The Central Bank Hiking Cycle

From 0 to 100 Real Quick

Beata Caranci, SVP & Chief Economist | 416-982-8067

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: March 29, 2022

- Category:

- Canada

- Financial Markets

Click here to jump to our forecast tables.

Highlights

- Market participants are catching their breath as Fed hawkishness has caused bond yields to jump over one percentage point since the start of 2022, reaching levels not seen since 2019.

- The central bank’s intention to quell high inflation has stoked fears that it is going to raise rates too far, too fast, throwing the economy into recession. With the slope of the yield curve narrowing to uncomfortable levels, talk of a policy error won’t go away anytime soon.

- The Bank of Canada is in the same position as the Fed. It needs to raise rates to combat high inflation and elevated house prices. But, with debt levels elevated, it will have to be careful as it attempts to tighten policy without thwarting the economic expansion.

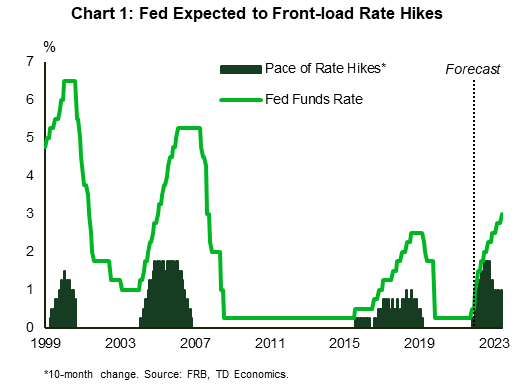

Bond yields have jumped in recent weeks as the Fed has hardened its messaging on inflation and raised its expectations for the pace of rate hikes. In March, the median Federal Open Market Committee (FOMC) member’s projection for the federal funds rate rose to 1.9% at the end of this year and 2.8% at the end of the next (Chart 1). In Chair Powell’s words, the Fed “will take the necessary steps to ensure a return to price stability.” According to its projections, this means taking the fed funds rate beyond the level it considers neutral.

The last time the Fed hiked this forcefully was right before the Global Financial Crisis (GFC). In that case, it raised rates from 1% in mid-2004, to 2.25% by year-end. It then continued to raise rates two percentage points in 2005 and another one percentage point in 2006, bringing the policy rate to a peak of 5.25%. That is precisely when the booming housing market made a U-turn, initiating the financial crisis.

The pace of rate hikes that the Fed is proposing between now and the end of this year is roughly equivalent to that pre-GFC time period, even as the resting point is much lower. This is because the estimate of the neutral policy rate (the setting consistent with stable inflation and unemployment) has come down significantly due to changes in the structure of the economy. Even so, as it did then, the FOMC anticipates getting close to is its estimated long-run rate of 2.5% by the end of this year and moving past it by the end of next year.

Still, rate hikes need not end in tears. In the mid-1990s, the Fed raised its policy rate from 3% in 1994, to 6% in early 1995, but in that case the economy did not go into a tailspin. Chair Powell referenced this example along with instances of soft landings in 1965 and 1984 in a speech last week. We agree with the nod to hiking cycles that led to soft landings, but we caution that the faster the rate hiking cycle, the lower the odds are that this is achieved. There was a day not too long ago when the central bank would remind us regularly that it’s better to start a rate hike cycle earlier and at a measured pace, rather than late and fast. That’s because interest rates feed through the economy with a lag, and the slow-and-steady option allows central bankers to better gauge market and economic outcomes.

Fed’s reaction function leading to aggressive catch-up

This cycle is certainly unique. Apart from the pandemic, the Fed threw out the playbook that had guided policy decisions and markets in the past. The central bank decided to give more weight to real-time data, rather than model predictions of the most likely trajectory of the economy and inflation. Waiting to observe a closed output gap or inflation at the 2% target before raising interest rates is one thing, but their patience extended beyond both of these points.

Why did they do this? The unprecedented pandemic led to unprecedented data volatility. In turn, this reduced the accuracy of forecasts. Although the logic seemed sound, it still required the Fed to follow its new guideline and be responsive to the information conveyed within the real-time data. By the end of the third quarter of 2021, it was clear that the unemployment rate was consistently surprising on the downside. And, long before then, it was already being observed that unprecedented government income supports had significantly muted the negative correlation between unemployment and the economy, evidenced by a strong impulse in consumer demand for homes, cars, electronics and anything else that wasn’t in lockdown. Lastly, employers maintained an eagerness to hire after every wave, and by July 2021, job demand had already outstripped the available supply of labor at that time.

This combination of events, alongside compelling evidence of inflation already being sustained above their 2% threshold, should have factored into the Fed’s monetary decision. It didn’t because there was a one-sided negative bias from the Fed since the spring. We have repeatedly pointed to the example that revisions to the payrolls data revealed that more than a million jobs were “missed” on the first count of the reports. Every month, revisions to the past month, were to the upside. Not only is it unusual to sustain one-sided revisions to the data, but the errors were larger than history. This too should have factored into the Fed’s estimation of labor market tightness. They additionally underestimated the stickiness of inflation, even though the forecast was serially revised up.

These examples show that the Fed consistently focused on the negative and minimized or underplayed the positive data that was calling for action. This was further minimized with their departure from having a reliance on the projection component of policy decision. “Suddenly”, the Fed found itself behind the curve.

This bias made matters worse for market participants. For the better part of two decades, central banks have preached the importance of tightening policy in a predictable way. It followed the logic that it was better to hike earlier and slow, than late and fast. With the pre-crisis policy playbook gone, markets are left grasping for guidance that is changing by the week, and this is likely why we are hearing chatter of a policy mistake and recession risks, after only one hike from the zero bound!

Part of the central bank bias comes from the fact that it was always assumed to be easier to control high inflation than low inflation. This caused the Fed to be quick with rate cuts and slow with rate hikes. Although this is true on the margin, it will be tested in this cycle with inflation metrics well past comfort levels.

Researchers at the Boston Fed have shown that consumers pay more attention to inflation on the upside than on the downside. As a result, there’s greater risk that sustained upside misses on inflation cause individuals to demand higher wages, the very dynamics that elevate the risk of a wage-price spiral and an unmooring of inflation expectations. We suspect this reaction is not linear. Meaning, as the misses to the upside get larger and/or last longer, the expectations on the wage-side may carry more longevity.

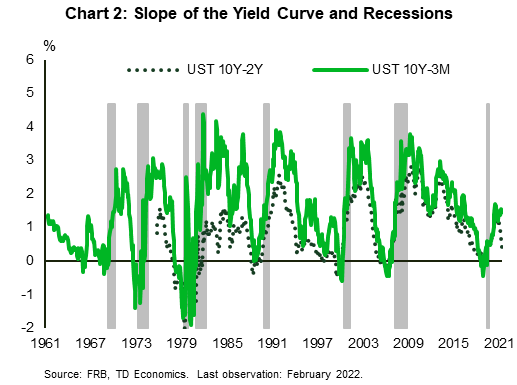

Is the yield curve predicting an error?

Given the yield curve’s accuracy in predicting recession, there is heightened probability of a policy error, or at the very least, that market participants are showing some angst that the central bank is on this heading down that path. Adding to this, the Fed has indicated an intention to run down its balance sheet at a faster pace than the post-GFC experience. Back then, former Fed Chair Janet Yellen said that Quantitative Tightening (QT) should be as boring as watching paint dry and would offer the equivalent of an extra 25 basis point hike. A faster and potentially larger tightening cycle this time around may not look like the past, which adds to the risk that it could undermine economic momentum or the confidence of financial market participants. History has taught us that yield curve signals should not be ignored.

From our lens, an inversion in the 10-year/2-year spread is increasingly likely. Should it occur, it would signal a one- to two-year lead time before recession, or at least imply that the Fed will get its policy rate into restrictive territory within that period. Other spreads, such as the 10-year/3-year and the 10-year/5-year have already inverted. While this has raised eyebrows, these metrics are less reliable predictors since they are subject to more volatility related to supply/demand factors. However, central bankers should take note that these tenors are communicating some degree of concern. Chair Powell highlighted that the best measure to use is the 10-year/3-month spread. This has been well studied within academia since the 3-month term is almost completely influenced by the Fed. By our estimates, if the Fed follows through with its more ambitious rate hike intentions, there is a clear and present risk that the metric will invert by the end of this year. However, we know the Fed holds this spread (and its signal) in high regard, so as the spread compresses towards the zero bound, this alone would likely trigger a recalibration of their rate hike objectives.

BoC under the microscope

While Canada’s inflation and wage pressures are more subdued relative to their U.S. counterparts, the environment and risks are definitely on the high side. The need to hike policy rates in Canada is just as pressing. Canadian inflation is running at a three decade high of 5.7% and our unemployment rate is below pre-pandemic levels at 5.5%. Although wage gains have failed to keep up with inflation, this will change with time. In a most unusual situation, there is one job available for every unemployed person. Of course, that doesn’t mean the skill-match or job-location fits to the available labor. The U.S.’s labor market hit this level in mid-2021, the same time that wages started to accelerate. It’s reasonable to expect Canadian wage pressures to heat up, particularly with workers and unions poignantly aware of the rising cost of living within a hot job market.

Just like with the Fed, the Bank of Canada (BoC) is coming from behind the inflation curve, creating greater urgency to anchor expectations. In fact, Governor Tiff Macklem recently stated that he is “not going to rule out a 50-basis-point move in the future.” This change in tone favoring a faster hiking path is a stark contrast to the decision in January to not hike interest rates at all, despite market participants fully braced for a hike. That was then, this is now.

Governor Macklem has also stated that “roughly 40% of our bond holdings mature within the next two years. This suggests that, other things being equal, our balance sheet would shrink relatively quickly.” Although the central bank has not yet disclosed its QT agenda, if they decide to follow through will the full run off of maturing securities, it would remove liquidity from the financial system at a quicker pace than any other major central bank. When combined with the possibility of a rate hike cycle moving at the quickest pace since the 1990s, there’s little wonder that recession chatter is circulating within Main Street and Bay Street so early in the monetary tightening cycle.

The Canadian 2-year yield sits near 2.4%, with markets expecting more than two percentage points in interest rate hikes over the rest of 2022. Comparatively, the Canadian 10-year yield has risen by 1% since the start of 2022, already coming to rest near our year-end target of 2.4%. That speed of adjustment is most analogous to the yield surge triggered by the U.S. taper tantrum post-GFC. In fact, there is a nuanced point within this observation. There is a higher correlation with Canada’s mid-and-longer dated yields with its U.S. counterparts. So, policy decisions or a communication error south of the border, can be imported into Canadian yields, creating an additional communication challenge for the Bank of Canada.

Canada also has more risks related to household indebtedness than its southern neighbor. Household debt has risen to 186% of disposable income and it’s estimated that 50% of new mortgages are tied to variable rates. Rising rates don’t necessarily trigger financial strain for this group, because a monthly fixed payment schedule would hold that constant. But, a greater share of those funds would be diverted to interest payments rather than principle debt. In turn, this will extend the payment schedule for those homeowners and not remove the risk created by a highly leveraged economy.

The Bank of Canada’s normalization path is no less complicated than that of the Federal Reserve, and we could argue it is even a greater task. The central bank has a larger share of holdings of government securities relative to the market, lacks precedent with Quantitative Tightening, and faces a more leveraged household sector. However, sometimes anecdotes offer the greatest signals on sentiment. Coming back from work last week, my Uber driver noted the coming recession would allow an opportunity to deploy his savings into the housing market. There are so many things wrong with this statement, including the implication to his employment prospects. But, what I took away from this conversation was the determination of the statement and his sources of information, which were likely Bay Street clients like myself.

Every time central banks embark on a regime change of monetary policy, communication and market confidence are key to getting the intended results. Perceptions can become reality, even if they are fundamentally unfounded at the time. There is still a lot of runway left in this business cycle, particularly given the strength of the job market. But nothing can be taken for granted. We, like others, maintain a cautious eye out for the ‘what ifs’. On that front, the yield curve (10Y-2Y and 10Y-3M) are queen and king as market and business cycle signals. So far, neither is flashing recession, even with the lead time afforded by the former. But, keeping that way will be the task at hand for central banks

Bottom Line

What does this mean for the economy? The Fed needs to anchor inflation and expectations, and this necessarily requires more tempered demand growth given that the economy is already operating with demand outstripping capacity. This process will erode the growth-cushion that is currently allowing the economy to withstand shocks. By extension, as this growth cushion deflates, the Fed needs to proceed with greater caution, particularly given the well-studied lags that exist between movements in rates and the transmission to the economy.

If you’re wondering why investors are already talking about recession risks after only one rate hike that’s barely off the floor, it’s not because interest rates are currently too restrictive. In an effort to convey confidence and determination in its ability to rein in inflation, the Federal Reserve may have leaned the ship too far. But, it’s important for investors to keep in mind that the central bank will be responsive to financial market signals, as the ‘dot plot’ path is not set in stone, and there’s still a lot of life left in this business cycle if confidence remains grounded.

Click here to jump to our forecast tables.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.