Canadian Business Investment: Cautiously Optimistic

Omar Abdelrahman, Economist | 416-734-2873

Rishi Sondhi, Economist | 416-983-8806

Date Published: August 18, 2021

- Category:

- Canada

- Business Investment

Highlights

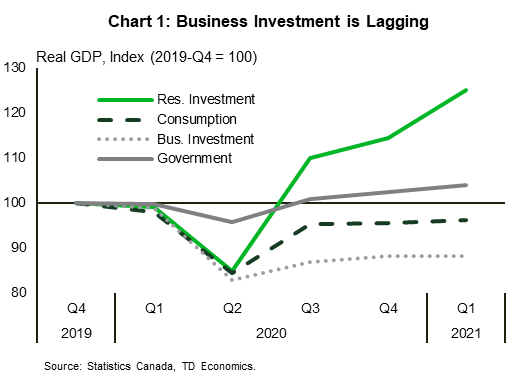

- Canadian business investment has only made modest strides after slumping at the onset of the pandemic. This stands in contrast to the more forceful bounce-back seen in residential investment, government spending, and consumer spending.

- Investment in Intellectual Property Products (IPP) has led the recovery in business investment so far. However, only a partial rebound has been seen in machinery and equipment investment. Meanwhile, investment in non-residential structures has barely nudged after bottoming out late last year.

- Recent indicators point to some upside to our outlook for business investment in the June Quarterly Economic Forecast. Several drivers, notably improving business capital spending intentions and solid overall growth prospects in Canada and the U.S. should support an acceleration in business investment starting in the third quarter.

- Notwithstanding the recently brightening outlook, a heroic performance for the sector over the medium term remains unlikely. For instance, investment in non-residential structures will continue to face structural impediments that prevent a meaningful acceleration.

Business investment has been a laggard in Canada's otherwise swift economic recovery (Chart 1), although this dynamic is not uncommon, as investment spending has generally lagged in prior recoveries. Uncertainty around COVID-19 meant that businesses have largely stayed on the sidelines with respect to new outlays, or even paused existing projects. The good news is that the proverbial ducks are lining up in favour of a bounce-back in investment activity in the second half of 2021 and into 2022. Indeed, the Bank of Canada's July Business Outlook Survey showed a notable and broad-based improvement in business sentiment and spending plans. At the same time, investment in intellectual property products (IPP), after years of subdued performance, has finally started showing signs of life.

Notwithstanding the brightening prospects, a number of factors prevent us from building in a heroic performance in our outlook. Investment in non-residential structures is one area that is unlikely to impress, owing to a cloudy backdrop for commercial real estate and energy capital spending. In addition, a still uncertain global backdrop amid lagging vaccinations and the rising presence of the Delta variant in some economies may more broadly impede some large-scale investment decisions in the coming quarters.

A Closer Look at Where We Are

Business investment has made modest strides after its slump at the onset of the pandemic. Nevertheless, progress has slowed dramatically since the third quarter of last year, likely as a result of elevated uncertainty amid rising infections and renewed restrictions during the second and third waves. In the first quarter of 2021, business investment was still 12% detached from its pre-pandemic (2019-Q4) level. Even in the second quarter, a meaningful bounce back appears highly unlikely. Several provinces had tightened restrictions further in April and May, and vaccinations only began ramping up in the latter stages of the quarter.

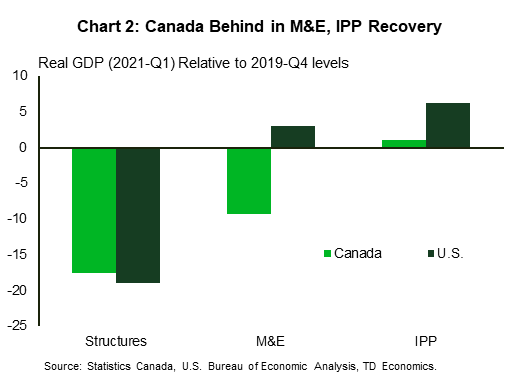

The overall subdued recovery in business investment masks an underlying divergence in its components (i.e. investment in non-residential structures, machinery and equipment, and intellectual property products). For context, structures investment has historically accounted for about 5% of GDP, followed by 3% for machinery and equipment (M&E) and just 2% for IPP. A comparison across these components and how they fared against their counterparts in the U.S. can help shed more light on the structural and cyclical elements shaping the current dynamics of investment.

IPP investment has held up better during the pandemic than either machinery and equipment or structures spending and is now trending above pre-pandemic levels (Chart 2). This is not entirely surprising. Research and development and software adoption were buoyed by an acceleration in digitalization, e-commerce, and work from home trends brought upon by the pandemic. But even then, a comparison to peers shows that IPP investment trends are less than meets the eye. Indeed, growth rates lagged those seen in the U.S. since the fourth quarter of last year, despite Canada facing a larger initital hit. This wedge in performances between Canada and the U.S. is longstanding and partly structural (see report). But a part of it is due to recently-subdued mineral exploration trends in Canada, which have been further impacted by the pandemic. Indeed, investment in mineral exploration was down by one-third compared to its pre-pandemic level in the first quarter of 2021.

Non-residential structures investment, meanwhile, has barely moved after bottoming out in the fourth quarter of last year. This is consistent with the experience seen south of the border. Capital spending in the energy sector, on a downtrend since 2015, took another leg down during the pandemic. However, the energy sector is not the full story. Commercial real estate is another culprit, dampened by uncertainty around return-to-office policies, potentially less need for brick-and-mortar retail amid a boom in online shopping, and a downtrodden hospitality industry. Indeed, as of June, inflation-adjusted spending on commercial structures was down 21% compared to its pre-pandemic level.

Sitting somewhere in between IPP and non-residential structures investment is spending on M&E – which has managed to recoup only some of its pandemic-induced losses, but is still well below pre-pandemic levels. This stands in stark contrast to the U.S., where spending on this category has far surpassed pre-pandemic levels. A deeper dive suggests that transportation equipment investment (i.e. vehicles and aircraft) is the key obstacle. In fact, excluding these high-cost categories, M&E investment would be a decent 4% above pre-pandemic levels. The largest gap between the two countries has come from investment in transportation equipment, despite it also being weak in the U.S. Restrictions on businesses stateside were relaxed far earlier than they were in Canada, thereby eliminating some of this uncertainty earlier on in the year. At the same time, the heavier presence of the energy sector in Canada may have held back spending on industrial machinery – which saw a slightly more notable comeback in the U.S.

With pandemic-related uncertainty lower than it was at the start of the pandemic, we expect the pace of the recovery in business investment in this country to pick up through the remainder of the year and into 2022. Our June Quarterly Economic Forecast (QEF) embeds a complete return to pre-pandemic levels by early 2023, several quarters after the overall economy. However, recent indicators suggest that there could be some upside to this forecast.

Most Divers Have Turned Positive

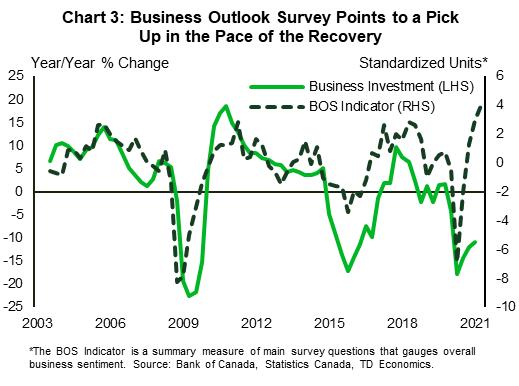

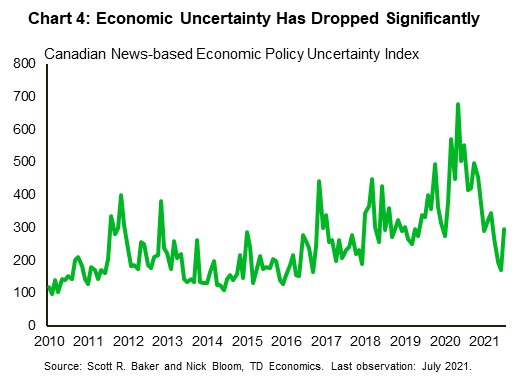

- Business sentiment is rebounding: The Bank of Canada's July Business Outlook Survey (BOS) showed broad-based improvements in sentiment and spending plans (Chart 3). Actual and intended investment tend to be highly correlated – supporting the case for a decent comeback in the third quarter. The BOS indicator (an all-encompassing indicator for the survey's main questions) rose from 2.95 to 4.17 in the second quarter. Part of this is due to a comparison to a weak base, but the improvement was also supported by a drop in pandemic-related uncertainty (see Chart 4) amid high vaccination rates in Canada. Businesses reported higher expectations of future sales growth and investment. The improving backdrop has also been echoed in other surveys. The CFIB's small business barometer now stands near its highest level since 2011. Elsewhere, Purchasing Managers Indexes (PMIs) remain comfortably in expansionary territory.

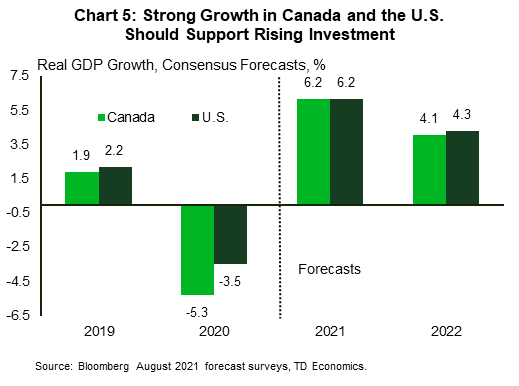

- Solid growth prospects domestically and abroad: The general expectation among economists is that the Canadian and U.S. economies are primed for solid economic growth through next year (Chart 5), fueled at first by re-openings during the spring and summer, as well as fiscal and monetary stimulus. As this backdrop unfolds, it should solidify confidence that the recovery is well-entrenched and boost demand for domestic and export-oriented firms alike. Despite growing concerns about the Delta and other variants, economies have generally been displaying increased resilience with each passing wave. And, indeed, Canada's economy is on track to outperform earlier expectations again in the second quarter notwithstanding the severe lockdowns that were put in place this spring. This resilience implies less scarring, or hit to the economy's long-term growth potential.

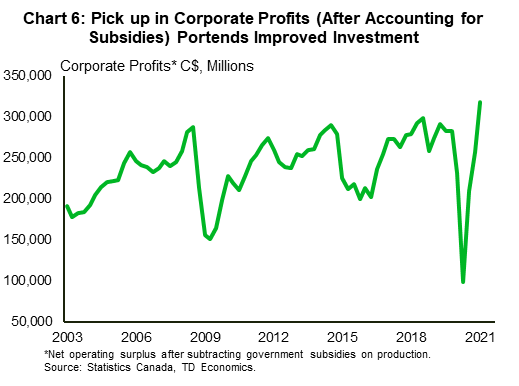

- Corporate profits are on the rise, balance sheets are improving: Canadian corporate profits have held up well during the pandemic and even managed to surge in the first quarter. Part of this was due to sizeable subsidies from the Canadian government (namely the CEWS, but also rent support programs). However, even controlling for the increase in subsidies, profits rebounded above pre-pandemic levels in the first quarter (Chart 6). Given that profits tend to lead business investment, specifically M&E and structures investment, by 1-2 quarters, this bodes well for a near-term increase. Looking further ahead, economic growth should support further gains in profits as we move through the remainder of the year and 2022. The bounce-back in profits, together with government subsidies, have also led to an increase in financial assets (namely cash and other liquid assets) – supporting balance sheets and increasing firms' financial capacity to invest. There are, of course, sectoral differences. The expiry of government support programs may not have a large impact on the broader picture for profits, but some sectors not yet operating at normal levels (arts/entertainment, air travel) will likely face some downside risks in the near term.

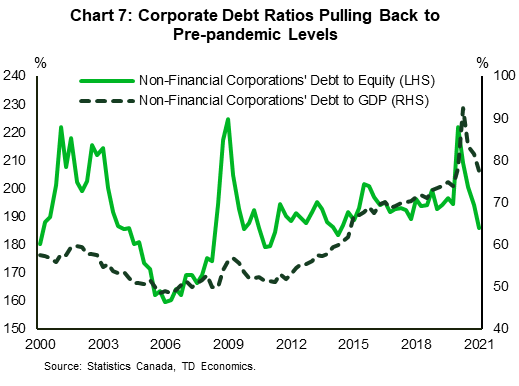

- Supportive borrowing backdrop: Both the Bank of Canada and the U.S. Federal Reserve are likely to keep policy rates at their ultra-low levels until the end of 2022. With growth and inflation firming, asset purchase programs being tapered (BoC) or soon to be reduced (the Fed), and central bank guidance pulled forward, this is likely to put modest upward pressure on interest rates, reversing the more-recent declines that we've seen in the U.S. and Canada. However, any increases are likely to be gradual, and rates should remain low by historical standards. Corporate spreads also remain below long-term averages, helping keep the borrowing environment relatively benign. At the same time, the terms and conditions for obtaining financing are favorable, as the Bank of Canada's Senior Loan Officer Survey showed a net easing of credit conditions in the second quarter. In addition, the latest BOS showed a net easing in credit conditions for the fourth straight quarter in Q2. At the same time, indicators of leverage, including debt-to-GDP and debt-to-equity ratios for non-financial corporations, have been falling consistently in recent quarters after an initial spike at the onset of the pandemic, as some firms repaid and retired debt (Chart 7). On the negative side, despite the improvement, firms remain highly leveraged, a possible impediment for investment. In addition, some of the harder-hit sectors have likely exhausted their capacity and/or appetite to borrow, as noted in responses to Statistics Canada's Survey of Business Conditions. Similarly, some firms – particularly those highly exposed to international tourism - may face some difficulty borrowing as government supports start to wane, but this risk should be lower now that the bulk of COVID-19 restrictions on businesses have been lifted.

- An accelerating digitalization trend: Recent survey responses (for instance, the Q2 BOS) suggest that the pandemic has accelerated firms' intentions to invest in digitalization and IT technologies. There are, of course, two sides to this coin, with labour markets potentially falling victim to this (See report). The Federal budget also included plans to incentivize small businesses to adopt digital technologies.

But a heroic performance is unlikely

Despite the improving backdrop, business investment as share of GDP is still expected to remain low relative to pre-pandemic trends. In the near-term, uncertainty from the Delta variant may cloud investment decisions. Over the longer-term, investment in non-residential structures is likely to lag, weighing on the overall level of spending. However, a low starting point means that this category will see a bigger bounce-back (in percentage terms).

Commodity prices remain elevated even with the recent pullback. As such, we may see a bounce back in related structures and machinery spending starting in the third quarter, in tandem with rising profits for energy producers. This recovery should continue as firms increase spending to maintain existing production levels. We have, however, noted before that the rally in commodity prices in recent quarters is more likely cyclical rather than structural. The latter is a necessary pre-condition for any large-scale investments in the sector. At the same time, elevated uncertainty around climate policies may impede any large-scale investments in the sector, not just in Canada, but globally.

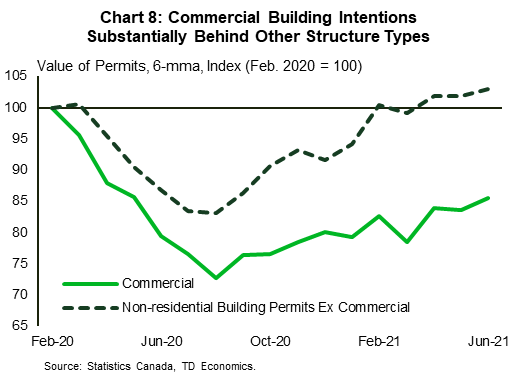

Meanwhile, commercial real estate remains a wild card. Understanding the impact of the pandemic on work-from-home trends, international tourism, and the future of brick and mortar retail will take some time. Recent permits data has shown a pickup in non-residential construction permits (Chart 8), but the strength is largely driven by government investments, with commercial permits still at subdued levels.

The outlook for M&E and IPP is more encouraging and reports of labour shortages beginning to re-emerge in some industries suggests that more investment could take place to offset these pressures. But even then, there are some factors that may put a lid on the pace of the recovery. Materials shortages owing to supply chain issues are one example. The most pressing of these, the global semiconductor chip shortage, is expected to ease starting this quarter. However, recent reports from auto manufacturers point to continued uncertainty into 2022. At the same time, the overall global backdrop will remain clouded by uncertainty as vaccination rates in other countries lag those in Canada and the U.S. In addition, any disruptions to production or border closures may create spillover effects on supply, demand, and financial conditions. Some businesses may also remain hesitant given the uncertainty around government responses and consumer engagement during the pandemic, though experiences in the U.K. and the U.S. suggests that the likelihood of significant renewed closures and/or a strong pullback in consumer engagement is minimal. Sectoral divergences in financial health will also likely remain, despite the overall brightening macro backdrop. This may become more apparent in some hospitality/arts/entertainment industries as government supports wane.

Bottom Line

Business investment has trailed the overall economic recovery. The good news is that with Canada ahead in its vaccination progress, recent indicators suggest some potential upside to our forecast.

Despite this rosier backdrop, we remain cognizant of the downside risks. A still uncertain global backdrop for the virus may disincentivize large-scale investments in the near term. Medium-term spending could be constrained by lingering uncertainties, particularly for non-residential structures.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: