2025 Nova Scotia Budget

Debt Burden to Climb Even with Firm Economic Growth Forecast

Rishi Sondhi, Economist | 416-983-8806

Date Published: February 18, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

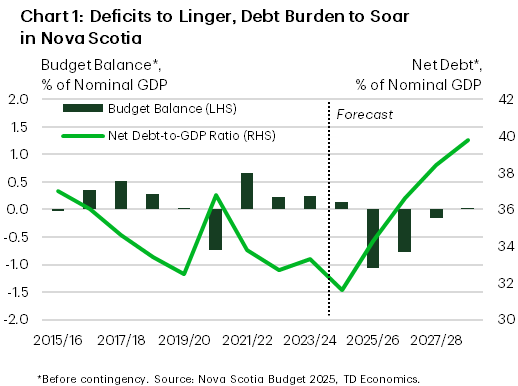

- Nova Scotia’s surprise FY 2024/25 surplus is set to quickly swing to a deficit this coming year, as the government follows through on previously announced tax relief measures. These measures include a 1 ppt reduction in the HST and a 1 ppt drop in the small business tax rate.

- The combination of deficits and capital spending is expected to send net debt-to-GDP to its highest level in about 25 years by FY 2028/29. And this is expected to take place even as economic growth remains firm over the next few years. Should they manifest, downside growth risks could weaken this position even further.

Unexpectedly strong revenues drove what’s now expected to be an $80 million surplus for Nova Scotia in FY 2024/25, a marked difference from the near $500 million shortfall projected in last year’s budget. Still, this black ink is not expected to last, with the province forecasting an $697 million shortfall (before a newly introduced $200 million contingency fund is factored in) in FY 2025/26. This amounts to a significant 1% of GDP. The Province expects to return back to a surplus (excluding the contingency fund) by FY 2028/29. Net debt-to-GDP, meanwhile, is seen climbing sharply over the forecast horizon.

Budget 2025 delivers on election promises made by the provincial government ahead of last November’s election. Tax relief features significantly in the budget, with the government set to roll out measures for households and small businesses. On the opposite side of the ledger, spending growth is projected to slow markedly this fiscal year.

Economic growth to be Firm Moving Forward

The Province expects continued solid economic expansion over the next couple of years, with real GDP growth expected to average 1.9% (in line with 2024’s estimated gain). Meanwhile, nominal GDP growth is projected to average 4.5% over 2025 and 2026, roughly 1 ppt above our December projection. Growth is expected to find support from the province’s capital spending plan and tax cuts, offsetting the provisioned impact of U.S. tariffs and slowing population growth.

Even with this relatively firm growth backdrop, revenues are budgeted to drop 1.8% in FY 2025/26, as tax cuts weigh on the province’s intake. In terms of tax measures, the government will follow through on its pledge to lower the HST by 1 ppt effective April 1st. Compared to provinces that have the HST, this reduction will put Nova Scotia’s rate below the other Atlantic provinces, but above Ontario’s 13% rate. The Basic Personal Amount will also increase while personal income taxes and certain credits will be indexed to inflation. These measures are expected to save an average family around $1k this year, for a total savings of $500 million.

Nova Scotia Economic Assumption

[ Percent change unless otherwise noted ]

| Budget 2025 | ||||||

| Calendar Year | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Nominal GDP | 4.8 | 4.7 | 4.3 | 3.6 | 3.0 | |

| Real GDP | 1.9 | 2.0 | 1.8 | 1.5 | 1.3 | |

| Employment | 2.8 | 1.4 | 0.6 | - | - | |

| Labour Force | 3.0 | 1.6 | 0.7 | - | - | |

| Unemployment Rate (%) | 6.5 | 6.7 | 6.8 | - | - | |

| CPI | 2.4 | 2.2 | 2.0 | - | - | |

Budget 2025 also follows through with the 1 ppt reduction in the small business tax rate to 1.5%, effective April 1st. Meanwhile, the small business income threshold will be raised to $700k from $500k – the highest among Canadian provinces.

On the opposite end of the ledger, expense growth over the coming year is projected at 3.7%, marking a notable slowdown from the prior fiscal year and restrained by a more moderate gain in healthcare spending. In contrast, education spending is forecast to surge by 11%. Meanwhile, debt servicing costs are seen as climbing 4.5% this year, lifted by borrowing requirements. As a share of revenues, they are pegged at 5.5% in FY 2025/26, below the long-term average of about 8%.

Debt Burden to Climb Significantly

Net debt-to-GDP is forecast to jump from last year’s estimated 31.6% to 39.8% by FY 2028/29 (excluding the boost to the ratio from the contingency fund). For reference, there is only one province (Newfoundland and Labrador) with a debt ratio currently above 40%.

The increase in the debt burden will be fueled by the combination of deficits and capital spending. On the latter, Nova Scotia’s FY 2025/26 $2.4 billion capital plan will invest in healthcare projects (like the Halifax Infirmary Expansion Project), education and public housing.

Borrowing requirements are expected to total $3 billion (before contingencies) in the upcoming fiscal year, up from $2.5 billion in FY 2024/25.

Bottom Line

This could remain a theme all budget season, but there is high uncertainty around the government’s solid economic forecasts, depending on how the situation with the U.S. evolves. There’s also some chance that the government may need to open its purse strings to cushion households and businesses in the province in the event of a Canada-U.S. trade spat. As such, the fiscal position of Nova Scotia could deteriorate, and we could be looking at a different situation by the time the next fiscal update rolls around. Note that net debt-to-GDP is already expected to rise to its highest level in about 25 years at the end of the projection horizon, even without significant downside risks manifesting.

Nova Scotia’s meaty capital plan (released a few days ago), will add to these fiscal pressures, although it could support economic growth in the short-term, helping offset the negative impacts on investment from tariff-related uncertainty. Indeed, the government is banking on this to some degree in their economic forecasting. Also beneficial is the potential for capital spending to lift productivity over the longer run.

Nova Scotia Government Fiscal Position

[ Millions of C$ unless otherwise indicated ]

| Fiscal Year | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Forecast | Estimate | Estimate | Estimate | Estimate | ||

| Revenues | 16,811 | 16,506 | 17,265 | 17,934 | 18,369 | |

| % Change | 8.2 | -1.8 | 4.6 | 3.9 | 2.4 | |

| Expenses | 16,950 | 17,569 | 18,148 | 18,395 | 18,713 | |

| % Change | 8.3 | 3.7 | 3.3 | 1.4 | 1.7 | |

| Consolidation/Accounting Adjustments | 221 | 366 | 361 | 353 | 353 | |

| Surplus (+) / Deficit (-) | ||||||

| Provincial Surplus (Deficit) - Before Contingency | 82 | -698 | -523 | -108 | 9 | |

| Contingency | -200 | -200 | -200 | -200 | ||

| Provincial Surplus (Deficit) - After Contingency | 82 | -898 | -723 | -308 | -191 | |

| Net Debt | ||||||

| Net Debt - Before Contingency | 19,750 | 22,420 | 24,981 | 27,165 | 29,017 | |

| % of GDP | 32% | 34% | 37% | 38% | 40% | |

| Net Debt - After Contingency | 19,750 | 22,620 | 25,381 | 27,765 | 29,817 | |

| % of GDP | 32% | 35% | 37% | 39% | 41% |

|

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: