2025 New Brunswick Budget

Spending, Economic Risks Driving Deficits

Marc Ercolao, Economist | 416-983-0686

Date Published: March 19, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

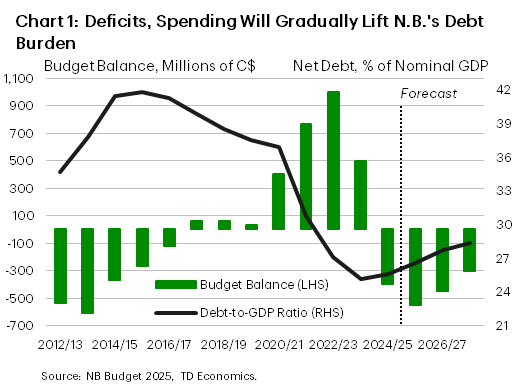

- New Brunswick is expected to record a budget deficit of 1.1% of GDP in FY 2025/26. Moderate but shrinking shortfalls are projected over the four-year horizon.

- Economic growth assumptions for 2025 have been scaled back in the face of trade uncertainty and slowing population gains. Risks to the government’s outlook are tilted to the downside, counterbalanced by the incorporation of a heathy contingency fund.

- The Province’s debt burden is expected to record steady increases over the next several years. At 26.6% in FY 2025/26, New Brunswick’s debt-to-GDP ratio would still be one of the lowest among provincial jurisdictions.

In its first post-election Budget, the Province of New Brunswick (N.B.) is projecting a $549 million deficit for FY 2025/26 (or 1.1% of GDP), before accounting for a newly-introduced $50 million contingency fund. This comes after a $400 million deficit in FY 24/25, which was revised from a modest $40 million surplus shown in last year’s budget. That ended a seven-year streak of black ink.

The government is keeping with its election pledge by pushing forward with priority spending in areas like health care, housing, and education. The budget also established a business support package of $112 million to combat against U.S. tariff uncertainty.

Economic Projections Acknowledge Some Risks Around Trade

The government is anticipating real GDP growth in 2025 to slow to 1.1% from an estimated gain of 1.5% the year prior. The forecast attributes the slowdown to a deceleration in population growth and trade uncertainty (although regarding the latter, no explicit tariff assumptions were provided). Real GDP growth is then projected to accelerate slightly to 1.3% next year and average 1.5% in the outer years of the forecast horizon.

These projections are below our own comparable March projections of around 0.5% this year and next. We have incorporated both conservative assumptions around U.S. tariffs as well as disproportionately deeper impacts relative to most other Canadian provinces. However, the budget has adopted cautious assumptions around GDP inflation, which leaves nominal GDP forecasts roughly in line with our own. Additionally, the projected 3.2% gain in 2025 nominal GDP is below the province’s long-term average.

Consistent with the moderate nominal growth, revenue is expected to rise by 4.0% this year, with revenue gains being scaled evenly across personal and corporate income taxes. No significant tax measures were incorporated in the Budget. Further, the budgeted $50 million contingency is enough to offset lower GDP growth of roughly 0.2 to 0.3 ppts – any downside to growth materializing past this will weigh further on the bottom line.

New Brunswick Economic Assumption

[ Percent Change Unless Otherwise Noted ]

| Budget 2025 | |||||

| Calendar Year | 2024 | 2025 | 2026 | 2027-29 | |

| Nominal GDP | 3.9 | 3.2 | 2.7 | 2.6 | |

| Real GDP | 1.5 | 1.1 | 1.3 | 1.5 | |

| Employment | 2.9 | 1.0 | 0.7 | 0.8 | |

| Unemployment Rate (%) | 7.0 | 7.3 | 7.2 | 7.1 | |

| Population | 2.7 | 0.9 | 0.5 | 0.6 | |

| Retail Trade | 3.2 | 3.5 | 2.8 | 3.0 | |

| CPI | 2.2 | 1.8 | 2.0 | 2.0 | |

Brisk Spending Gains in FY 25-26, More Modest Increases Beyond

On the opposite side of the ledger, expense growth is projected to expand at a 4.9% rate after last year’s robust 9.2% spending growth. New spending of $30 million is earmarked for the health care sector to improve access to primary care. Other focus areas include education and housing, with a planned increase of $18.8 million for the New Brunswick Housing Corp. to build more homes. Expense growth subsequently slows to under 2.5% per year over the remainder of the forecast horizon.

Meanwhile, the province has ramped up capital spending with a $1.26 billion plan for FY 2025/26, representing a near 10% year-on-year gain. Capital spending growth is almost entirely focused on transportation infrastructure and health care.

Debt-to-GDP to Rise Modestly

New Brunswick’s net debt-to-GDP ratio is expected to drift slightly higher this fiscal year, as a decent gain in nominal GDP is outstripped by an increase in the level of debt. The Province expects the debt-to-GDP ratio to continue to grind steadily higher by FY 2028/29 to 28.4%, from 25.6% in FY 2024/25. Still, N.B. carries the lowest debt burden across the Atlantic provinces. Total borrowing requirements in FY 2025/26 are forecast at $3.5 billion, around twice as much as last fiscal year.Bottom Line

The New Brunswick government is projecting moderate deficits for the foreseeable future as it continues to keep its foot on the spending pedal in the face of economic uncertainty. Nonetheless, the province’s continues to boast a relatively low debt burden that provides some wiggle room alongside this year’s healthy contingency reserve.

New Brunswick Government Fiscal Position

[ Millions of C$ Unless Otherwise Noted ]

| Fiscal Year | 2024-25 | 2025-26 | 2026-27 | 2027-28 | |

| Revised | Budget | Plan | Plan | ||

| Revenues | 13,266 | 13,792 | 14,247 | 14,749 | |

| % Change | 4.4 | 4.0 | 3.3 | 3.5 | |

| Expenditures | 13,665 | 14,341 | 14,694 | 15,053 | |

| % Change | 9.7 | 4.9 | 2.5 | 2.4 | |

| Surplus (+)/Deficit (-) | -399 | -549 | -447 | -304 | |

| % of GDP | -0.8 | -1.1 | -0.9 | -0.6 | |

| Net Debt | 12,500 | 13,429 | 14,346 | 15,021 | |

| % of GDP | 25.6 | 26.6 | 27.7 | 28.3 | |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: