2025 Manitoba Budget

Trade War Could Impede Manitoba's Finances

Rishi Sondhi, Economist | 416-983-8806

Date Published: March 21, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

- Manitoba’s budget deficit is forecast to shrink to 0.8% of GDP this fiscal year, while both the ongoing shortfall and robust capital spending lift its debt burden by 0.8 ppts. However, those forecasts were made with relatively strong real GDP growth assumptions, which are threatened by the U.S.-Canada trade war.

- The provincial government stands ready to offer targeted supports in the event of a sustained trade war, although this will further impair the province’s fiscal position. Note that debt servicing charges are already gobbling up an elevated 9% of revenues.

- The Province is projecting robust spending growth in FY 2025/26 and plans on rolling out a massive capital plan, both of which could stimulate the provincial economy at what could be a turbulent time.

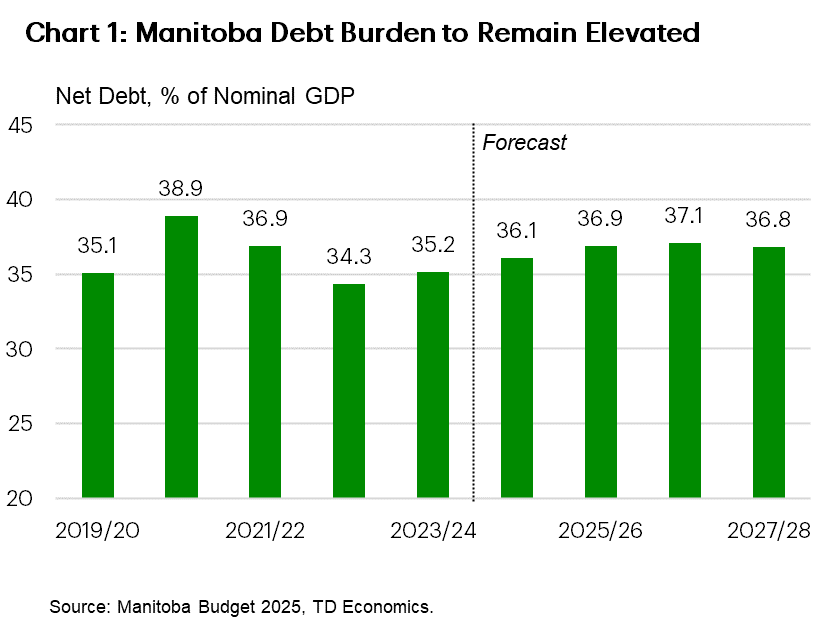

Faster-than-expected expense growth drove Manitoba’s $1.2 billion FY 2024/25 shortfall which was some $800 million higher than forecast in last year’s budget. This fiscal year, the government expects the deficit to shrink to $794 million as robust expense growth is paired with even stronger revenue gains. This anticipated shortfall represents 0.8% of GDP – roughly in line with the long-run average and on the lower end of provinces that have released budgets so far this year. The Province plans on balancing the budget by FY 2027/28. Net debt-to-GDP, meanwhile, is seen as creeping higher over the medium term.

Some modest tax relief is introduced in the budget, including support for businesses through lower payroll taxes. This follows the government’s decision to allow businesses affected by tariffs to defer the payroll tax for at least three months starting in February.

On the opposite side of the ledger, spending growth (net of debt servicing) is seen as accelerating this fiscal year after a below-trend increase in FY 2024/25. Infrastructure investment is an important focus of the budget. Indeed, the Province is set to roll out a $3.7 billion of spending in FY 2025/26 in the hopes that it will lift support economic growth during a tumultuous period.

Baseline Real GDP Growth Firm

The government’s baseline economic forecast sees real GDP growth advancing 1.7%, on average in 2025 and 2026, versus a 1.1% gain in 2024. These forecasts are firmer than ours, although our assumption of a stronger gain in the deflator in both years leaves our nominal GDP forecasts on par with the government’s.

Revenues are projected to advance at a heady 8% pace in FY 2024/25, lifted by income taxes and a hefty presumed gain in federal transfers. This is even with a built-in $200 million revenue contingency to guard against downside risks. Support to revenues will come from the government’s decision to freeze the indexation of the Basic Personal Amount (BPA) and tax brackets to inflation, which is expected to lift the government’s coffers by $40 million in FY 2025/26. This represents the largest new tax measure in the budget.

Manitoba Government Fiscal Position

[ Millions of C$ Unless Otherwise Noted ]

| Fiscal Year | 2024/25 Forecast |

2025/26 Budget |

|

| Revenues | 23,267 | 25,056 | |

| % Change | 6.8 | 7.7 | |

| Expenditures | 24,506 | 25,850 | |

| % Change | 3.1 | 5.5 | |

| Operating Surplus (+) / Deficit (-) | -1,239 | -794 | |

| % of GDP | -1.3 | -0.8 | |

| Net Debt | 34,472 | 36,500 | |

| % of GDP | 36.1 | 36.9 | |

On the opposite end, modest support measures for households and business are pledged including a reduction of the Health and Post Secondary Education Levy – commonly known as the payroll tax – benefitting about 1k businesses. The way it will work is that the threshold at which businesses start to pay the tax will be lifted to $2.5 million from the current level of $2.25 million. Meanwhile, the threshold at which the second tax rate kicks in will be raised to $5 million from $4.5 million. Additionally, the Homeowners Affordability Tax Credit will be increased, as will the Renters Affordability Tax Credit.

On the spending side of the ledger, total outlays (excluding debt serving charges) are projected to jump 6% in FY 2025/26, boosted by healthy gains in healthcare (reflecting new agreements with healthcare workers) and education spending.

Sustained, Steep Tariffs are a Severe Threat to the Outlook

While the government’s baseline real GDP growth forecasts are relatively rosy, Budget 2025 presents the government’s analysis of a scenario where 25% across-the-board tariffs are applied by the U.S. and Canada retaliates. The projections are quite severe for certain sectors, with a 55% drop in manufacturing real GDP in this worst-case scenario. Overall, the government estimates that nominal GDP could be reduced by up to 3.8%, pulling down revenues by up to $559 million in 2025, under this worst-case scenario. This would be comparable to the recession experienced by Manitoba in 2009. Chinese tariffs on agricultural products plus their on-going antidumping investigation into Canadian canola products are also a key risk to the outlook, according to the government.

If tariffs were sustained, the government would offer $500 million additional spending and supports, made up of funding for trade exposed firms as well as money for skills training and for increased demands on government programs and services. Meanwhile, some $125 million would be made available through loans and guarantees, while the government’s revenue contingency would be boosted to $600 million. These measures would add $1.1 billion (about 1.1% of nominal GDP), to the deficit.

Manitoba one of the More Indebted Provinces

Net debt-to-GDP is forecast to increase from last year’s estimated 36.1% to 37.1% by FY 2026/27, before easing to 36.8% by FY 2027/28. This would leave Manitoba as one of the more highly indebted provinces. Notably, debt servicing charges are seen as gobbling up 9% of revenues this year, down from 10% in FY 2024/25, but above the post-GFC average and higher than provinces such as Ontario and Quebec, where ratios are closer to 6%.

The increase in the debt burden will be fueled by the combination of deficits and capital spending. Manitoba’s record $3.7 billion capital plan will invest in healthcare and education structures, as well as highways. Of note, February’s capital intentions survey suggested that public sector capital spending will be flat this year, although this follows back-to-back double digit annual gains.

Borrowing requirements are expected to total $5.9 billion in FY 2025/26, compared to a forecast of $6.2 billion for FY 2024/25 at the time of last year’s budget.

Bottom Line

The combination of robust program spending growth and solid capital investment could buffer Manitoba’s economy at a potentially vulnerable time. Note that Manitoba’s public sector accounts for an outsized share of its GDP. However, net new tax reduction measures are unlikely to offer any meaningful lift this year.

Manitoba remains highly indebted, and debt servicing charges are taking up a sizable 9% of revenues. Manitoba’s net debt burden is forecast to push higher, and this is with relatively lofty economic growth assumptions. Should downside growth risks manifest, then Manitoba’s fiscal position could deteriorate more significantly.

The province has taken the prudent step of outlining a worst-case tariff scenario and stands ready to offer supports to impacted businesses at the cost of a significantly worsened fiscal position. Unfortunately, given its large manufacturing sector, Manitoba is highly exposed to the U.S.-Canada trade war.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: