Canadian Rental Market Outlook

Rent Growth to Continue Cooling in 2025

Rishi Sondhi, Economist | 416-983-8806

Date Published: January 15, 2025

- Category:

- Canada

- Real Estate

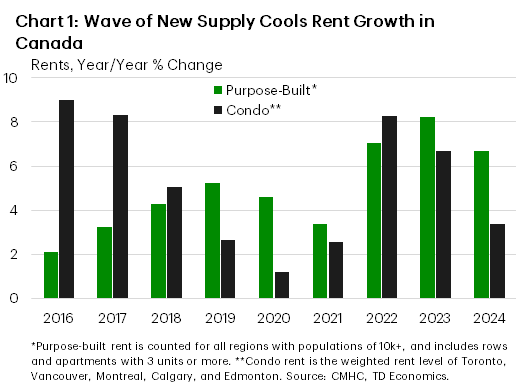

- About a year ago, we forecast that growth in CMHC’s measure of Canadian1 purpose-built rents would slow from 2023’s record 8% gain to a still strong 5-6% pace in 2024, as robust population growth faced off with a wave of newly completed rental supply. As it turns out, we were almost on the mark, as they advanced about 6.5%. Our call that Canadian condo rent growth2 would be even weaker was also realized, as it cooled to a below average 3.4% pace, on the back of modest growth in Toronto (Chart 1).

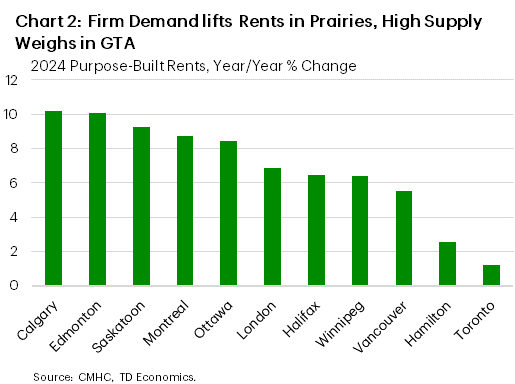

- Regionally, purpose-built rent growth was similar to that of home prices last year. Indeed, major markets in the Prairies led the way in terms of rent gains, while regions in Ontario (like Toronto and Hamilton), lagged (Chart 2). In Calgary, for example, the combination of robust demand, the delivery of new, higher-priced rental supply, and a lack of rent growth guidelines fueled a double-digit gain, according to CMHC. In contrast, rent control and an elevated supply of purpose-built and condo rentals hitting the market kept a lid on rents in Toronto. What’s more, poor ownership affordability in Toronto kept many renters in their units. This low rental turnover rate weighed on rents, as they are typically increased significantly when renters vacate their units.

- Elsewhere, tight conditions and solid population growth lifted rents in Montreal, Ottawa, and Winnipeg. Rent growth was also firm in Halifax, due to population growth and rising rental turnover rates. However, population growth is slowing rapidly across much of the Atlantic region, weakening the demand backdrop for this year. In Vancouver, rent growth cooled significantly, on the back of some softening in demand, rising supply, and affordability challenges. Still, tight conditions into 2024, and a slight increase in the rental turnover rate kept rent growth firm. Notably, the resale market was firmer in the GVA than in the GTA, providing a better opportunity for investors to sell their properties, instead of listing them on the rental market. This helped slow the decline in GVA rent growth, compared to the GTA.

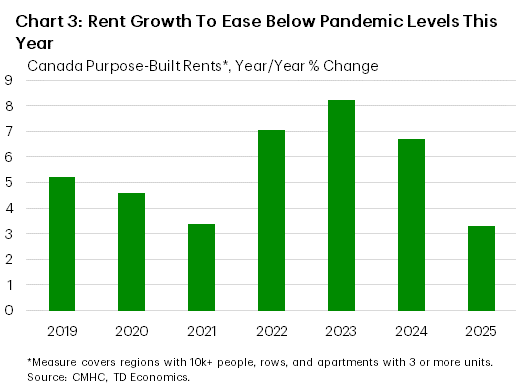

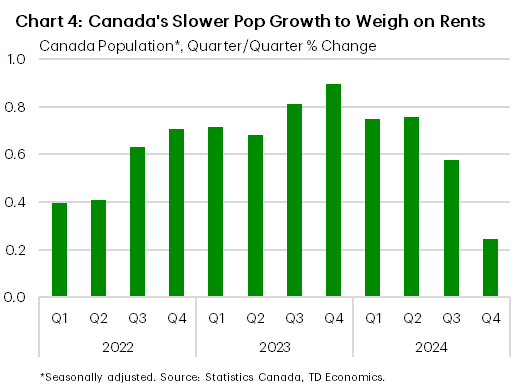

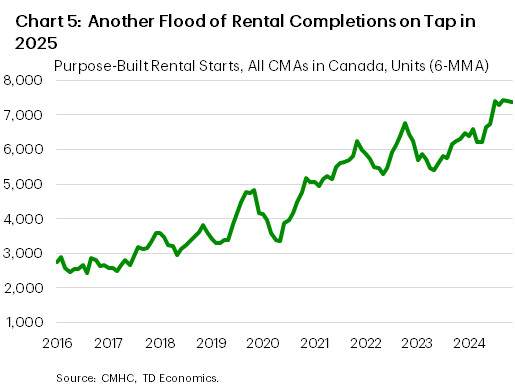

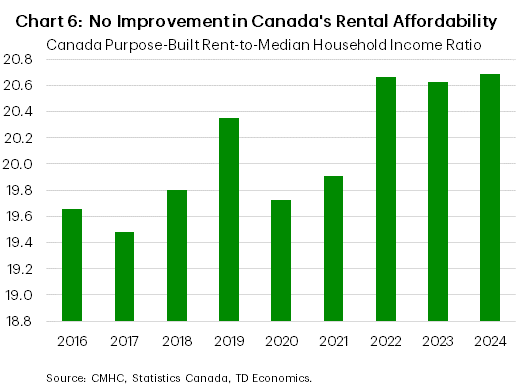

- For 2025, we expect Canadian, purpose-built rent growth to slow to a range of 3-4% (Chart 3). Our outlook reflects a multitude of factors. Firstly, we’re expecting population growth to cool dramatically this year as the federal immigration plan is rolled out. We’ve already had a taste of this, with quarterly population growth easing to its slowest rate since 2021 in the third quarter (Chart 4). In addition, another flood of rental supply will reach completion this year (Chart 5). Interest rates are also likely to push lower in 2025, helping renters make the transition to homeownership. What’s more, falling interest rates should lower costs for landlords, reducing the pressure to pass through these costs to rents. Rental affordability also remains strained, with no improvement taking place last year, according to our metric (Chart 6). In the condo market, rent growth could be even weaker, weighed down by these same factors. Another muted year in the GTA will also be an important element, as the region is a larger part of the nation’s condo rental market than it’s purpose-built one.

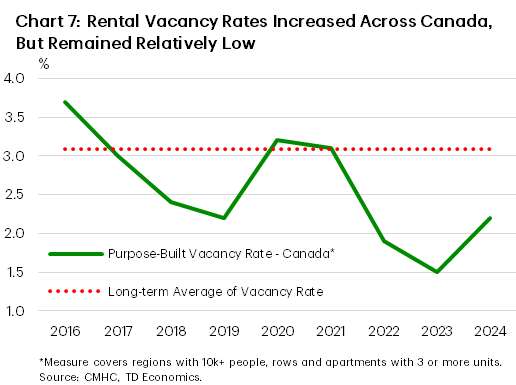

- Supporting rent growth is a relatively tight starting point, with the purpose-built vacancy rate rising in 2024 but remaining below it’s long-run average (Chart 7). What’s more, despite a significant slowdown, population growth should be positive this year, bolstered by immigration. Rental turnover should also upwardly pressure rents this year, although perhaps not to the same extent as recent years, given the prospect of significantly softer population inflows. Additionally, purpose-built rents don’t tend to swing wildly from one year to the next. It also seems to take a lot for purpose-built rent growth to turn negative, as rents increased 1% during the Global Financial Crisis and were flat during the early-mid 90s housing market meltdown in Ontario.

- Our forecast also hinges on continued economic and job growth as a baseline. A growth penalty from U.S. tariffs was incorporated into this projection (see here), but there is a growing risk that the impact could be more pronounced than we expected in our most recent economic forecast. This would depend on the size, scale and duration of potential U.S. tariffs, and the extent of retaliation by Canada. Depending on what unfolds, rents could flatten out, or even decline. Such a scenario would mark the weakest rent growth since the early 90s, at least.

End Notes

- Purpose-built rent is measured for Canadian centres with populations of 10k or more and includes row and apartment buildings with 3 units or more.

- Growth in the weighted average rent in Toronto, Vancouver, Montreal, Calgary, and Edmonton, which together represent about 90% of CMHC’s measure of the condo rental stock.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: