Highlights

- Canadian consumer spending has been remarkably robust, despite a weak first quarter of 2025. This has been primarily driven by lower interest rates that have encouraged households to spend rather than save, even as the labour market and housing sector remain subdued.

- Household spending growth is expected run at a below-trend rate as income growth and the labour market weaken, with further drawdowns in the savings rate providing the main support.

- A stronger revival in the housing market or stronger-than-expected debt growth present upside risks to the forecast.

Canada’s resurgent consumer has grabbed headlines. Robust spending growth in the face of significant challenges has raised questions about what’s behind the surprise and whether it is sustainable. Our answer is simple: monetary policy. Lower interest rates have tilted the math towards spending in households’ spend vs. save decisions, helping to cushion the economy from a slowing labour market and subdued housing market. Looking forward, the lower rates mean the savings rate should have a little more room to fall – keeping consumer spending out of the red as the unemployment rate rises.

To set the stage, spending clocked in at a healthy 4.8% (annualized) over the back half of 2024, as the cumulative effect of 125 basis points of Bank of Canada rate cuts since June 2024 worked their way through the economy. The good times were, unsurprisingly, arrested by the U.S. tariff threats at the start of the year that tanked consumer confidence. However, this proved relatively fleeting with outlays surging 4.5% in Q2. So, what’s been going on in the background?

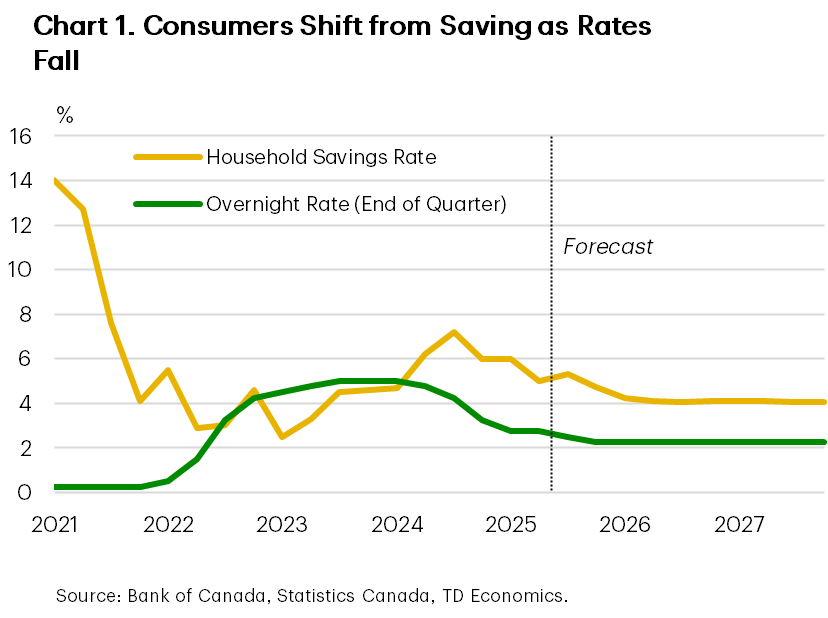

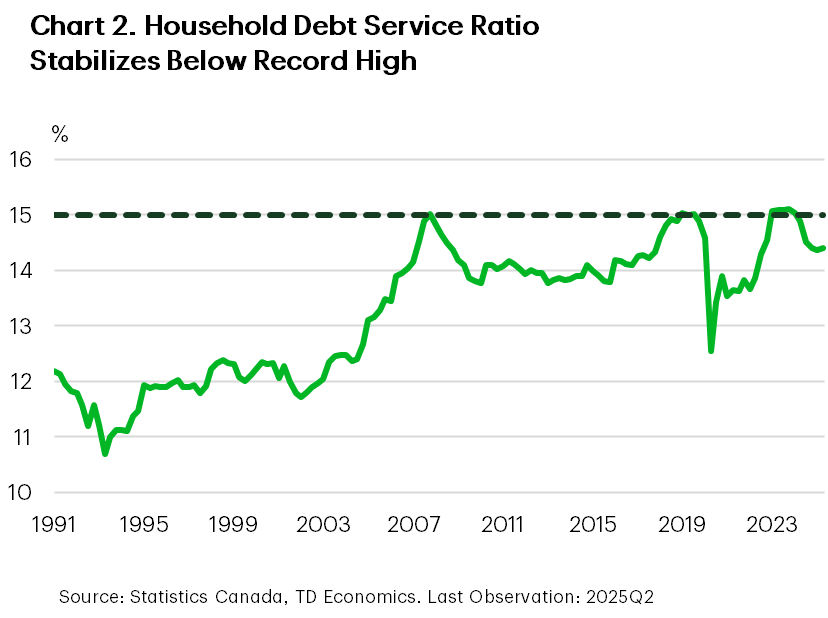

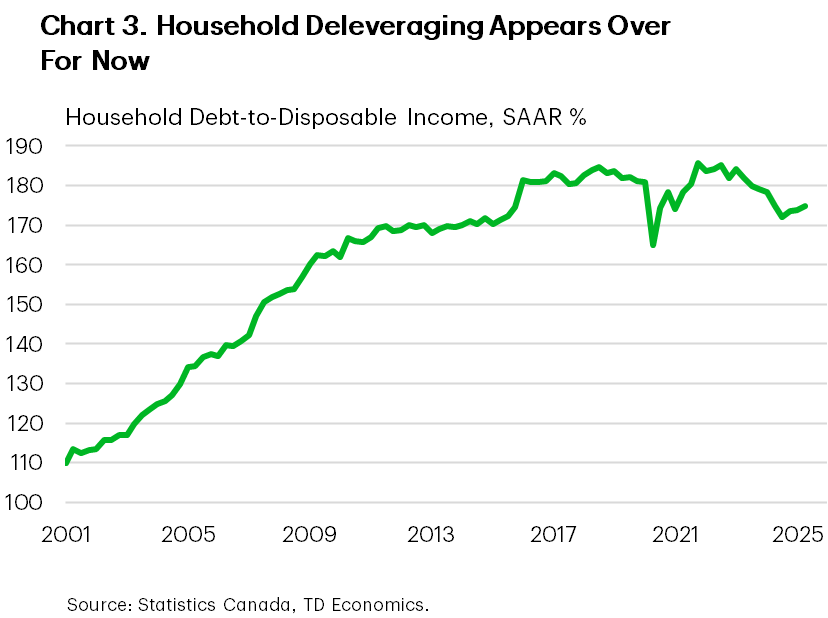

Well, the household savings rate has fallen 2.2 percentage points (pp) since 2024Q3. Not coincidentally, the drop has come as interest rates have fallen (Chart 1). When the Bank of Canada started raising interest rates in 2022, alongside other global central banks, the cost to service the obligations shot higher, driving Canada’s household debt service ratio to its previous high of 15% (Chart 2). In what has become a pattern, at this level households shift their strategy, pushing pause on additional borrowing (Chart 3). Amid multi-decade high borrowing costs, household borrowing slowed dramatically. This pushed the debt-to-income ratio 13.5 pp lower by late 2024, bringing it back down to levels last seen a decade ago.

