Tip of the Iceberg:

Rising Debt Service Costs Are Only Starting to Be Felt by Canadian Households

James Marple, Associate Vice President | 416-982-2557

Rannella Billy-Ochieng’ , Senior Economist

Ksenia Bushmeneva, Economist | 416-308-7392

Date Published: December 19, 2022

- Category:

- Canada

- Consumer

- Real Estate

- Provincial & Local Analysis

Highlights

- The Bank of Canada nearing the end of its rate hiking cycle. From 0.25% in February, the overnight rate has risen to 4.25%. We anticipate another 25 basis points in additional hikes, taking the overnight rate to 4.5% in early 2023.

- While interest rates have been rising since the start of this year, the impact on household’s bottom lines has only just begun. Debt service costs rise with a lag as mortgages and loan payments are renewed at current market rates.

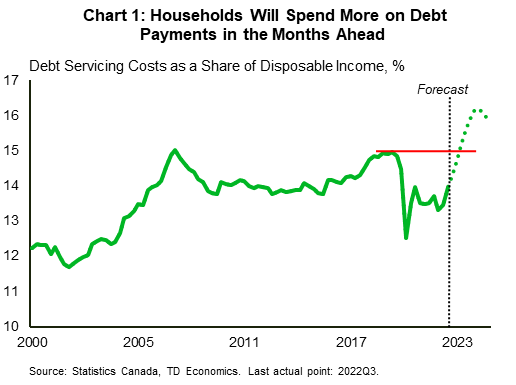

- From a starting point of 13.3% of disposable income in the first quarter of 2022, debt service ratio increased to 14% in the third quarter. The debt service ratio is likely to rise by another two percentage points, eclipsing the pre-pandemic peak by the second half of next year.

- The increase in debt service will come entirely from higher interest payments. As already witnessed in the third quarter, payments on principal will likely continue to trend lower, as qualifying households extend amortizations and slow non-mortgage debt repayment to mitigate the increase in required monthly payments.

- Households will need to adjust spending and saving in order to accommodate higher debt payments. Fortunately, the personal saving rate is elevated relative to its pre-pandemic level, providing a cushion. Still, we expect consumer spending growth to stall over the course of 2023 and much of the excess saving built up during the pandemic to be drawn down by the rise in debt service costs.

In early December, the Bank of Canada raised its key lending rate by 50 basis points (0.5 percentage points), bringing it to 4.25%. In its accompanying statement, the central bank signaled that, after 400 basis points in hikes since March, it is likely nearing the end of its rate hiking cycle. We expect the overnight rate to a peak at 4.5% in the first quarter of 2023.

Higher interest rates have already made their way to new borrowers. Variable rate mortgages have seen rates go up one-for-one with increases in the policy rate (see Text Box 1), while fixed rate mortgages have risen by over 200 basis points. Rising borrowing costs have slowed housing market activity, and some borrowers are already feeling the sting. As glaring as those changes have been, much of its impact on borrowers is yet to come.

As loans renew at a higher rates, debt servicing costs will continue to climb. Canadian households currently spend 14% of disposable income on principal and interest.1 This figure will likely rise by another two percentage points to above 16% by the end of 2023 (Chart 1).

The increase in debt service will be driven entirely by higher interest costs. Principal payments will fall relative to income, as overall borrowing slows and as qualifying households that have the room extend their amortization in order to minimize the increase in monthly payments. With debt payments eating up more income, households will have to reduce savings or curb spending elsewhere, weighing on Canadian economic growth. We anticipate both over the course of 2023, with spending growth stalling and the personal saving rate drifting lower.

Text Box 1: Pandemic Sprint into Variable Rate Mortgages Will be Costly

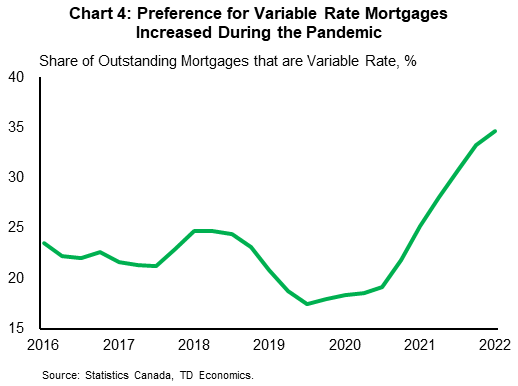

One of the legacies of the pandemic was that many households took advantage of record-low short-term rates to take on variable rate mortgages. From the start of the pandemic, the share of variable rate mortgages in mortgage originations increased from 6% in the fourth quarter of 2019 to 56% in the first quarter of 2022.

Much of the rise in the share of variable rate mortgages occurred in 2021, following guidance from the Bank of Canada in October 2020 that the policy rate should be expected to be held at the zero lower bound until sometime in 2023. Though this period, the share of variable rate mortgages in the overall stock of outstanding mortgages rose from below 20% to 35% (Chart 4).

The Pandemic Helped Push Down the Household Debt Service Ratio

One of the consequences of the pandemic has been a notable decline in the household debt service ratio (DSR). After peaking at 15% of disposable income in late 2019, the DSR sat at 13.3% at the start of this year.

The DSR fell and remained low throughout the pandemic even as household debt grew by a robust 16.5% (or 6.3% annualized) from the end of 2019. Three factors explain its descent.

The first contributing factor was brisk growth in disposable income, which increased by an almost equally strong 6.2% annualized over the same period. Government income supports were key to sustaining growth in disposable income early in the pandemic, but as they pulled back they were replaced with solid growth in nominal employee compensation.

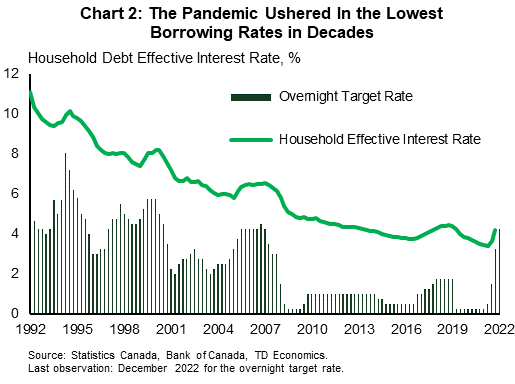

The second factor was a decline in the effective interest rate on household debt (calculated by dividing total interest payments by total debt). The effective rate fell from 4.4% in the final quarter of 2019 to 3.4% in the first quarter of 2022. In fact, with only a few exceptions – when the Bank of Canada has tightened policy – the effective interest rate on household debt has been on a thirty-year decline (Chart 2). The pandemic accelerated this trend.

The final factor behind the decline in the DSR was an increase in the average amortization of mortgage debt, which rose by slightly over half a year.2 The impact of this lengthening in average amortization was small, however, subtracting just 0.2 percentage points from the DSR.

Debt Service Costs Will Rise Quickly from Here

Even as the Bank of Canada approaches the end of its rate hiking cycle, the impact of higher rates on household finances is only just beginning. In the absence of a significant reversal in interest rates, the DSR will soar to a new record, peaking in the first quarter of 2024.

Driving the increase, the effective interest rate on household debt will continue to rise as households renew their mortgages or take on new credit at the current market rate. It has already risen from an estimated 3.4% in the first quarter to 4.2% in the third. Based on the historical relationship with market interest rates, as well as the shift in the composition of mortgages toward variable rates (from below 20% to 35% of outstanding mortgages), the average effective rate on household debt is likely to rise further from its current rate of 4.2% to over 6% by the first quarter of 2024. Underneath this, the effective rate on mortgages is expected to rise one and a half percentage points, while the rate on non-mortgage credit is expected to rise by slightly over three percentage points.

Faced with higher borrowing costs, some households that are not at their maximum amortization of 30 years may choose to extend the length of their loans. For variable rate mortgage holders with fixed rate payments, amortization will increase automatically, though only up to a point. Once borrowers hit rates at which they are no longer covering any principal, they may have to raise their payments.3

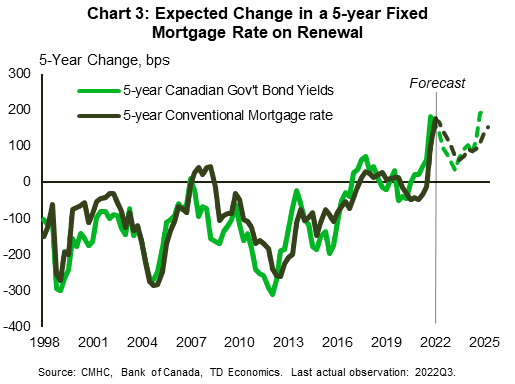

At the same time, an estimated 13% to 18% of fixed rate mortgage holders will face renewal next year. For these borrowers, interest rate increases will be the highest in twenty years (Chart 3). While there is a high degree of uncertainty around average amortization, our analysis suggests an upper bound increase of one year by the end of 2023. Anything less than this and the DSR will rise by an even greater amount.

Debt service cost will rise despite a sharp slowdown in household borrowing over the next year. We expect household credit to slow to under 2% year-on-year by the end of next year, down from 7.4% in the third quarter of 2022. Mortgage credit growth will lead the slowdown, but consumer credit will also lose momentum as spending on durable items – such as appliances and furniture – slows and renovation activity eases off, reducing demand for home equity lines of credit.

Three quarters of variable mortgages have fixed payments that only increase if the interest portion of a mortgage is not covered.3 According to the Bank of Canada, only 6% of mortgage holders have a variable rate that automatically reprices with interest rates. Those families, and others with mortgage contracts up for renewal have been the first to face higher interest costs.

Bottom Line

All told, even as the Bank of Canada comes to the end of its rate hiking cycle, household debt service costs will continue to rise, hitting new highs over the next year. Even with slowing household debt growth and some increase in average amortization, debt payments are set to rise by two percentage points of disposable income, exceeding the pre-pandemic peak of 15%.

The increase in debt service costs will come entirely from higher interest payments, which, on average, are expected to rise by 60% by the end of 2023. Meanwhile, the share of total debt payments going toward principal will drop, as repayment slows.

Text Box 2: Fixed Rate Mortgage Holders Will See Slower, but Longer Adjustment in Debt Payments

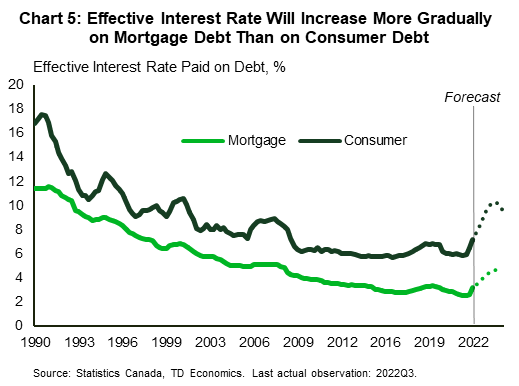

The average effective household interest rate can be broken down into mortgage debt and non-mortgage debt. The rate on mortgage debt is smoother than that on non-mortgage debt and slower to respond to changes in market interest rates (Chart 5).

While non-mortgage debt tends to be based on short-term variable interest rates, a large portion of mortgage debt is fixed and priced off longer-term government bond yields. As a result, mortgage debt is slower to rollover, as most households lock into fixed rate mortgages, with just under half of those with terms of five-years or more.

An estimated 13% to 18% of fixed rate mortgages are scheduled to renew over the next year. For 5-year fixed rate mortgages, increases in rates at renewal will range from 0.8 to 1.6 percentage points. In a hypothetical example, a borrower with a $500,000 mortgage originated in the third quarter of 2017 at the prevailing mortgage rate, would have their monthly payment rise by $700 in the third quarter of 2022 due to the 1.8 percentage point jump in the 5-year fixed rate relative to the time when the loan was originated.

The longer interest rates stay elevated, the more households will see their mortgage payments rise on renewal. Our forecast assumes that 5-year government bond yields peaked at 2.9% in the second quarter of this year, and will begin to move lower, stabilizing at 2.35% at the end of 2024. Mortgage rates are likely to follow bond yields lower. Even so, mortgage holders will continue to face higher mortgage payments on renewal, as interest rates remain higher than rates that prevailed when these mortgages were issued.

End Notes

- Latest available data is to the third quarter of 2022

- With data on the level of mortgage debt, debt payments and effective interest rates, we can estimate the average amortization for existing mortgages.

- According to Bank of Canada research published before the latest 50 basis point rate hike, about half of variable-rate mortgages or roughly 13% of all mortgages have already hit their trigger point. With the 50 basis point hike in early December, this share is expected to approach 17% of all mortgages. Murchison, Stephen & Maria teNyenhuis. 2022. “Variable-rate mortgages with fixed payments: Examining Trigger Rates” Bank of Canada Staff Analytical Note No. 2022-19. https://www.bankofcanada.ca/2022/11/staff-analytical-notes-2022-19/.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: