Small Business Outlook Improves, But The Post-Pandemic Economy Creates New Challenges

Ksenia Bushmeneva, Economist | 416-308-7392

Date Published: November 17, 2021

- Category:

- Canada

- Commodities & Industry

Highlights

- After being hard-hit by lockdowns and restrictions, small business health has been on the mend this year. Financial vulnerability declined between Q2 and Q3 of this year, with significant progress in many hard-hit industries.

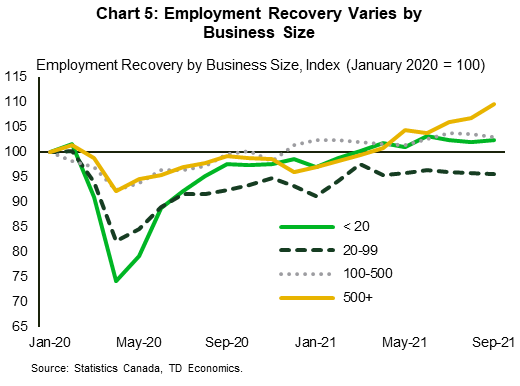

- In terms of employment, establishments with fewer than 20 employees surpassed their pre-pandemic level of employment. For establishments with 20 to 100 employees, employment is 5% shy of its pre-crisis level. The pandemic has increased workers’ preference for remote work: small and young companies appear to be slightly more willing to move all or at least some of their workforce to telework.

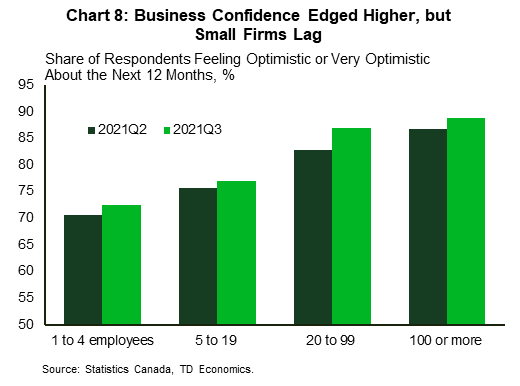

- In tandem with employment, firms’ year-ahead outlook has also brightened. Businesses are feeling more optimistic about the future, and most were also planning to remain “in business” a year from now. Also encouraging is the fact that, after plunging in 2020, new business formation rebounded in the second half of 2020 and remained strong this year.

- Still, small businesses continue to face challenges. While consumer demand fundamentals are robust, supply chain bottlenecks, shortages of inputs and labor and higher prices are weighing on small business recovery.

- Small businesses also lag in their adoption of new technologies and processes, and in their access to high-speed internet connectivity. This could put them at a relative disadvantage in the post-pandemic world. Significant debt overhang may also weigh on recovery.

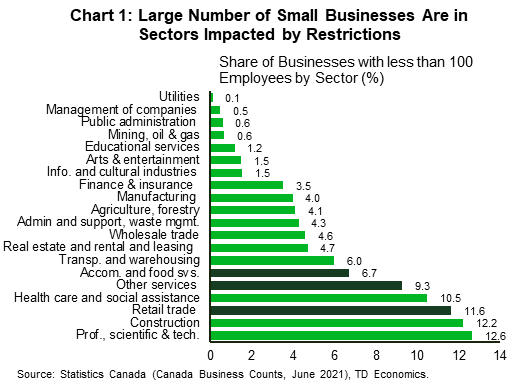

In any economic crisis, smaller and younger businesses tend to be more vulnerable than their larger, more established peers.1 The pandemic was particularly damaging for small businesses, given their significant presence in hard-to-distance service industries most impacted by government-mandated closures and restrictions (Chart 1).2

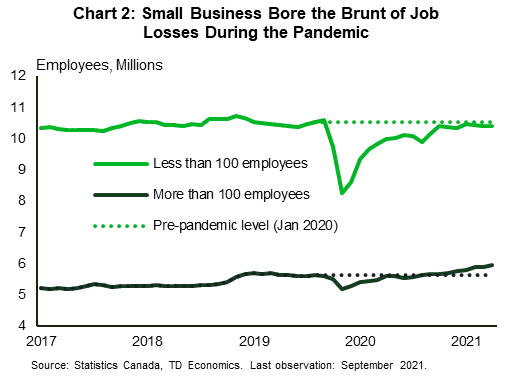

In the early months of the pandemic, small business establishments accounted for a disproportionately large share of job losses. Establishments with fewer than 100 employees represented 85% of all job losses between January to April of 2020 despite accounting for 65% of overall employment (Chart 2). Our previous research found that smaller businesses (particularly those with less than 20 employees) were under significantly higher financial stress than their larger counterparts. A greater share of small businesses suffered significant revenue declines as a result of the pandemic and while lacking liquidity, were unable to take on additional debt and thus were more likely to close their doors for good.

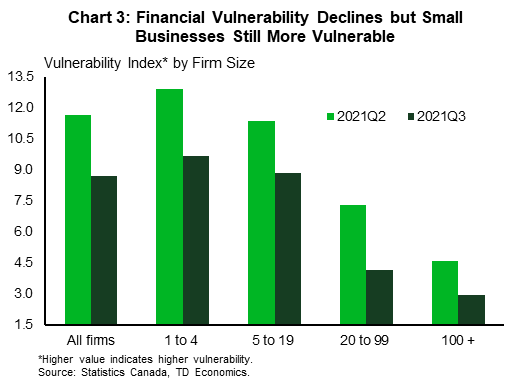

Fortunately, small business health has been on the mend, making significant headway on several fronts. Our updated Vulnerability Index shows a reduction in financial vulnerability for firms of all sizes between the second and third quarters of 2021.3 However, very small firms (those with less than 20 employees) remain relatively more financially vulnerable than their larger counterparts as captured by higher values of Vulnerability Index (Chart 3).

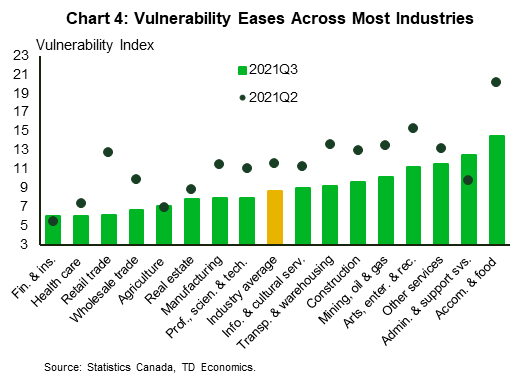

The Vulnerability Index declined across all industries, with exception of administrative & support services. The most notable improvement was in the hardest-hit accommodation & food services, arts & entertainment, as well as retail trade, thanks to the easing of restrictions on these sectors during the summer months (Chart 4). That said, vulnerability still remains highest in the accommodation and food industry. With provinces continuing to lift restrictions on this industry, (for example with Ontario recently lifting its capacity limits on restaurants), the outlook should continue to brighten for this hard-hit sector in the months ahead. The deterioration in the administrative & support services sector was likely due to the ongoing strain from increased teleworking and reduced business travel.

In terms of employment, establishments with fewer than 20 employees have recovered all jobs lost during lockdowns, even surpassing their pre-pandemic level of employment. For establishments with 20 to 100 employees, employment is just 5% shy of its pre-crisis level (see Chart 5).

Changes in the Way Canadians Work Likely to Have Long-Lasting Implications For Small Business

Looking beneath the headline job numbers, the pandemic has had a profound effect on the way Canadians work. Over 24% of Canadians are currently working remotely, compared with just 4% in 2016.4 Given the significant preference of employees for remote work (with 80% wanting to work at least half of their hours from home) and the willingness of employers to fulfill at least some of those requests, the prevalence of remote work is going to remain higher than it was prior to the pandemic.

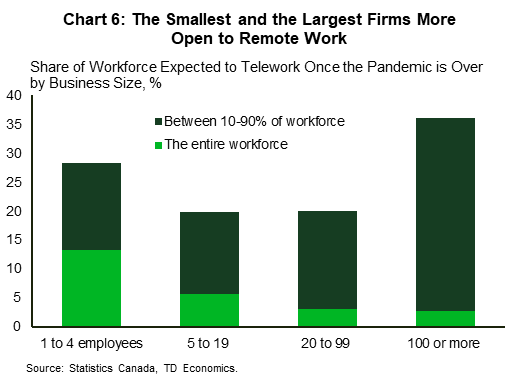

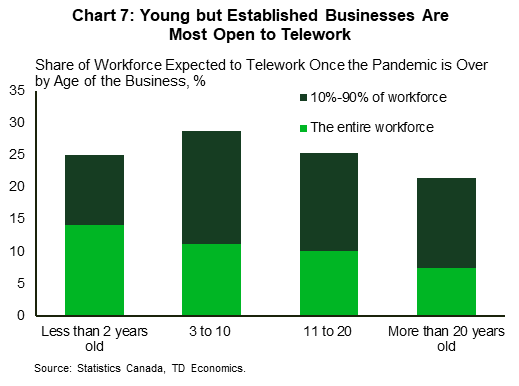

On that front, very small firms (with less than 5 employees) and very large businesses (those with more than 100 employees) are the most willing (or able) to move either all or part of their workforce to remote work (Chart 6). Additionally, young but somewhat established companies (those that are 3-10 years old) are the most willing to shift some or all of their workers to telework (Chart 7). However, the youngest companies (those younger than 2 years), many of which were likely started during the pandemic, appear to have the strongest intentions to have their entire workforce work from home. For startups and very small companies, their ability to offer flexible work may be away to differentiate themselves in the competition for talent, particularly in the current environment marked by labour shortages.

Small Businesses Confidence Is Up, So Is New Firm Creation

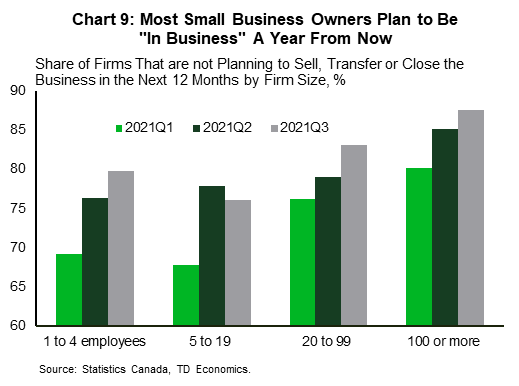

In tandem with employment, firms’ year-ahead outlook has also improved, and most businesses – large and small – are feeling more optimistic about the future (Chart 8). Most were planning to remain “in business” a year from now, with the share of business owners who were not planning to sell, transfer or close a business increasing consistently over the last three quarters (Chart 9).

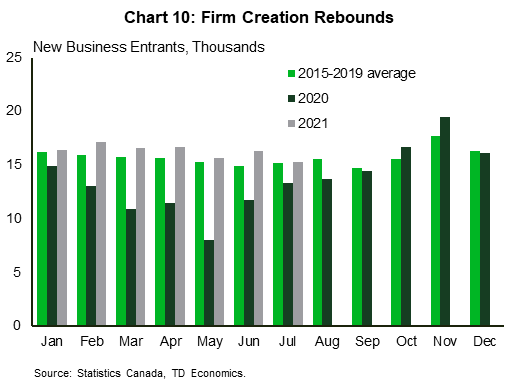

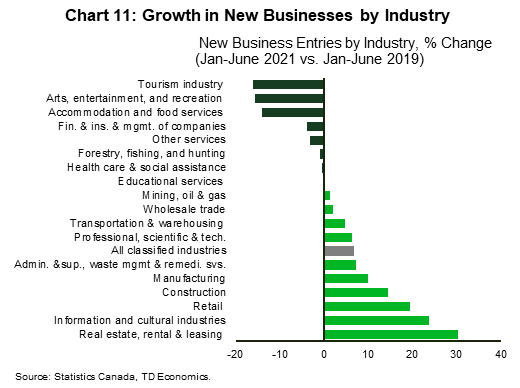

At the same time, new firm creation has rebounded. After plunging last year, new business entries bounced back in the second half of 2020 and remained at elevated levels in the first half of 2021, compared to 2015-2019 average (Chart 10). Not surprisingly, given the strength in housing, the category of real estate, rental and leasing is at the top of the leader board, with construction not far behind. Together these sectors saw 17k new entrants in the first half of 2021 – representing one-fifth of all new businesses created during this time (Chart 11).

Along with challenges, the pandemic has created new opportunities, particularly for firms able to capitalize on expansion within the digital and data-driven economy. As a result, there has been significant inflow of firms operating in high-skilled/knowledge-based industries, such as information and professional, scientific & technical services.

Interestingly, retail trade – an industry highly impacted by lockdowns – also saw a significant increase in new entrants, perhaps due to the pandemic-induced boom in online sales of goods but also in services, such as online classes, medical advice, counselling and interior design consultations. The share of firms making at least some of its sales online increased four percentage points from 17.6% to 21.6% between 2019 and 2020, but the gains were larger for accommodation & food and retail trade, which were forced to adapt to harsh restrictions for in-person experiences. In those industries, the share of firms making at least some sales online rose by 9.5 and 6.9 percentage points, to 45% and 30% respectively.

Demand Is No Longer a Challenge, But Supply Issues Are

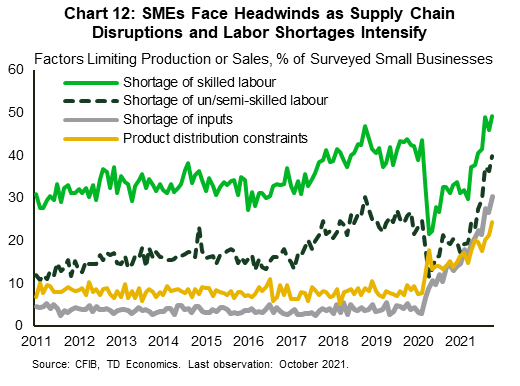

Despite significant progress over the last few months, small businesses continue to face a number of hurdles, which they may be less prepared to tackle due their more limited resources. Earlier months of the pandemic brought about painful lockdowns, making insufficient consumer demand and low revenues the main source of anxiety for business owners. As the economy and businesses reopened, those concerns faded and new ones emerged. As consumer demand returned with vengeance, firms struggled to ramp up sales and output amid intensifying global supply chain bottlenecks, higher costs and shortages of labor and inputs (Chart 12).

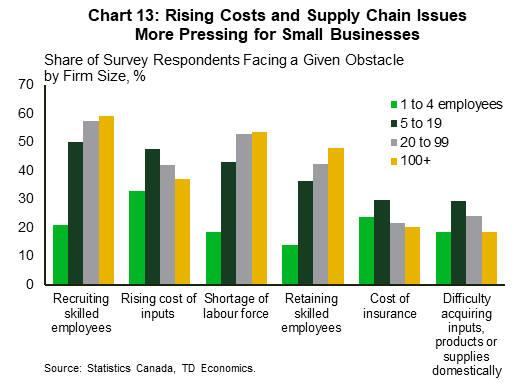

While recruiting skilled employees appears to be a significant challenge for all companies, for smaller firms (those with 20 employees or less) cost-related issues such rising costs of inputs, insurance and difficulty acquiring inputs and supplies appear to be more important than they are for larger businesses. These costs pressures will likely persist well into next year as supply chains remain hindered. On the other hand, larger firms are more concerned about labour shortages and retention of existing employees (Chart 13). Imbalances and frictions in the Canadian labour market increased this year due to a number of factors (see report) and could also prove longer lasting. This could present more difficulty for smaller firms who may be less able to compete with larger businesses on wages and benefits.

Adoption of Digital Technologies Should be a Priority for Small Businesses

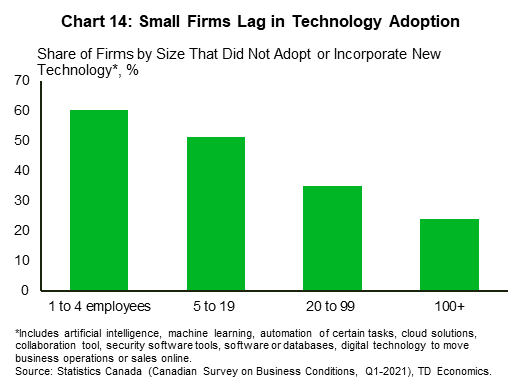

The pandemic has accelerated the proliferation of digital technologies and led to greater automation in many industries. While small businesses increased their online presence during this time, more than half of very small companies did not incorporate any new technologies or processes last year (Chart 14). Small businesses also lag in their access to high-speed internet connectivity – another key component for digitalization. Just 24.8% of small enterprises have fiber-optic line internet connection, compared to 73.1% of larger companies.5 This could put them at a disadvantage in the post-pandemic world.

Fortunately, realizing this, the federal government has put in place a new Canada Digital Adoption Program in its 2021 Budget, which will allocate grants and interest-free loans to small businesses looking to increase their e-commerce capabilities and accelerate adoption of new technologies. Just as important is support for new firm creation and business investment. On that front, the budget has significant tax measures to expense a broad range of investments, including those made in digital assets and intellectual property.

Access to Capital and Debt Repayment Concerns Expected to Linger

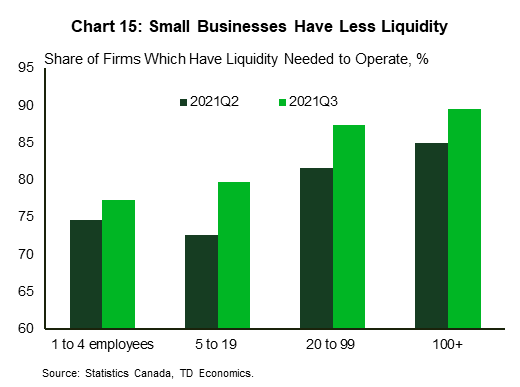

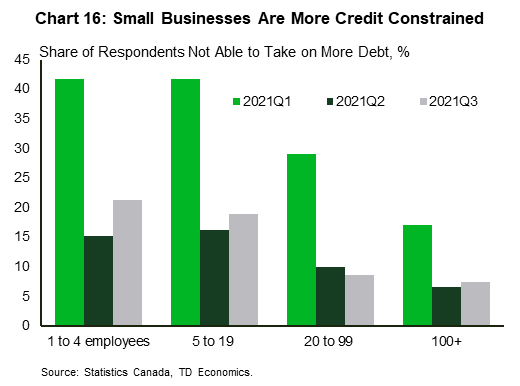

Access to liquidity and grants is important for small businesses as they tend to have less liquidity and are more credit constrained (Charts 15 and 16). This became apparent during the pandemic, as many small businesses accumulated significant debts. According to the survey by the Canadian Federation of Independent Businesses, 71% of small businesses have taken additional debt during the pandemic, owing $170,000 on average.6 Businesses in the hard-hit hospitality sector owe nearly double this amount. The partially forgivable CEBA loans have helped many small businesses to keep the lights on when restrictions were most stringent, but these need to be repaid by the end of 2022 in order to be eligible for debt forgiveness, and it appears that many small businesses will struggle to meet this timeline. In the CFIB survey, three-quarters of businesses reported that it will take more than a year to repay the debt they have accumulated. Higher debt burdens are likely to weigh on firms’ profitability and growth, particularly as some still struggle to return to full capacity.

Elevated Public Health Risks Mean Some Industries Will Continue to Require Support

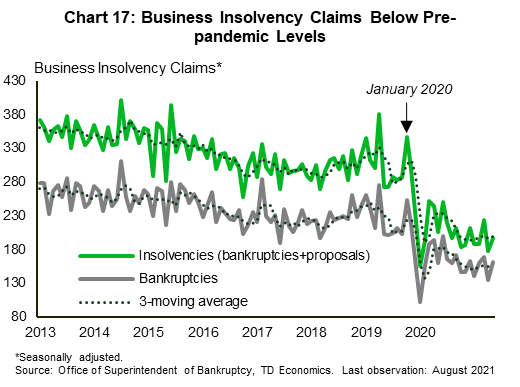

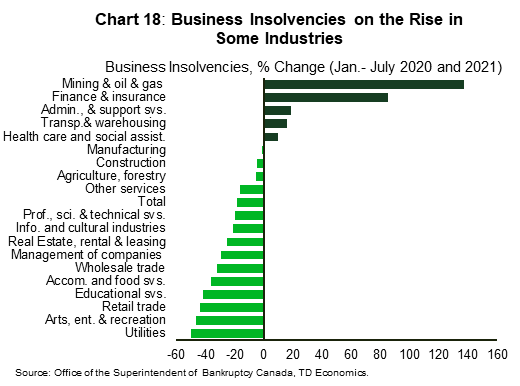

Any future virus flare-ups and the subsequent restrictions remain a lingering concern for small businesses, and could delay the healing process. Business insolvencies, while still depressed relative to the 2019 level, are higher this year than they were in 2020 for several industries (Charts 17 and 18).

Until the situation normalizes, businesses impacted by lockdowns or restrictions will need some government support. Around 20% of very small businesses (those with less than 20 employees) surveyed in 2021 Q3 indicated that they could not take additional debt, with this share higher in more indebted industries. It is therefore encouraging that in its recent announcement, the federal government chose a targeted approach focused on extending wage and rent subsidies to the most impacted sectors. Wider support in the event of additional restrictions and lockdowns, should go a long way to mitigating the lingering uncertainty related to public health.

Bottom Line

Small businesses have been hard-hit by the pandemic, but their health has been on the mend. Smaller establishments have rehired most of the workers, which they had to let go earlier in the pandemic, and many indicators of their financial well-being have improved. New firm creation has also rebounded, as economy reopened and changing consumer demand created new opportunities. Still, small businesses continue to bear some pandemic scars, such as increased indebtedness, and remain more financially vulnerable than their larger counterparts. While some headwinds have eased as pandemic retreated, others, such as supply chain bottlenecks, shortage of labour and inputs and risings costs, have intensified, creating new challenges for small business owners to navigate in the post-pandemic world.

{related-articles-row}

End Notes

- Brookings Institute. “What the Great Recession can tell us about the COVID-19 small business crisis.” https://www.brookings.edu/blog/the-avenue/2020/03/25/what-the-great-recession-can-tell-us-about-the-covid-19-small-business-crisis/

- Business Development Canada defines small businesses as businesses with fewer than 100 employees.

- The score is made up of five categories, which are equally weighted in index: the share of firms with pessimistic outlook over the next 12 months, the share of firms that are not able to take on more debt, the share of firms that can operate at current level of revenue for less than 12 months before filing for bankruptcy, the share of firms with plans to close in the next 12 months, and the share of firms that do not have liquidity and are not able to acquire it.

- This estimate comes from the General Social Survey conducted in 2016, and refers to the share of workers that worked most of their hours from home – the only pre-pandemic measure available. Based on the same survey, fourteen percent of employees aged 15 to 69 usually worked some of their hours from home in 2016.

- Statistics Canada. “Internet access by type of Internet connection, industry, and size of enterprise”. https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=2210011601

- CFIB. “Small Business Debt: The COVID-19 Impact”. https://content.cfib-fcei.ca/sites/default/files/2021-08/Small-Business-Debt-The-COVID-19-Impact.pdf

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Download

Share this: