Federal Budget Takes Small Steps To Cool Frothy Housing Market

Rishi Sondhi, Economist | 416-983-8806

Date Published: May 5, 2021

- Category:

- Canada

- Real Estate

Highlights

- The 2021 federal budget cast a wide net in terms of new policy initiatives. However, relatively modest steps were taken to cool the nation's frothy housing markets, amid calls for significant action on this front.

- A new 1% tax on vacant, non-resident owned properties was the most attention-grabbing new measure. However, this policy is unlikely to significantly dent current activity, as non-resident demand has already been cooled to a significant degree by measures taken in B.C. and Ontario and the current sales pace is driven to a large-extent by domestic buyers.

- On the supply side, the government plans to invest heavily in the construction, repair and support of nearly 36,000 units, nearly all of which are geared to vulnerable populations.

The federal government's ambitious April 19th budget included a wage range of new policy initiatives. Beyond pandemic support measures, commitments to support low-wage workers, students, indigenous communities, seniors and small and medium sized businesses were pledged. On top of these commitments, massive investments in the green economy were pledged. However, the marquee measure was a new, national daycare program, projected to cost $30 billion to set up and $9 billion annually thereafter.

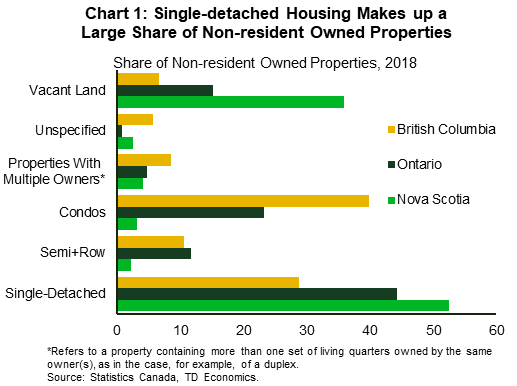

Despite calls from a number of analysts to take action to cool the nation's frothy housing market, the government stayed its hand on broad based taxes. Still, a few notable measures were included. Probably the most attention-grabbing was the announcement of a new 1% tax on the value of vacant units owned by non-residents. This tax would become effective January 1st, 2022 and is projected to increase revenues by $700 million over 4 years. While data covering non-resident housing ownership is generally sparse, we note that single detached units made up about half of non-resident homes owned across Ontario, B.C. and Nova Scotia combined in 2018, while condos accounted for about 1/3rd (Chart 1).

Non-resident Vacant Homes Tax Unlikely to Significantly Quell Demand

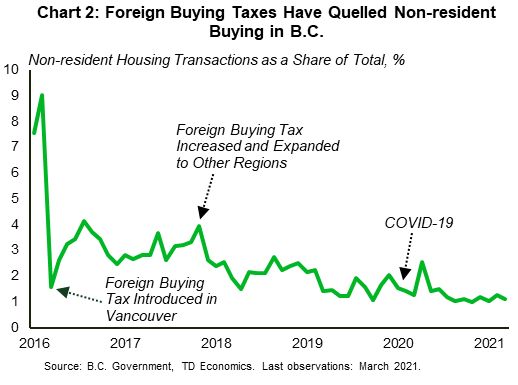

This measure could influence both housing demand and supply, although we think it will do little to curb current housing market froth which appears to be overwhelmingly domestic-driven. In addition, non-resident activity has already been cooled to a significant degree by foreign buying taxes already implemented in B.C. and Ontario. In B.C. for example, non-resident purchases accounted for only about 1% of total transactions in the first quarter. In fact, this share plummeted after the introduction of foreign buying taxes in Vancouver and has remained low amid a subsequent increase in the foreign buying tax rate, and its expansion into other markets (Chart 2).

As an analog to the national policy, a non-resident speculation tax has already been implemented in B.C. Introduced in 2018, this measure charges a 2% tax rate on nearly all eligible properties. It's difficult to tease out the impact of this policy on demand, as several other measures were introduced at around the same time, including the above-mentioned changes to the foreign buying tax, along with higher transfer and property tax rates for expensive houses. However, all these measures do not appear to have moved the needle that much, as of the number of non-residents who own either one or multiple properties in B.C. was flat from 2018 to 2019 according to Statistics Canada. This compares to a 1% gain for resident owners.

A national non-resident vacancy tax could positively impact rental supply by incenting some owners to rent out their vacant units. Data gaps make it difficult to precisely assess the potential impacts on rental supply. However, we note that the number of condominium units rented out in key markets in B.C. jumped by 16% in 2019, versus the 2% decline the prior year. This suggests the potential for some positive impact on rental supply from the federal government's proposed measure. However, this stock would likely be more expensive to rent than purpose-built units. Less probable are increases in resale housing supply. We note that new listings declined in B.C. during 2019 and, while we don't know what would have happened in absence of the policy, it's clear that resale supply didn't boom higher.

Housing Supply Measures Geared Towards Vulnerable Populations

Budget 2021 also included measures to boost housing supply, nearly all of which is meant for vulnerable Canadian populations. To this end, the government is pledging an additional $2.5 billion over 7 years and bringing forward $1.3 billion of previously allocated funds, mostly into FY 2021/22 and 2022/23. This funding will go towards the construction, repair and support of about 36,000 units, with an emphasis on accelerating construction and repair timelines. We applaud the government's efforts in this crucial area.

Some $300 million of this funding will flow to the Rental Construction Financing Initiative (RCFI), which is meant to support the construction of new rental supply by offering favourable financing terms to developers. The government hopes that this will result in the conversion of excess commercial space (driven in part by COVID-19) into 800 market-based rental units. Of course, 800 units is a drop in the ocean with respect to rental supply, although nearly 25,000 units have been supported through the program since 2017, according to the government. It's worth noting there is some debate regarding how much the program has incented builders to construct rental units (over other types), versus improving the financing terms for those already planning to build rental properties1.

Other measures include the federal government's intention to invest $4.4 billion over 5 years, available through interest free loans of up to $40,000, to help homeowners complete energy efficient retrofits. In addition, in situations where two or more individuals who are not considered to be "relations" (i.e. related by marriage, blood, etc) purchase a home, only one will now have to list the property as a principal residence in order to qualify for the GST New Housing Rebate, instead of all purchasers as before. It's unclear what, if any, impact this will have on demand.

While some modest steps were put forth in the federal budget, the possibility of further actions to cool the nation's heated housing markets remains. At a recent event, the Finance Minister noted she would closely monitor the outcome of OFSI's stress test proposal on uninsured mortgages (see note) and could follow with similar changes to the insured mortgage market. As well, there will be growing pressure on policymakers to take additional action if housing markets don't begin to cool from their recent frenzied pace.

End Notes

- Pomeroy Steve, "Toward Evidence Based Policy: Assessing the CMHC Rental Housing Finance Initiative." Centre for Urban Research and Education Policy Brief, Carleton University, January 2021.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: