Canadian Automotive Outlook

The Road Back to Normality

Andrew Foran, Economist | 416-350-8927

Date Published: May 13, 2024

- Category:

- Canada

- Commodities & Industry

Highlights

- Canadian light vehicle sales are expected to grow by 9.6% in 2024 to 1.9 million units, as affordability challenges diminish and population growth bolsters demand.

- Risks to our forecast are roughly balanced, with elevated population growth offsetting the risks related to moderating economic fundamentals.

- North American automotive production is expected to grow by 2.9% in 2024, providing further support to supply levels.

Light vehicle sales in the first quarter of 2024 totaled over 391k units, representing a 9.1% increase relative to the same period last year. Car volumes were up 17.4% year-on-year (y/y) in the first quarter, while light truck volumes were up a more modest 7.6% y/y. Light trucks continued to account for more than 80% of light vehicle sales, but the segment’s share has fallen modestly relative to last year as the supply mix rebalances amid rising production and enhanced demand for affordable models.

Despite the numerous economic challenges facing Canadian consumers, demand for automobiles has shown surprising resilience over the past year, with sales growth in 2023 roughly matching that seen in the U.S. This occurred even though the Canadian economy expanded at a pace less than half that seen south of the border last year. This can in part be explained by the binding nature of supply constraints over the past few years, as gradual inventory improvements were matched by pent-up demand in both countries. While this remains the driving factor in 2024 for Canada amid a solid build-up of accumulated consumer savings, elevated population growth has also been boosting sales volumes.

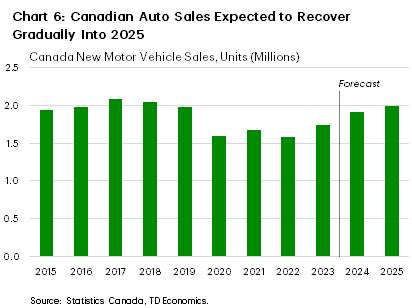

For the year, we expect that vehicle sales in Canada will grow by 9.6% - reaching 1.9 million units - although moderation is expected through the year as the economy slows and the post-pandemic bounce-back recedes gradually. We anticipate that sales will return to the pre-pandemic level next year as the economy recovers and lower interest rates facilitate stronger buying activity.

North American & Canadian Production Rebounding

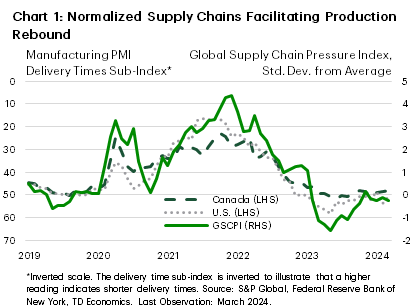

The automotive industry returned to a state of normality in 2023 as easing supply chain issues improved procurement times (Chart 1) and facilitated a rebound in production. As a result, North American light vehicle production increased 9.6% last year, putting total production only 3.9% below 2019 levels. This helped to push inventory levels to their highest level in three years to start 2024.

In Canada, 1.54 million light vehicles were produced last year, representing a 25.7% increase relative to 2022. Although this production level is roughly 18.9% (or 357k units) below the nation’s 2019 production level, most of this decline (~95%) is accounted for by discontinued production of the Chevrolet Equinox at General Motor’s Ingersoll plant and the Dodge Caravan at Stellantis’ Windsor plant. However, both facilities have seen partial offsets from the production of other models.

Looking to 2024, North American automotive production is expected to increase by 2.9% as automakers continue to adjust to the post-pandemic market. Canadian production in contrast is expected to decline, but this is related to the temporary shutdown of the Stellantis Brampton plant and the Ford Oakville plant as the two facilities are upgraded for electric and hybrid vehicle production. Over the coming years, the upgrading of assembly facilities is expected to keep aggregate Canadian auto production output subdued.

Canadian Labor Market Moderately Supportive of Demand

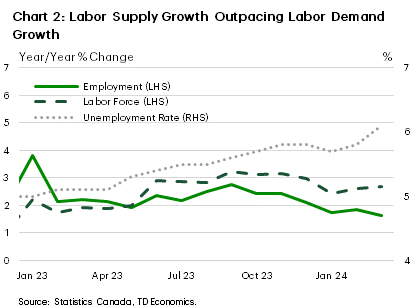

The Canadian labor market is not quite as weak as is suggested by the one percentage-point increase in the unemployment rate over the past year. With the nation’s population growing by 3.2% last year, we have seen labor force growth outpace employment growth consistently since May 2023 (Chart 2), which has exerted upward pressure on the unemployment rate. Canadian job gains in 2023 actually exceeded those seen in 2019 by more than 100k jobs, but the economy would have needed roughly 160k additional new jobs to offset outsized labor force growth and keep the unemployment rate unchanged relative to the start of 2023. At the same time, while part-time jobs contributed more to last year’s gains than usual (25% vs. 3% in 2019), full-time job growth was above that seen in 2019. So, while the Canadian labor market is not remarkably strong, it is not currently in the doldrums either.

This has contributed to the resilience in real income growth and bolstered the financial situation of households. Real household disposable income was roughly 8.8% higher in the fourth quarter of 2023 relative to the fourth quarter of 2019. However, the household savings rate has remained at an elevated level, suggesting that Canadians are opting to retain a higher share of these gains than they did prior to the pandemic. While there are multiple reasons why this might be, one of the primary drivers is related to shelter costs.

Housing Costs Continue to Have a Strong Influence on the Economy

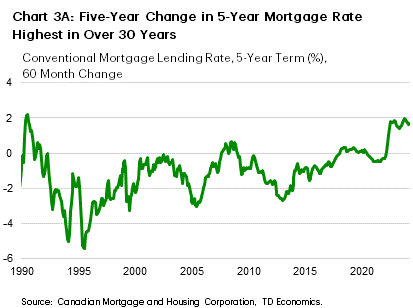

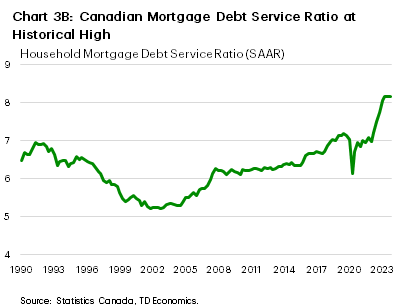

About 35.5% of Canadian households currently hold a mortgage, and roughly half of them have yet to see their rates renew since the Bank of Canada began to raise interest rates back in early-2022. Precautionary saving is likely elevated among this cohort as interest rates are expected to remain above the pre-pandemic level for the foreseeable future. The other half of mortgage holders, which includes variable rate mortgage holders, have already seen their payments increase, which has pushed up the mortgage debt service ratio to its highest level on record (Charts 3a & 3b). In addition to mortgage holders, many households that rent (which encompass roughly a third of households) have also seen their housing costs rise through elevated rent price growth over the past few years. Renters wishing to own one day are also likely boosting their savings as housing prices remain elevated.

Collectively, roughly two-thirds of Canadian households have either seen their housing costs rise or expect them to rise at some point in the future. While the magnitude of the increase will vary between households, on aggregate this remains a headwind to consumption and by extension vehicle sales. This is particularly saliant in the context of the current automotive market, as affordability challenges remain amid elevated vehicle prices and financing costs. So, the question is, why are sales still trending higher?

Canadian Vehicle Sales Continue to Grow Despite Headwinds

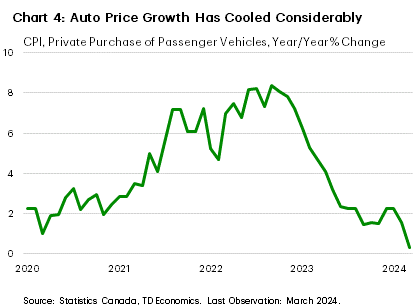

The first reason is owing to the delayed post-pandemic recovery in the automotive sector. The lack of available inventory in the market over the past three years has created a build-up of pent-up demand, which is one of the reasons why Canadian vehicle sales growth roughly matched that seen in the U.S. last year despite materially different economic trends. As production ramped up and supply levels gradually improved last year, consumers in both countries pushed sales to their highest level since 2019. This is expected to continue to support sales moving forward, with moderating vehicle prices (Chart 4) and lower financing costs providing support to this channel through the second half of the year.

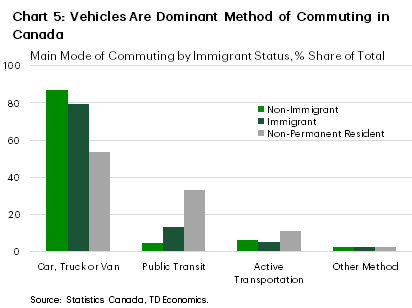

The second factor pushing up Canadian vehicle sales over the past year has been population growth. Commuting to work via a vehicle is the main method of transportation for all segments of the population, including non-immigrants, immigrants, and non-permanent residents. While non-permanent residents, the largest source of population growth in Canada over the past two years, tend to rely on public transportation for commuting to a greater degree, more than half typically use a vehicle (Chart 5). In 2022, supply constraints and low inventory levels negated the impact this would normally have on sales, but through the second half of 2023 and into 2024 we have seen population growth begin to feed through to demand.

Looking ahead for 2024, we expect that vehicle sales in Canada will grow by 9.6% to 1.9 million units before moderating to 4.3% in 2025, with healthy inventory levels and lower financing costs improving affordability into the new year (Chart 6). Risks to our forecast are roughly balanced, as population growth may have a stronger feedthrough effect than expected, while at the same time moderating economic growth and the potential for persistent affordability challenges could weigh on sales as well.

Bottom Line

With 1.76 million vehicles sold in Canada last year and inventory levels reaching a three-year high to start 2024, the long-awaited recovery in the automotive market is well underway. Inventory levels are expected to continue to grow in 2024, with supply chain disruptions and union negotiations of prior years soundly in the rear-view mirror. The demand picture on the other hand continues to be nuanced, with economic headwinds, particularly related to the housing sector, running up against the countering influence of elevated population growth. We expect that Canadian vehicle sales will grow by 9.6% this year, before converging with the pre-pandemic level of sales in 2025.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: