Are Rising U.S. Tides Washing Manufacturing Jobs to Canadian Shores

Thomas Feltmate, Director & Senior Economist | 416-944-5730

Date Published: November 3, 2022

- Category:

- Canada

- Commodities & Industry

Highlights

- While the U.S. has experienced a resurgence of reshoring in manufacturing activity through the pandemic, Canada has not benefited to the same degree.

- However, foreign direct investment into Canada's manufacturing sector has accelerated in the last year-and-a-half, offering some hope that future gains may already be in the pipeline.

- The most obvious inroads are in the transportation space. If North America is to become a meaningful global player in the production of electric vehicles, establishing a domestic end-to-end battery supply chain is essential.

- Given Canada's abundance of natural resources, it stands well positioned to becoming an integral piece of the supply chain, which has the potential to attract other related high skilled electronic manufacturing industries.

Are Rising U.S. Tides Washing Manufacturing Jobs to Canadian Shores?

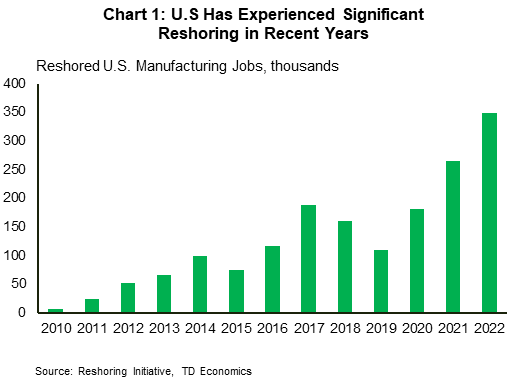

The COVID pandemic upended global supply chains and has led to a resurgence in companies moving some or all elements of the production process back to domestic shores. This concept of "reshoring" has become most apparent in the U.S., with some estimates suggesting nearly 800,000 manufacturing jobs have already returned to America since 2020 – more than double the number seen in the three years preceding the pandemic (Chart 1). A natural question to ask is whether Canada's manufacturing sector is also benefiting from reshoring? And if so, are there specific industries that have benefited the most?

To answer this question, we look at three main factors: domestic production to imports (DPI), employment metrics specific to the manufacturing sector, as well as foreign direct investment into the Canadian economy.

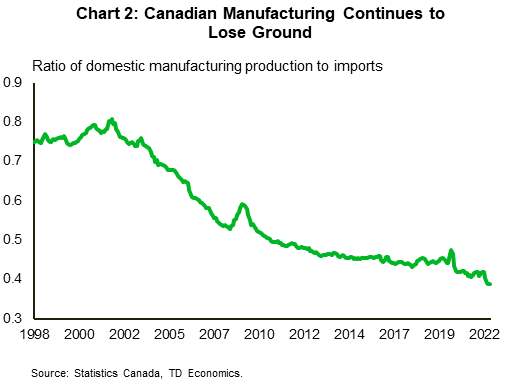

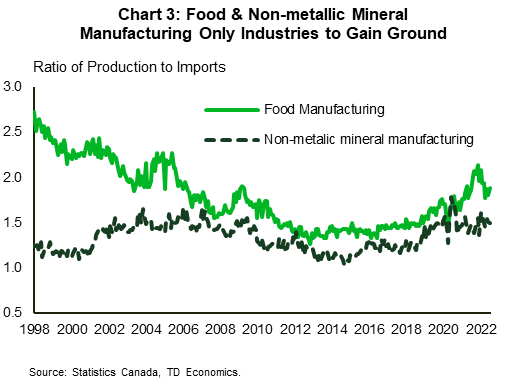

The rationale for examining domestic output to imports is simple. When domestic production and investment increases faster than the rate of imports (i.e., the ratio is rising), it suggests growth within the sector and hence some degree of "reshoring". Unfortunately, the aggregate metric offers little evidence of Canada's manufacturing sector gaining any ground in recent years. In fact, it's been just the opposite. Through the pandemic, the ratio has fallen by 6.5 points and is at the lowest level in history (Chart 2). Admittedly, this doesn't capture the whole story. Within the manufacturing sector, there are a number of different industries, so we would be remiss to not extend the analysis across each of them to see if there has at least been some shifting in industry composition. If that's the case, it could be a good predictor of where future gains will reside. Table 1 below summarizes the results, comparing average levels of each industry's respective ratio in 2019 to current levels, as well as averages over each of the last two decades preceding 2019.

Table 1. Most of Canadian Manufacturing Industries Continue to Lose Ground

| Food Manufacturing | Textile | Petroleum | Chemical Manufacturing | Plastic | Non-metical Mineral Product | Primary & Fabricated Metals | Machineary Manufacturing | Computer & Electronic Manufacturing | Electrical Equipment Manufacturing | Transportation Equipment | Furniture | Pharmacuetical & Meidcal Equipment | |

| Average 1997-2007 | 2.2 | #N/A | 1.9 | 0.5 | 0.8 | 1.4 | 0.9 | 0.4 | 0.4 | 0.3 | 0.3 | 2.0 | N/A |

| Average 2008-2018 | 1.5 | 0.2 | 1.2 | 0.4 | 0.7 | 1.3 | 0.7 | 0.3 | 0.2 | 0.2 | 0.3 | 0.8 | N/A |

| 2019 | 1.6 | 0.1 | 1.1 | 0.4 | 0.7 | 1.4 | 0.8 | 0.3 | 0.1 | 0.2 | 0.2 | 0.8 | 0.4 |

| 2022 | 1.9 | 0.1 | 0.7 | 0.3 | 0.7 | 1.5 | 0.6 | 0.3 | 0.1 | 0.1 | 0.2 | 0.7 | 0.3 |

While each of these examples show modest evidence of reshoring, the overall impact is quite small. Taken together, food manufacturing and non-metallic mineral manufacturing only account for 18% of total manufacturing activity or roughly 2% of total Canadian output.

Do Employment Metrics Offer Any Evidence?

With production metrics showing little evidence of reshoring, it's worth looking at whether employers are still in the "ramp-up" or transition phase within the job market. If this is the case, production metrics could be understating the degree of potential reshoring already in the pipeline.

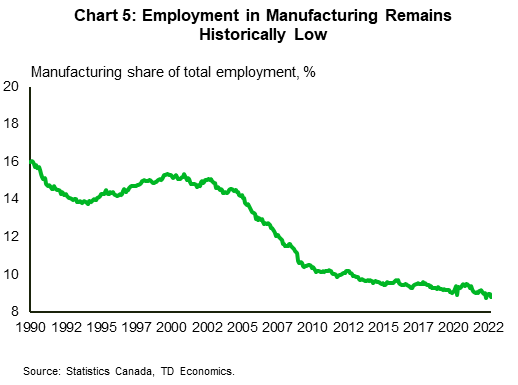

At present, the manufacturing sector accounts for about 1.7 million jobs in Canada, which is where it has hovered since 2010. Measured as a relative share of total employment, the manufacturing sector has lost a bit of ground, currently accounting for just 8.8% of the workforce, compared to 9.2% in 2019 (Chart 5). Indeed, labour shortages have long been a factor hindering manufacturers' ability to hire, reflecting a growing generational skills deficiency across most technical manufacturing industries. The pandemic further exacerbated this trend, accelerating the number of baby boomers who retired and leaving many industries at a net loss from an employment perspective in the post-pandemic world. This is why manufacturing's employment share has continued to trend lower.

To be fair, hiring metrics alone also might not be capturing the whole story. It's possible that the "reshoring" is still very much in the infancy stage, and because Canada (like many other advanced economies) is battling a skills deficiency within the sector, looking at metrics of labor supply in isolation run the risk of potentially masking business's intentions to ramp-up. We should also consider measures of labor demand to at least get a sense of whether the sector is trying to expand. Under these circumstances, there's a case to be made that the skills gap may just be a temporary barrier for companies, that could ultimately be fixed through both targeted skills training programs and a more defined skills immigration stream.

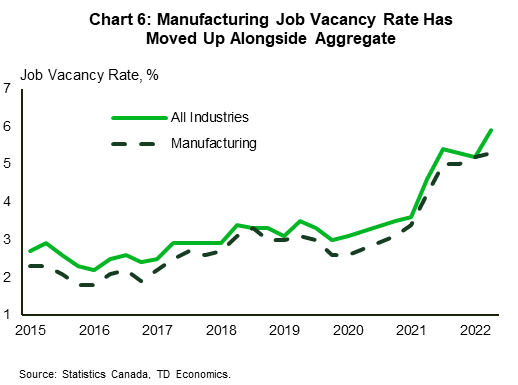

Indeed, the job vacancy rate has moved higher through the pandemic but has only done so alongside the national average (Chart 6). In absolute terms, job vacancies within the manufacturing sector have increased by approximately 45,000 relative to pre-pandemic levels, though its share of total Canadian job vacancies has recently trended lower – and is currently a bit lower than manufacturing's employment share. This is not what we would expect to see if the sector was truly in "expansion" mode.

And How About Foreign Direct Investment?

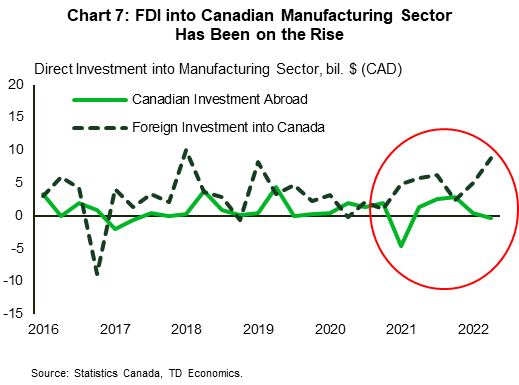

With both DPI and employment metrics offering little evidence of reshoring, it's worth considering the foreign direct investment (FDI) angle. Here there's some encouraging developments. FDI into Canadian manufacturing has definitely shown some promising signs over the last year-and-a-half (Chart 7). At the same time, Canadian direct investment in the manufacturing sector abroad has shown some signs of softening which may suggest domestic investors are pivoting and instead investing domestically. The combined movements provide evidence that investment dollars are funneling into the domestic manufacturing sector, though it's still too early to know definitively whether this is the start of a new trend or a near-term anomaly. The data is notoriously volatile, and there have been other periods in recent years where foreign investment ran hot, with little measurable impact to the overall manufacturing sector.

Outlook is Not as Dire as Data Suggests

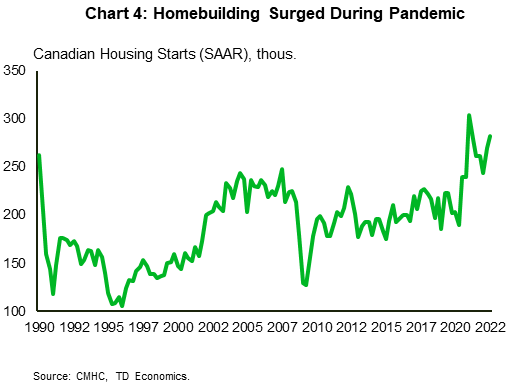

While the hard economic data provides little evidence that the Canadian manufacturing sector is benefiting from the recent resurgence of U.S. reshoring, that doesn't necessarily mean it won't over the coming years. The U.S. may prove to be the "rising tide that lifts all ships". Perhaps no better example illustrates this point than the transformation already taking place in the automotive sector. North American automakers have made significant investments in both existing and new manufacturing facilities in recent years, in an effort to scale production of electric vehicles. The investment dollars spent have not only been concentrated on the assembly side, but also on manufacturing facilities specifically intended to produce key components, such as semiconductors and lithium-ion batteries. If North America is to become a leading player in the global production of electric vehicles, developing fully integrated supply chains on both fronts is an essential first step.

Given Canada's abundance of natural resources, it stands to be a direct beneficiary, particularly on the battery production side. Seed investments from the Federal government have already been announced in last year's budget specifically targeted at accelerating the mining and processing of critical minerals that are essential in the production of EV batteries. While small relative to what will actually be required to make mines operational, the initial investments do show a degree of commitment. Since last year's budget announcement, interest among global cell manufacturers has grown, with several having already committed to building facilities in Canada. Moreover, Ontario's Minister of Economic Development has recently said that the government is currently in talks with six other cell manufacturers, who are all actively pursuing building facilities in Canada. And this has the potential to be just the tip of the iceberg. If Canada were able to establish a stronghold in battery cell manufacturing, then it has the potential to create a waterfall effect of other electronic component producers also wanting to move to Canada, as suppliers typically like to have a close proximity to their customers.

Outside of battery manufacturing, the Federal Government has also committed $240 million dollars in direct investments into the Canadian semiconductor and photonics industries. The announcement comes alongside the recent passage of the $52 billion Creating Helpful Incentives to Produce Semiconductors & Science (CHIPS) Act of 2022 in the U.S., which has already helped to attract multiple large-scale investments from semiconductor manufactures. Admittedly, these have all been in the U.S., though Canada is also likely to benefit over the coming years from sheer proximity. This is true on multiple fronts. The recent passing of the U.S. Inflation Reduction Act (IRA) has made additional consumer incentives (up to $4,000) available at the point-of-sale to vehicles made in North America. Previous iterations of the bill had only included the additional incentives on those vehicles made specifically in America. Beyond the benefits on the assembly side, the IRA also stipulates that 50% of mineral content must be sourced from North America, while 60% of the battery components (by value) must also be assembled in North America. These percentages rise gradually over the second half of the decade, before reaching caps of 80% and 100%, respectively.

These requirements do present a challenge since neither country has a reliable supply of critical minerals needed in EV and battery manufacturing – the average EV uses 8 times as many critical minerals as an internal combustion engine vehicle. China currently dominates those markets, accounting for approximately 50% of the entire global supply chain of EV batteries – from mining to materials processing and manufacturing. Supply limitation and skyrocketing global demand for critical minerals have led to significant price pressures – lithium prices, for example, have risen by nearly 800% since 2020 due, in part, to battery demand from automakers' EV ambitions.

Canada and the U.S. are thus pressed to expedite new critical mineral production. Both countries have significant critical mineral deposits and have signed a joint action plan on establishing a critical minerals supply chain in North America – ironic for Canada considering the energy transition will invariably bring the nation full circle, from de-prioritizing fossil fuels to a different set of natural resources. However, typical timelines for mine development, including exploration, permitting, and construction need to be addressed if climate targets such as EV sales goals are to be met.

All that to say, the opportunity for Canada is there, and given the country's skilled workforce, favorable immigration policies, and comparatively affordable utilities, it stands reasonably well positioned to make more inroads in the electronic manufacturing space in the years ahead.

Bottom Line

At present, Canada's manufacturing sector has not benefited to the same degree as the U.S. through the global pandemic. Measures of DPI and various metrics of employment both suggest that the manufacturing sector has lost ground in recent years. That being said, foreign direct investment into Canada's manufacturing sector has accelerated since 2021, while investment from domestic firms abroad has slowed. This offers some hope that future gains are already in the pipeline. Moreover, Canada's manufacturing sector stands to benefit from the global push to renewable energy, particularly in industries directly tied to the production of electric vehicles. If North America stands a chance at becoming a global front runner in electric vehicle production, establishing a well-defined end-to-end domestic battery supply chain is essential. Given its abundance of natural resources, Canada is well positioned to becoming an integral piece of North America's battery supply chain, which also has the potential to bring other aspects of high skilled electronic manufacturing industries to Canadian shores.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: