2025 PEI Budget

Deficits to Persist Over Projection Horizon

Rishi Sondhi, Economist | 416-983-8806

Date Published: April 11, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

- PEI's deficit is pegged at a meaty 1.7% of GDP in the upcoming fiscal year, as expenditures are juiced by program spending and a new contingency for tariff-related growth risks.

- Economic growth is expected to be solid in 2025. In turn, revenue growth is forecast to be firm, despite tax relief measures for households and businesses.

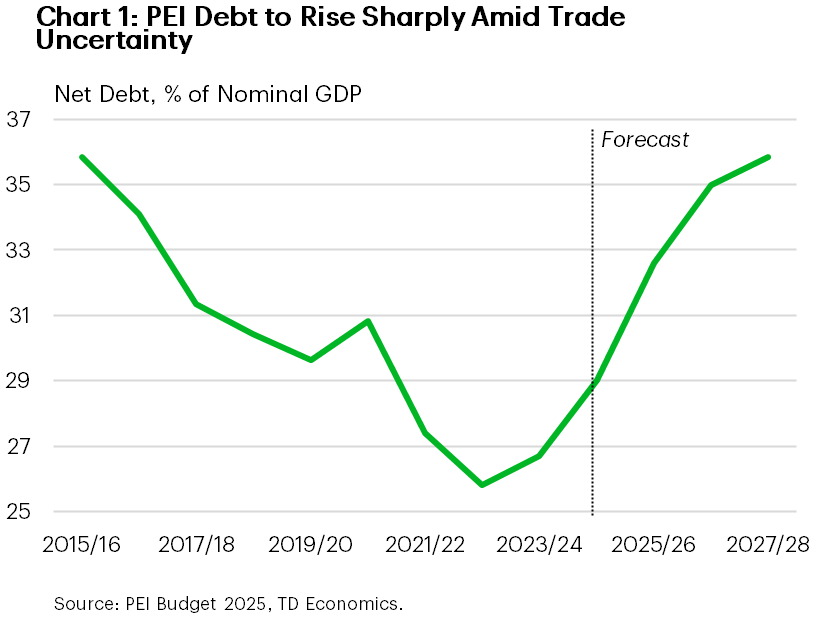

- Net debt-to-GDP is forecast to climb significantly over the medium term, reducing flexibility to respond to downside growth shocks.

PEI's FY 2024/25 deficit is pegged at $166 million. This works out to about 1.6% of GDP, putting it in line with the shortfalls observed during the Global Financial Crisis. Weaker revenue gains and stronger program spending were the contributors. This deficit is projected to climb to $184 million (or 1.7% of GDP) this year, on the back of a huge gain in spending. Deficits are expected to persist through FY 2027/28. Net debt to GDP, meanwhile, is seen as climbing nearly 7 ppts from its FY 2024/25 level over the projection horizon.

Tax relief is a notable feature of the budget, with measures for households and businesses. The Island has also introduced a sizeable contingency for tariff-related downside growth risks.

Reasonably Firm Economic Growth Expected

PEI is projecting real GDP growth of about 2.3%, on average, in 2025 and 2026, supported by a rising population and homebuilding. Meanwhile, nominal GDP is seen as advancing by an average of 4.2% over the two years. In comparison, our forecast has softer nominal GDP gains in 2025 and 2026, driven by a weaker outlook for real GDP.

This relatively firm backdrop is expected to support a 7% surge in revenues this year, with healthy gains in own-source revenues and federal transfers expected. This gain also comes despite a few tax relief measures introduced. For households, this includes increasing the basic personal amount to $14,650 for the 2025 tax year and to $15,000 in 2026. In addition, all personal income tax bracket thresholds will be increased by 1.8% starting in January 2026. These measures will cost the government $5.1 million. On the business side, the small business threshold will be increased to $600k, while the corporate income tax rate is cut by 1%. The cost to the government from business tax relief is pegged at $9.3 million.

On the opposite end of the ledger, spending growth is expected to soar by 7.2% in FY 2025/26. Program spending growth is seen as climbing significantly, lifted by gains for big ticket items like healthcare and education. The Island has also introduced a $32 million contingency (about 0.3% of GDP) to guard against downside growth risks from U.S. tariffs.

Debt Burden to Rise Notably

Net debt-to-GDP is forecast to jump from last year’s estimated 29% to35.9% by FY 2027/28. This marks a sizeable shift for the Island, which had seen debt levels closer to 27% of GDP over the past several years. In fact, if PEI's debt burden does climb to 35.9% by the end of the projection horizon, that would mark the highest level since FY 2014/15.

Long-term borrowing requirements are expected total $800 million for FY 2025/26, up from $400 million the prior fiscal year.

Bottom Line

The uncertain economic backdrop could challenge PEI's healthy revenue growth projection for this year and cause the Island's fiscal position to deteriorate. Note that debt to GDP is forecast to climb significantly through FY 2027/28, reducing flexibility to respond to downside growth shocks that may loom in coming years.

Prince Edward Island Government Fiscal Position

[ Millions of C$ Unless Otherwise Noted ]

| Fiscal Year | 2024-25 Forecast |

2025-26 Estimate |

2026-27 Plan |

2027-28 Plan |

||

| Revenues | 3,123 | 3,343 | 3,498 | 3,671 | ||

| % Change | - | 7.1 | 4.6 | 4.9 | ||

| Provincial* | 1,898 | 2,022 | 2,111 | 2,211 | ||

| % Change | - | 6.5 | 4.4 | 4.8 | ||

| Federal Transfers | 1,224 | 1,321 | 1,387 | 1,459 | ||

| % Change | - | 7.9 | 5.0 | 5.2 | ||

| Expenditures | 3,289 | 3,527 | 3,666 | 3,790 | ||

| % Change | - | 7.2 | 3.9 | 3.4 | ||

| Program Spending | 3,248 | 3,502 | 3,611 | 3,726 | ||

| Interest | 167 | 170 | 214 | 238 | ||

| Amortization | 126 | 145 | 159 | 174 | ||

| Budget Balance | -166.3 | -183.9 | -167.8 | -119.5 | ||

| % of GDP | -1.6 | -1.7 | -1.5 | -1.0 | ||

| Net Debt | 3,040 | 3,562 | 3,976 | 4,239 | ||

| % of GDP | 29.0 | 32.6 | 35.0 | 35.9 | ||

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: