Highlights

- Zero-emission vehicle adoption has been expanding across Canada, but more so in British Columbia and Québec where the market has benefited from years of consistent government support.

- In particular, provincial and federal rebates for consumers buying or leasing zero-emission vehicles have been instrumental in shoring up consumer demand.

- As zero-emission vehicles have higher sticker prices than conventional vehicles, rebates continue to be necessary for helping the market to grow in line with the escalating sales targets that are set to reach 100% by 2035.

- Weak sales of zero-emission vehicles following the elimination of purchase subsidies in countries like Germany bring into question plans to phase out many of the provincial and federal rebate programs over the next two years.

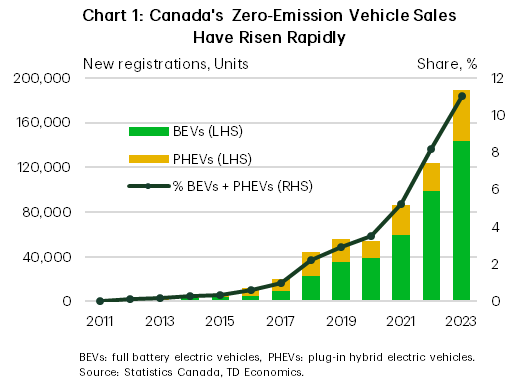

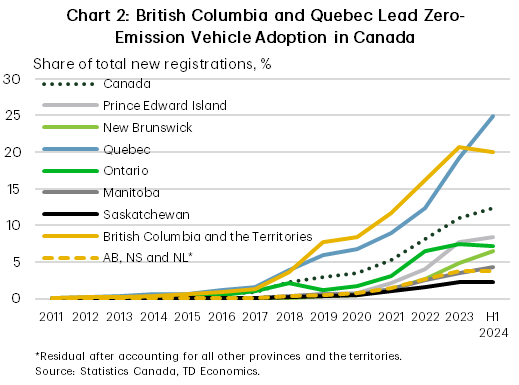

Sales of zero-emission vehicles (ZEVs) have been rising quickly in recent years, from virtually nothing just a few years ago to comprising over 12% of new light-duty vehicle registrations in the first half of 2024.1 However, the distribution of sales across the country is skewed as Québec and British Columbia have much higher ZEV adoption rates compared to the rest of the country. In the first six months of 2024, ZEVs accounted for about 25% of sales in the former province and 20% in the latter. The third highest market share was just 8.4% in Prince Edward Island. Overall, more than 60% of new ZEVs have been registered in British Columbia and Québec every year since 2019.2

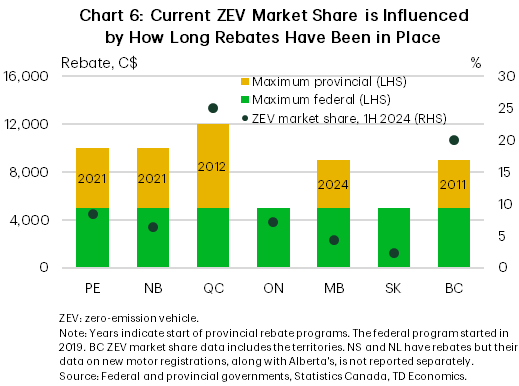

The differences between British Columbia and Québec versus other provinces highlight the role that consistent supportive government policies have played in bolstering ZEV sales. For the two leading provinces, these include rebates for consumers purchasing or leasing ZEVs and regulatory standards which require car manufacturers to sell a minimum level of ZEVs in the domestic market. Additionally, public charging infrastructure has also increased faster in the two provinces.3 While many provinces now offer rebates, as does the federal government, British Columbia and Québec introduced their programs earlier, helping to build momentum in the market. The long lead time the two markets have had to grow explains their higher ZEV adoption rate today though they are no longer unique in offering rebates.

As many of the rebate programs are expected to end in 2025 and 2026, ZEV mandates will be the main tool used by governments to encourage ZEV adoption, including the federal standard which will be applicable starting with the 2026 vehicle model year. However, it is questionable if the mandates will be sufficient for helping the country achieve the ZEV sales targets set for this decade. This is because ZEVs continue to be more expensive to buy/lease than comparable gasoline and diesel vehicles. Without subsidies to help reduce the price disparity, sales will likely weaken. In fact, this scenario is currently playing out in Germany and the U.K. where the recent phase out of purchase incentives has affected sales. It is necessary for governments in Canada to rethink plans to end the subsidies and perhaps restructure the programs to focus more on supporting lower-income individuals.

ZEV sales have increased strongly in recent years

Annual ZEV sales have been growing rapidly in Canada helped by a combination of supportive government policies as well as the increasing production of more affordable mass market ZEV models and growing consumer preference for ZEVs. Around 189,000 new full battery electric and plug-in hybrid electric light-duty vehicles were registered in Canada in 2023, four times the number registered just five years earlier. Over the same period, their market share of light-duty vehicle sales increased from 2% to 11% (chart 1). This share climbed to 12.3% in the first six months of 2024.

There has also been a shift in the mix of new ZEVs registered towards full battery electric vehicles (BEVs) which now comprise a majority of ZEV sales in all regions. This change is positive for emissions reduction efforts as full battery electric vehicles have no tailpipe emissions unlike plug-in hybrids (PHEVs) which rely on internal combustion engines for extended range.

Québec and British Columbia lead ZEV uptake in Canada

Sales vary across Canada with Québec and British Columbia largely being the primary markets driving national numbers. The market share of ZEVs in the two provinces in 2023 was almost three times as high as it was in Ontario and PEI, the provinces with the next highest adoption rate (chart 2). Moreover, in the last five recent years, British Columbia and Québec accounted for more than 60% of national ZEV sales while representing just 36%4 of the population.

Rebates improve payback period for ZEVs

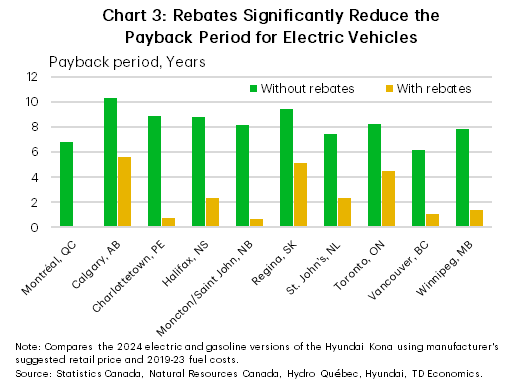

While electric vehicles have higher purchase and lease prices, they generally have lower running costs as they are more fuel efficient and require less maintenance compared to internal combustion engine vehicles.5 In many cases, the lower fuel and maintenance costs can compensate for the higher upfront costs of electric vehicles within a few years.

The availability of rebates narrows the price differential between electric vehicles and gasoline vehicles, which in turn reduces the payback time for electric vehicles and makes them a more attractive option for consumers. Taking the gasoline and electric versions of the Hyundai Kona as an example, the payback period for the electric Kona would range from 6 years in Vancouver to 10 years in Calgary in the absence of rebates. However, with current maximum federal and provincial rebates, the price differential between the two versions of the Kona is eliminated in Québec. In other provinces, the payback time falls to less than a year in Prince Edward Island and New Brunswick and almost six years in Alberta (chart 3).

But it takes time for a new market to develop

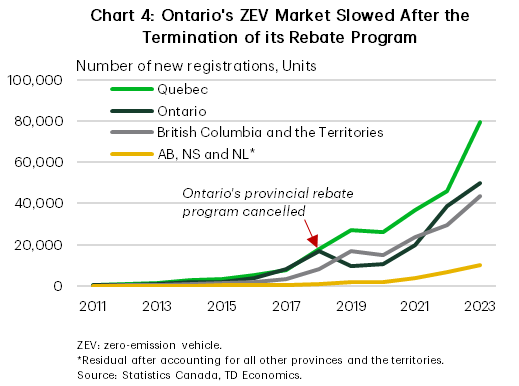

Government rebate programs are now widely available across Canada, but they were first introduced in the early 2010s in Ontario, British Columbia and Québec (table 1, appendix). These rebates and other support for building out public charging infrastructure were instrumental in helping the ZEV market develop faster in the three provinces. By 2018, the year in which Ontario’s program was cancelled, the market share of ZEVs was 2-4% in those three provinces versus 0.3% or less in other provinces. The importance of the incentives for shoring up consumer demand was demonstrated by the drop in ZEV sales and market share in Ontario in 2019. As a result of the change in policy, sales in Ontario diverged from Québec’s and have consistently remained lower in subsequent years (chart 4). It is likely that the decline would have been steeper and the recovery slower without the federal rebate, which became available starting May 2019.

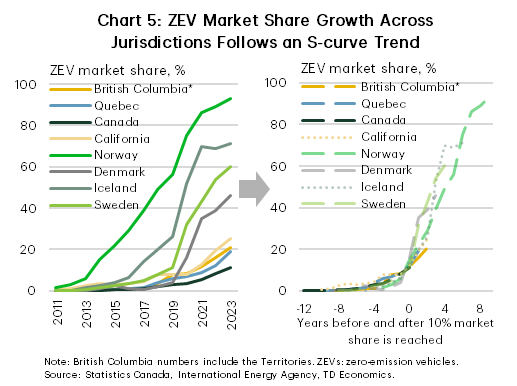

The trajectory of the ZEV sales market share in many regions seems to be typical of the so-called ‘S-curve’ growth trend for new technologies, which is characterized by slow growth in the initial years, followed by rapid growth and then slower growth again as sales approach market saturation. Leading ZEV markets such as Norway and Iceland, where uptake rates were 93% and 71%, respectively, in 2023, exhibit this pattern. British Columbia and Québec seem to also be following a similar path though they still have some ways to go to reach market share levels seen in Norway and Iceland (chart 5). It took 6-7 years from when the provincial rebates were implemented for the market share of ZEVs to reach around 4% by 2018 in the two provinces. However, over the next five years, during which period subsidies available to consumers were boosted by the introduction of the federal rebate, the ZEV market share rose to about 20% by 2023.

The evolution of the ZEV market in British Columbia and Québec indicates that it takes time for the market share to grow while Ontario’s trajectory shows that reducing support too early could arrest development. The S-curve also partly explains the variation in the current market share of ZEVs in British Columbia and Québec versus the other provinces that introduced rebates in the past three years (chart 6). In fact, a buyer eligible for the maximum provincial and federal rebates would get more in Prince Edward Island and New Brunswick ($10,000) than in British Columbia ($9,000). Hence, looking at current rebates alone, one would expect similar or higher uptake rates in the two Atlantic provinces. However, that is not the case as the markets in many of the regions in Canada that have relatively new purchase subsidies have not had enough time to develop.

ZEV mandates complement demand-side policies

While rebates are intended to encourage consumers to choose ZEVs over gasoline/diesel vehicles, ZEV mandates compel car companies to sell ZEVs in the regulated market (for which they earn compliance credits, similar to other regulatory systems such as the clean fuel regulations or the industrial carbon price). Québec and British Columbia are currently the only regions in Canada that have operative ZEV standards. Both mandates have an increasing sales target that will reach 100% zero-emissions light-duty vehicles by 2035.6,7 However, starting with the 2026 vehicle model year, manufacturers will be subject to the federal ZEV regulations, which also require 100% ZEV sales by 2035.8

These mandates can incentivize car companies to prioritize the regulated markets, be it to avoid being fined for non-compliance or to generate additional revenue from selling excess credits to other car manufacturers. Inventories data shows that British Columbia and Québec have more supplies of ZEVs at dealerships compared to other regions.9 Ontario and British Columbia are interesting contrasts especially given population differences between the two. Although absolute sales of ZEVs in Ontario surpassed British Columbia’s beginning in Q4 2021, inventories at dealerships were about 62% greater in British Columbia by the end of the following quarter. This data suggests that sales in British Columbia and Québec could also be helped by the availability of more vehicles for potential buyers to choose from while insufficient supply in other regions could be a hinderance to sales. In other words, the policy combination of carrots and sticks may be a more effective tool for supporting ZEV market growth.

Is the market ready to be weaned off rebates?

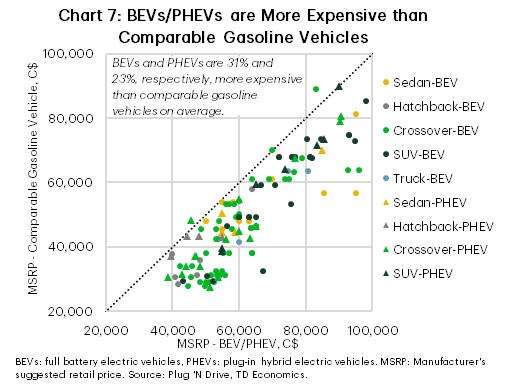

Lithium-ion battery prices have fallen by over 80% (in real dollars) since 2013,10 enabling ZEVs to become more affordable over time. However, there is still a price disparity between ZEVs and conventional vehicles. For ZEV models that are available in Canada, full battery electric vehicles are about 31% and plug-in hybrids around 23% more expensive than comparable gasoline vehicles (chart 7). Furthermore, there are not many ZEV alternatives for some of the popular gasoline vehicles below the $30,000 price point.

Trends in countries like the U.K. and Germany that recently phased out their support programs suggest that purchase incentives may still be necessary. Following the elimination of a grant for private buyers in 2022, the growth in ZEV sales and market share in the U.K. has been driven by fleets and businesses, for whom subsidies are available, while sales to individuals have declined.11 In Germany, the first phase of subsidy removal applied to plug-in hybrids in early 2023 and led to a 50% drop in plug-in hybrid sales that year, which in turn contributed to a 16% drop in total ZEV sales. Additionally, the market share of ZEVs declined from 31% to 24%, the first such drop based on records going back to 2010.12 Data from the first half of 2024 indicates the market remains weak, with the slump extended to full battery electric vehicles whose subsidy was removed at the end of 2023.13

With many of Canada’s rebate programs scheduled to expire over the next two years (table 1, appendix), the ZEV mandates will be the main tool governments use to drive ZEV adoption in much of the country. Given the existing sticker price premium on ZEVs, it is doubtful that sales can grow at levels commensurate with targets set for the next decade without the rebates. If anything, current market trends in Germany and the U.K. put into question the wisdom of plans to phase out purchase incentives in the country. Instead of eliminating the programs, they could be restructured to provide support to lower-income buyers who are least likely to be able to afford the high upfront prices of ZEVs. British Columbia’s program provides a model in which rebate amounts vary with an applicant’s income. Similarly, California also recently cancelled its general rebate and has enhanced the program aimed at low-income individuals, including offering higher rebates for those scrapping their current gasoline vehicles and replacing it with a ZEV.

Although not the focus of the paper, it would be amiss not to mention the carbon price. From the Hyundai Kona example above, the payback period for the electric Kona would be a few months higher in the absence of the current carbon price. Additionally, a stronger carbon price would have a bigger impact on helping to make electric vehicles more competitive. Overall, a policy toolbox that includes ZEV mandates, a strong carbon price and ZEV rebates for lower-income individuals (until upfront price parity is reached) would put Canada in a better position to achieve its ZEV sales targets and emissions reduction targets for the transportation sector.

Appendix

Table 1: Zero-Emission Vehicle Rebates

| Maximum Incentive Amount | Start | End | |

| Current Programs | |||

| Federal | $5,000 (available across Canada and is additive to provincial/territorial rebates) |

2019 | 2025 or until funds run out |

| Newfoundland and Labrador | $2,500 | 2023 | 2025 or until funds run out |

| Prince Edward Island | $5,000 | 2021 | |

| Nova Scotia | $3,000 | 2021 | Available until funds runs out |

| New Brunswick | $5,000 | 2021 | |

| Québec | $7,000 Amount to decrease in 2025 and 2026, reaching $0 in 2027 |

2012 | 2026 |

| Manitoba | $4,000 | 2024 but applies retroactively to 2023 | 2026 |

| British Columbia | $4,000 | 2011 | |

| Yukon | $5,000 | 2020 | |

| Expired Programs | |||

| Ontario | $10,000 plus an additional $3,000 for vehicles with larger battery capacities and $1,000 for vehicles with 5+ seats | 2010 | 2018 |

End Notes

- Statistics Canada, New motor vehicle registrations, quarterly (September 9, 2024)

- Statistics Canada, New motor vehicle registrations, annual sum (September 9, 2024)

- Transport Canada, Electric charging and alternative fuelling stations locator data

- Statistics Canada, Population estimates on July 1, by age and gender (February 21, 2024)

- Canada Energy Regulator, Market Snapshot: Battery electric vehicles are far more fuel efficient than vehicles with internal combustion engines (February 24, 2021)

- Quebec Government, Regulation respecting the application of the Act to increase the number of zero-emission motor vehicles in Québec in order to reduce greenhouse gas and other pollutant emissions

- British Columbia Government, Zero-Emission Vehicles Amendment Act, 2023

- Government of Canada, Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations: SOR/2023-275

- Dunsky Energy + Climate Advisors, Zero Emission Vehicle Availability: Estimating Inventories in Canada, 2022 Update (January 31, 2023)

- BloombergNEF, Lithium-Ion Battery Pack Prices Hit Record Low of $139/kWh (November 27, 2023)

- Theo Leggett, Electric car sales to private buyers fall sharply, BBC News (October 5, 2023)

- International Energy Agency, Global EV Data Explorer (April 23, 2024)

- Cécile Boutelet, Germany: Drop in electric car sales weakens battery industry, Le Monde (July 16, 2024)

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: