2025 Newfoundland and Labrador Budget

One More Year in Deficit

Marc Ercolao, Economist | 416-983-0686

Date Published: April 9, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

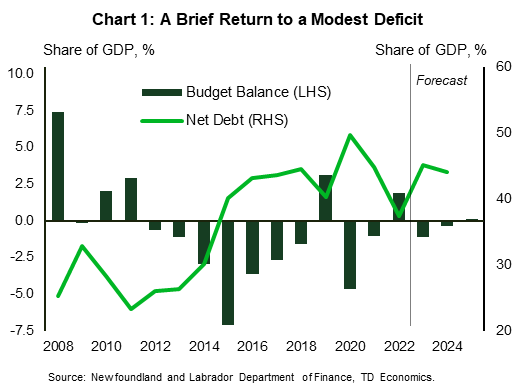

- Newfoundland & Labrador is projecting a second consecutive year in deficit territory, before balancing the books next fiscal year.

- At almost 45%, the government’s debt-to-GDP ratio is still the highest among the provinces.

- The province experienced robust economic growth in 2024. A strong GDP projection for 2025 hinges on a rebound in commodities production, which is currently in the crosshairs of the ongoing trade war.

Newfoundland & Labrador (N.L.) is projecting a $372 million deficit in FY 2025/26 (-0.9% of GDP). This represents a slight deterioration from the $252 million shortfall now estimated for FY 2024/25. The latter balance was eroded by decreased offshore royalties and an increase in health care expenses. Relative to last year’s budget, the return to balanced books has been postponed by one year to FY 2026/27.

To combat against the ongoing trade war, the government introduced a hefty $200 million contingency fund. Past this, the government is holding the line on medium-term spending. Aside from incremental investments in key education and health care services, and additional grants and subsidies, the Budget is devoid of new major tax or affordability measures.

Economic Projections Hinge on Continued Oil Sector Momentum

On the heels of last year’s solid growth, the N.L government assumes real GDP gains of around 4.4% this year, which underpins a 4.1% rise in revenues for FY 2025/26. Tariff impacts were broadly captured in the economic forecast, though details around the assumptions were not provided. The GDP forecast is reasonable should the anticipated +10% gain in oil production this year materialize. The biggest risk to the outlook is the recent oil price rout that has seen Brent prices slide by 15% in the past week to $65/bbl as the global trade picture deteriorates. Compared to the government’s $73/bbl forecast, over $200 million in revenues is at stake–per the government’s updated sensitivities– should oil prices fail to gain traction from current levels. That said, the beefy contingency fund could go a long way in covering this potential shortfall. In the following years, revenue growth is expected to average a tepid 1-2%.

Government Tightening Their Purse Strings

Total spending is projected to rise by 5.1% in FY 2025/26. What’s more, the rest of the five-year planning horizon sees slightly negative annual average expense growth, which represents a further drop on average in real pre-capita terms. Spending this year is mainly geared towards the healthcare and education sectors. The government also announced that it would extend the 8.05 cent/litre gas tax reduction, the 50% reduction in passenger vehicle registrations, the home heating supplement as well as the elimination of retail sales tax on home insurance.

Meanwhile, the government significantly scaled back its capital investment forecast. Relative to last year’s budget, cumulative capital investment by the year 2028 will be more than $30 billion lower. Capital spending last year did, however, grow by almost 25%.

Newfoundland & Labrador Economic Assumptions

[ Per cent change unless otherwise noted ]

| Fiscal Year | 2025 | 2026 |

| Real GDP | 4.4 | 1.6 |

| Nominal GDP | 4.3 | 3.1 |

| Unemployment Rate (%) | 10.8 | 11.4 |

| Employment | -1.2 | -0.5 |

| Retail Sales | 2.0 | 1.7 |

| Population | 0.2 | 0.4 |

| 2025-26 | ||

| Exchange Rate (CAD/USD) | 0.70 | |

| Brent Price ($US per Barrel) | 73.0 |

Financial Challenges Exist, But Debt Levels Remain Controlled

Newfoundland and Labrador plans to borrow $4.1 billion this fiscal year of which $2.6 billion represents a net new funding requirement. The remainder is for debt maturity pre-borrowing and increased liquidity needs. All in, this figure is higher than the $2.8 billion in gross requirements this past fiscal year. Increased borrowing and current deficits are driving the stock of net debt to a projected $19.4 billion in FY 2025/26, or around 44.7% of GDP. This represents a slight increase from the 44.4% recorded last fiscal year. While the debt ratio has stabilized over the last two years, it still represents the highest debt burden across Canada’s provinces.

Bottom Line

The N.L. government is set to spend another year in deficit territory before an improved economic growth backdrop lifts coffers and returns the budget into the black in FY 26-27. The government’s 2025 GDP forecast may be on the optimistic side given the worsening global trade backdrop, but a healthy contingency fund could spare the province from diving deeper into the red ink.

Newfoundland & Labrador Fiscal Position

[ C$ millions, unless otherwise noted ]

| Fiscal Year | 24-25 | 25-26 | 26-27 | 27-28 | 28-29 | 29-30 |

| Revenues* | 10,254 | 10,670 | 10,819 | 10,726 | 11,150 | 11,391 |

| % Change | - | 4.1% | 1.4% | -0.9% | 4.0% | 2.2% |

| Less: Oil Risk Adjustment | - | 0 | 20 | 40 | 55 | 75 |

| Expenditures | 10,506 | 11,042 | 10,703 | 10,636 | 10,714 | 10,745 |

| % Change | - | 5.1% | -3.1% | -0.6% | 0.7% | 0.3% |

| Base Expense | - | 10,365 | 10,281 | 10,224 | 10,303 | 10,332 |

| 100% Funded | - | 677 | 422 | 412 | 411 | 413 |

| Surplus (+)/Deficit (-) | -252 | -372 | 96 | 51 | 381 | 571 |

| % of GDP | -0.6% | -0.9% | 0.2% | 0.1% | 0.8% | 1.0% |

| Net Debt | 18,500 | 19,400 | ||||

| % of GDP | 44.4% | 44.7% |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: