The BoC’s Shelter Inflation Problem

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Date Published: February 20, 2024

- Category:

- Canada

- Forecasts

- Financial Markets

Highlights

- The Bank of Canada’s inflation problem is mostly a housing issue. With shelter inflation accounting for more than half of overall inflation, this has become the biggest hurdle preventing the BoC from cutting rates.

- We map out three scenarios to determine how the BoC could influence the path of shelter inflation based on when it decides to cut rates. We find that the BoC will have little ability to quickly cool shelter prices, meaning that structurally higher inflation in Canada will persist.

- This argues for the BoC to start looking past the influence of shelter inflation, as it has under past regimes.

- For as long as the BoC continues to focus on inflation metrics which are being held up by shelter inflation, Canadians will suffer under the weight of high interest rates.

High shelter inflation is the single biggest factor preventing the Bank of Canada (BoC) from achieving its 2% inflation target. Mortgage interest costs are rising at the fastest pace ever, while rents have soared alongside low vacancies. This has shelter inflation running at 6.2% year-on-year (y/y, Exhibit 1). Given its huge 30% weighting within the CPI basket, this component alone has accounted for more than half of overall Canadian inflation.

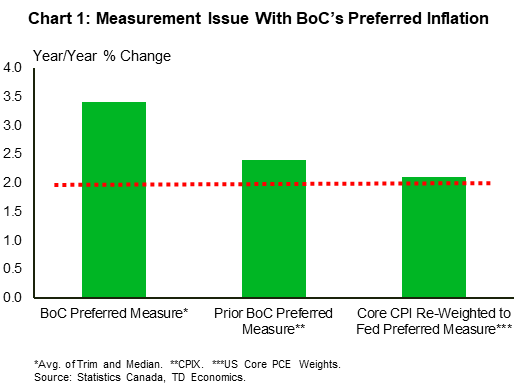

The outsized impact of shelter costs is keeping measures of underlying inflation higher in Canada than in other major economies. Much has been made about how the Federal Reserve will likely start cutting interest rates before the BoC because its preferred inflation metric, core PCE, is running at 1.5% on a 3-month annualized basis and 2.9% y/y. That is much better than the BoC’s preferred metrics, which are running at 3.2% on a 3-month basis and 3.4% y/y. But what’s interesting is that if we calculate Canadian inflation using the same weights as the Fed’s preferred metric, Canadian inflation would be at just 2.1% y/y (Chart 1)! Even the BoC’s former preferred measure of core inflation (CPIX) that takes out mortgage costs and other volatile items is at 2.4% y/y.

While this may argue for the BoC to look past hot shelter prices and focus on the big picture, the BoC has doubled down, preaching patience as it fears cutting rates could stoke further gains in shelter inflation. To test this hypothesis, we ran three different scenarios to determine how the various paths for the BoC’s policy rate would impact both shelter prices and overall inflation in Canada.

Exhibit 1: Shelter Inflation in Canada

| Current Annual Inflation Rate | Weight in Shelter Index | |

| Total Shelter Inflation | 6.2% | |

| Rent Accommodation | ||

| - Rent | 7.9% | 24% |

| Owned Accommodation | ||

| - Mortgage Interest Costs | 27.4% | 13% |

| - Homeowners' Replacement Cost | -1.6% | 19% |

| Water, Fuel, and Electricity | 0.6% | 12% |

To cut or not to cut?

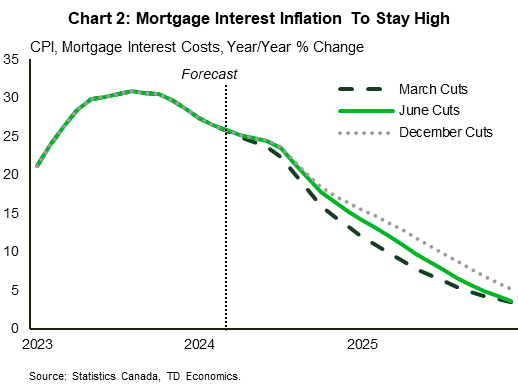

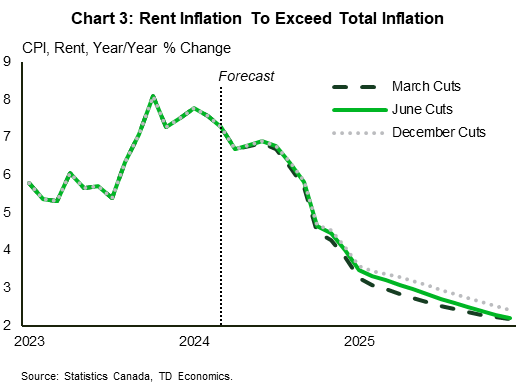

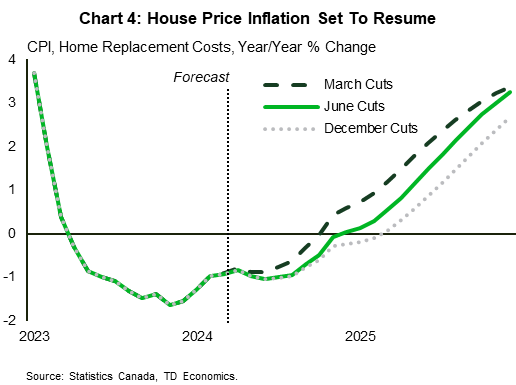

That’s the question on the mind of Governor Macklem. If he cuts rates too early, does he stoke demand-side inflation again? Or if he holds off on rate cuts, does the pass-through of higher policy rates keep mortgage interest cost and rent inflation in the stratosphere? Our three scenarios look to address this. In the first case, we assume the BoC is aggressive with rate cuts, initiating the first cut in March and executing on 175 basis points in cuts over 2024. In the second scenario, we assume the baseline scenario that the BoC initiates its first cut in June (125 bps in cuts over the year). In the final scenario, we have the BoC holding off on cuts until December 2024.

What we find is what you’d expect. If the BoC cuts early, mortgage interest inflation and rent inflation come down faster than if the BoC decides to wait to cut (Chart 2 and 3). At the same time, homeowners’ replacement costs (a measure of inflation in house prices) rises ahead of the spring buying season and continues to grow while the BoC keeps cutting rates (Chart 4). What’s interesting is that there is less inertia in house prices than in mortgage costs and rent. While housing demand and prices quickly respond to the move in the BoC rate, there are other factors at work when it comes to mortgage rates and rent. In 2019, the BoC’s policy rate was just 1.75%. This was cut to 0.25% in early 2020 and kept there through early 2022. So unless the BoC cuts rates to below 2% this year and even lower in 2025, the majority of people that renew their mortgages over the coming two years are in for a big payment shock. This is how mortgage interest cost inflation is calculated in CPI (alongside variable rates). And in the case of rent inflation, the huge under supply of rental housing has worsened in the last year alongside unrestrained population growth. It will take many years for this to unwind, which means that rent inflation will remain above overall inflation for the foreseeable future. Furthermore, our estimates show that landlords are more likely to pass on higher carrying costs (higher interest) rates rather than higher house prices.

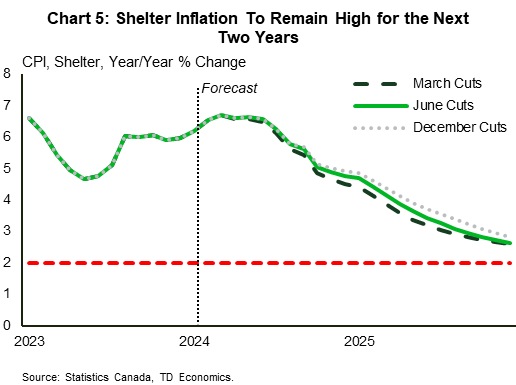

Combining the impact of the various paths for the BoC policy rate on house prices, mortgage costs, and rent, no matter how quickly the BoC cuts rates, shelter inflation will average close to 6% over 2024 (Chart 5). This is problematic. As we highlighted in our paper from January, if shelter inflation remains close to 6%, the rest of the inflation basket must have close to zero price growth for the BoC to get total inflation down to 2%. That is highly unlikely outside of a significant recession.

When exclusion is a good thing

It is pretty clear that the BoC has a shelter inflation problem. So, what is the BoC to do when one sector of its inflation basket is causing all the trouble? Well, the BoC had done some work on this when it decided to make CPI median, CPI trimmed mean, and the now defunct CPI common its preferred inflation metrics. Prior to the adoption of these inflation measures, it preferred to follow CPIX, which directly excluded eight items deemed more volatile: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. In the case of mortgage interest costs, Canada is an outlier in that it is included in the headline CPI basket. It was an easy sell to exclude this from the core inflation index. The other items were removed as they can mislead the BoC in assessing the future path of inflation should they spike for reasons outside of the cyclical nature of the economy. When the BoC adopted its three new measures in 2016, it described its rationale as follows:

“Since monetary policy primarily acts on inflation through its effect on demand, measures of core inflation that move with the output gap and are largely insensitive to transitory sector-specific developments would be more effective as operational guides to policy”

In other words, a good measure of inflation is one that moves with the economy and doesn’t have a single sector skewing the index. The BoC’s three core measures were supposed to do this. But given that the economy has flatlined since last spring, the BoC’s preferred core metrics have become less connected with the economic cycle due to the influence of structural factors related to housing. And the fact that one sector is driving this disconnect means that the current inflation metrics aren’t doing a good enough job at guiding monetary policy for the broad economy.

Bottom Line

Shelter inflation is a major thorn in the side of the BoC. Even worse, it isn’t going away no matter how quickly it decides to cut rates. While we have been arguing for the Bank to begin looking through the shortcomings created by shelter inflation and instead focus on the health of the broad economy, it is clear from recent central bank communication that it isn’t ready to do so. And the longer the BoC continues to look at inflation through its current lens, the longer Canadians will have to bear the weight of a heavily restrictive policy rate.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: