Canadian Rent Growth to Cool, Not Collapse, Moving Forward

Rishi Sondhi, Economist | 416-983-8806

Date Published: February 8, 2024

- Category:

- Canada

- Real Estate

Choose any metric you want, and the message is that rent growth in Canada was unbelievably robust last year:

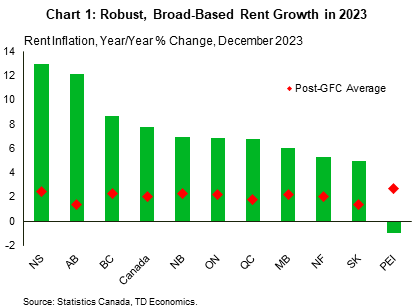

- The rent component of the Consumer Price Index was up 8% year-on-year across Canada in December 2023 (Chart 1), led by rip-roaring gains in Nova Scotia (13%), Alberta (12%) and B.C. (9%). And, growth was at least 5% in every province except for PEI, where a rent freeze was implemented (although it’s slated to end this year).

- CMHC data pegs rent growth in the purpose-built market at over 8% last year, marking the fastest gain on record (spanning back to 1992). Meanwhile, weighted average rent growth for condominium units in Calgary, Edmonton, Montreal, Toronto, and Vancouver (which together account for about 90% of the condo rental stock) clocked in at 6% - a powerful gain, although down from 9% in 2022.

- Data from Rentals.ca1 suggests that asking rents for all residential property types were up 9% year-on-year in December, bolstered by gains in Alberta, Quebec, and Saskatchewan.

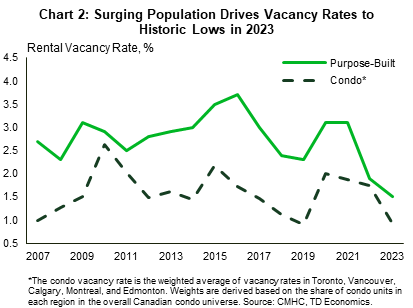

It’s no secret as to why rent growth was so strong. The fastest Canadian population growth since 1957 drove vacancy rates in the purpose-built rental market to their nadir, and to levels matching historical lows for condo units (Chart 2).

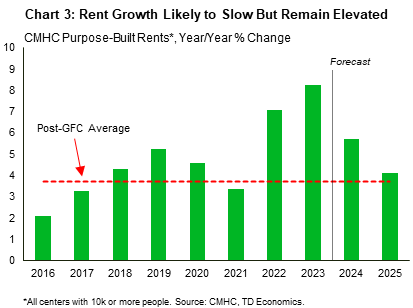

While rent growth was robust for 2023 overall, some data suggests that it has more recently lost some momentum, at least in Toronto. Data from the Toronto Real Estate Board points to modest year-on-year growth of around 2-4% for one- and two-bedroom condo apartments in the final quarter of 2023, consistent with the story told by the Rentals.ca data covering the same market. This trend fits with our view that rent growth is poised to come down from the stratosphere over the next couple of years, although we believe this moderation will be more generalized across regions. That said, it’s tough to envision too much of a cool down, for a few key reasons. In the purpose-built rental space, for instance, an increase in rents of around 5-6% is a reasonable projection for this year according to our model, with this figure likely to ease even further in 2025 (Chart 3). Below, we detail the factors underpinning our forecast.

Interest Rates: CMHC’s latest rental market report notes that higher borrowing costs were passed through into rents in several markets across Canada last year. However, our forecast calls for bond yields to continue to grind lower through 2025, alongside significant cuts in the Bank of Canada’s overnight rate. When rates fall, debt servicing costs for landlords push lower, which could lessen the upward pressure on rents from this source. In addition, declining borrowing costs have a beneficial impact on housing affordability, thereby potentially enticing current renters into the ownership market while encouraging would-be renters to consider buying instead.

Admittedly, because affordability in the ownership market remains so stretched, the downward impulse on rents from lower rates may not be as pronounced as it has been in prior cycles. What’s more, property taxes are expected to rise in many markets in Canada, including places like Montreal, Vancouver, and Calgary, which will also make ownership less attractive. Property taxes are also going up significantly in Toronto, although the municipal government has pledged to lower the proposed increase for multi-residential properties, to manage cost increases for renters.

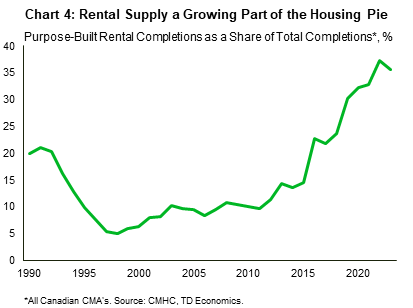

Completions: Canada has had some success in increasing the amount of new rental supply delivered to housing markets. For example, last year purpose-built rental units made up about 35% of total housing completions in Canadian CMAs – over twice its long-run average (Chart 4). Support has likely come from the steep increase in rents and various government programs aimed at this market. At the same time, some 57k condo units were completed across CMAs last year, marking the highest level since 2015. Notably, the condo market has become an increasingly important source of rental supply, with nearly 60% of new condo units completed since 2016 (when Canada’s population growth really started to pick up) slated for the rental market in places like Toronto, Vancouver, and Calgary. Trends in starts suggest that both purpose-built and condo completions should remain elevated over the next few years, upwardly pressuring rental vacancy rates, with the opposite effect on rents.

The decision by the federal government and several provinces to cut the HST that developers face when constructing purpose-built rental units should lift this type of starts by around 5k according to our estimations. However, the timing of this policy (introduced late last year), suggests that any boost to rental completions from it will be a more of a story after 2025.

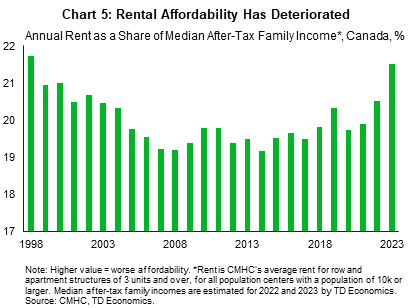

Rental Affordability: Scaling rents in the purpose-built market to median incomes suggests that in 2023, rental affordability deteriorated to its worst level since the dot-com boom in the late 1990s (Chart 5). There are some nuances here as well, with Statistics Canada analysis suggesting that recent renters are more likely to have higher shelter costs, with rent control policies restraining costs for households with a longer renting tenure. Deteriorated affordability is yet another factor that could downwardly pressure rent growth.

In contrast to the above, there are some factors that should limit the extent of the anticipated slowdown in rent gains:

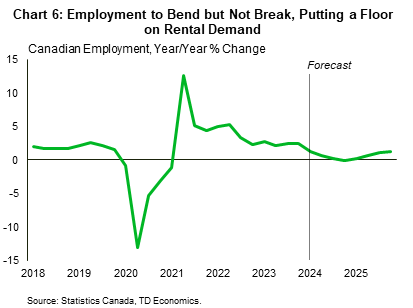

Economy: Moving forward we are projecting a weak economic performance for the country but are not expecting a deep recession to manifest. Accordingly, only a mild dip in employment is likely this year (Chart 6) before job growth resumes in late 2024 and 2025, thereby putting a floor on rental demand. Of course, prospects are different across Canada, with job markets likely to hold up better across the Prairies and much of the Atlantic Region this year. Alberta in particular stands out, as its economy should outperform and its population growth will likely remain relatively strong, which are both plusses for rent growth. Meanwhile, relatively soft growth performances should force a steeper rise in unemployment rates in Ontario, B.C., and Quebec.

Inertia: Rent growth typically displays some inertia. This means that rents don’t tend to swing wildly from one year to the next. For example, during the pandemic, purpose-built rent growth only slowed from 5% in 2019 to 3% in 2021. And this was with population growth screeching to a near halt through much of 2020 and 2021. Also, consider than the standard deviation in purpose-built rent growth since the early 90s is 1.7%, compared to 5.4% for Canadian average home prices.

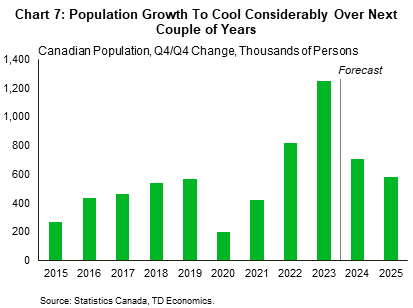

Population Growth: Alongside our expectations for the economy, our view on population growth is the most important factor underpinning our rent growth forecast (Chart 7). And it’s a bit of a double-edged sword, in that it will drive rent growth lower through next year but, at the same time, will keep it from collapsing.

We expect the inflow of non-permanent residents (made up of students and temporary foreign workers) to ease considerably over the next few years. Non-permanent resident inflows were the single biggest factor driving Canada’s ballooning population last year, so this is a notable change. We base this view on a few factors. First is the likelihood economic growth will remain soft and job market conditions will weaken over the next few quarters. History tells us that when the economy cools, so do inflows of non-permanent residents. The jobs market has already moderated to a notable degree, with job postings well off their pandemic peaks, save for a few industries like construction and healthcare.

Recent federal government policy changes that will impose caps on the inflow of foreign students will also weigh significantly on population growth, although the timing of when this drag will hit is uncertain, despite the communicated timeline of a fall 2024 rollout for the policy. An industry estimate suggests that the policy could lower the student intake by at least 200k spots 2.

This policy should have disproportionate impacts on Ontario, where students have accounted for a relatively large share of non-permanent resident inflows compared to the rest of Canada. What’s more, estimates suggest that there are upwards of 125k international students enrolled in GTA-area public-private-college partnerships (PPPs)3. Students at these institutions will no longer have access to post-graduate work permits. These permits are a key draw for foreign students, as they allow them to stay in the country and work after graduation to get Canadian work experience.

Although we expect population growth to slow through 2025, a substantial easing is likely not in the cards. An important boost will come from federal immigration targets, which remain robust, and this type of newcomer disproportionately tends to rent when first coming to the country.

Bottom Line

Rent growth is likely to cool in coming years amid affordability pressures, a wave of new supply hitting the market, and falling interest rates. However, we’d be hesitant to pencil in too much softness given the prospect of a resilient economy, the fact that rent growth doesn’t typically swing much year-to-year, and the likelihood that population growth remains firm, despite economic and regulatory headwinds. Rent growth in the purpose-built space could cool to 5-6% this year from 8% in 2023. Meanwhile, growth in the more expensive condo space could be slower, given indications that gains are already easing in markets like Toronto amid rising supply and stretched affordability.

Notably, our view on rent growth squares with the Bank of Canada’s, in that shelter costs will only gradually improve, while acting as a “material headwind” towards the return of inflation to its 2% target.

End Notes

- Urbanation. (2024). January 2024 Rentals.ca Report. Rentals.ca. https://rentals.ca/national-rent-report

- Usher, Alex. (2024). The New International Student Regime. Higher Education Strategy Associates. https://higheredstrategy.com/the-new-international-student-regime/

- Ibid.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: