Ontario’s Industry-based Outlook: Navigating Turbulent Waters

Rishi Sondhi, Economist | 416-983-8806

Date Published: November 14, 2024

- Category:

- Canada

- Provincial & Local Analysis

Highlights

- A sharp drop in goods production has put a significant damper on Ontario’s overall output performance this year. In contrast, the services sector is on track to record a decent gain, bolstered by the public sector.

- 2025 is set to be a similarly modest year for economic expansion in the province, as lower borrowing costs, some improvement in auto production and income-boosting government measures face off with much softer population growth, weaker government program spending and falling homebuilding.

- We expect the U.S. to turn in another year of firm growth in 2025, which should lay the foundation for a gain in Ontario’s manufacturing and wholesale trade industries. However, the outlook is subject to heightened uncertainty following the November election, with the threat of U.S. tariffs on Canadian exports looming large.

Ontario’s industry-based GDP managed to increase at a slightly faster year-on-year pace than the rest of Canada in the first half this year. This is noteworthy given that the province has had the weakest housing market in the country and is home to rate-sensitive, highly indebted households. That said, Ontario’s economy has still faced a difficult slog. Indeed, on a per-capita basis, the province’s economy has shrunk by nearly 3% since mid-2022. This weakness has rapidly cooled Ontario’s labour market, with job vacancies now below where they were in 2019, and the unemployment rate up nearly 2 ppts from its 2023 trough.

Ontario’s overall GDP numbers look better, thanks to a helpful boost from tremendously strong population growth. However, they are still modest. In the second quarter, for example, Ontario’s industry-based GDP advanced at a sub-trend 1.3% year-on-year pace, with a similar outturn projected for Q3. Next year, the province looks set to turn in another subdued performance.

2024 Growth Diverges Across Goods and Services

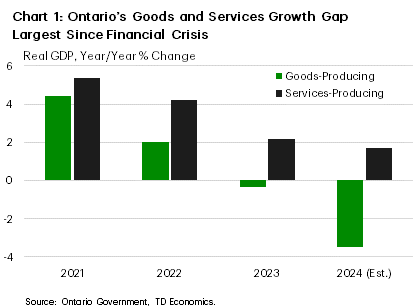

When it’s all said and done, overall output for goods-producing industries will have likely tumbled at its steepest rate since the pandemic in 2024. In contrast, the services sector is on track to produce a near-trend performance, leaving the growth gap between the two at its widest since the Global Financial Crisis (Chart 1). What’s more, nearly 80% of Ontario’s GDP is likely to be accounted for by service industries, a record high share.

Manufacturing and construction are the key culprits behind the woes of the goods sector this year. A sharp decline in condominium investment is weighing on residential building, as the industry is retrenching in response to very weak home pre-sales activity in key markets like the GTA. Falling construction activity may also be bleeding over into manufacturing, given the nature of the industries (metals/fabricated metals & machinery) that have struggled so far this year. However, the main drag on manufacturing output this year has been the auto sector, where plant closures in Canada and the U.S. for EV retooling has weighed heavily.

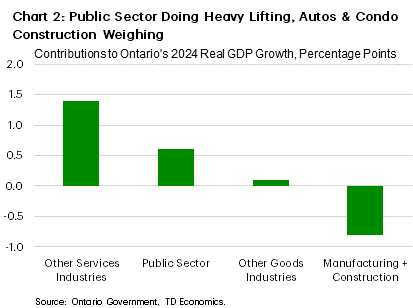

Driving the decent services outturn has been the public sector, where hiring has surged. In fact, we estimate that the healthcare, education and public administration industries could contribute nearly half of Ontario’s expected 2024 real GDP growth (Chart 2). Elsewhere, the province’s outsized finance/insurance/real estate (FIRE) sector is poised for a reasonably firm 2024 gain – an impressive feat given housing market weakness – boosted by financial market trading activity as well as rising output at insurance carriers.

On the opposite end of the spectrum, the retail industry has struggled, as elevated borrowing costs have weighed on demand for interest-sensitive goods, notably within the automotive sector, while housing-related spending has been dulled by the subdued market. Professional/administrative services is another large services sector that is likely to record sub-trend growth. However, its annual average performance is being dampened by weak momentum heading into 2024, and a better quarterly outturn has been recorded so far this year, supported by architectural and consulting services.

Better Prospects Emerge for the Goods Sector

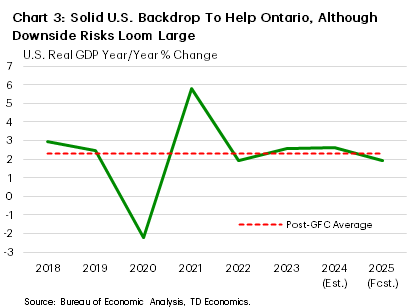

We envision a better – but still muted – year unfolding for the goods sector in 2025 on the back of some improvement in manufacturing activity. Automotive production will likely edge higher next year, supported by sales gains in Canada and the U.S., turning it from a heavy drag on manufacturing in 2024 to a mild support. We also see decent U.S. growth prospects for 2025, albeit with significant policy uncertainty on the heels of Trump’s presidential win (Chart 3). Resilient U.S. demand should underpin some pickup in Ontario’s manufacturing, and the low Canadian dollar will provide support, although the potential for tariffs on Canadian products ahead of the 2026 USMCA negotiations looms large (see here).

Construction, meanwhile, is likely to record another decline, as condo building continues to cool. In contrast, non-residential spending should be lifted by continued investments in EV battery plants and robust government infrastructure plans (including in hospitals, transit, and nuclear refurbishments).

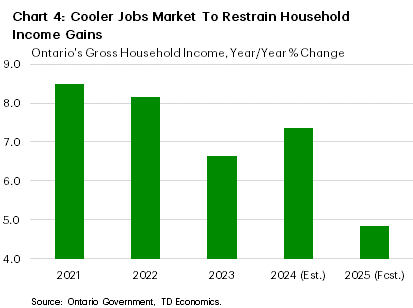

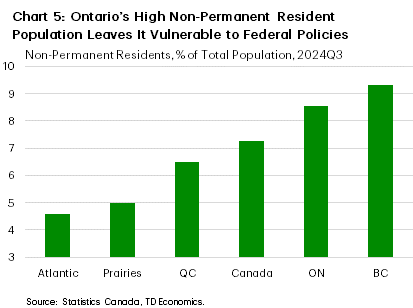

Population Standstill to Hit Household Spending

Personal income growth is likely to ease next year, reflecting markedly weaker population growth and the lagged impact of this year’s weaker jobs market on employee compensation gains (Chart 4). The federal government’s immigration plan imbeds a drastic about-face on Canadian population growth, such that it could slow from around 3% to near-zero next year. Much of this change is set to come through the non-permanent resident channel, where Ontario is particularly suspectable given its share of these newcomers is relatively elevated (Chart 5). A caveat here is that while overall income and household spending growth will take a hit from the population slowdown, we think that per person spending will be firmer (see here).

Weaker labour income growth will likely restrain output gains in a variety of services industries including professional services, recreation/entertainment, and personal services. However, we expect some offset to come from healthy government infrastructure plans, (which will raise the demand for architectural services, for example). What’s more, a low flying loonie and resilient U.S. demand should help the tourism industry weather the impact from softer domestic income growth, and increased manufacturing activity will likely enhance the demand for transportation services.

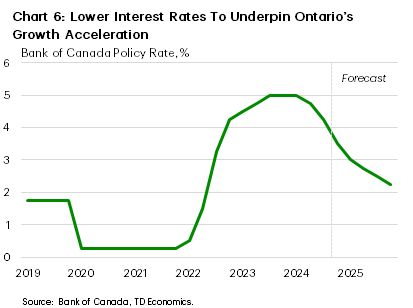

Also on the supportive side, lower interest rates should help unlock pent-up demand for autos, offering a fillip to the retail sector (Chart 6). This improved backdrop for borrowing costs, coupled with stimulative federal measures, points to a sturdier year for housing in 2025, following a marked improvement in activity in the early part of Q4. This should tee up an acceleration in output growth for the FIRE industry.

The Fiscal Update Giveth and Taketh Away

As formalized in Ontario’s most recent fiscal update, the province will be giving $200 rebate cheques to households early next year at an estimated cost of $3 billion. We estimate that this will lift gross personal income by 0.4 ppts in 2025, ultimately resulting in a smaller 0.1 ppt add to GDP growth after factoring in the cautious behaviour of Ontario’s households. The resulting shot in the arm to household spending should spur activity in industries such as retail services.

The fall update also revealed that, when the funds allocated towards stimulus funding are removed, program spending growth will be paltry in the coming fiscal year. This suggests that the public sector will turn from an impressive growth support in 2024 to a mild drag in 2025.

Bottom Line

Ontario is on track to record a modest growth year in 2024 on the back of declining goods production. On the plus side, this subdued performance has helped inflation return to the 2% target.

We envision a similarly subdued year unfolding in 2025, as the tailwinds from lower borrowing costs, government income-support measures, non-residential investment, decent U.S. economic growth, and rising auto production clash with continued softness in homebuilding, much weaker population gains, and modest government program spending.

With economic growth likely to hold near this year’s rate and population growth set to cool markedly, we expect Ontario’s unemployment rate to fall in 2025. Meanwhile, these same factors should help labour productivity turn positive for the first time in 5 years.

Table 1: Real GDP Growth – Ontario

| 2023 | 2024 | 2025 | |

| Other Goods* | 2.1 | 2.8 | 1.5 |

| Retail + Wholesale Trade | 0.7 | 1.9 | 2.3 |

| Public Sector | 3.7 | 2.9 | -0.9 |

| Manufacturing | 0.1 | -6.0 | 2.6 |

| Construction | -2.0 | -2.5 | -3.3 |

| Other Services** | 4.8 | 2.8 | 2.5 |

| FIRE | 0.1 | 2.7 | 2.9 |

| Prof/Sci/Tech | 4.0 | 1.7 | 2.7 |

| Overall GDP | 1.8 | 1.3 | 1.4 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: