Canadian ‘Supercore’ Inflation

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Tarek Attia, Research Analyst

Date Published: March 23, 2023

- Category:

- Canada

- Financial Markets

Highlights

- We present a measure of ‘supercore’ inflation to assess the cyclical price pressures that may challenge the Bank of Canada’s ability to convincingly restore price stability.

- This measure is constructed in the spirit of Federal Reserve Chair Powell’s preferred inflation metric and has run hotter than other measures of core inflation in Canada.

- Given the ongoing strength in the labour market and the surge in consumer spending, there is a risk that the cyclicality of supercore inflation will be a fly in the ointment that delays the return of price stability.

Canadian CPI data for February continue to point to easing price pressures. Total inflation has slowed to 5.2% on a year-over-year (y/y) basis, down from 5.9% in January and 8.1% last spring. Core inflation metrics that strip out noisy price movements have also moderated with every measure now running below 5% year-on-year (y/y). For the Bank of Canada (BoC), this steady improvement is exactly what it was hoping for when it decided to pause rate hikes earlier this month. And although these are steps in the right direction, doubts remain. With the labour market refusing to cool, consumer spending has been ramping up again and wage growth continues to forge ahead at a pace inconsistent with BoC’s 2% inflation target.

Getting inflation lower is easy, but will it be low enough?

Despite these lingering risks, we expect y/y inflation to continue decelerating in the months ahead. This is because most of the inflation seen over 2022 occurred between January and June. Mainly due to Russia’s invasion of Ukraine, the average monthly inflation rate (annualized) during the first half of last year was approximately 10%. Since then, inflation has averaged close to 3% monthly. Assuming this trend prevails, by the time July rolls around, the 12-month change in inflation would be reduced to around 3%. Considering that 1% to 3% is the BoC’s range for acceptable inflation, there is a tailwind to support inflation returning to more comfortable levels by this summer.

But what next? Will inflation keep falling in a linear fashion back down to 2%? We’d argue that the path to get inflation to fall from 5% to 3% is easier than from 3% to 2% given underlying forces that may keep it from decelerating further. Here we are talking about cyclical inflation. South of the border, Fed Chair Jay Powell has a new favourite inflation gauge that he is tracking: a measure of services inflation that strips out housing and other non-market items. It is referred to as ‘supercore’ inflation, but it is really just cyclical inflation – the price pressures that come from the strength of the domestic economy. When the economy is humming along, this measure of inflation picks up. This is why the Fed keeps talking about how it needs to see cooling in the labour market before it can be confident inflation is on the path back to 2%.

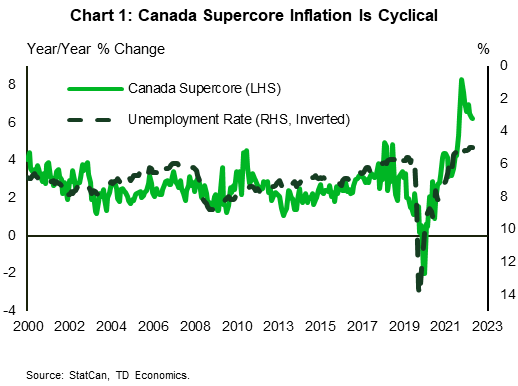

The BoC hasn’t referenced a version of supercore inflation like its U.S. counterpart, but it has talked about its concern that the domestic economy remains too hot. In order to explore how cyclical inflation has been trending in Canada, we have built our own measure. Here we only include services in which prices respond to changes in demand. Given the structure of Canada’s economy and with various levels of government involvement in price setting, this is admittedly narrower than any U.S. version (10% of the basket vs 15% in the U.S.). For example, we have to exclude things like childcare in Canada. As we show in Chart 1, this inflation closely follows the unemployment rate, implying strong cyclicality.

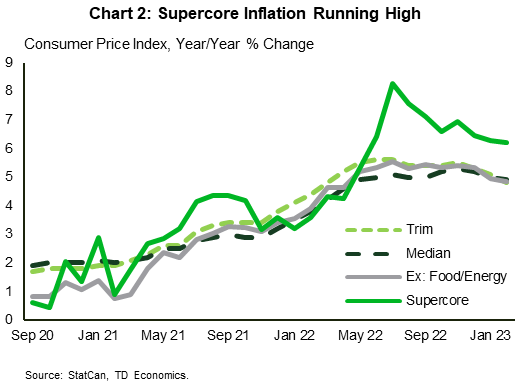

When we compare Canadian supercore inflation to other popular core measures, we can see that it is tracking well above (Chart 2). Indeed, cyclical inflation is running 1.4% ppts above the average of the BoC’s Trim, median, and CPI ex. food and energy . Contributing to this is the relatively high weight of household services (ex-child care), travel, and recreation. The impact of rising wages and still apparent pent-up demand for services means that this supercore measure will hang-up around 4 % to 5% through this summer. This is because the drivers of cyclical inflation kept rolling even when goods prices started to fall last summer. It won’t be until the very end of this year or even in early 2024 before cyclical inflation can get to the edge of the BoC’s 1% to 3% target range.

Looking for a shock

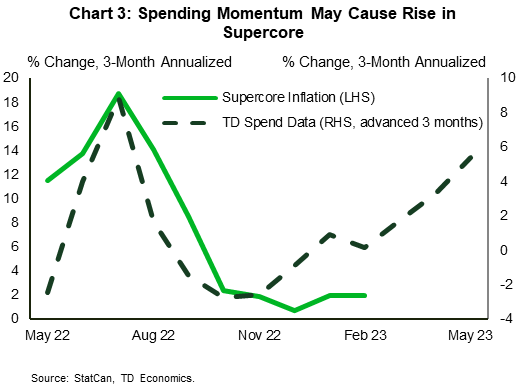

This slower deceleration is a concern for the Bank of Canada. Given its cyclicality, there is a risk that it could see another turn higher following the recent surge in employment and subsequent rush of consumer spending. As we show in Chart 3, the three-month annualized pace of supercore inflation is tied to growth in consumer spending. Although supercore unexpectedly dipped to the 2% pace over the last 3 months ended February - this respite may not last.

The BoC should be closely watching this. It is great that goods inflation and various non-market items have pulled CPI to more comfortable levels. But that is the low hanging fruit when it comes to bringing down inflation. The BoC will need the cyclical side of the economy to slow for supercore to ease. Any pickup in demand now will delay the timing of this. For the BoC to achieve its goal of price stability, it needs the current upturn in economic momentum to come to a halt.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: