executive order to remain in place for the foreseeable future, immigration flows are likely to continue to slow.

However, given where we are in the business cycle, slower immigration growth may not be a bad thing. The labor market has significantly cooled over the past year, and we’re now seeing the unemployment rate pressured higher as labor force growth outstrips job creation. With labor demand likely to continue to cool through the remainder of this year, some easing in labor force growth would help to mitigate the overall economic impact.

Implications for Financial Markets

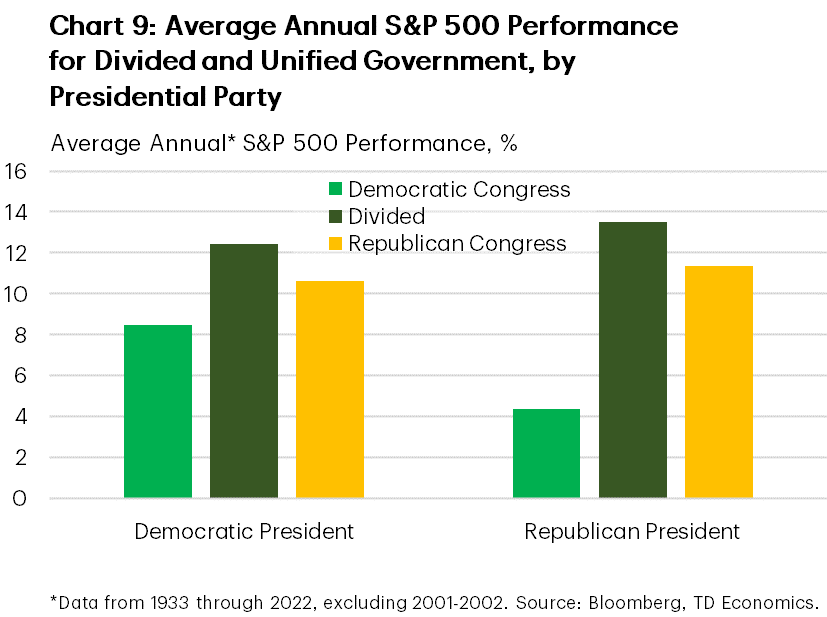

In terms of financial markets, equities tend to have a short-lived boost following a Republican presidential win and setback following a Democratic win. But these gains are temporary, and history shows that irrespective of the party in the White House, a divided or Republican controlled Congress has historically been a bigger boon for equities in the years that follow the election (Chart 9).

While a Republican sweep would likely mean status quo on the personal tax structure, the potential for a significant reduction in the corporate tax rate would be a net positive for corporate earnings, and thus equities. However, funding these tax breaks through increased tariffs is likely to create a lot of angst across financial markets, particularly if Trump were to follow through with the full-scale tariffs he has campaigned on. What’s more, the expected revenue generated from the tariff increases will not be enough to offset the costs of extending TCJA and further reducing the corporate tax rate. Ultimately, this means even larger deficits than what’s currently assumed in the CBO’s baseline forecast.

To date, market participants have shown little unease with America’s unsustainable debt trajectory. But those good fortunes will eventually run out – particularly if no effort is made to curb the growing problem. Moreover, a significant increase in U.S. tariffs would likely result in tit-for-tat retaliation from trading partners, helping to destabilize still fragile global supply chains, disrupting global trade flows, and creating a potential catalyst for a global recession. If fiscal restraints were to suddenly come into focus, the U.S. would likely be more limited in its fiscal support measures, potentially amplifying the shock. With all this to consider, the market response to a Republican sweep is likely to be quite cautious given the potential policy uncertainties.

But the same is likely true under a Democrat sweep. All else equal, a combination of tax increases, more regulation and a pro-labor bent, a Democratic sweep would also likely be a net negative for equities, given the impact on corporate profits. One potential offsetting influence could stem from a more predictable and business-friendly path on geopolitical matters and trade policy. Another positive for markets would be a less meddlesome approach to the Federal Reserve. Like Biden, Harris supports an independent Fed and would be unlikely to criticize the Fed in public or nominate unconventional candidates for board positions. And while the Biden administration has already made moves to tighten boarder security, immigration flows are still expected to converge back to something closer to where they were during the second term of the Obama administration, or potentially even a bit higher. Taken alongside Harris’s initiatives to reduce income inequality (with a more progressive tax structure and further spending initiatives to support lower-income families), it could help to boost the underlying pace of economic growth over the long-run. This would eventually raise the natural or equilibrium fed funds rate – what economists call R* – in turn, lifting longer-term bond yields.

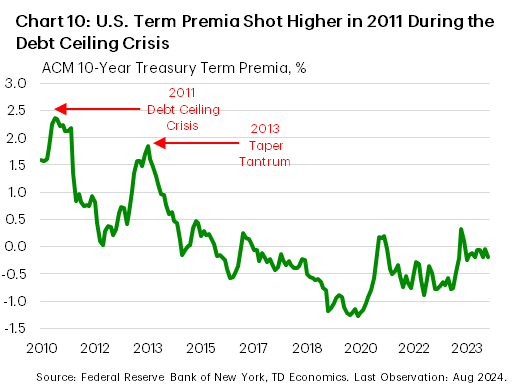

Our current forecast assumes a “fair value” on the U.S. 10-year Treasury yield of 3.45%. This implies a 1% real neutral rate, 2% long-term inflation target and a 45-basis point (bp) term-premium, which is roughly 50 bps higher than today’s estimated levels (Chart 10). In large part, the expected increase in the term-premium reflects the gradual unwinding of central bank balance sheets over the coming years. However, any flare-up in investor concerns regarding fiscal sustainability could significantly pressure the term-premium higher, potentially by as much as 50-100 bps – getting it closer to the levels reached at the height of the 2011 debt ceiling crisis (Chart 10).

Irrespective of who wins the White House, the first order of business will be addressing the debt limit. Back in June 2023, President Biden and Congress negotiated a compromise bill – the Fiscal Responsibility Act – that temporarily suspended the debt ceiling through January 1st, 2025. Should Congress not extend the suspension or lift the debt ceiling by early-January, the Treasury will again be forced to take “extraordinary measures” – prioritizing necessary expenditures but withholding funding for all non-essential services. In all likelihood, this will buy Congress several more months to negotiate a deal, though the closer the U.S. gets to reaching the “X-date” the more volatility this is likely to inject across global financial markets.

The Bottom Line

Presidential elections always matter for the economy and financial markets, but markets will be particularly attuned to policies that worsen the deficit and debt levels when there’s already a shortening runway to bend the curve under aging populations and rising entitlement commitments.

Under a Harris presidency, fiscal policy looks to be either neutral or even slightly expansionary for the economy should the Democrats take control of both chambers of Congress. It may succeed in reducing the deficit by $2.3 trillion over the next decade, but this could be viewed as a drop in the bucket since it’s coming atop of the CBO’s baseline projections that show an expanded deficit of $22 trillion during that time.

On its own, the tax cuts proposed by Trump would be expansionary in nature. However, funding those cuts by universally increasing tariffs on all of America’s trading partners threatens to disrupt trade flows and destabilize global supply chains – increasing the odds of a global recession and disruptions to American corporations and consumers. Depending on the severity of the tariffs and retaliation imposed by trading partners, the economic damage caused from the protectionist measures alongside the erosion in real household income from more expensive consumable goods is likely to offset or perhaps even outweigh the lift to growth stemming from the tax breaks. Moreover, the revenues generated from the tariffs are likely to fade over time as import flows decline, which means the deficit is likely to widen by even more than what’s currently projected by the CBO.

At this point, neither candidate’s economic plan appropriately addresses the U.S.’s unsustainable fiscal trajectory. While financial markets have so far taken America’s growing debt burden in stride, those good fortunes could quickly run out, particularly in the event of an economic downturn that would require additional fiscal supports or even a disorderly debt ceiling debacle next year. A more serious fiscal adjustment that includes some combination of higher taxes, cuts to major entitlement programs and/or deep cuts to discretionary spending will eventually be required to put the U.S. on more sustainable fiscal path. This is unlikely to happen over the near-term. But at some point, over the coming decade, the music will stop, and whoever is in power will be forced to make some hard decisions. Until then, both the Democrats and Republicans will be left playing a game of “hot potato”, never addressing the root causes required to put America back on a more sustainable fiscal trajectory.

Exhibits

Table 1: Harris's Policy Initiatives Go a Step Further Than Biden's

| Policy Initiative | Harris | Biden |

| Increase corporate tax rate to 28% | X | X |

| Increase top capital gains tax rate to 33% for individuals earning +$1M | X | Top rate increased to 44.6% |

| Increase startup expense deduction for small businesses to $50,000 | X | ----- |

| Establish 25 percent billionaire tax on unrealized income | X | X |

| Increase Child Tax Credit and make fully refundable | X | X |

| Child tax credit of $6,000 for newborns | X | ------ |

| Expand Income Tax Credit for workers in low-income jobs | X | X |

| Maintain tax rates for earners <$400,000 | X | X |

| End taxing of tips for service & hospitality workers | X | ----- |

| Provide a $25,000 first-time homebuyer credit | X | Tax Credit was $10,000 |

| Provide a $25,000 first-generation homebuyer credit | X | Capped at 400,000 individuals |

| Tax incentive for starter & rental homes + $40 billion housing innovation fund | X | ----- |

| $35 Insulin for all Americans | X | X |

| Capping out of pocket medical expenses at $2,000 for all Americans | X | X |

| Extending enhanced Affordable Care Act subsidies | X | X |

Table 2: Summary of the Fiscal Effects of the Harris and Biden-Harris Economic Platforms

| Policy | Ten-Year Deficit Impact Cost/Savings (-), Billions of $ |

| Tax Cuts, Tax Credits and Tax Breaks | $1,870 |

| Expand CTC to $3,000 or $3,600 for young children | $1,100 |

| Further expand CTC to $6,000 for parents with newborns | $100 |

| Expand the Earned Income Tax Credit for workers without child dependents | $150 |

| Extend the ACA premium tax credit expansion | $400 |

| End "tax on tips" for service & hospitality workers | $100 |

| Increase startup expense deduction for small businesses to $50,000 | $20 |

| Spending Increases | $2,267 |

| Enact additional affordable housing policies for four years | $100 |

| Provide a $25,000 first-time homebuyers credit for four years | $100 |

| Expand access and funding for pre-K and childcare | $600 |

| Establish national paid family and medical leave | $325 |

| Offer free community college, increase Pell Grants & other higher educ. spending | $290 |

| Increase health service funding as well mental and public health funding | $344 |

| Increase near-term discretionary spending levels | $170 |

| Improve Medicaid home and community-based services | $151 |

| Enact other spending increases | $187 |

| Subtotal, Gross Costs | $4,137 |

| Spending Reductions | -$930 |

| Reduce prescription drug and other health care costs | -$250 |

| Slow future growth of discretionary spending | -$511 |

| Extend the mandatory sequester for Medicare and other programs | -$90 |

| Expand user fees and spectrum auctions and other spending changes | -$79 |

| Tax Increases | -$5,109 |

| Increase corporate tax rate from 21% to 28% | -$1,425 |

| Increase capital gains and estate taxes | -$300 |

| Increase corporate book minimum tax and stock buyback tax rates | -$317 |

| Reform international tax rules | -$641 |

| Enact other corporate tax increases | -$144 |

| Establish 25 percent billionaire tax on unrealized income | -$503 |

| Increase top individual income tax rate from 37 percent to 39.6 percent | -$256 |

| Expand limit on deductibility of executive compensation | -$272 |

| Increase and expand Net Investment Income (NIIT) and Medicare surtax | -$814 |

| Reduce tax gap for extending IRS funding and other policy changes | -$260 |

| Close various fossil fuel, digital currency and other tax break loopholes | -$177 |

| Subtotal, Gross Savings | -$6,039 |

| Net Interest Savings | -$350 |

| Total, Policy Savings under Biden-Harris Economic Plan | -$2,252 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: