Why I’m willing to eat crow on the Bank of Canada call

Beata Caranci, SVP & Chief Economist | 416-982-8067

Date Published: October 21, 2024

- Category:

- Canada

- Financial Markets

I find myself in an unusual position of advocating for a 25-basis point reduction in the Bank of Canada policy rate come Wednesday, when all bank peers have moved into the 50-basis point camp. When the Bloomberg poll was conducted in early September, not a single hand was up for 50 basis points.

The big shift in sentiment occurred when Canada’s September CPI inflation report came in at 1.6% (y/y) two weeks ago, breaching the Bank of Canada’s 2% threshold. Consensus was expecting inflation to hit 1.8%, with the “miss” due to a deeper drop in gasoline prices. Energy prices collapsed as OPEC+ announced production increases that would move global supply into modest surplus position by early 2025. However, this doesn’t hit the mark for a central bank to hasten rate cuts after setting a quarter-point pace at the previous three meetings. Meanwhile, the Bank’s preferred core measures were unchanged in September, both just north of 2%.

So what gives? The inflation report was a “see, I told you so” moment for analysts, who have argued the economy is treading water, slack is building and a policy rate north of 4% is too restrictive relative to the neutral rate. The Bank places that estimate within a 2.25-3.25% range. We agree with all these arguments. But none of this is new news.

Here are problems that can emerge in the public mindset with a one-time, mid-cycle 50 basis point cut.

-

Signal– Since the early 2000s, when the Bank became disciplined in having eight scheduled policy meetings per year, it has never accelerated a rate-cut within a monetary cycle in the absence of the whites of the eyes of a recession. For instance, the last time was in 2001 as the U.S. tilted into a recession and concerns flourished that Canada would follow. This is neither the Bank’s current position on either economy, nor that of a single analyst calling for a 50 basis point cut.

- Economic evolution – The job market strengthened since the last two policy meetings that delivered 25-basis point cuts. Nearly 100,000 private sector jobs were created in September and August, compared to modest losses in the prior two months.

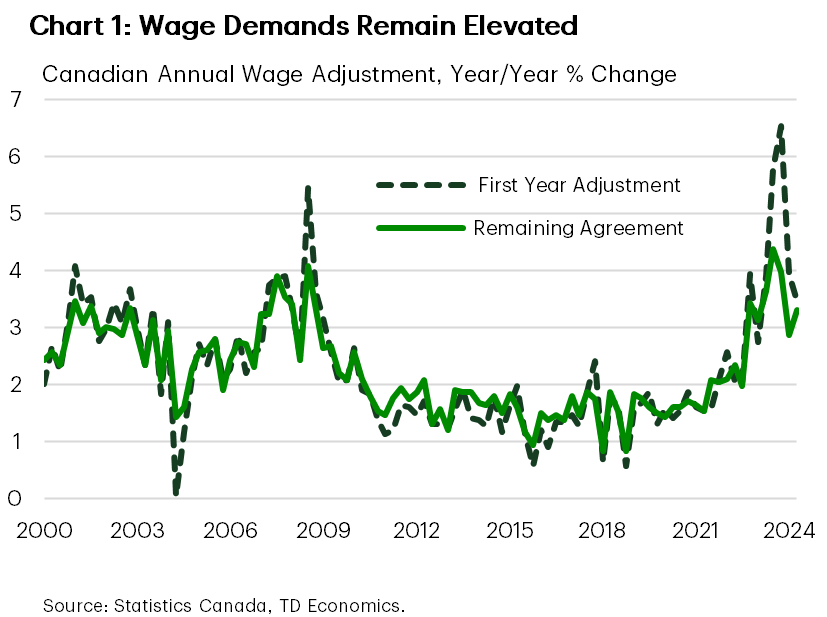

- Add to this wage growth above 4% that returns sizable purchasing power to individuals — an argument the European Central Bank made when it cut by 25 basis points last week amidst a much weaker economy. Canadian wage negotiations have been eye-popping and unrelenting, making us question whether inflation expectations are fully anchored on Main Street. In the second quarter, wage contracts were averaging 3.5% growth in the first year and 3.3% over the remaining two to three years. Both are well above historical norms and the 2% inflation target (Chart 1). And the latest contract data for June and July showed even higher figures for both timeframes.

- Finally, unlike their American counterparts, Canadians have a lot of dry powder to spend as interest rates fall. The savings rate is high, as are deposits. So far, Canadians are not showing financial stress in making mortgage payments, despite some regional variation.

- The bottom line: there’s no fire to douse by accelerating rate cuts.

- Financial Risks – Let’s remember the high indebtedness of Canadian households and the potential for the Bank of Canada to repeat the mistakes of the past. The central bank must avoid igniting the embers smoldering under household financial stability.

- One of the biggest criticisms of the central bank was its role in fueling debt exuberance by leaving interest rates too low for too long during the late stages of the pandemic and in the proceeding years. A repeat of interest rates moving to the zero bound is highly unlikely, but the Bank must guard against creating a market and household psychology that every hiccup to economic growth expectations necessitates a strong monetary policy response.

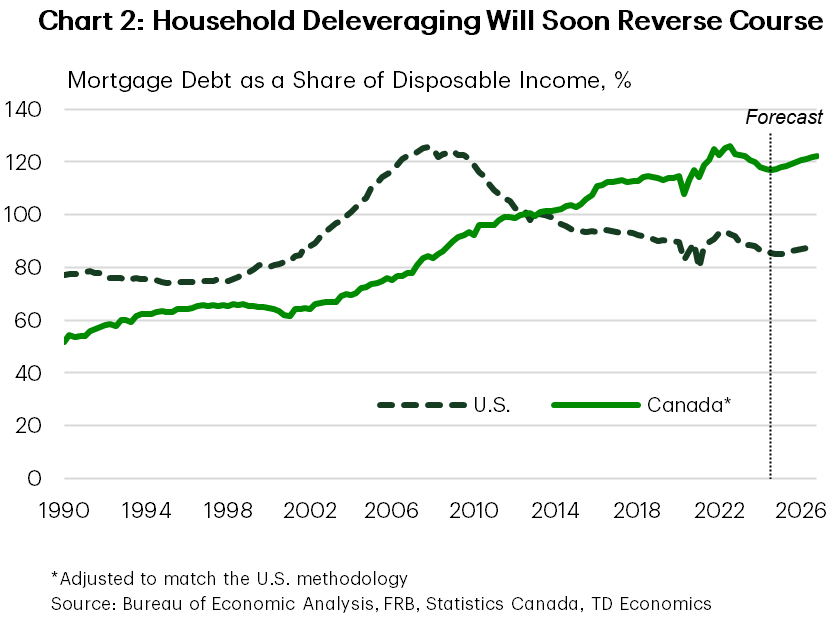

- We need to get comfortable with the uncomfortable. A Canadian economy trending in a 1-2% range is not abnormal for the degree of leverage. It is a necessary dynamic to allow debt demand to subside and/or allow income growth to outpace. We are in the early stages of a deleveraging cycle (Chart 2). With the help of strong after-tax income growth and slower debt demand, the debt-to-income ratio is finally tilting down but remains higher than pre-pandemic. As interest rates continue to fall, some of this progress will automatically unwind, so accelerating rate cuts in the absence of economic urgency will likely cause an earlier and faster redirection.

- All risks are two sided, and the other side is that mortgage holders who transacted in 2020 will be resetting contracts at higher rates in 2025. But once again, this isn’t new news. The risk is well monitored and understood by the central bank when it commenced the quarter-point rate cut path several months ago. In fact, the finances of mortgage holders have fared better than expected.

- Housing – Canada’s favorite sport is back. Sales rose in both August and September, with buyers in the very early stages of reacting to lower mortgage rates — which are likely to head lower. In addition, since the BoC’s September policy meeting, the Federal government has added fuel to housing demand. In mid-December, two changes to mortgage rules will facilitate qualification among homebuyers who struggle to meet the minimum downpayment threshold to avoid insurance (see report). These measures run counter to the Bank of Canada’s intention.

- First, it acts as additional implicit easing to mortgage rates exactly when the central bank is already cutting interest rates. The policy changes will further encourage home buying and add more lift to prices next year. Second, the measures encourage those households more prone to bouts of financial stress to take on more debt.

- In fact, these policy changes offer an argument to cut interest rates by less than had they not been enacted, rather than speed up the pace.

Given that market consensus shifted in the absence of any new communication from the central bank, we will find out soon enough how the BoC is framing Canada’s economic juggernaut. The first order will be to downgrade the forecast from July. In that Monetary Policy Report, the BoC penciled in Q3 growth of 2.8% and CPI inflation of 2.3% y/y. Those numbers will be closer to 1.5% and 2.0% inflation. Certainly, in this context, communication of a larger 50 basis point cut would be made easier.

However, many analysts had scratched their head on the BoC’s growth estimate of 2.8%, which was noticeably higher than any ‘street estimate’ at the time. It has fueled chatter that the forecast miss allows the BoC to move more quickly on rates. It’s important to keep in mind that at the time of the forecast, the observed monthly data on exports showed considerable strength, as capacity was ramping up in the Trans Mountain system. In addition, as more data points become known, analysts have the benefit of adjusting their forecasts publicly with much greater frequency than the BoC. Lastly, economic growth in the second quarter was reported at 2.1%, beating consensus and the BoC’s forecast of 1.5%, while the prior quarter also received a slight positive revision. So it’s less of a clear-cut case that a one-quarter forecast miss on the downside justifies an accelerated rate cut cycle.

That leaves one last argument. Interest rates are simply too high and a swifter drop would encourage much-needed business investment, a worthy trade off to potentially fueling household financial risks. The Bank’s own, Business Outlook Survey, showed that demand remains weak despite improving expectations on future sales. Business investment remains in the doldrums as companies continue to prioritize maintenance and repairs, rather than expansion and efficiency improvement. To economists, this offers little optimism around an improvement in productivity and competitiveness. However, what ails Canada, the BoC can’t fix. It goes far beyond the level of interest rates. Productivity woes predate the rise in interest rates, and are rooted in domestic policies of tax structures, regulation complexity, scale, business culture and domestic competitiveness, rather than monetary policy. Case in point, the United States is the poster child of strong productivity, and that economy has much higher interest rates.

So let me end by saying…is this Bank of Canada call the hill I want to die on? No. But a one-time 50 basis point move planted in the middle of a monetary cycle warrants very clear communication on how the central bank is framing that decision against the factors noted above, particularly future household financial risks and interest rate expectations. Come Wednesday, I might be eating crow on this rate call, but I’ll take to heart what a wise man once said: It’s best to be eaten while it’s still fresh.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: