Ontario's Outlook by Industry: Growth Set to Rev Higher Next Year

Rishi Sondhi, Economist | 416-983-8806

Kaleab Kebede, Research Analyst

Date Published: October 20, 2021

- Category:

- Canada

- Provincial & Local Analysis

Highlights

- Ontario's economy will likely underperform the rest of Canada's in 2021, partly as a reflection of a very weak second quarter. A 2.9% annualized contraction was recorded in Q2, as the economy was hit with a tough 3rd wave, severe semi-conductor shortages, and softer housing activity due to a normalizing market.

- We expect better fortunes in the second half of this year, although here too our forecasts have been scaled back compared to June, reflecting persistent headwinds such as input shortages.

- A further acceleration in the recovery is expected in 2022, as Ontario's economy likely bucks the trend to slower growth seen elsewhere in Canada. Supply chain disruptions and labour shortages, especially in high-contact industries, should ease to some degree. Still, uncertainty how these imbalances will evolve going forward remains a formidable risk to the outlook.

The fact that Ontario's economy contracted by less than the rest of the country in 2020 was a mild surprise given the relative severity of the pandemic in the province. Yet, the tables have turned this year. Full-year economic growth in Ontario is forecast to be below that of Canada in 2021, partly reflecting a greater exposure of its key manufacturing sector to global supply-chain disruptions and more prolonged lockdowns during the second and third waves. As the impact of these disruptions likely eases next year, Ontario's growth should accelerate, bucking the slowdowns expected elsewhere in Canada.

This note details how major industries in Ontario have performed so far this year, what we see as likely to take place in the remainder of 2021, and our expectations for these sectors in 2022.

Second Quarter Weakness to Give Way to Second Half Strength

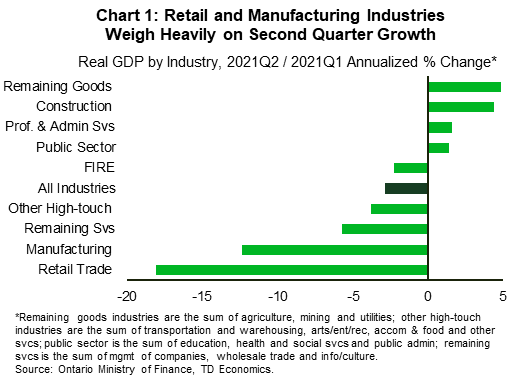

Last Friday's release of Ontario Economic Accounts for 2021Q2 confirmed that after a good start to the year, Ontario's economy suffered a significant setback (Chart 1). Real GDP in the province contracted at a 2.9% annualized rate (when measured by industry) in the second quarter, walloped with the one-two punch of a nasty 3rd wave and semi-conductor shortages. And, it appears Ontario accounted for a good chunk of the weakness observed at the national level, as stripping away Ontario's performance leaves the rest of Canada with positive growth during the quarter.

Lockdowns resulting from the pandemic undercut recoveries in high-touch service industries, including retail trade, which plunged nearly 20% annualized. Meanwhile, a lack of semi-conductors severely hindered auto production, dragging down overall manufacturing output. However, it's been a struggle for much of the sector, with only 3 of 11 major industries (machinery, electrical and electronic products, and "other" manufacturing) above pre-pandemic levels as of Q2. Elsewhere, a housing market normalizing from absurdly high levels led to falling output in the finance, insurance, and real estate (FIRE) industry. Scanning other industries, decent performances from the professional and administrative (PA), construction and public sectors prevented a worse outcome.

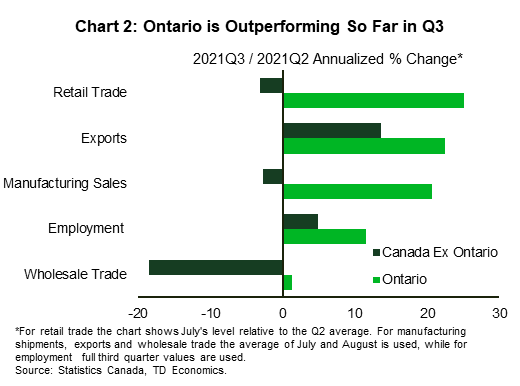

On a brighter note, data on hand for the third quarter suggests that Ontario's economy managed to record a stronger rebound than the rest of Canada (Chart 2). Perhaps most notably, employment increased at a comparatively strong pace in Ontario. But, while we assume this momentum to build further in the final quarter of 2021 and into 2022, we did opt to scale back our near-term growth outlook in our latest September outlook relative to June to factor in more persistent headwinds.

The trend in new Delta variant cases has encouragingly taken a turn for the better in recent weeks, prompting the provincial government to ease capacity restraints in high-touch industries Our forecast assumes no return to widespread lockdowns, as the province's high vaccination rate alongside the use of alternative tools such as vaccine passports, keep cases manageable. Media reports note that the government is planning to further ease restrictions for restaurants, bars and gyms this week. This should provide a nice fillip this autumn to the accommodation/food and arts/entertainment/recreation industries, although is unlikely to dramatically boost the overall outlook, as businesses in these sectors comprise a relatively small portion of the overall economy, are already open to a degree, and require vaccine passports for entry.

Like other provinces, Ontario is still not out of the woods yet with respect to the Delta variant. There is some chance that cases turn higher in the fall and winter months as people spend more time indoors. Ontario has maintained the most stringent restrictions of any province for almost the entire pandemic, thus showing itself ready to react should the situation worsen. Although we cannot rule out further lockdowns if cases jump and the hospital system is put under pressure, the government has signaled that its first reaction would be to enact measures that are targeted and local.

Supply Chain Disruptions, Labour Shortages Present Material Risks to the Outlook

As Delta worries have eased, concerns have migrated to growing supply chain issues which are weighing on growth and contributing to upward inflationary pressure. In this regard, the poster child for Ontario has been the ongoing global semi-conductor shortage. Case in point is the recent announcement by a major automaker that it will cut one shift from its production schedule in April. That said, our forecast assumes that these supply chain pressures will have greatly diminished by the end of 2022. It's also worth noting that manufacturing output is recovering from its Q2 setback, even in the face of these challenges. Indeed, nominal sales are tracking a 20% annualized gain so far in Q3. Although this has been helped by a bounce in motor vehicle shipments from their depressed Q2 level, nearly all other industries have grown, with important contributions coming from plastics/rubber products and primary metals. We also note that inventories in the Canadian manufacturing sector have displayed some resilience, having increased for 3 straight months. This compares somewhat favourably to the U.S., where inventories continue to drop.

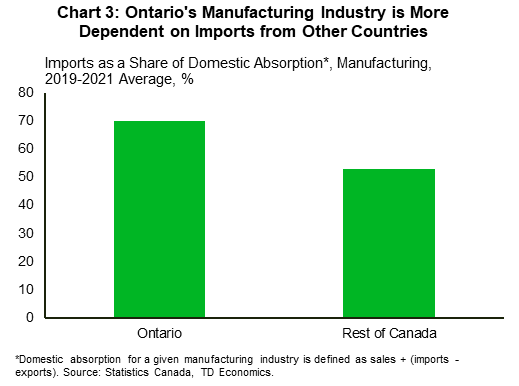

However, materials shortages could be more persistent, or supply a larger growth hit, than we are anticipating. Ontario's manufacturing sector is especially vulnerable, as it is more reliant on imports of goods from other countries in its production process compared to the rest of Canada. This is clear when we examine imports as a share of domestic absorption1 in the manufacturing sector (Chart 3). However, it's not just the manufacturing sector that is at risk, as supply chain pressures could slow growth across a range of industries (like technology services for example), by more than we are expecting. Media reports have also flagged the risk that supply-chain bottlenecks could disrupt retailers during the vitally important holiday shopping season.

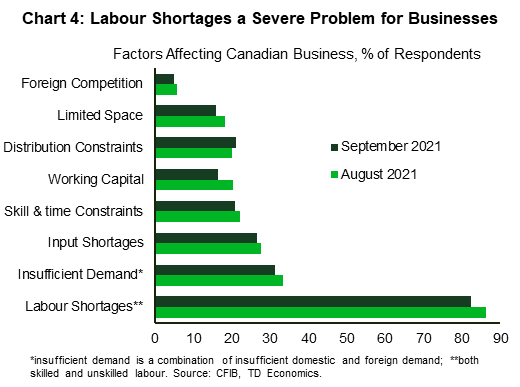

Businesses in Ontario could also struggle increasingly to find workers to meet demand (Chart 4). Although down significantly from its pandemic high, at 7.3%, Ontario's unemployment rate is still nearly 2 ppts above where it stood before the pandemic hit. On the surface, an elevated unemployment rate would imply a deep labour pool from which to draw. But under the hood, certain industries are facing outsized challenges in attracting workers, particularly those that have suffered disproportionately during the pandemic (see report). As a result, wages are likely to experience significant upward pressure in these sectors, leaving businesses with the potential dual challenge of reduced output and higher labour costs. Generous government benefits, virus fears, decisions by workers not to return to their pre-pandemic jobs and skill-erosion among the long-term unemployed may all be constraining factors. And, these pressures are likely to linger for some time. In fact, we expect it to be well into next year before these workers are fully integrated back into the workforce.

Healthy Growth in the Cards for 2022

Assuming the supply-side pressures abate to some extent, Ontario's economy is well-positioned to deliver strong growth next year, outpacing Canada by about 0.5 ppts. Within the goods sector, manufacturing output is poised to lead the way (Table 1), supported by a rebound in auto production. In addition to refreshing low dealer inventories, the shortages of new vehicles have likely only delayed purchases in both the U.S. and Canada. More broadly, a solid expansion in the U.S. should offer support for industries where sales have lagged, and international exports play an important role, such as plastics, furniture, and computers. Meanwhile, strong growth performances in Ontario and the rest of Canada will likely support sales of manufactured food products, an industry where interprovincial demand is important. On the weaker side of the spectrum, slower homebuilding activity should weigh on wood product manufacturing, while growth in nominal petrochemical sales could be impacted if oil prices flatten next year, as we expect.

Outsized growth contributions coming from "high-touch" industries are also likely next year under our assumption of no widespread lockdowns, thereby allowing these hard-hit sectors to recoup lost output. What may be notable here is that growth in retail output is likely to hold up better than the rest of the country. However, this is partly a function of what looks to be a healthy rebound in third quarter spending (which boosts 2022 growth when calculated in annual average terms), after real sales fell markedly in the second quarter. Note that Ontario has more ground to make up, as inflation-adjusted spending had only matched pre-pandemic levels as of July, compared to being well above in the rest of Canada. After the third quarter, quarterly retail output growth is likely to decelerate, as spending is increasingly allocated towards reopened services industries.

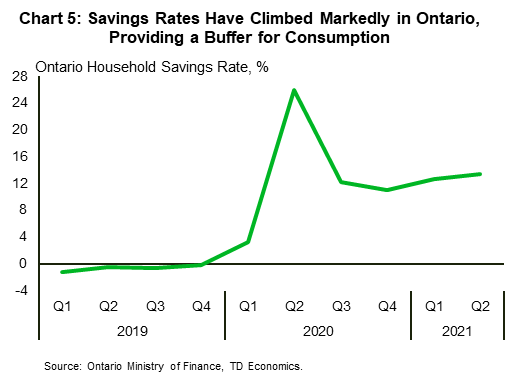

Overall household spending should be lifted next year by continued job and income growth as well as a rising population, while high vaccination rates support improved consumer confidence. Also, as of the second quarter, we estimate that households in Ontario had accumulated between $100 - $115 billion in excess savings during the pandemic (Chart 5), providing a considerable buffer for both present and future consumption. However, inflation has run faster than wage growth for several months, implying falling real wages, which has the potential to offset these tailwinds to a degree in the near-term.

Our forecast assumes a step-down in public sector spending growth next year, consistent with the latest provincial budget, which called for slower program spending gains outside of COVID-19 time-limited funding. However, the recently released public accounts for FY 2020/21 reveals a markedly better fiscal backdrop than policymakers were anticipating earlier in the year. The deficit in FY 2020/21 was $16.4 billion (or about 2% of GDP), some $22 billion less than what was expected. While the details of how this surprise will influence government spending and tax policies in the months ahead are not known, it's safe to assume that some additional funding be funneled into program spending, presenting some upside risk our forecasts in these sectors and, in turn, overall economic growth next year. In addition, we have yet to bake-in any additional federal spending that may flow after the September election. Earlier, we estimated that measures in the Liberal Party's platform could lift Canadian GDP growth by around 0.2 – 0.5 ppts next year (see report).

We also expect lesser, but still-decent growth contributions from the FIRE, PA and wholesale industries next year. Tamer housing market activity should moderate growth in the FIRE industry, which was only one of 3 major sectors to record any gains in 2020 (the others being construction and agriculture), while also boasting a robust performance this year. In the PA industry, growth will likely ease somewhat after a meaty outturn in 2021. However, it should remain healthy as economic growth underpins profits and companies continue their push towards digitalization and automation. Notably, in Statcan's third quarter Survey of Business Conditions, about 40% of respondents operating in Ontario's professional services sector anticipated no short-term growth obstacles, nearly double the rate of all industries, while also having a relatively rosy 12-month business outlook. Activity in the wholesale sector, meanwhile, should be bolstered next year by rapid U.S. economic growth and solid domestic household spending.

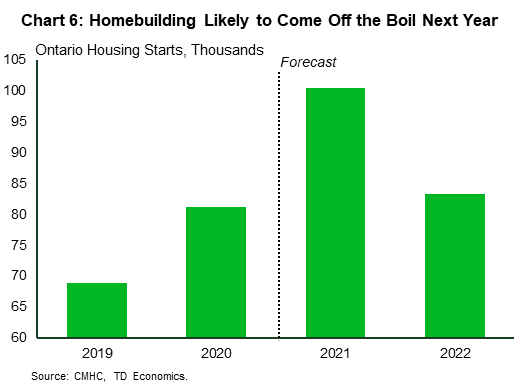

One area where we are less upbeat on is construction. After making one of the largest positive contributions to growth this year on the back of robust homebuilding activity, we envision a much lesser contribution coming from this sector in 2022. This is because housing construction is likely to ease (Chart 6) and uncertainty around return-to-office and the hospitality sector owing to the pandemic should moderate commercial real estate investment. These weights will likely offset what should be a healthy boost from government spending on infrastructure.

Bottom Line

The second quarter was likely the nadir for Ontario's growth, as the economy was walloped by semi-conductor shortages, the 3rd wave and a steep housing market correction. A better performance is likely in store for the second half of this year and 2022 as supply chain pressures ease and high vaccination rates and other measures keep the virus at bay. However, these same factors provide the biggest downside risks to our outlook, particularly as Ontario has shown that it's not afraid to impose restrictive measures to counter the virus and has a manufacturing industry that is highly dependent on imports from other countries.

| Industries | 2020 | 2021F | 2022F |

| All Industries | -5.0 | 4.6 | 4.9 |

| Construction | 0.3 | 12.0 | 2.5 |

| Manufacturing | -10.8 | 4.2 | 7.2 |

| Remaining Goods* | -0.3 | 4.5 | 1.8 |

| Retail Trade | -3.4 | 4.3 | 4.2 |

| Other High-touch** | -27.1 | -3.1 | 24.3 |

| FIRE | 3.0 | 2.8 | 2.2 |

| Prof., Sci. and Tech. | -5.4 | 6.0 | 4.5 |

| Public Sector | -4.8 | 6.9 | 4.2 |

| Remaining Services*** | -2.5 | 4.0 | 2.9 |

End Notes

- Domestic absorption is defined for a given NAICS manufacturing category as manufacturing sales + (imports – exports) .

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: