Prairies Housing Outlook:

Outperformance on Tap for Prairie Provinces

Date Published: January 30, 2023

- Category:

- Canada

- Real Estate

- Provincial & Local Analysis

Highlights

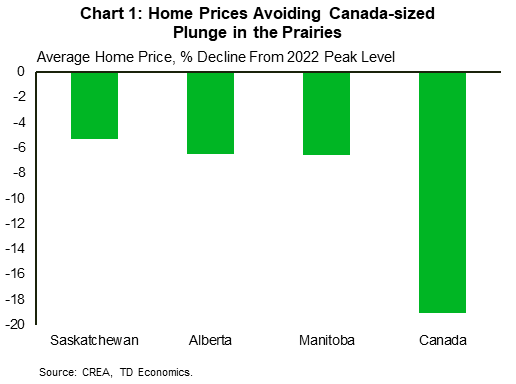

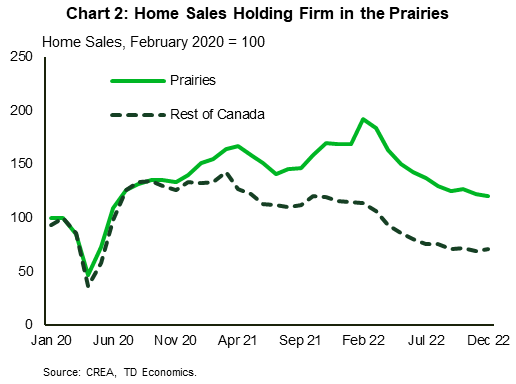

- While average home prices are down across Canada, the decline in the Prairies has been comparatively smaller. This is partly a function of resilient sales activity in the region.

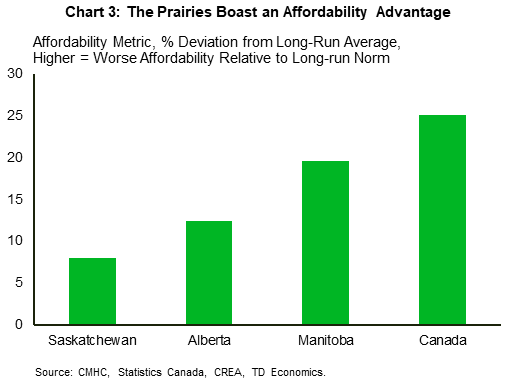

- Moving forward, the same factors that have been propping up activity in the Prairies should keep the region outperforming the nation overall. Among other elements, this list includes a comparatively favourable affordability backdrop.

- Across the Prairies, sales and prices should bottom in the first half of this year, before staging a modest recovery thereafter.

A notable feature of the current Canadian housing landscape is the relative outperformance of Prairie markets. Indeed, while the country overall has seen a near-20% drop in monthly average home prices from their 2022 peak, prices in the Prairies are only down by an average of 6% (Chart 1).

A key factor behind this price outperformance is resilience in home sales. In Manitoba and Saskatchewan, home sales are down about 20% from their 2022 peaks, compared to a near-40% drop observed Canada-wide. Even in Alberta, where sales are also down about 40%, they're still well above pre-pandemic levels (Chart 2).

Moving forward, the same factors that have been helping to prop up markets in the Prairies over the past year are likely to remain in place.

Affordability is remains decent by historical standards in the Prairies, especially compared to other markets in the country (Chart 3). This a function of a smaller runup in prices in the region during the pandemic and years of weak price growth preceding it. Its affordability advantage has allowed the region to absorb the impact of higher rates better than other regions in Canada and should make it comparatively easy for potential buyers to jump into the market as the Bank of Canada likely halts its rate hike campaign and bond yields (which underpin fixed mortgage rates) grind lower.

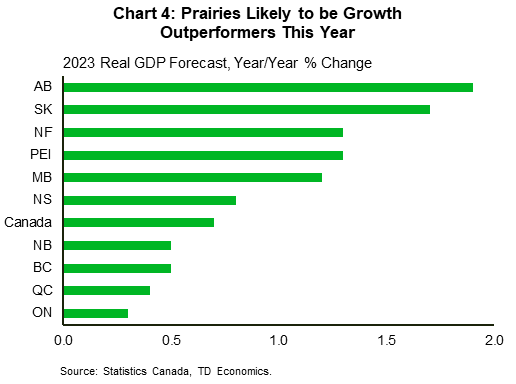

Economic resilience is yet another factor that should help the Prairies outperform. Indeed, we are forecasting the Prairie economies to post relatively strong growth rates in 2023 and 2024 (Chart 4), with smaller increases in unemployment rates. Support to growth should come from still-elevated commodity prices and increased agricultural production. This year, households in Alberta will also see an important offset to the headwinds of higher interest rates, slowing job growth, and inflation from the provincial government's inflation relief package.

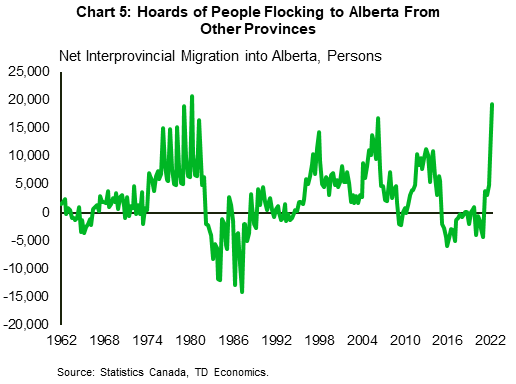

Population growth is improving across the region (Chart 5), supported by massive immigration and a record inflow of non-permanent residents. Alberta, in particular, has seen a surge of interprovincial migrants. Although there is an absence of data on this front, these types of migrants are probably more likely to purchase homes sooner than either immigrants or non-permanent residents. And, given a likely economic outperformance over the next few years and its affordability advantage over other large jurisdictions like Ontario and B.C., housing demand in Alberta should receive further support from this source.

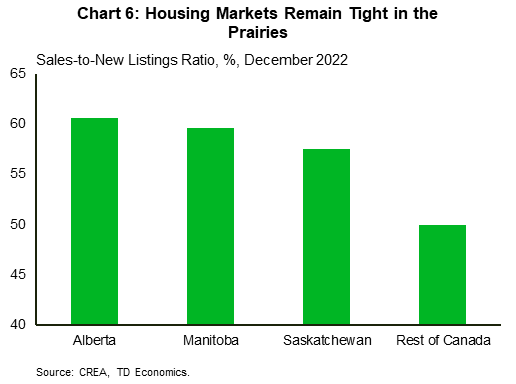

Markets are also relatively tight across the Prairies (Chart 6), given comparatively elevated sales levels and falling new supply. Of the three Prairie provinces, listings have fallen the most in Alberta in recent months, mirroring the trend in sales. In fact, listings have declined by more in Alberta than the country overall since its market began to soften, while new resale supply trends have held up moderately better than nationally in Saskatchewan and Manitoba.

Sales-to-new listings ratios in all three Prairie provinces remain around 60% - close to what is considered seller's territory. This level of tightness is consistent with rising prices and indeed, we saw price growth turn positive on a trend basis in December across the region.

In the new home market, starts in the Prairies have run about 30% above their pre-pandemic levels, on average, over the past few years which is in line with Canada. A chunk of homes started in 2022 will be completed this year, but so far, oversupply in new home market has not been an issue. Unabsorbed inventory levels remain below long-term averages in the region, despite a recent uptick.

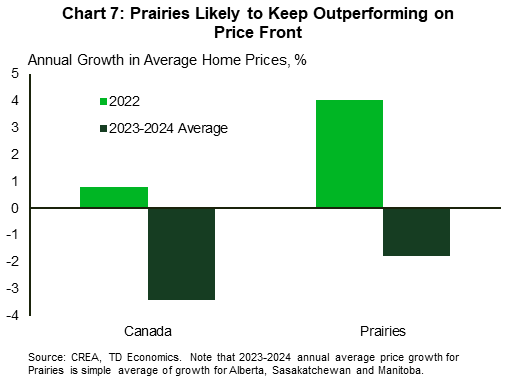

Overall, sales and prices in the Prairies should bottom in the first half of the year before staging a modest recovery thereafter. We also see sales holding well above pre-pandemic levels through 2024, marking a steep contrast compared to the nation overall. This relatively resilient demand backdrop should also lead price growth in the Prairies to outperform the rest of Canada moving forward (Chart 7, also, our latest forecast).

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: