Highlights

- The Canadian economy is going to bounce back from January's weak employment report, as we are likely past the worst of the Omicron wave and government restrictions have already started lifting.

- When we look past this temporary setback, we see an economy that is still humming. Business output has fully recovered, employment is above pre-pandemic levels, and inflation is pushing multi-decade highs. What's missing is wages.

- Several factors have delayed an acceleration in wage growth, including the stop-start nature of the recovery, but our analysis shows that workers will likely see significant wage growth over the next year.

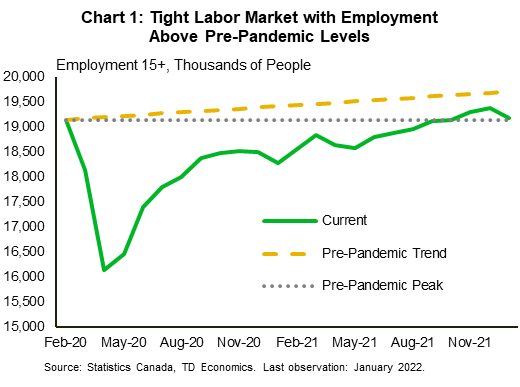

Despite the setback in January, the Canadian labour market continues to exhibit strength. We expect the unemployment rate to fall from 6.5% in January to 5.7% (the February 2020 rate) in a matter of months. In terms of total employment, there are now more than 32 thousand people with a job today than there were before the pandemic (Chart 1).

Notwithstanding the speed of recovery, wages have failed to keep up with the cost of living. This has left many Canadians feeling the pinch, hoping that it is just a matter of time before wages adjust to reflect the current feverish demand for workers.

Is the Labour Market Really that Hot?

As we showed in the first chart, the number of Canadian's employed is higher than in early 2020. But what the chart also reveals is that we still have further to go before employment returns to its pre-pandemic trend. By our calculation, we would need to see another 500 thousand jobs in order to return to that trajectory. In other words, there may need to be more labour market improvement before things really start to heat up.

The other factor influencing wages is the willingness and ability for Canadians to remain (or even re-enter) the workforce. The prime age labour force participation rate (15 to 64-year-olds) has risen to 79.3%, compared to 78.8% in February 2020. This level of participation stands out relative to Canada's global peers with respect to the total, but also when broken down by sex. We have seen participation rise among both men (82.6% from 82.1%) and women (75.9% from 75.6%) since the start of the pandemic. The boost in participation means that Canada has 67 thousand more men and 38 thousand more women in the workforce today than it would have if pre-pandemic participation rates persisted. Much has been made about how participation rates in the U.S. are much lower than in Canada. With fewer workers, businesses in the U.S. have had to fight harder to attract and retain workers and are having to raise wages to do so. Higher labour force participation is a great thing for Canada, but it means that wage growth may have been delayed.

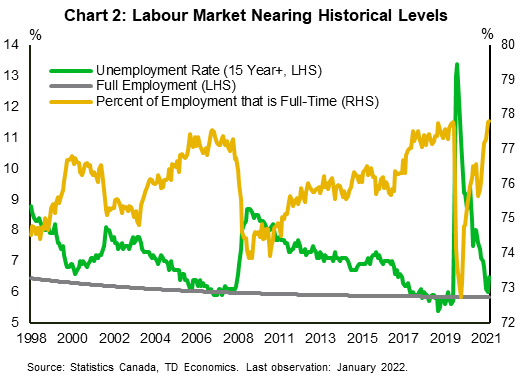

From our lens, this means that higher wage growth could be just around the corner. The cyclical indicators are pointing to this outcome. For one, the job vacancy rate is very elevated at 5.4%. At the same time, the number of hours worked by employees had been rising and should start to accelerate again now that the worst of the Omicron impact looks to be behind us. Furthermore, the number of Canadians that have voluntarily quit their job have risen. As more workers switch jobs, wages tend to rise. The demand for workers has also allowed many people to switch out of part-time jobs and into full-time ones. Indeed, the share of full-time employment has reached the peak of the last three business cycles (Chart 2). This peak correlates well with the unemployment rate and has historically served to confirm that the Canadian labor market has reached full employment. This could further boost wages as full-time workers tend to have more bargaining power than part-time workers.

Timing the Wage Jump

Over the last 12 months, the average hourly wage rate has grown at 2.4%, compared to 5.5% in 2020 and 3.8% in 2019. This deceleration in wages has occurred while consumer prices have grown at 4.8% in 2021 (compared to 0.7% in 2020 and 2.2% in 2019). With the drop in consumer purchasing power and employee bargaining power increasing in a drum-tight job market, further wage acceleration is likely in store.

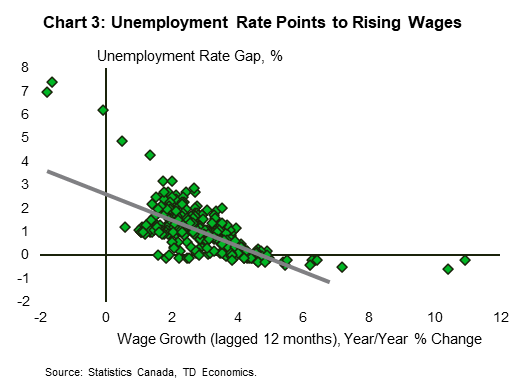

To help determine when Canadians could expect this adjustment to occur, we simulated our internal models to map out the timing and magnitude of where wages are headed. What we found was that when an improvement in employment occurs, it takes around six months to a year for wages to fully respond. Though that seems like a long time, it means that wages at the end of 2022 should see a notable move upwards (Chart 3).

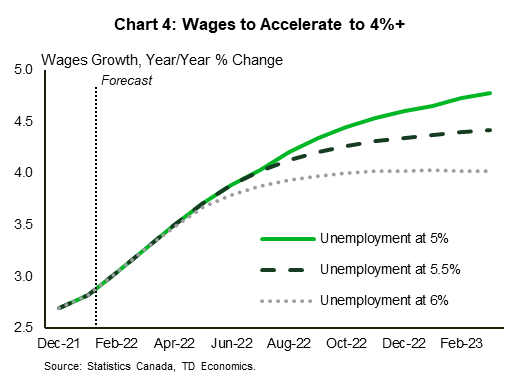

How high wages get will be highly dependent on how much more improvement we see in employment. We tested three scenarios for the unemployment rate. One where the unemployment rate returns to 6%, one where it goes to 5.5%, and another where it hits 5% (Chart 4). Based on our model output, even if the economy stabilizes at year-end 2021 levels, wages should still rise to around 4%, offsetting the devaluation of real wages over 2021 (assuming CPI inflation moderates). In the most robust scenario, wages could push towards 5%, a much hotter labour market than we currently have today.

There are certainly other factors that could influence the outcome for wages. In our example above, we assume inflation goes from 5% today and gradually returns to 2% by the end of 2023. Should inflation come in higher/lower than that forecast, we would assume that there would be a one-for-one impact on wages over time. Secondly, productivity improvements could also impact wages. Prior to the pandemic, weak productivity had been a limiting factor for wage growth.

Bottom Line

With the labour market tight and inflation at 5%, it is surprising that wages have failed to keep up. That looks about to change. Workers have not had this level of bargaining power in decades. Though there have been some factors delaying the growth of wages, our analysis shows that workers will likely see significant wage growth in 2022.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: