2025 Saskatchewan Budget

Protecting the Surplus

Marc Ercolao, Economist | 416-983-0686

Date Published: March 20, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

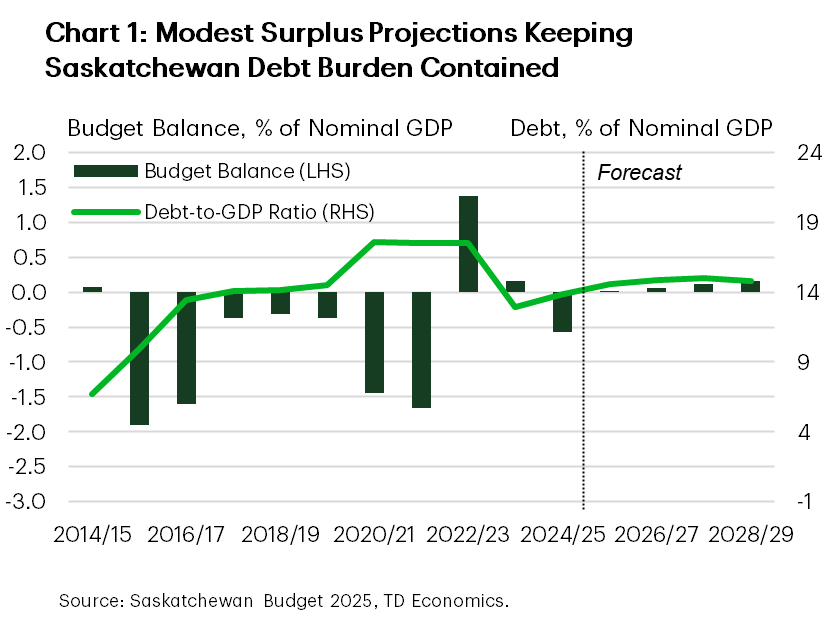

- Saskatchewan is back to projecting surpluses after a brief dip into the red ink last fiscal year. As it stands, Saskatchewan is the only province expecting a surplus for the year ahead.

- The debt-to-GDP ratio is expected to creep up in the year ahead, but the Province will likely retain its position as one of the least indebted coast-to-coast.

The Province of Saskatchewan is projecting a razor thin $12 million surplus in FY 2025/26, marking an improvement from the $661 million shortfall now estimated for the 2024/25 fiscal year. The government is anticipating stable and growing surpluses in the three years following.

The budget does not incorporate the impact of the most recent U.S. tariff developments into the outlook, nor does it make mention of the recent 100% tariffs imposed by China on Canadian canola products. This leaves the projection susceptible to downside risk. The government forwent building in a contingency reserve given the heightened uncertainty during the Budget preparation. That said, relatively constrained spending growth in recent years and a still-low debt burden affords the province the capacity to support the economy should worst-case trade risks materialize.

Notably, the province pushed through with tax cuts as promised in their campaign platform. An estimated $250 million in tax savings this year are derived from:

- Raising the basic personal exemption, spousal and equivalent-to-spouse exemption, dependent child exemption and the seniors supplement by $500 a year, over the next four years.

- Increasing the Disability, Caregiver, and Infirm Dependent tax credits by 25%.

- Reinstating the home renovation tax credit.

- Reducing education property tax mill rates across all property classes.

Economic Assumptions May Be Stale, But Trade Risks Scenarios Are Considered

The government forecasts an acceleration in 2025 and 2026 real GDP growth to 1.8% and 2.0%, respectively. Worth noting, the government’s economic outlook uses the average of private-sector forecasts, which were collected a month ago, before the recent escalation in the trade war. In contrast, our recent forecast for Saskatchewan’s economy, which incorporates tariff assumptions, calls for slower real GDP growth, averaging 1.2% over the next two years. The government does highlight the implications of a worst-case tariff scenario – which is not part of their official forecast – that shows revenues could be shaved by $1.4 billion over a year, more than erasing near-term surpluses.

The Province is assuming that WTI oil prices average $71/bbl for FY 2025/26. This forecast is more optimistic than our $67/bbl projection that incorporates the unwinding of OPEC supply cuts and escalating global trade tensions. If oil prices land closer to our projections, revenues could be negatively impacted to the tune of $70 million, given the government’s updated sensitivities. We believe 2025 projections for potash prices ($239/tonne) and the CAD (70.4 cents/USD) are reasonable.

Saskatchewan Economic Assumptions

[ Percent Change Unless Otherwise Noted ]

| Budget 2025 | |||||||

| Calendar Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | |

| Nominal GDP | 4.2 | 2.6 | 3.8 | 4.5 | 4.4 | 4.1 | |

| Real GDP | 1.6 | 1.8 | 2.0 | 2.2 | 2.2 | 2.3 | |

| Unemployment Rate (%) | 5.4 | 5.6 | 5.4 | 5.5 | 5.6 | 5.4 | |

| CPI | 1.4 | 2.0 | 1.9 | 1.8 | 1.8 | 1.8 | |

| WTI (US$/Barrel) | 74.3 | 71.0 | 72.0 | 75.3 | 76.5 | 78.3 | |

| Potash (US$/KCI Tonne) | 223.0 | 239.0 | 258.0 | 277.0 | 297.0 | 317.0 | |

Total revenues are projected to rise by 3.2% in FY 2025/26 after slipping 2.6% in the year prior. Non-renewable resource revenue, led by potash and uranium sales, is expected to see a healthy 8% jump. Meanwhile, a hefty bump in provincial sales taxes is expected to drive total taxation up by 3.5% this year. Personal income tax revenues will likely flatline on the back of the newly-implemented tax measures. In the outer years of the forecast horizon, revenue growth is pegged at 3.7% on average.

Government Outlays Are Focused on Capital Spending

Total spending in FY 2025/26 is expected to hold virtually constant. It is worth noting that a 5% boost in in-year spending last fiscal year has created a higher jump-off point for outlays. Health care and education expenditures will gobble up 60% of the total spend, despite seeing no growth relative to updated FY 2024/25 forecasts. Transportation, general government, and environment spending will see increases on the margin.

This stands in contrast with Saskatchewan’s capital plan which is expected to accelerate to $4.6 billion in FY 2025/26, a 10% increase from last year. Targeted areas include health facilities, various government services, along with Crown Corporations such as SaskPower and SaskEnergy. Capital spending plans of $4.4 billion on average over the next three years puts spending well above historical levels.

Net Debt Trajectory Still Intact

The net debt-to-GDP ratio is projected to rise modestly to 14.6% in FY 2025/26, before cresting at 15% by FY 2027/28. These levels are still comparatively low relative to the province’s history and shouldn’t jeopardize Saskatchewan’s standing as the province with the second lowest debt burden in Canada. The near-term uptick in the debt burden comes on the back of borrowing for the Saskatchewan’s capital plan. Meanwhile, total borrowing requirements for FY 2025/26 will decrease by 20% to $4 billion.

Bottom Line

Saskatchewan’s projected surpluses are positive but fragile as new risks inject potential downside to the outlook. In light of the economic uncertainty, the government took its foot off the spending pedal and opted to keep its powder dry. Barring a major downturn in key commodity prices or general economic conditions, the province is still well-positioned to support business and households.

Saskatchewan Government Fiscal Position

[ Millions of C$ unless otherwise indicated ]

| Fiscal Year | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Forecast | Budget | Target | Target | Target | ||

| Revenues | 20,408 | 21,056 | 21,835 | 22,643 | 23,481 | |

| % Change | 0.1 | 3.2 | 3.7 | 3.7 | 3.7 | |

| Expenditures | 21,069 | 21,044 | 21,759 | 22,499 | 23,264 | |

| % Change | 1.0 | -0.1 | 3.4 | 3.4 | 3.4 | |

| Surplus (+)/Deficit (-) | -661 | 12 | 76 | 144 | 217 | |

| % of GDP | -0.6 | 0.0 | 0.1 | 0.1 | 0.2 | |

| Net Debt | 15,889 | 17,123 | 18,139 | 19,082 | 19,656 | |

| % of GDP | 13.9 | 14.6 | 14.9 | 15.0 | 14.8 | |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: