2024 Federal Economic Statement

Francis Fong, Managing Director & Senior Economist

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Derek Burleton, Deputy Chief Economist | 416-982-2514

Date Published: December 16, 2024

- Category:

- Canada

- Government Finance & Policy

Highlights

- It was a wild day in Canadian politics, with the Finance Minister resigning ahead of the Fall Economic Statement (FES). This did not preclude the FES from being tabled, giving us some window into the government’s economic plan in the face of a second Trump administration. However, political uncertainty looms large with a significant cabinet shuffle and an election looming.

- The government has broken its pledge to keep the budget deficit below $40 billion in 2024-25. That said, the deficit is expected to ease from $61.9 billion in FY 2023-24 to $48.3 billion in FY 2024-25 (1.6% of GDP) to $23 billion in 2029-30. The government did meet its obligation of a falling debt-to-GDP ratio, which is expected to have peaked at 42.1% in FY 2023-24, before moving lower over the remainder of the budget forecast.

- A total of $23.3 billion in net-new measures were announced, including $1.6 billion on a GST rebate, $1.3 billion on tightening border security, and $18.4 billion to incentivize investment. These supports more than offset the impact from a stronger 2024 hand-off and lower than expected interest rates, leading to a net deterioration in the budget balance over the forecast horizon.

Wider Deficits to Support Consumption

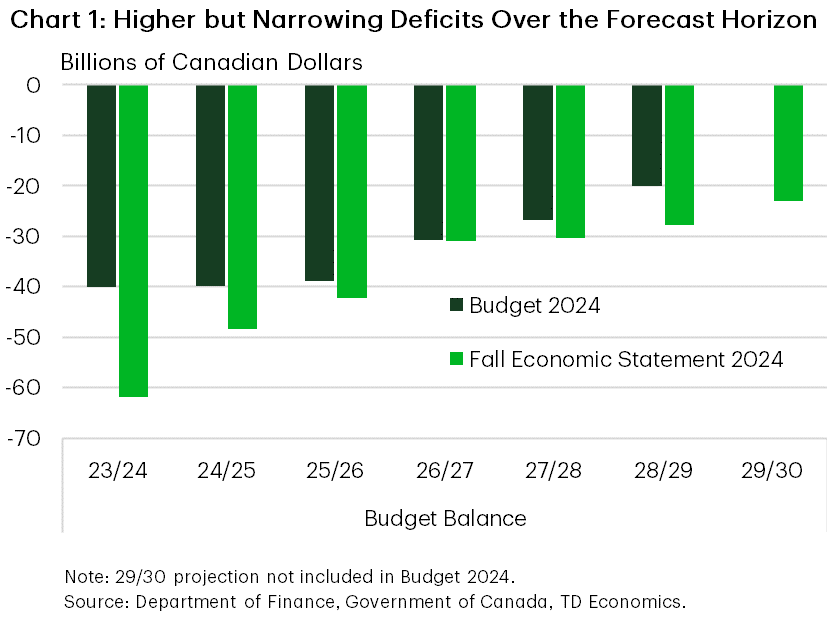

The Federal Economic Statement (FES) confirmed that the government is on track to blow through its deficit target set out in Budget 2024 (B24). The deficit for FY 2024-25 is expected to come in at $48.3 billion (vs. the $40.1 billion cap promised, Chart 1), equivalent to 1.6% of GDP. Consistent with this higher jump-off point, the cumulative deficit projection from 2024 to 2029 was upgraded to $179.7 billion, versus a previous estimate of $156.3 billion in B24.

The bulk of this year’s deficit overshoot reflects higher-than-expected program spending. The update includes a laundry list of measures that had been announced in recent days. Those initiatives – alongside other commitments booked since the spring budget and less revenues expected in future years – are set to deliver a combined fiscal hit of $23.3 billion over the budget horizon, with the focus on efforts to improve the spending power of Canadians ahead of a forthcoming election. The positive fiscal impact of a decent economic handoff in 2024 provides a fiscal counterbalance to these pressures, but only modest.

Despite the increase in the budget shortfall relative to plan, the government has managed to cap this year’s debt-to-GDP ratio at 41.9%, before easing over the remainder of the budget horizon. Meanwhile, the deficit-to-GDP peaked at 2.1% in the prior fiscal year and is expected to move below the government’s target of 1% by 2026-27.

The new spending program is expected to pass in Parliament with support from the NDP. News of Finance Minister Freeland resigning will likely add further uncertainty for the Liberals who are inching closer to an election. Public Safety Minister Dominic LeBlanc appears set to take over the role. Canadian bond yields are up marginally today relative to U.S., while the Loonie remains in danger of moving below the psychological 70 U.S. cent mark.

More Money More Problems

Changes to the government’s economic projections explain part of the revised fiscal outlook. The nominal GDP growth forecast has been upgraded for 2024 based on private sector assumptions (from 3.7% to 4.3%), giving the government some fiscal room - meaning that the deficit miss would have been somewhat worse if it weren’t for this economic growth surprise. Looking forward, GDP growth assumptions do not assume a severe tariff downside to growth like what we have modeled out, although the downside scenario from the government does speak to some of the growth risks. This is important as Canada will not just be facing geopolitical threats, but a slowdown in population growth that could put further strain on government revenues in the coming years.

For FY 2023-24, the deficit came in at whopping $61.9 billion, well above the $40.0 billion in B24. Accounting adjustments related to CEBA loan repayment provisions and one-time payouts were responsible for the big miss on the 2023-24 deficit. For FY 2024-25 and beyond, new policy measures are the main driver of larger budget deficits. The GST holiday from Dec. 14th to Feb. 15th will temporarily boost consumer spending, but the revenue lost will amount to $1.6 billion in 2024-25. Of note, the $250 cheques (which would have cost double the GST break) are not included. There was also the important extension of the investment incentives via the accelerated capital allowance, which added $17.4 billion to the accumulated deficit from 2025-30. There were no major revenue measures to offset new policy spending.

Lower Policy Rate Not Enough to Ease Debt Burden

Interest costs are slated to be another headwind on the government’s medium-term fiscal plan even though the BoC’s policy rate has come down significantly (from 5.0% at the beginning of the fiscal year to 3.25% today. As such, debt service charges are expected to increase from $23.7 billion this fiscal year to just under $70 billion by fiscal 2029-30 (in B24 debt charges were estimated to reach $64.3 billion in 2028-29). As a share of revenue, interest costs are projected to rise from around 1% at the low point during the pandemic to 1.9%.

Fortunately, the government is acting from a position of strength, as it has maintained the best net debt-to-GDP ratio of all G7 nations. It also is the only country with a AAA credit rating. And while there was some hope that the government would soon build on this advantage, new spending means even less dry powder should rising geopolitical risks hit the economy.

Details of Significant New Measures

Several measures aimed at raising productivity and investment were announced both ahead and in the FES. Changes are being made to the Scientific Research & Experimental Development tax credit, including:

- Raising the expenditure limit on the enhanced 35% credit from $3 million to $4.5 million

- An increase in the capital threshold at which the tax credit phases out from $10-50 million to $15-75 million

- The inclusion of public corporations in addition to Canadian-controlled private corporations

SR&ED is one of the federal government’s largest tax expenditures, totaling $3.9 billion in foregone revenue in 2022-23 and nearly $27 billion over the last 8 fiscal years. The government expects an additional cost to this measure of $1.8 billion over the next 5 years (though this was mitigated by $750 million being drawn from previous funding).

The changes to pension fund rules and measures to increase pension investments came out of an economic working group chaired by former Bank of Canada governor Stephen Poloz. Measures include:

- Lifting the 30% investment cap on pension funds’ ownership of Canadian entities

- Crowding in private investment through a fourth $1 billion round of the Venture Capital Catalyst Initiative

- Making $45 billion in loan and equity investments available to invest in AI data centres subject to a 2:1 crowd-in rule on private investment from pension funds (resulting in $15 billion buy-in from the government)

Lastly, the government also extended the accelerated capital cost allowance (CCA) rules first implemented in 2018 in response to President Trump’s Tax Cuts and Jobs Act and which were set to be phased out between 2024-27. The rules allows a 1.5x prescribed CCA rate for certain eligible property and full and immediate expensing of both manufacturing and clean energy investments. Government’s assessment of the measure in 2018 had suggested a reduction in corporate marginal effective tax rates on investment of between 3.1 percentage points on average, with the manufacturing sector seeing the greatest reduction, from 9% to 3.1%. The extension of the CCA rules is expected to cost $17.3 billion over 5 years and will phase out between 2030-33.

The government also allocated $1.3 billion in new spending on border security in a nod to the Trump administration’s demand to possibly avoid costly tariffs.

The GST holiday that runs for two months is expected to cost $1.6 billion in the current fiscal year. This tax rebate covers items ranging from Christmas trees to restaurant meals and is intended to help improve the cost of living for Canadians. Importantly, the rumored $250 cheques to Canadians earning less than $150k was not in the FES. In terms of economic impact, we believe this policy will add 0.1 to 0.2 percentage points to growth in H1 2025, before completely unwinding by H1 2026.

The Canada Secondary Suite Loan Program is getting increased in an effort to make it more affordable to add a new dwelling to an existing home. It will increase the loan limit from $40,000 to $80,000 and maintain the 2% interest rate on this loan. Homeowners will also have the ability to refinance (up to a home value of $2 million) with an insured mortgage up to an amortization of 30-years. These policies are in addition to the new mortgage rules, which increases the cap on insured mortgages to $1.5 million (from $1 million), reducing the required downpayment for many homebuyers. They also are allowing 30-year amortizations for all first-time homebuyers and all buyers of newly constructed homes. All of these will improve affordability on the margin for Canadians.

In preparation for an uncertain fiscal outlook

The reality is that Canada’s fiscal deficit is neither unprecedented nor even that significant from an international perspective. At 1.6% of GDP, Canada still stands far apart from the US and some European counterparts where deficits are 3-4x that in Canada, as a % of their GDP. That being said, missing your deficit target eight months after you initially set it would put some abandoned new year’s resolutions to shame. The brief history of the federal government’s fiscal guardrails has, up to this point, avoided punitive measures like balanced budget legislation or other strict controls. Instead, government used metrics like a falling debt-to-GDP ratio and set the bar at a point that would never be binding.

In addition, the external environment is set to turn from cooperative to combative in a second Trump term, meaning fiscal capacity takes on even greater importance. Current demands from the incoming administration to avoid extremely punitive tariffs are already expected to be spending-positive on priorities like meeting our 2% NATO spending target by 2032 and more stringent border security. The PBO recently estimated that the current trajectory of defense spending baked into the current deficit forecast only reaches 1.58% by fiscal 2029-30. This suggests another nearly half a percentage point hit to the deficit as a % of GDP sprinkled over the next 8 years. Add on the additional $1.3 billion in spending expected by the government on more border security and the potential significant economic hit from reduced trade or the Trump administration implementing tariffs anyway, and you have a highly uncertain outlook that Canada is poorly prepared for given still unnecessarily large deficits.

There will be questions on whether this FES will impact the Bank of Canada (BoC). The boost to consumer spending lifts our GDP tracking only marginally in H1 2025, and any impact on growth should unwind later in the year. Our forecast assumes the BoC will cut by 25 bps in January, before pausing in March. The policy rate is already within the BoC’s neutral range, which means it can slow down the pace of rate cuts over 2025.

2025 will likely be a year of change for Canada. New population targets and the threat of tariffs from the new U.S. administration are likely to weigh on economic growth and put pressure on government finances. We expect the government will soon have to pivot away from providing cash transfers to Canadians to making real investment in the country’s future. Greater investment in defense and border security is likely a prerequisite in tariff negotiations, while a focus on tax and regulatory competitiveness will be needed for Canada to compete for investment dollars with the U.S. The extension of the accelerated CCA rules goes a significant way in supporting higher investment. However, Canada still faces challenges in terms of infrastructure spending, technology adoption, and skills training which will be needed for long-term productivity gains, enabling the country to regain its economic standing and improve the quality of life for Canadians.

Tables

Table 1: Fall Economic Statement 2024 - Summary

[Billions of Dollars, unless otherwise stated]

| Fiscal Year | 23-24 | 24-25 | 25-26 | 26-27 | 27-28 | 28-29 | 29-30 |

| Budgetary Revenues | 459.5 | 495.2 | 516.2 | 537.1 | 563.1 | 586.3 | 612.8 |

| Program Expenses | 466.7 | 485.7 | 500.3 | 509.3 | 529.7 | 549.7 | 570.3 |

| Public Debt Charges | 47.3 | 53.7 | 54.2 | 57.6 | 62.0 | 66.3 | 69.4 |

| Total Expenditures | 513.9 | 539.5 | 554.5 | 567.0 | 591.7 | 615.9 | 639.7 |

| Budgetary Balance Before Net Actuarial Losses | -54.4 | -44.3 | -38.3 | -29.9 | -28.6 | -29.6 | -26.9 |

| Budget Balance | -61.9 | -48.3 | -42.2 | -31.0 | -30.4 | -27.8 | -23.0 |

| Per Cent of GDP | |||||||

| Budgetary Revenues | 15.7 | 16.2 | 16.3 | 16.3 | 16.4 | 16.4 | 16.5 |

| Program Expenses | 15.9 | 15.9 | 15.8 | 15.4 | 15.4 | 15.4 | 15.3 |

| Public Debt Charges | 1.6 | 1.8 | 1.7 | 1.7 | 1.8 | 1.9 | 1.9 |

| Budget Balance | -2.1 | -1.6 | -1.3 | -0.9 | -0.9 | -0.8 | -0.6 |

| Federal Debt | 42.1 | 41.9 | 41.7 | 41.0 | 40.2 | 39.5 | 38.6 |

| Budget Balance - Downside Scenario | -61.9 | -49.7 | -51.6 | -41.6 | -36.8 | -32.0 | -27.0 |

| Per Cent of GDP - Downside Scenario | |||||||

| Budget Balance | -2.1 | -1.6 | -1.7 | -1.3 | -1.1 | -0.9 | -0.7 |

| Federal Debt | 42.1 | 42.0 | 42.8 | 42.5 | 41.7 | 40.8 | 39.9 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.