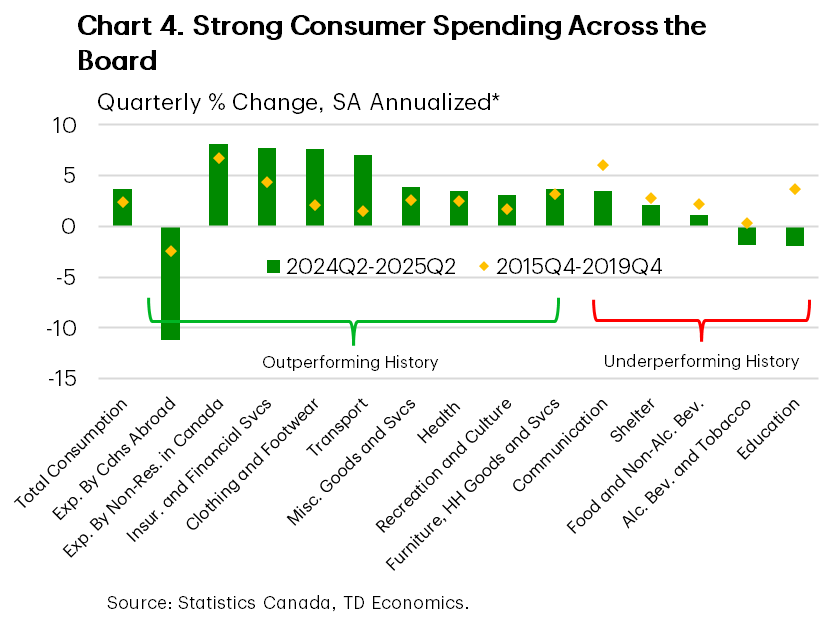

Now, the reverse is occurring as lower borrowing costs have meant more post-debt income available for indebted households, and Canadians have responded by spending it. However, this time, the money hasn’t primarily flowed to housing, but on a wide variety of goods and services (Chart 4). Shelter spending, and particularly rent and imputed rent (the quarterly value of housing assigned to homeowners), has grown more slowly than in past cycles. With weak population growth, this is not all that surprising. What is surprising is the strength of just about every other consumption category. The Canadian consumer has splashed out across just about every category of consumption in a way that is far beyond what would be expected in the context of a soft labour market and downbeat sentiment.

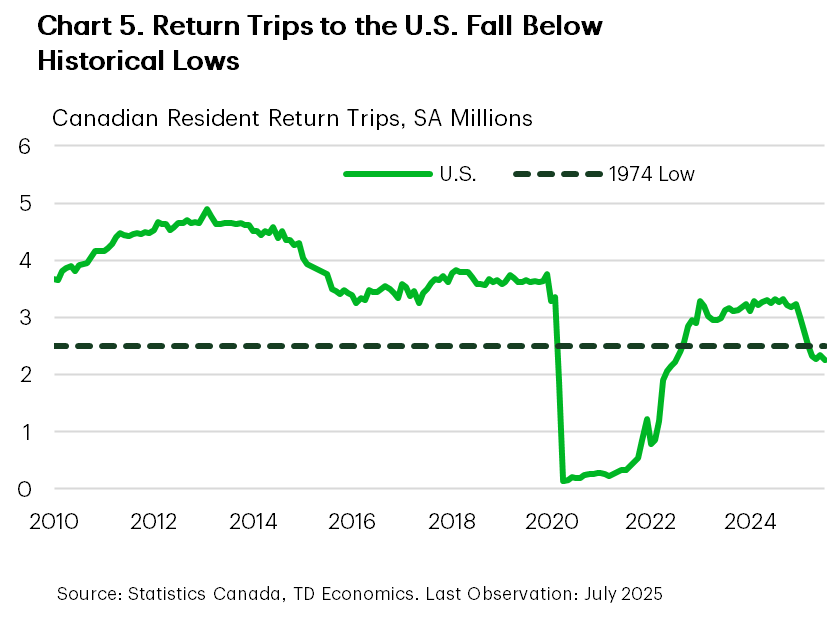

In fact, there are a couple of reasons we expect the consumer to continue to outperform the weak labour market. First, Canadian spending abroad has fallen to a level not seen since 2010. In fact, the 2.3 million (seasonally adjusted) return trips from the United States recorded in July were the lowest total (apart from during the pandemic lockdowns) going back to at least the early-70s (Chart 5). Moreover, the return trips from the U.S. are down 1.2 million year-on-year (y/y) as of this July (-32.4%) and were only partially offset by 80k more returns from other countries. This suggests a structural shift towards domestic tourism and services spending. The tourism sector might still feel a pinch as American entries into Canada were also down 102k in July (-3.0%), but these were nearly totally offset by global entries (ex. U.S.) rising 93k (10.2% y/y). Looking forward, with limited upside for the Canadian dollar against most currencies, Canadians’ preference towards domestic travel is likely to persist, to the benefit of domestic firms.

Secondly, the Canadian housing market has started to show some verve of late. Sales have climbed for the past 5 months. Overall activity is still soft by historical standards, but we expect an ongoing recovery. As purchase activity grows, so too will consumption spending, not just for shelter, but for the furniture, appliances, and other household goods that benefit from new home acquisitions.

Monetary Policy Can Only Go So Far

The positive effects from rate cuts are working to offset the drags the economy faces, but the drags are substantial. The unemployment rate looks likely to rise, only limited by slower population growth. A brief resurgence in vehicle sales in the second quarter should normalize in Q3, dragging goods spending lower. Moreover, medium- and long-term borrowing rates appear unlikely to offer much more relief. The good news is further Fed cuts should also help to limit the upside risk to rates by keeping a lid on U.S. bond yields, and their international counterparts, over the coming months.

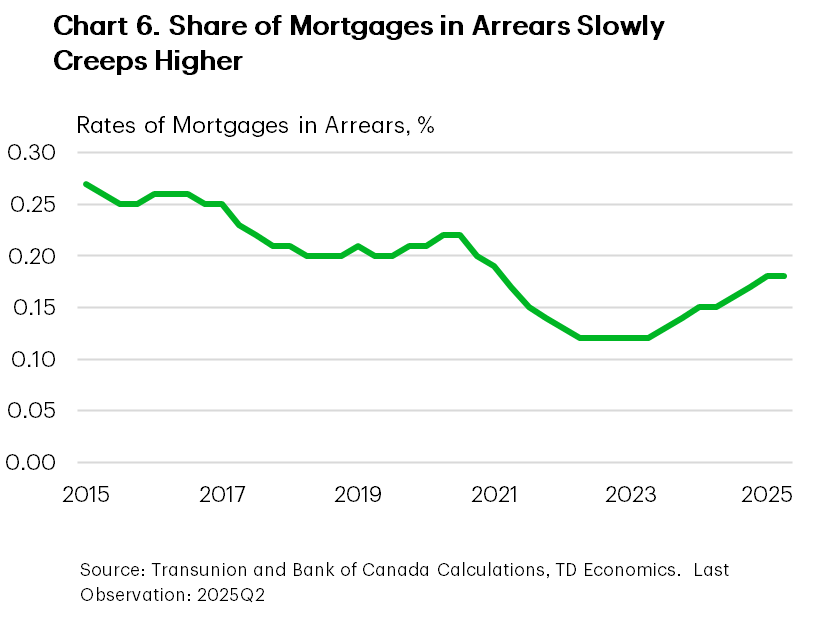

The housing market, although appearing to show signs of life as of late, is still mired in a supply glut, with benchmark prices still falling. A small recovery in the coming months will help, but we don’t expect boom times to return. More mortgage rate resets are on the way, draining some possible spending, while the rate of loans in arrears has crept higher (Chart 6). The goods news is stress tests appear to have worked as intended to prevent a major wave of defaults, and recent income and wealth gains have created some wiggle room for borrowers to navigate resets.

Bottom line, Canadian household spending growth is expected to register a below-trend rate of 1.3%-1.4% in late 2025 and early 2026. Income growth is expected to be modest, in line with a weaker labour market. As such, we’re looking for consumer spending growth to moderate in the coming quarters as downbeat economic sentiment and slower income growth act as drags. This means the driving force behind the figures is a further drawdown in the savings rate. Of course, there is potential upside risk comes from the housing market and debt accumulation. A sharper recovery in housing or a larger acceleration in debt growth loom as upside risks.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: