Highlights

- A provincial divide has opened in Canada’s job market. While job vacancies remain elevated in the Prairies and Atlantic Canada, labour markets in Quebec, Ontario, and British Columbia have relatively normalized.

- Although shifts in immigration and interprovincial migration can explain why labour markets have loosened across the country, still high commodity prices have boosted economic growth in the Prairies, causing its job market to remain tight.

- Given our favourable outlook for oil and other commodities in 2024, regional outperformance in the Prairies should continue, keeping their labour markets tighter than the rest of Canada.

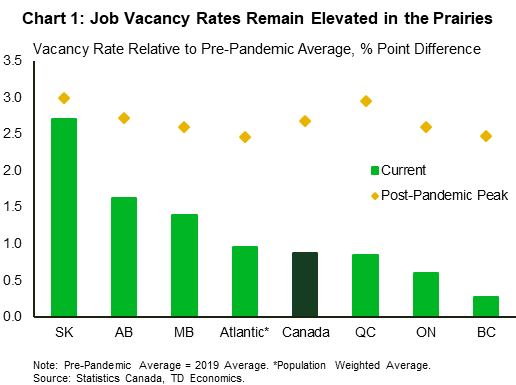

Canada’s labour market has experienced a growing provincial divide. While the job market has cooled from its peak at the national level, the degree of progress made in re-establishing labour market equilibrium varies across the provinces. Job markets remain the tightest in the Prairie region, with job vacancy rates in Saskatchewan, Alberta, and Manitoba currently well above their pre-pandemic norms (Chart 1). Tight labour markets are also found in Atlantic Canada, while the demand for labour in Quebec, Ontario, and British Columbia has relatively normalized. In this piece, we will investigate some of the drivers behind this regional disparity.

It’s Labour Supply

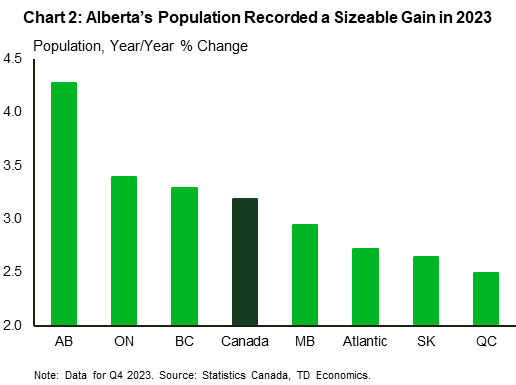

Strong labour force growth has been a key factor allowing all provinces to make significant headway in re-balancing their job markets. More available workers within a province offer firms a larger pool of candidates to draw from when seeking to fill their vacant positions. Over the last year, Canada’s population has grown by approximately 1.25 million, with the majority of new Canadians residing in Alberta, Ontario, and British Columbia (Chart 2). At the same time, there has been significant interprovincial migration into Alberta and Atlantic Canada, with outflows coming from Ontario, Manitoba, and British Columbia.

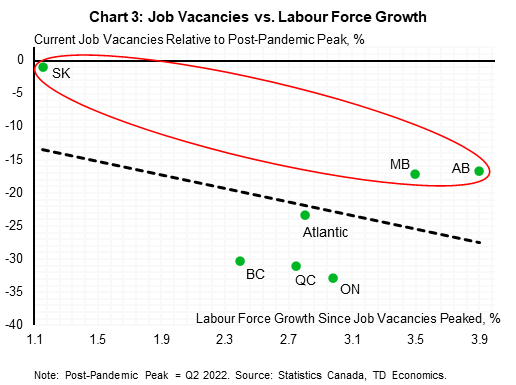

In Chart 3, we show how the provincial drop in job vacancies from their 2022 peak is tied to labour force growth. While increases in the number of workers can explain the falling level of job vacancies in Ontario, Quebec, British Columbia, and Atlantic Canada, three provinces have been outliers. Saskatchewan, Manitoba, and Alberta have not seen job vacancies decline as much as would be explained by increases in labour supply. This implies that demand-side factors may also be contributing to the persistence of elevated job vacancies in the Prairie region.

And It’s Labour Demand

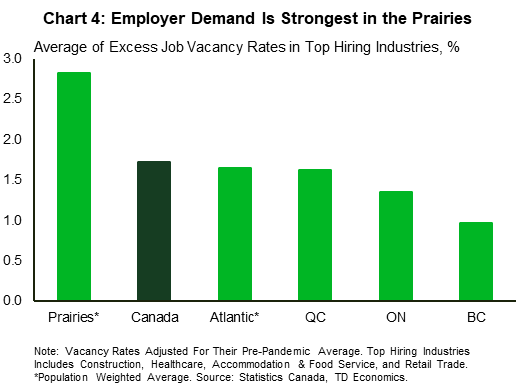

What’s special about the Prairies when it comes to still robust labour demand? To answer this, we first look at industries with the highest number of job openings. We find that Construction, Healthcare, Accommodation & Food Service, and Retail Trade are the sectors that have the highest job vacancies in the Prairies (Chart 4). Interestingly, these are also the top hiring sectors in every province across the country. So, it is not just that firms in the Prairies are seeking a different labour force skillset compared to other provinces, but the magnitude of employer demand is simply greater.

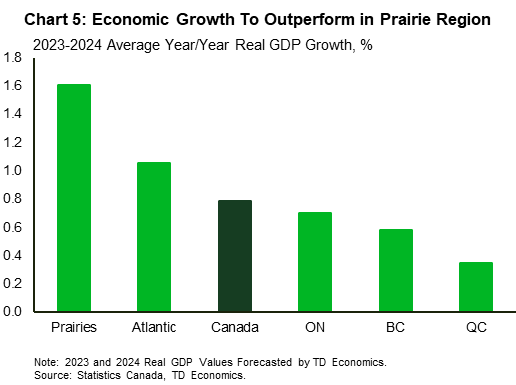

We believe that strong employer demand in the Prairies is tied to the region’s economic growth outperformance. Real GDP growth in the Prairie provinces clocked in at 5% for 2022 and it is currently tracking at close to 2% for 2023. This compares to just over 3% and less than 1% for the rest of Canada over the same period. Although the Prairie region will not be immune to an economic slowdown, we expect another year of economic outperformance relative to the nation in 2024 (Chart 5).

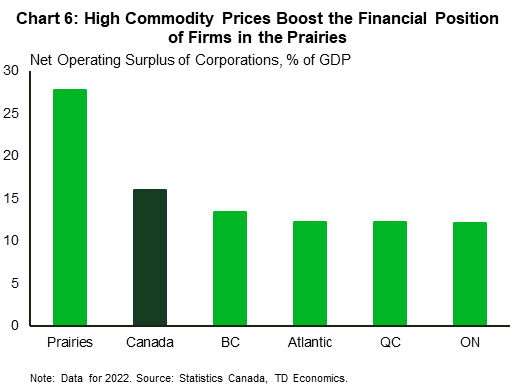

The Prairie region’s outperformance is driven by the relative size of its commodity-producing industries. In recent years, prices for commodities central to economic activity in the Prairies have increased notably due to various market-distorting events: the surge in wheat/oil prices following Russia’s invasion of Ukraine, OPEC+’s efforts to limit global oil supply, and conflict in the Middle East. While commodity prices have come off their peaks, they remain elevated. Given that energy and agriculture sectors have an outsized impact on Prairie region output, economic growth in the Prairies stands to gain the most from still robust commodity prices (link). The boost to economic activity from elevated commodity prices is reflected in the balance sheets of Prairie region corporations. The net operating surplus of firms, often used as a proxy for profits, accounts for the largest share of provincial GDP in the region (Chart 6). This robust financial position allows firms in the Prairies to better withstand economic headwinds (high inflation/interest rates) and likely contributes to the sustained high demand for labour in the region.

Bottom Line

There is a notable divide in the tightness of labour markets across provinces. While Ontario, British Columbia, and Quebec have made greater progress in re-balancing their labour markets, job vacancies remain relatively elevated in the Prairies. In these provinces, growing labour supply has not been enough to offset strong labour demand. Exposure to still high commodity prices has boosted economic growth and improved the financial position of firms in the Prairies. This has firms continuing to seek more workers, keeping their labour markets more resilient.

How long this will last is uncertain. While we are forecasting an economic slowdown next year, should commodity prices remain favourable on the back of a challenging supply environment, the Prairies would once again be the country’s economic outperformer. This would support firm profitability and keep labour markets in the Prairies much tighter than the rest of Canada.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: