Ready or Not, Here He Comes

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Date Published: January 17, 2025

- Category:

- Canada

- Financial Markets

- Trade

Highlights

- Donald Trump will be inaugurated on Monday, and Canadians are bracing for the economic threats in recent weeks to turn into action through a flurry of executive orders.

- Canada is economically tied to the U.S., with $1.9 billion in daily goods and services exported to its southern neighbour. That amounts to over 20% of GDP.

- While we aren’t expecting the worst-case scenario on tariffs, even a tapered down set of tariffs could be enough to send temporary shockwaves through the economy and financial markets.

Donald Trump will be inaugurated on Monday, and Canadians are bracing for the economic threats in recent weeks to turn into action through a flurry of executive orders. While we aren’t expecting the worst-case scenario, even a tapered down set of tariffs could be enough to send temporary shockwaves through the economy and financial markets. To assess the magnitude of this threat, here are the areas of economic growth and jobs most at risk on Trump’s return to the White House.

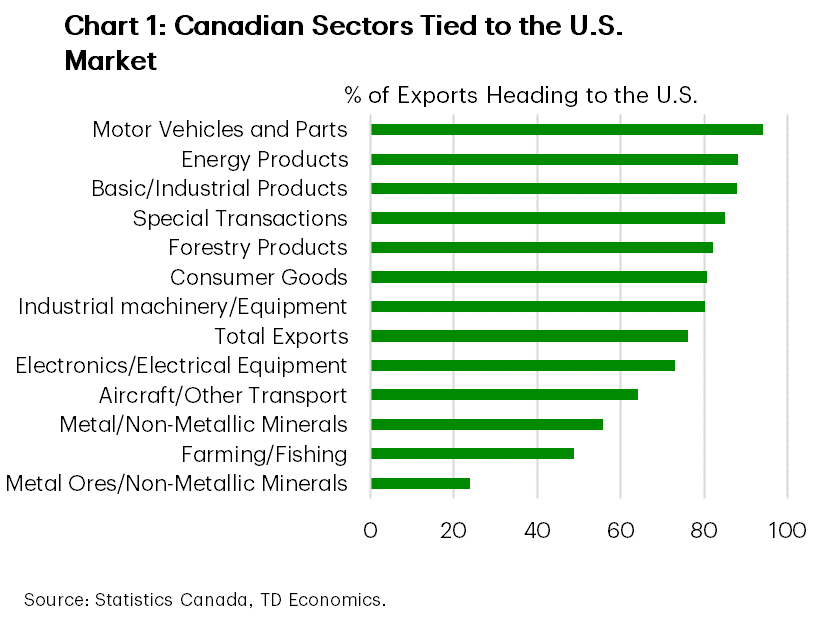

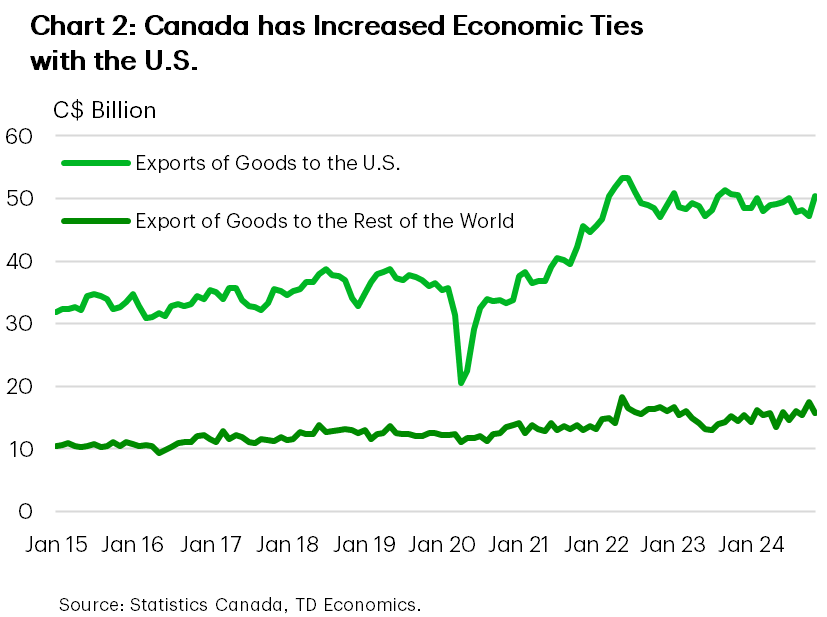

Three-quarters of Canadian exports head south of the border. This amounts to $1.9 billion in daily goods and services exports, meaning that exports to the U.S. account for over 20% of Canada’s GDP. Breaking it down by sector, energy is by far the largest contributor in dollar terms, making up more than a quarter of total exports. However, non-energy exports are also highly vulnerable. As shown in Chart 1, sectors ranging from motor vehicles to forestry have more than 80% of their production destined for the U.S. An estimated 46k companies in Canada depend on exporting to the U.S., supporting around 2 million jobs (nearly 10% of total employment).

Geographically, the risk is widespread. All provinces have exposure to U.S. tariffs, ranging from B.C. lumber to Quebec metals to Nova Scotia live animal exports. However, Ontario tops the list in terms of total dollars due to its diversified industries being deeply integrated with its southern neighbour. Motor vehicle and parts manufacturing may get most of the attention, but Ontario is also home to significant production of machinery, base metals, chemicals, and even food/beverage. While many of these goods are a part of well-established integrated supply chains, it won’t assuage fears, as nearly a million jobs in the province are tied to U.S. trade. Alberta is another key province to flag given its energy concentration. There’s speculation that Trump may give Canadian oil a “carve out” from tariffs to prevent rising gasoline prices for American consumers, but still, there are over 300k jobs in Alberta tied to exports.

What President Trump ultimately implements is highly uncertain. Our baseline assumption is that Canada avoids blanket tariffs and instead faces temporary sector-specific threats as leverage for broader negotiations. However, we must also prepare for a worst-case scenario: a blanket 25% tariff with Canadian retaliation. Such an outcome would almost certainly push the Canadian economy into recession, driving the unemployment rate above 8%. However, some of the downside would be mitigated by government action, with discussions well underway on support to affected businesses and consumers. The Bank of Canada would also create a cushion by accelerating rate cuts, as would an inevitably weaker currency. A larger interest rate gap with the U.S. and the nature of this risk could cause the Loonie to test the historical low of 62 U.S. cents. This would also provide a cushion for Canadian exporters.

This is the playing field for Canada. The country faced similar risks in 2016, when Trump defied economic logic by igniting a trade war with China and imposing tariffs on specific Canadian exports. While fears were running high and many forecasters slashed their GDP outlooks, the economic impact was less severe than anticipated, as Trump’s goal was to secure a deal.

This time, Canadian officials must be strategic. Short-term supports may be necessary to assist industries and workers, but the government cannot miss acting on long-term opportunities. This crisis creates a burning platform that could enable bold action to build out Canada’s competitive advantages, such as reducing regulatory barriers/red tape, and improve tax competitiveness to incent business investment.

As the old Churchill saying goes: “Never let a good crisis go to waste”.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: