Markets Brace For Higher Inflation and Interest Rates Under President Trump

Beata Caranci, SVP & Chief Economist - 416-982-8067

Thomas Feltmate, Director & Senior Economist | 416-944-5730

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Marc Ercolao, Economist | 416-983-0686

Date Published: November 6, 2024

- Category:

- Canada

- Financial Markets

- Trade

- Commodities & Industry

Summary of Election Results & Financial Market Reaction

- As of 11 AM ET, Donald Trump has secured 277 of the 538 Electoral College votes, becoming the 47th president. While ballots are still being counted, President Trump also looks to have won the popular vote, which has not happened for a Republican president since George W. Bush in 2004.

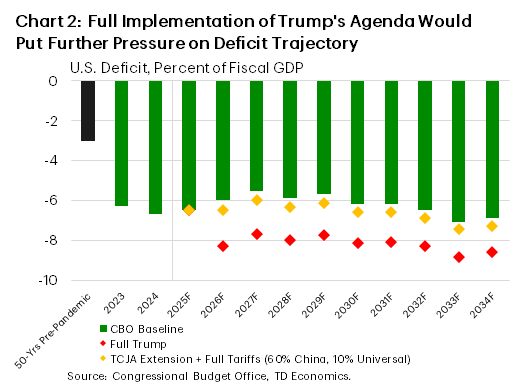

- The Republicans have also taken control of the Senate, securing 52 of the 100 seats. Six seats are still up for grabs, so there’s potential for the Republicans to gain a bit more ground in the Senate once the final votes are counted. Either way, a GOP controlled upper chamber will make it much easier for President Trump to make key appointments requiring Senate approval.

- Meanwhile, control of the House of Representatives remains up in the air, with 57 seats still to be called. As of the time of writing, the Associated Press is showing that the Republicans have secured 198 of the required 218 votes. However, it is possible that the final outcome of the House isn’t known for a few days, leaving some ambiguity on how much of Trump’s agenda will be implemented, since Congressional approval is required for tax or spending changes.

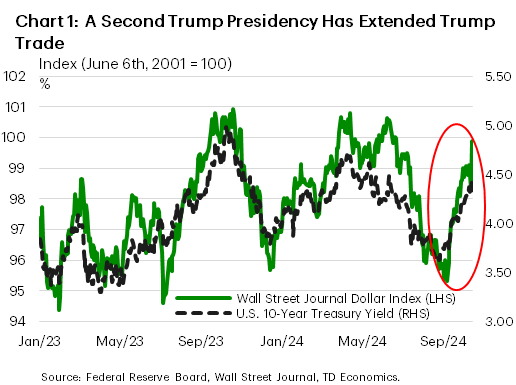

- Financial markets responded swiftly, extending the moves seen right before the election. The S&P 500 is up by nearly 2% today. Bond yields are also rising, with the U.S. 10-year Treasury up 17 bps this morning. Fed funds futures for the remainder of 2024 are relatively unchanged, still pointing to a 25 bp cut tomorrow and a near 70% chance of another 25-bps cut in December. Further out, pricing has shifted higher by nearly 20 bps, implying that markets are expecting the combination of tax cuts and tariffs raising the Fed’s neutral rate. Importantly, we aren’t seeing much in the way of rising U.S. debt risk premia, which was feared to rise with potentially wider fiscal deficits. The U.S. dollar has continued to gain ground against most of its peers, with the trade-weighted measure up nearly 2% this morning (Chart 1). Most of the gains are coming against the Mexican peso and euro (both down around 2%).

- We are changing our forecast for the Fed, as higher inflation results in a slower pace of rate cuts in 2025. We now have the Fed cutting by 25 bps tomorrow, in December, and in January, but then pausing in March. The Fed will continue with a cut-pause-cut pace through 2025, resulting in a higher fed funds rate at the end of 2025 of 3.5%, up from 3.0%. In H1 2026, we have the Fed cutting to 3.0%, implying that we don’t see any change to the neutral rate, just that the Fed gets there later.

In the Event Republicans Also Win the House…

- We expect Congressional Republicans to provide some degree of fiscal check on President Trump, limiting passage of the full $10 trillion worth of tax cuts he floated in the campaign.

- It is likely Trump can extend much, if not all, of the 2017 Tax Cuts and Jobs Act (TCJA) measures set to expire at the end of 2025. The cost of this is around $4.5 trillion. Should the Republicans end up with a narrow majority in the Senate, the GOP will likely need to use reconciliation, setting up another expiry showdown at a future date. Lastly, extending TCJA avoids fiscal tightening rather than expanding fiscal accommodation. Because our forecast assumes status quo on current policy, even a full extension of TCJA is unlikely to add further upside to the outlook.

- Expensive promises like repealing the cap on the state and local tax (SALT) deduction, eliminating tax on social security benefits and overtime pay as well as reducing the corporate tax rate for domestic manufacturers are less likely to be passed, but cannot be completely ruled out.

- Trump has also said he would eliminate many of the clean energy tax credits built into the 2022 Inflation Reduction Act (IRA). There is less clarity on whether these efforts will meet success given that 75% of the investments from the IRA have flowed to Republican-held states and repealing the IRA would require approval from Congress.

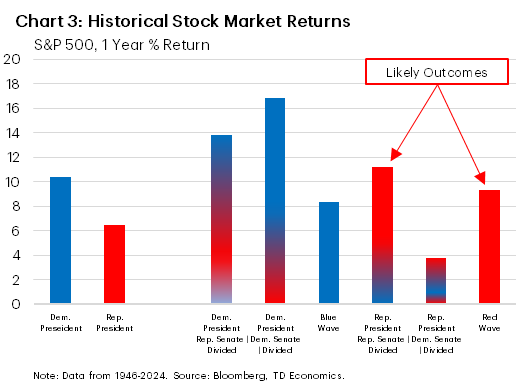

- However, when it comes to tariffs, the President can act more independently. Some version of this promise will be kept. Trump has proposed a universal 10% tariff on all countries exporting to the U.S., and a 60% tariff on China to help pay for the tax cuts proposed above. However, even with the potential added revenue, the federal deficit would still grow by another $7 trillion over the next decade (assuming Trump’s full suite of tax promises are implemented). If only TCJA were extended, but the full suite of tariffs was still imposed, the deficit trajectory would worsen relative to the CBO’s current baseline, but by far less than the alternative scenario (Chart 2).

- From a legal standpoint, it appears that President Trump has the authority to implement tariffs as he sees fit. In 2018, Trump used Section 232 of the Trade Expansion Act of 1962 to implement broad steel and aluminum tariffs, only to reduce/eliminate the tariffs through negotiations with some countries. Similarly, Trump used section 301 of the Trade Act of 1974 to leverage tariffs on China and the European Union.

- In his second term, Trump will likely invoke the International Emergency Economic Powers Act (IIEPA), which will allow for faster and more expansive power to leverage tariffs. We suspect Trump is likely to move quickly on implementing the tariffs.

- The big question is whether some countries get specific carve-outs. An obvious example would be Canada and Mexico, who are technically both covered under an existing trade agreement (US-Mexico-Canda Trade Agreement) that was signed into law under the prior Trump administration. One possibility is that Canada/Mexico would remain insulated from tariffs, so long as they follow the U.S.’s lead and leverage similar tariffs on China.

- For China, Trump is likely to repeal the Permanent Normal Trade Relations (PNTR), which was passed after China joined the WTO in 2001, leading to a vast reduction in tariffs. Repealing PNTR would result in current Chinese tariffs increase from 19% to 61%. This will require approval from Congress.

- Assuming full implementation of the Trump tariffs in early-2025, our estimates suggest that the twelve-month change on core PCE inflation could be higher by 50-100 bps by the end of next year relative to our current baseline where inflation is assumed to have returned to 2%.

- In the event of a full and simultaneous implementation of Trump’s policy proposals, our analysis suggests that the drag on economic growth, when combined with tighter border security and the potential deportation of a million immigrants, would more than offset the growth-impulse from the tax cuts.

- This would leave the American economy on a weaker growth trajectory, with structurally higher deficits, inflation, and interest rates.

- This is not a combination any new administration wants, which is why many analysts believe there will be a broader tactical approach on tariffs to create some space for negotiation that pressures parties to the table in a swift and effective manner.

- Estimates vary, but most suggest that for each percentage point increase in the deficit (measured as a share of GDP), it can add anywhere from 15-30 bps to longer-term yields. Some of that increase has already been priced into Treasury yields in recent weeks, but there’s probably a bit more room for yields to climb.

- We will be closely watching how markets respond over the coming days. From past experience, Trump’s rhetoric and policies are likely to inject uncertainty into financial markets, but a lot depends on whether polices threaten the current soft-landing of the economy.

In the Event Democrats Win the House …

- A divided Congress entirely rules out many of Trump’s promised tax cuts, with an extension of TCJA likely being the one exception:

- However, Democrats will likely require some concessions from Republicans, which could come in the form of bringing back the expanded child tax credit and/or further extending the Affordable Care Act premium tax credits that are set to expire at the end of 2025.

- Both of these would add to the deficit. The Committee for a Responsible Federal Budget estimates that reverting the CTC to $3,600 would cost north of $1 trillion over the next decade, while extending the ACA premium tax credits would cost $400 billion.

- Trump would also have executive power to tighten border security, largely through reinstating his 2019 “remain in Mexico program” and Title 42 policy, which allowed U.S. border authorities to quickly deport migrants crossing the Mexico border before being able to claim asylum. These measures would result in lower immigration numbers over the coming years, with net immigration likely falling closer to 2019 levels of ~500,000 per-year or roughly a quarter of this year’s expected gain.

- However, it is highly unlikely that Trump would be able to implement “mass deportations” as it would require significant government funding which would ultimately require approval from Congress.

- On tariffs, Trump is likely to take a more measured approach. We suspect that he’ll remain “tough on China” but soften his stance on allies and close trading partners. This would be closer to what played out under the prior Trump administration, where allies such as Canada, Mexico, United Kingdom and the European Union were all able to make concessions.

- Lastly, the suspended debt ceiling – negotiated as part the 2023 Fiscal Responsibility Act – is set to expire on January 1st, 2025. Under a divided Congress, this is likely to bring some fireworks as it’s highly unlikely that a resolution will be reached before the deadline, particularly given that any increase in the debt ceiling is likely to be tied to TCJA negotiations. This means the Treasury will again have to resort to “extraordinary measures” to keep the government financed through early-2025. Estimates suggests that the Treasury can likely buy Congress several more months to negotiate a deal, though the closer the U.S. gets to the “X-date” the more volatility this is likely to inject across global financial markets.

Implications for Canada

- The nail biting is over, and now the concern is real. Since the USMCA trade agreement came into effect in 2020, trade between Canada, the U.S. and Mexico has flourished. Canada enjoys a healthy goods trade surplus with the U.S. at over 7% of GDP, mainly led by energy exports. The small surplus in exports outside of energy has also been on the rise since the implementation of the USMCA.

- Our research shows that a full-scale implementation of Trump’s 10% tariff plan could lead to a near-5% reduction in Canadian export volumes to the U.S. by early-2027, relative to our current baseline forecast. Retaliation by Canada would increase costs for domestic producers, and push import volumes lower in the process.

- Slowing import activity mitigates some of the negative net trade impact on total GDP that helps avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026.

- The hit to growth could force the Bank of Canada to cut interest rates by about 50–75 basis points more than we currently forecast, widening the spread to U.S. rates and putting additional downward pressure on the Canadian dollar. It would not surprise us to see the loonie break below 70 cents. The CAD is currently down around 1% this morning, to 71 U.S. cents, while BoC pricing is lower by just a few bps. Given that the Canada 10-year is up over 10 bps this morning, it implies that investors are baking in a risk premia to Canadian debt.

- Tariffs create a negative income hit to Canadians as they pay more for imports, which would feed into a temporary and modest re-acceleration of inflation to the 2.5–3.0% y/y range before reverting back to the Bank of Canada’s (BoC) 2% target by 2026.

- The auto sector would face the deepest negative impacts. The automotive supply chain is one of the most integrated and hardest to diversify away from, evidenced by the almost 20% of intermediary goods inputs that are sourced from the U.S. alone. Outside of autos, the energy sector, chemical/plastic/rubbers manufacturing, forestry products, and machinery have outsized exposure to the U.S. market. The metal ores and non-metallic minerals industries and agriculture sector are a little more insulated as only 25% and 50% of the industries’ exports, respectively, end up in the U.S.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: