2025 Quebec Budget

Large Deficit on Tap for This Year

Rishi Sondhi, Economist | 416-983-8806

Date Published: March 26, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

- Quebec’s deficit is forecast to increase from 1.3% of GDP in FY 2024/25 to 1.8% this year. This is the second largest anticipated shortfall of any province that’s reported budgets this year and comes despite a steep slowdown in anticipated spending growth.

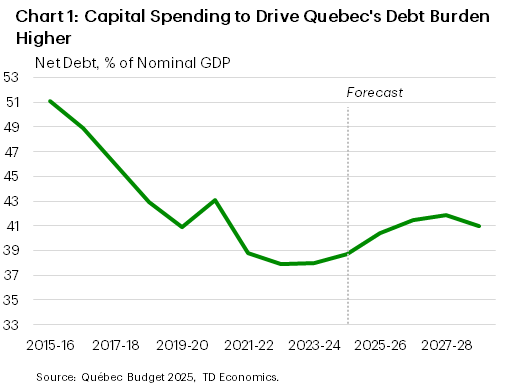

- Net debt-to-GDP is expected to climb over the next several years, reflecting ramped up infrastructure investments meant to cushion the economy at a time of turbulence. The government will also be rolling out tax relief and financial supports for businesses.

- A weaker-than-assumed economic backdrop raises the chance that the government won’t be able to balance the budget by FY 2029/30 – currently a requirement under the Balanced Budget Act.

A better-than-anticipated economic performance helped Quebec post a slightly smaller FY 2024/25 shortfall than the one envisioned in last November’s fiscal update. The FY 2024/25 deficit (before deposits into the Generations Fund) is now seen at $8.1 billion – a $700 million improvement compared to the fall update. However, this measure of the deficit is anticipated to swell to $11.4 billion in FY 2025/26. That would represent a meaty 1.8% of GDP - well above the long-term average for Quebec and higher than nearly all provinces that have reported so far (B.C.’s is the exception). The Province is still pledging a small surplus (again, before deposits into the Generations Fund) by FY 2029/30. Net debt-to-GDP, meanwhile, is seen as climbing about 2 ppts over the medium term.

Exceedingly weak revenue growth is seen as contributing to the larger deficit this year. On the opposite end of the ledger, spending growth is also expected to be modest this year, weighed down by slower spending growth in big-ticket categories. The budget will also allocate significant funds to its 10-year infrastructure plan.

Baseline Economic Forecast Incorporates Trade War

The government’s economic forecast assumes that the U.S. would impose tariffs on several trading partners, including Canada. These tariffs would last two years and be equivalent to a 10% tariff rate. This assumes higher tariffs are in place for a longer period than in our own baseline forecast (see latest Quarterly Economic Forecast), but the government still sees real GDP rising a respectable 1.1% in 2025 and 1.4% in 2026. In the government’s view, tariffs are expected to shave 0.7 ppts off growth in both years. Notably, the government’s projection is meaningfully above our own forecasts, which anticipate real GDP increasing by an average of 0.85% over the two years. That said, because we are more bullish on price growth, our nominal GDP forecast is in line with the government’s projection, on average, in 2025 and 2026.

In an alternative scenario where 25% tariffs (and 10% on energy) were imposed on trading partners by the U.S., the Quebec government estimates that the budgetary balance would deteriorate by $9.4 billion over 6 years, after deposits into the Generations Fund. Meanwhile, net debt-to-GDP would be 2 ppts higher relative to the baseline at the end of FY 2029/30.

Québec Economic Assumptions

[ % change unless otherwise noted ]

2025 Budget

| Calendar Year | 2024 | 2025 | 2026 |

| Real GDP | 1.4 | 1.1 | 1.4 |

| Nominal GDP | 5.3 | 3.4 | 3.4 |

| Unemployment Rate (%) | 5.3 | 5.8 | 5.4 |

| Population (000s) | 9,056 | 9,101 | 9,103 |

| Housing Starts (000s) | 48.7 | 50.5 | 49.3 |

| 3-Month T-Bills (%) | 4.3 | 2.6 | 2.5 |

| 10-Year Bonds (%) | 3.4 | 3.0 | 3.0 |

Revenue Growth to Ease Markedly This Year

Revenue growth is projected to ease to 1.0% in FY 2025/26 from a near 9% gain the year prior. This is despite the government’s efforts to improve the tax system by, for example, eliminating inefficient tax expenditures and refocusing the tax credit relating to resources on critical and strategic minerals. These efforts are estimated to lift revenues by $3 billion over 5 years. In terms of the largest drags on topline revenues, the corporate income tax intake is expected to fall this year, as the trade war weighs on corporate profits. Miscellaneous revenues (tuition fees, interest revenues, the sale of goods and services, and fines, forfeitures, and recoveries) are also expected to drop this year, partially unwinding a huge gain in FY 2024/25. Federal transfers, meanwhile, are seen as flat. In contrast, personal income and consumption tax revenues are seen as advancing at a resilient 3% pace this year, reflecting rising household spending and wages.

On the expenditure side, program spending is seen as advancing at a below-average 1.8% rate in FY 2025/26, restrained by slower health and education spending, and declining expenditures in the Ministry of Transport and Sustainable Mobility. The latter reflects a partial pullback after a hefty gain the year prior.

To support the province through this turbulent economic period, the government will provide financial assistance in the form of loans to affected businesses, representing liquidity of $1.6 billion. The government will also extend accelerated depreciation measures that were set to be phased out. They will now extend to 2029 for items such as manufacturing and processing machinery and equipment, clean energy generation equipment, and zero emission vehicles. This is estimated to provide $2.4 billion in tax relief for businesses over 5 years. This is part of a broader plan to “support and revitalize Quebec’s economy” through providing transitional support to businesses affected by the tariffs, fostering market diversification, supporting businesses investment projects, and making it easier to identify Quebec products. The government will also offer a new fully refundable tax credit for research, innovation, and commercialization (CRIC) which will replace eight tax measures currently in effect. The Province also builds in a $2 billion contingency reserve in FY 2025/26 to address downside risks.

Quebec’s Debt Burden to Grow

Net debt-to-GDP is expected to rise from 38.7% on FY 2024/25 to 41.0% FY 2028/29 before easing up a touch by FY 2029/30. This is well above the 25% (simple) average of provinces that have released budgets thus far. Ongoing deficits will contribute to the rising debt burden, as well as a stepped-up commitment towards infrastructure investment. Indeed, the government has announced an $11 billion increase in infrastructure investment from FY 2025/26 – FY 2027/28 to help cushion the economy in the near-term. This falls in line with February’s capital intentions survey which pointed to a 3.2% gain in public sector capital investment this year after massive gains from 2022-2024. Fortunately, the so-called “interest bite” on this debt is expected to be manageable. Interest costs are expected to total about 6% of revenues in FY 2025/26 – not meaningfully different from the year prior and well below the long-run average of about 12%.

Borrowing requirements are expected to total $29.7 billion in FY 2025/26, down from $36.7 billion in FY 2024/25, as $9.3 billion in pre-financing has already been carried out.

Bottom Line

The provincial government’s Balanced Budget Act requires the government to return to a balanced budget by FY 2029/30. However, a more severe tariff backdrop could stand in the way of this goal, according to the government’s own modelling. Notably, the starting point on the path towards balance is tough, with the government forecasting a massive deficit in FY 2025/26, This comes even with a commitment to significantly slow program spending growth this fiscal year and significant uncertainty about the outlook.

These softer program spending gains will likely act as some restraint on the pace of economic growth this year, given Quebec’s outsized public sector. That said, ramped up infrastructure investment could offer some offset in this tough economic backdrop (depending on how quickly projects are able to be initiated). And, the government will be rolling out several supports to businesses to help ease the blow.

Québec Government Fiscal Position

[ Millions of C$ Unless Otherwise Noted ]

| Fiscal Year | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 | |

| Revenues | 155,181 | 156,342 | 165,187 | 171,205 | 176,249 | 181,289 | |

| % Change | 6.6 | 0.7 | 5.7 | 3.6 | 2.9 | 2.9 | |

| Own-Source | 124,545 | 125,732 | 132,825 | 138,134 | 143,139 | 148,186 | |

| Federal Transfers | 30,636 | 30,610 | 32,362 | 33,071 | 33,110 | 33,103 | |

| Expenditures | 163,259 | 165,772 | 170,313 | 173,878 | 176,099 | 179,392 | |

| % Change | 7.7 | 1.5 | 2.7 | 2.1 | 1.3 | 1.9 | |

| Program Expenditures | 153,406 | 156,102 | 159,911 | 162,322 | 164,092 | 167,150 | |

| Debt Charges | 9,853 | 9,670 | 10,402 | 11,556 | 12,007 | 12,242 | |

| Total Consolidated Entities | -8,078.0 | -9,430.0 | -5,126.0 | -2,673.0 | 150.0 | 1,897.0 | |

| Contingeny Reserves | 0 | 2,000 | 2,000 | 1,500 | 1,500 | 1,500 | |

| Surplus (+) / Deficit (-) | -8,078 | -11,430 | -7,126 | -4,173 | -1,350 | 397 | |

| % of GDP | -1.3 | -1.8 | -1.1 | -0.6 | -0.2 | 0.1 | |

| Generations Funds Deposits | 2,354 | 2,177 | 2,402 | 2,522 | 2,648 | 2,796 | |

| Gap to be Bridged | 0 | 0 | 0 | 1,000 | 2,500 | 2,500 | |

| Budget Balance* | -10,432 | -13,607 | -9,528 | -5,695 | -1,498 | 101 | |

| % of GDP | -1.7 | -2.2 | -1.5 | -0.8 | -0.2 | 0.0 | |

| Net Debt | 235,826 | 255,003 | 270,435 | 282,588 | 286,431 | 288,149 | |

| % of GDP | 38.7 | 40.4 | 41.5 | 41.9 | 41.0 | 39.8 | |

| Gross Debt | 258,369 | 279,634 | 298,326 | 313,341 | 320,409 | 325,339 | |

| % of GDP | 42.4 | 44.4 | 45.8 | 46.5 | 45.9 | 45.0 | |

| Accumulated Deficits | 126,087 | 137,221 | 144,051 | 146,928 | 145,482 | 142,289 | |

| % of GDP | 20.7 | 21.8 | 22.1 | 21.8 | 20.8 | 19.7 | |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: