Oversupplied GTA Condo Market a Headwind for Home Prices

Rishi Sondhi, Economist | 416-983-8806

Date Published: September 5, 2024

- Category:

- Canada

- Real Estate

Highlights

- Yields have fallen significantly in recent months, yet home sales in the GTA remain subdued. However, it’s likely only a matter of time before sales growth turns stronger, including in the resale condo market.

- GTA resale condo supply is highly elevated, and the gradual recovery expected in sales means that it will take time for supply and demand to become more balanced. Condo prices – which have already declined by around 5% since 2023-Q3 – could post a further mid-to-high single-digit drop through the early part of next year.

- There are risks to the near-term condo price outlook on both sides. On the downside, the wave of condos slated for completion will continue to add to supply. On the upside, condo sales could react more aggressively to falling rates than what we’ve assumed, or investors could yank their properties off the market, tightening conditions at a faster-than-anticipated rate.

The Bank of Canada is now firmly in rate cut mode. Our forecast calls for two more moves this year, and for the overnight rate to ultimately settle at 2.5% at the end 2025. At the same time, the U.S. Federal Reserve is on track to begin later this month, with three cuts of their own on tap in 2024. Markets are thinking the same way. The Canadian 5-year yield has plunged about 90 bps since early May, and further declines should be on tap.

GTA home sales levels have been subdued since the Bank of Canada began cutting rates in June. That said, sales growth should turn stronger, as the steep decline in yields gets more fully reflected in mortgage rates. Yet, even as sales growth heats up in coming months, average resale price growth in the GTA will probably trail by a considerable margin. Part of the reason is that affordability in Toronto is historically poor, challenging the market’s ability to sustain a stretch of rapid price gains.

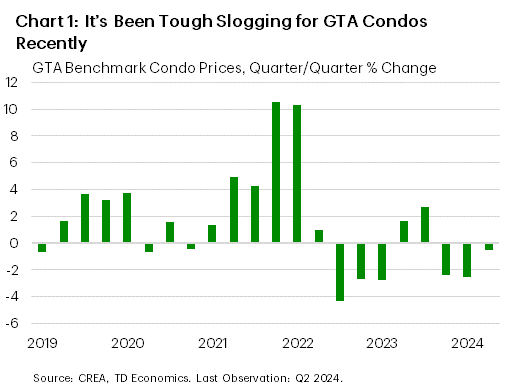

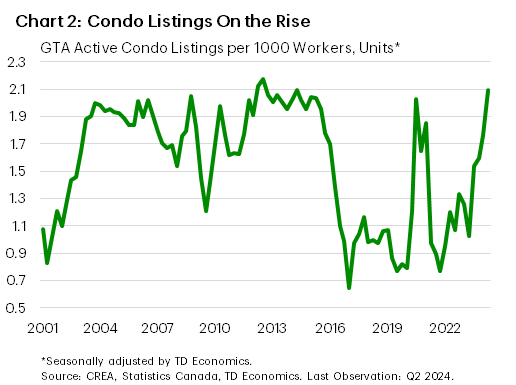

However, another very important reason is the glut of condos available for purchase in the GTA’s resale market. This is likely to continue downwardly pressuring condo values in the coming months, even as benchmark prices have already declined 5% from 2023Q3 – 2024Q2 (Chart 1). For context, the sales-to-active listings ratio (a measure of the supply/demand balance in a housing market) in the GTA’s condo market was 60% below its long-term average in Q2, meaning there was too little demand chasing too much supply. This, in part, reflects the fact that condo listings have been rising sharply for a full year, leaving them about 30% higher than what is typically seen, after adjusting for population and job growth (Chart 2).

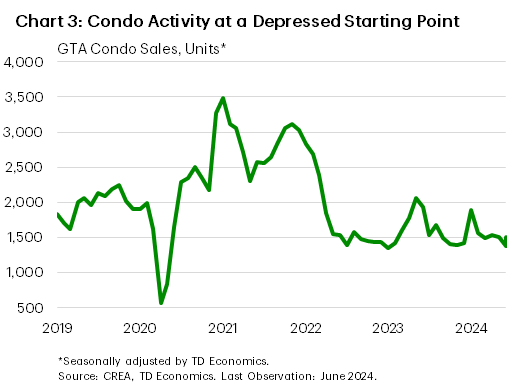

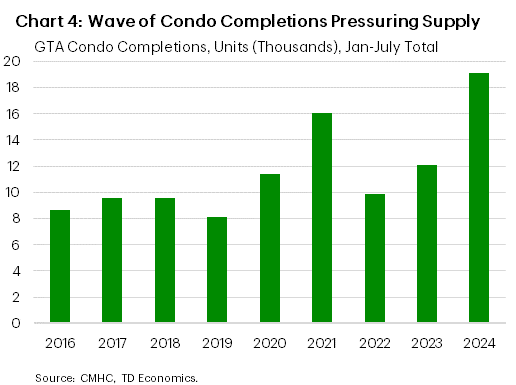

Why has the resale condo market seen so much new supply? It’s partly a function of weak sales activity that is not absorbing supply fast enough. Indeed, as of July condo resales in the GTA were some 25% below their pre-pandemic level (Chart 3). Additionally, it is tied to the wave of completions hitting the market recently (Chart 4) alongside elevated rates that have made it difficult for some buyers to close on their mortgages. Investors are seemingly listing their properties as well, as a share of them are cashflow negative and rents are dropping in the GTA1. Furthermore, federal government policies meant to cool population (and therefore rent) growth could be spooking potential investors. Finally, the relatively elevated interest rate backdrop means that the gap between the rate of return from a condo in the GTA (known as the cap rate) and from a “risk-free” government bond has narrowed. This may have reduced the incentive to hold a condo as an investment, although the recent drop in yields could be helping to re-widen this spread.

Looking Ahead

What could the condo market going to look like moving forward? We think that condo sales will increase through next year, as falling yields drive mortgage rates lower, thereby helping unlock what is likely a considerable pool of pent-up demand. Many first-time homebuyers are also receiving financial gifts to put towards down payments (and the size of the gift is growing), offering some offset to deteriorated affordability. In this vein, it could be first-time homebuyers leading the charge on demand over the next few quarters, although lower borrowing costs and a general improvement in activity could entice investors as well.

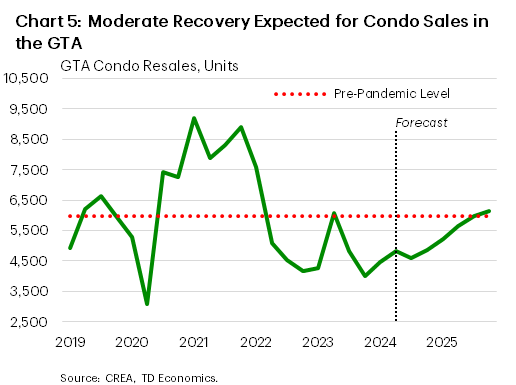

All of that said, interest rates will likely remain relatively elevated into 2025 and the affordability backdrop will be strained. What’s more, the jobs market has hit a soft patch and household income growth will probably slow. These factors should limit the upside for activity, resulting in a gradual sales recovery. In fact, it could take until next year before sales climb back towards their pre-pandemic level (Chart 5).

At the same time, condo supply is highly elevated. The relatively subdued sales recovery means that it will likely take several months to soak up these inventories, and further price concessions could be required to facilitate the process. In fact, benchmark condo prices could post a mid-to-high single-digit decline from 2024Q2 through the early part of next year, before being constrained to below average gains thereafter by stretched affordability.

This projection implies that prices will have contracted for about five straight quarters, marking the lengthiest pullback since 2000. This would also be amongst the steepest price reductions in over 20 years, potentially larger than the plunge observed from mid-2022 to the early part of 2023 (when the Bank of Canada was aggressively hiking interest rates) and the retracement that took place during the Global Financial Crisis. Context is required here, however, as even this scale of retrenchment would still leave condo prices approximately 20% above their pre-pandemic levels.

There are risks on both sides of the ledger. On the downside, the jobs market could be softer than we anticipate. In addition, the near record amount of condo units under construction in the GTA will upwardly pressure supply once they are completed, potentially cooling prices by more than expected in coming months.

On the upside, there is the possibility that sellers become dissatisfied by soggy conditions and de-list their properties, tightening markets faster than projected. Notably, we have yet to see this dynamic play out in what’s been a soft market. In past reports we’ve spoken about a so-called “coiled spring” effect in Canada’s housing markets. Although more recent rate cuts have yet to reflect this, markets have been highly reactive to developments on the rate front in the past. For example, Canadian home sales surged in the spring of 2023, after the Bank of Canada temporarily paused its rate hiking campaign, and again in the early part of this year amid a steep plunge in bond yields. As such, markets could react to falling rates more aggressively than we’ve forecast.

There’s also the potential for it to be a bumpy ride lower for prices over the next several months. In other words, there could be periods of positive price growth that interrupt a broader downtrend. This looks to have been the case between 2022Q2 – 2024Q2, where a couple of quarters of price gains were sandwiched between several declines.

Putting all the pieces together, condo valuations will likely continue declining, keeping home price growth in Toronto and (by extension) Ontario subpar through next year. The result will be average home prices that record below-average gains in 2024 and 2025. However, there are risks to this forecast on both sides.

End Notes

- “Condo Market Report – 2024Q2,” Toronto Regional Real Estate Board, July 26, 2024, https://trreb.ca/wp-content/files/market-stats/condo-reports/condo_report_Q2-2024.pdf

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: