Popping Canada’s Population Bubble

Marc Ercolao, Economist | 416-983-0686

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Rishi Sondhi, Economist | 416-983-8806

Date Published: November 7, 2024

- Category:

- Canada

- Government Finance & Policy

Highlights

- The federal government’s recently-released immigration plan -- which captures both a sizeable reduction in the pool of non-permanent residents and a scaling back in permanent immigration targets -- will see Canada’s population growth grind to a halt after a historic run.

- The abrupt slowdown in headcount will not be lost on the Canadian economy, though the overall impact is likely to be less dramatic than some fear.

- We expect the new plan to exert a drag on aggregate consumer spending and labour supply. However, these effects are expected to be mitigated by a number of influences, including less upward pressure on rents, lower interest rates and increased spending per capita. Moreover, a reduced supply of low-wage temporary immigrants is expected to increase the incentive for businesses to invest.

The federal government has hit pause on Canada’s booming population growth. Through planned reductions in both the pool of non-permanent residents (NPRs) and a scaling back in its annual permanent immigration targets, the country’s population growth is set to stall over the next two years. This abrupt slowdown will impact the economy, but not as dramaticly as some fear. This period could offer a reprieve to key sectors that haven’t been able to keep up, such as housing supply. It also increases the incentive for businesses to invest by shifting reliance away from low-wage temporary immigrants.

Details of the Immigration Plan

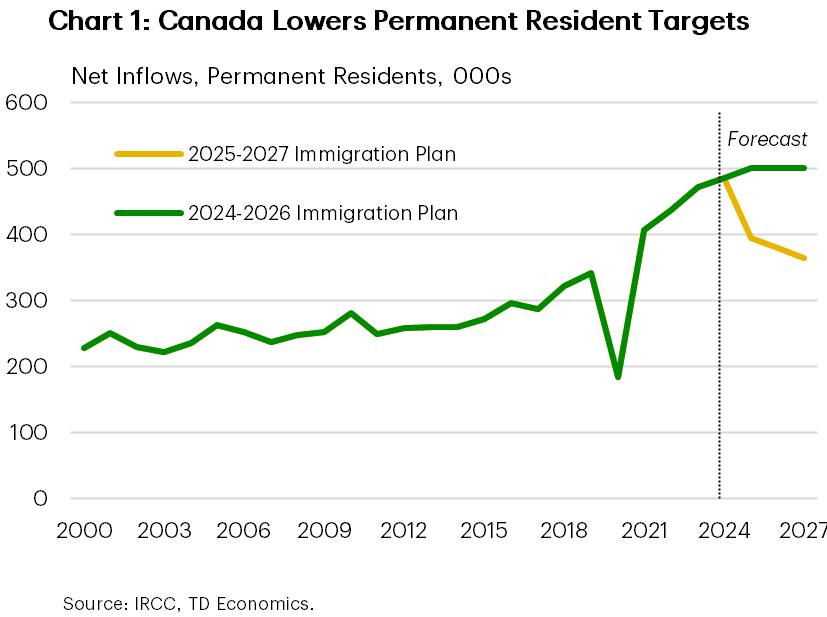

The 2025–2027 Immigration Levels Plan (Plan) tabled the admission targets for both permanent residents (PRs) and non-permanent residents (NPRs). The biggest surprise in the release was the decision to reduce the number of planned PR admissions. Compared to last year’s target (500k per year in 2025 and 2026), this year’s update calls for roughly three-quarters of that (Table 1). Despite the pullback, net PR flows will remain higher than in the years leading up to the pandemic (Chart 1).

Table 1: Permanent Resident Targets (000s)

| 2024 | 2025 | 2026 | 2027 | |

| 2024-2026 Plan | 485 | 500 | 500 | |

| 2025-2027 Plan | 395 | 380 | 365 |

In the lead up to the release, the government telegraphed their plans for the NPR population as they set out to reduce their share of the total population to 5% by the end of 2026 (currently at over 7%). What the Immigration Plan offered, for the very first time, were hard targets for the various NPR categories, which provides clarity for how the 5% goal will be achieved (Table 2). Changes on this front are particularly meaningful, given that the bulk of the population surge over the past couple of years reflected an uncontrolled inflow of international students and temporary foreign workers (TFWs).

Within the NPR group, a significant decrease in workers is expected due to a large reduction in work permits allocated to the International Mobility Program (IMP). IMP visa holders account for around 40% of total NPRs. Moreover, permits issued under the Temporary Foreign Worker Program (TFWP) are set to remain flat at 82,000 per year for the next three years. To achieve this, the government introduced a 10% cap on employer hiring in the low-wage stream and recently announced an increase to the starting hourly wage for TFWs in the high-wage stream by 20% to encourage domestic hiring. It is worth noting that many policy changes in the TFW space represent a rolling back to pre-pandemic norms. Meanwhile, international students are capped just shy of 310,000 over the next three years, with provincial application processing caps being allocated based on population shares.

Table 2: Temporary Resident Targets

| 2025 | 2026 | 2027 | |

| Total | 673,650 | 516,600 | 543,600 |

| Workers (Total) | 367,750 | 210,700 | 237,700 |

| International Mobility Program (IMP) | 285,750 | 128,700 | 155,700 |

| Temporary Foreign Worker Program (TFWP) | 82,000 | 82,000 | 82,000 |

| Students | 305,900 | 305,900 | 305,900 |

Population Growth Taking a Breather

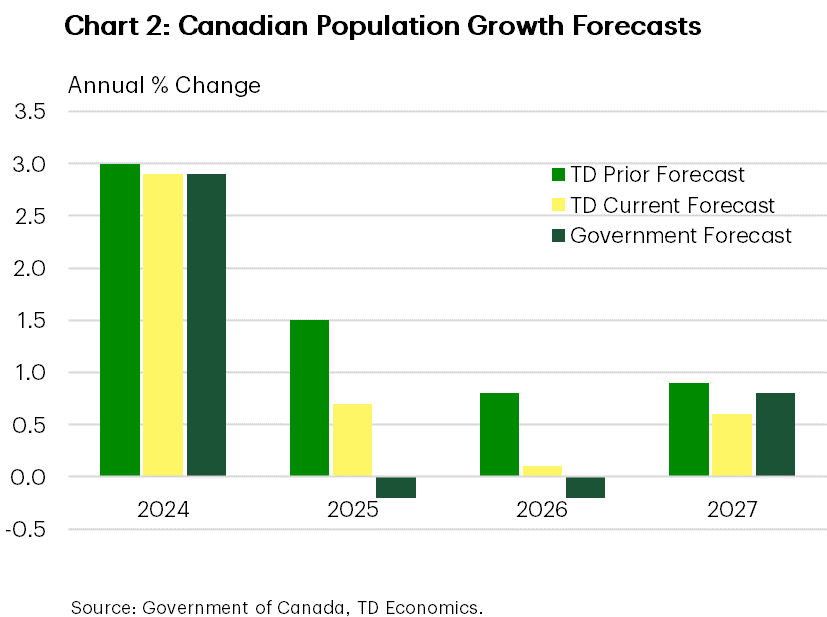

Any way you slice it, population growth will decelerate sharply. The federal government’s projections show modestly negative population growth (-0.2%) over the next two years before flipping back to positive territory in 2027 (0.8%). This is noteworthy, since Canada’s population has never outright contracted on an average annual basis. Our population forecast has also been significantly scaled back, though we do see some modest upside risk to the federal forecast. Still, we are projecting below historical average population growth between 2025 and 2027 (Chart 2).

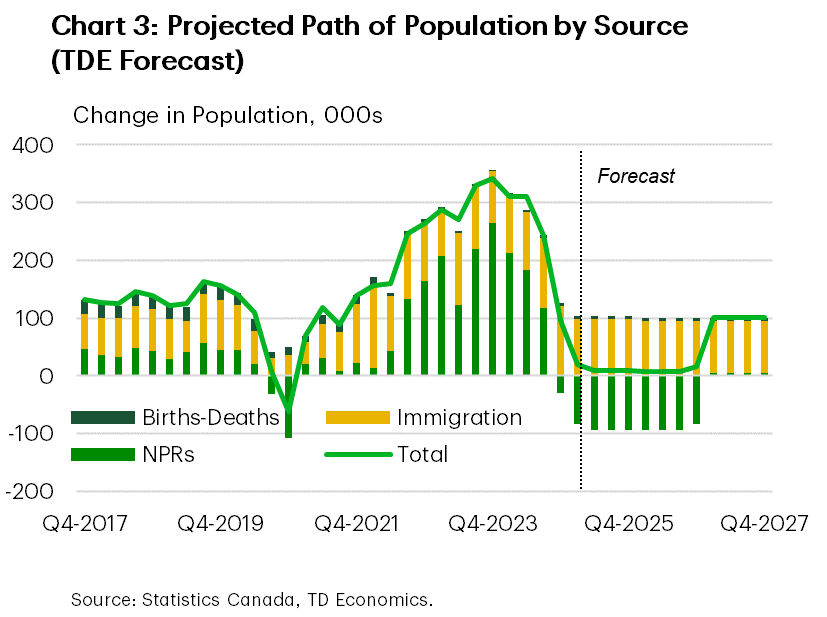

Given the time it takes to implement reforms and the inherent complexity of the immigration system, achieving the 5% NPR target will present some challenge. To put that into perspective, it will require net outflows of nearly 1 million NPRs (or around 110k per quarter). As far as the composition of NPR flows, recent data is showing that a slowdown in international students is already taking place. TFW’s and other NPR permit holders should start to reel back by Q1-2025 (Chart 3).

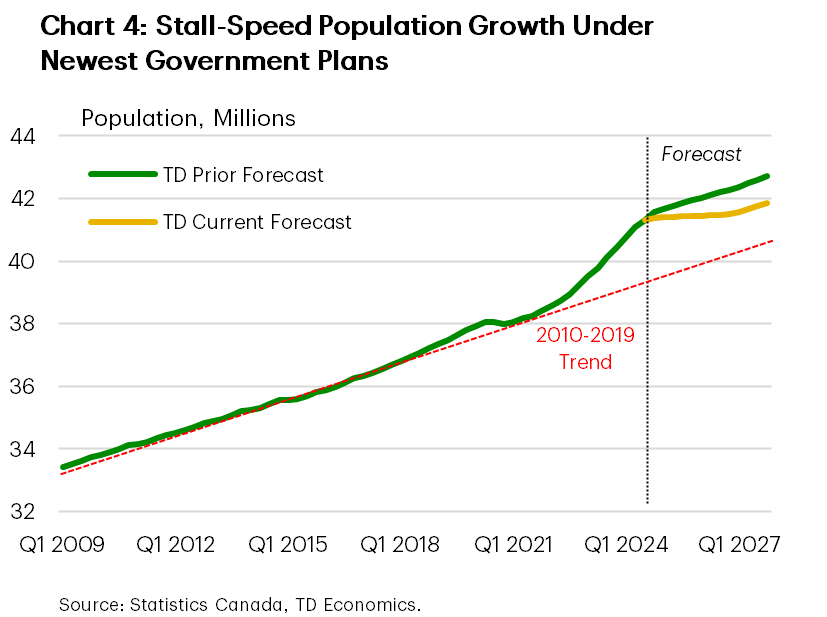

While the Plan’s changes will result in large annual swings in population relative to the status-quo, Chart 4 puts them in better context. The population level under the planned trajectory manages to remain above its pre-pandemic trendline. As such, we view these changes more as a recalibration.

How Will This Filter Through The Economy?

Undeniably, moving from 3% annual population gains to stall speed will lead to some negative short-term adjustments for the economy. In particular, the new targets will weigh on labour supply. In the longer-term, the driver of the economy is the growth in a country’s labour force plus the improvement in worker productivity. Over the last few years, Canada has mainly relied on population-fueled labour force growth, which peaked at a 3.0% annual growth rate in 2023, effectively matching the population surge. At the same time, productivity fell for the third straight year. The offsetting factors led to below-trend GDP growth and falling living standards for Canadians. Furthermore, the unemployment rate rose from a low of 4.8% to 6.5% over the last two years, as firms were unable to absorb the population wave. Indeed, much of the increase in joblessness was born by newcomers as evidenced by a near 5 ppt rise in their unemployment rate, up to 11.7% as of September 2024.

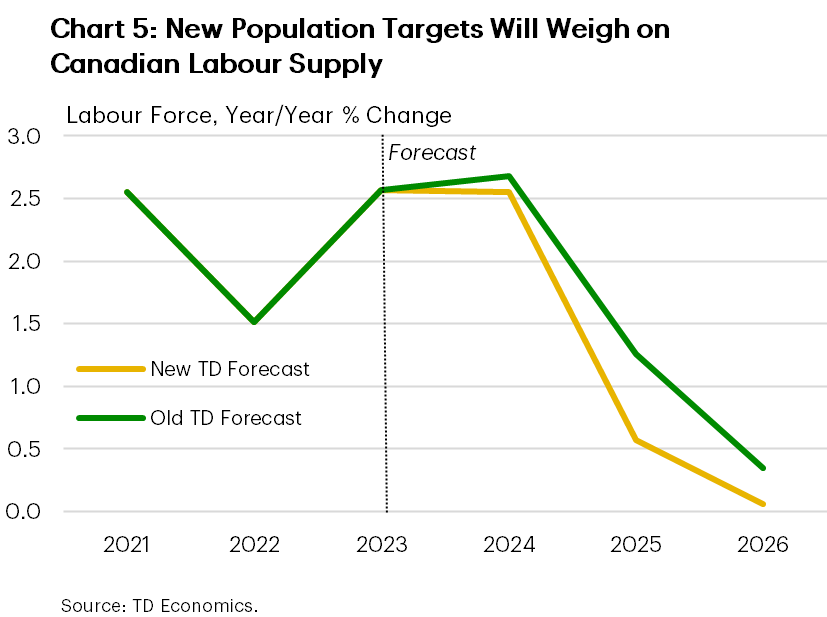

The government’s new population plan necessitated a downward adjustment to our labour force growth forecast by around 0.5% in both 2025 and 2026, relative to our prior baseline forecast (Chart 5). While over 40% of NPRs are expected to transition to permanent status next year, the remainder will leave the country. And with the permanent targets getting cut, many of those spots will be taken up by transitioning NPRs. This leaves relatively fewer spots for economic immigrants entering the country through traditional programs. It is worth noting that on a relative basis, federal high skilled immigration will not take as big a hit as other immigration categories. In any event, an expected decline in the supply of foreign workers will put downward pressure on the labour force and likely yield a moderate pull-back in the national jobless rate over the coming quarters.

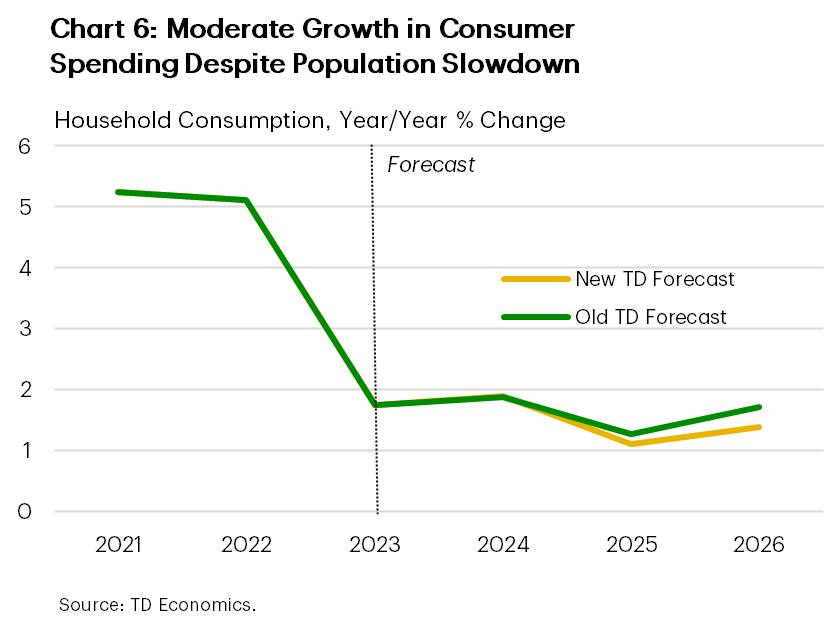

The stalling out in population growth will not be lost on Canada’s consumer spending outlook. Still, the net effect on overall spending is not expected to be large. This is because weaker gains in the number of households is projected to be counterbalanced by higher spending per household. Temporary residents typically spend less than average on an ongoing basis notwithstanding some upfront expenditures to get settled. Another mitigating factor is the influence of the BoC’s rate cutting cycle. Over the last two years, many Canadian households pared back spending in the face of high rates. And while there will still be a sticker shock when people renew mortgages with rates still above 2020/2021 levels, the damage will be less than previously thought and rates on new mortgages/auto loans/lines of credit are coming down. We see this sparking demand for housing and big-ticket items, unleashing the spending power of existing Canadians that have been hibernating. On net, our consumer spending forecast still points to moderate growth over the next two years despite being shaved a couple tenths of a percent from our prior forecast (Chart 6).

Honing in on housing, the impacts of these changes should be most apparent in the rental market. In the GTA, rents are already falling in year-on-year terms without this looming negative demand shock (having been pressured lower by a wave of newly completed rental units hitting the market). Industry data suggests that rent growth is also cooling in places like B.C. and Quebec and the federal government’s policy will only exacerbate these trends. As such, the attractiveness of these units as income-generating properties will be diminished, likely weighing on investor demand.

The direct impact on ownership housing demand will likely be small, given that both non-permanent and permanent residents largely rent when they first come to the country. However, flat population growth for a few years will offer an opportunity for builders to close the sizeable gap between housing completions and population-based, underlying demand for new homes that opened up from 2022-2024 (estimated at a meaty 575k units). However, this gap is more likely to be narrowed, rather than eliminated completely. This suggests that this new population policy will not, by itself, be a panacea for Canada’s housing affordability problem, even if it’s a step in the right direction from this perspective.

Other factors could also mitigate the impacts of reforms and deliver some offsetting positive influences. With less pressure on housing and infrastructure, inflationary pressure will be further reduced, supporting the BoC’s efforts in normalizing its policy rate. Moreover, should productivity gains not offset reduced labour input, potential output in Canada’s economy would be revised lower. From this standpoint, the Bank of Canada’s (BoC) estimate for the neutral rate would likely be revised downwards, suggesting lower rates over the medium-term.

Reducing access to low-wage temporary immigrants also increases the incentive for businesses to invest in automation, an area that has been woefully lagging the U.S. in recent years. The shift from labour to capital in production plans could pave the way for a modest uptick in Canada’s productivity growth over the next few years.

While the immigration policy changes will likely generate a number of cross-currents on the macro landscape, some sector-specific adjustments are likely to be particularly notable. One worth calling is the Post-Secondary Education (PSE) sector, which is already facing the squeeze from tuition freezes in some provinces such as Ontario. A sharp reduction in international study permits over the next few years will add to this financial pressure, posing a risk to Canada’s future talent pool.

Bottom Line

Despite this shift from the status-quo, we are not anticipating large negative effects overall on the Canadian economy. The changes will undoubtedly create some near-term economic disruptions, especially with respect to labour supply and consumption. However, there will be notable counterbalancing influences, including lower rent inflation, better incentives for businesses to invest, and potential for a faster normalization in policy rates.

From a longer-term perspective, immigration will still be a critical ingredient of offsetting the impact of an aging workforce. In recent years, the system moved away from its emphasis on human capital selection and meeting longer-term skills requirements to fulfilling immediate labor market needs. These reforms mark a shift back in the right direction.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: