Quebec Fiscal Update

Emerging From the Pandemic in Relatively Good Shape

Rishi Sondhi, Economist | 416-983-8806

Date Published: November 26, 2021

- Category:

- Canada

- Government Finance & Policy

Highlights

- Quebec's fiscal position is better-than-expected at the time of the budget, lifted by stronger-than-anticipated economic growth. Indeed, the FY 2020/21 deficit was nearly $8 billion below prior expectations, and this year's shortfall is projected to total $3.6 billion, or a mere 0.7% of GDP.

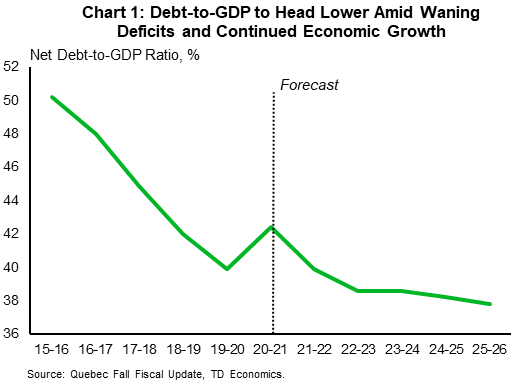

- Moving forward, policymakers envision hitting a surplus (before contributions to the Generations Fund) by FY 2024/25 – a year earlier than previously anticipated. Meanwhile, net debt-to-GDP is expected at 39.9% this fiscal year, a drop of 2.5 ppts from FY 2020/21, and is forecast to continue falling.

- The government has used this room to roll out supportive measures aimed at tackling cost of living challenges, combatting labour shortages, and bolstering investment and innovation. Program spending is forecast to grow at a stronger pace over the next few years compared to the March budget, offering some support to overall economic growth.

With its finances receiving a boost from a stronger-than-anticipated economic growth, the Quebec government is proposing measures to combat labour shortages, accelerate productivity growth, and boost activity in the cultural sector. Further support is pledged to help Quebecers deal with the impacts of high consumer and house price inflation. Those on the lower end of the wage spectrum are expected to see a notable benefit from these measures. Policymakers are also steering significant funding towards childcare, largely through enhancements to the refundable tax credit for childcare expenses (at a cost of $1.1 billion over 5 years) and subsidizing the creation of 37,000 new spaces. These new measures come alongside some additional investment in Quebec's healthcare system.

In terms of providing cost of living support:

- The government plans on introducing an "extraordinary cost of living allowance" (a single-lump sum payment of $200 per adult and an additional $75 per person who lives alone), increasing the senior assistance amount (to $400 from its current level of $209), implementing an affordable housing construction assistance program (aiming to build 2,200 affordable housing units) and offering financial support to help households pay their rent.

To combat the labour shortage and stimulate economic growth:

- Policymakers will support the retraining and requalification for workers as well as aim to attract new talent, all at a cost of $2.9 billion over 5 years.

- Increase funding for business investment projects and support the implementation of innovation zones (which plan to unite researchers, businesses, and employees in certain geographic areas so that it's easier to transition from the idea phase to the market phase).

Table 1: Québec Economic Assumptions

[ Percent change unless otherwise noted ]

| Calendar Year | 2021 Fall Update | ||

| 2020 | 2021 | 2022 | |

| Real GDP | -5.5 | 6.5 | 3.3 |

| Nominal GDP | -2.4 | 10.8 | 7.2 |

| Employment Rate (%) | 91.1 | 93.7 | 94.3 |

| Unemployment Rate (%) | 8.9 | 6.3 | 5.7 |

| Housing Starts (000s) | 54.1 | 69.7 | 57.3 |

| 3-month T-bills (%) | 0.4 | 0.1 | 0.4 |

| 10-year Bonds (%) | 0.7 | 1.3 | 1.7 |

All told, the cost of these new pledges is expected to total $13.1 billion over 5 years, starting this fiscal year. However, a chunk of this funding is dedicated towards temporary pandemic relief measures. Subtracting these funds shrinks the size of this investment to $9.5 billion.

The Deficit Backdrop is Much Better than Anticipated at the Time of the Budget

Much like its larger neighbour to the east, Quebec's deficit came in much lower-than-anticipated in the last fiscal year, at $4.2 billion (0.9% of GDP) – well below the $12 billion figure (2.7%of GDP) anticipated in the March budget. The improvement is linked to both higher-than-anticipated revenues and lower-than-expected expenditures. This improved starting point, coupled with a steep decline in pandemic supports, sets the Province on track to reach surplus (before contributions to the Generations Fund) by FY 2024/25 – a year earlier than previously expected. For this fiscal year, the deficit is seen totaling $3.6 billion (or a mere 0.7% of GDP), comparing favourably to the $9 billion shortfall projected in the budget.

Economic Projections Are Reasonable

Quebec's economy has staged a remarkable recovery from the pandemic depths, with output reaching its pre-pandemic level as of March, and real GDP up 6.2% in the year-to-July compared to its depressed 2020 level. For comparison, Canada's real GDP was up by 4.6% over this same time. This places Quebec's economy well on track to meet or surpass the government's forecast for a robust 6.5% advance in real GDP this year. Similarly, nominal GDP is now forecast to advance by 10.8% in 2021, fuelled in part by accelerating inflation. While this represents a sharp upgrade from the spring budget assumption of 6.0%, it is still a touch shy of our latest estimate of 11.2%. This implies an upside risk to tax revenues. The government's growth forecasts for 2022 are within the ballpark of our own estimates.

Decent Revenue Gains Expected Moving Forward, Program Spending Growth Profile Lifted

Relative to the budget, revenue growth is forecast to be much stronger in FY 2021/22, as own-source revenues benefit from the province's strong recovery. However, after this fiscal year, revenues are projected to rise at about the same pace, on average, as shown in March (3% per year), restrained by the assumption of flat growth in federal transfers.

The better-than-anticipated deficit backdrop has afforded room to boost spending. And indeed, total expenditure growth is slated to be much stronger in FY 2021/22 than projected in March, with gains holding at a faster trajectory on average over the next several years driven by program spending.

Robust spending growth is targeted across nearly all major categories in FY 2021/22. After this fiscal year however, the healthcare and postsecondary education sectors see the strongest gains through FY 2023/24. In the other major sectors, education spending outside of the post-secondary sector is forecast to see slower growth, as are "other portfolio" expenditures. COVID-19 support and recovery measures are also forecast to fall significantly next year and drop to nearly zero by FY 2023/24.

Significant Headway Expected on the Province's Debt Burden

Helped by smaller deficits, Quebec's debt backdrop continues to brighten. Net debt-to-GDP is forecast at 39.9% this fiscal year, down 2.5 points from FY 2020/21 and below the projection included in the budget. This is also well below Ontario's, which is forecast to be 43.4% in FY 2021/22. Notably, Quebec's ratio had been converging on Ontario's for some time, finally dropping below in FY 2019/20. This wedge is expected to persist moving forward.

Quebec's debt burden is slated to fall even further after this fiscal year, despite robust infrastructure spending under the Quebec Infrastructure Program. Indeed, by FY 2025/26, debt as a share of the economy is projected to have dropped to 37.8%.

Rising interest rates are projected to put upward pressure on debt service charges, causing them to climb by 11.4% this fiscal year, followed by a more modest rise of 3.3% in FY 2022/23. However, because of the way the Quebec calculates these charges, (i.e. including interest charges on liabilities tied to retirement plans and other future employee benefits, which are projected to drop, in addition to what's charged on direct debt), debt service charges forecast to decline after FY 2022/23. As a percent of revenue, debt service charges are forecast to remain at historically low levels of 6.1% – 6.5% through FY 2025/26.

Borrowing requirements are pegged at $24.5 billion in FY 2021/22, down by about $4 billion compared to March. In the coming fiscal year, requirements are forecast to climb to about $31 billion and reach $32 billion by FY 2025/26.

Bottom Line

Thanks in part to a swift economic recovery, Quebec's finances are emerging from the health crisis in relatively good shape. Indeed, the Province's budget shortfall (before contributions to the Generations Fund) is on track to shrink to a negligible level in FY 2023/24. In addition, the Province's debt-to-GDP ratio last year was below levels seen as recently as FY 2017/18, despite the havoc caused by the pandemic. What's more, the government expects this measure to drop to its lowest level in about 20 years by FY 2025/26. It's also worth noting that policymakers have funneled some of this fiscal room towards additional program spending, which should be growth supportive as we head into 2022.

Table 2: Québec Government Fiscal Position

[Billions CAD unless otherwise noted ]

| Fiscal Year | 2021 Fall Update | |||||

| 20-21 | 21-22 | 22-23 | 23-24 | 24-25 | 25-26 | |

| Revenues | 122.6 | 131.1 | 133.4 | 138.1 | 141.7 | 146.3 |

| % Change | 4.8 | 6.9 | 1.8 | 3.6 | 2.6 | 3.2 |

| Own-Source | 91.8 | 101.6 | 104.9 | 108.2 | 112.3 | 116.1 |

| Federal Transfers | 30.7 | 29.4 | 28.5 | 29.9 | 29.4 | 30.2 |

| Expenditures | 113.4 | 126.7 | 132.2 | 135.9 | 140.2 | 145.4 |

| % Change | 0.6 | 11.7 | 4.4 | 2.8 | 3.1 | 3.7 |

| Program Expenditures | 105.7 | 118.1 | 123.3 | 127.2 | 131.2 | 136.4 |

| Debt Charges | 7.7 | 8.6 | 8.8 | 8.7 | 9.0 | 9.0 |

| Total Consolidated Entities | 9.2 | 4.4 | 1.2 | 2.2 | 1.5 | 0.9 |

| COVID-19 Support and Recovery Measures | 13.0 | 7.6 | 1.0 | 0.1 | 0.0 | - |

| Change in accounting application standard respecting transfer payments | 0.5 | 0.4 | 1.2 | 1.3 | 0.8 | 0.0 |

| Provision for economic risk and other support measures | - | - | 1.3 | 1.0 | 0.5 | 0.5 |

| Surplus (Deficit) | -4.2 | -3.6 | -2.3 | -0.1 | 0.2 | 0.4 |

| % Of GDP | -0.9 | -0.7 | -0.4 | 0.0 | 0.0 | 0.1 |

| Generations Fund Deposits | –3.3 | –3.3 | –3.3 | –3.9 | –4.3 | –4.4 |

| Accounting Adjustment | ||||||

| % Of GDP | -1.7 | -1.4 | -1.0 | -0.7 | -0.7 | -0.7 |

| Net Debt | 190 | 199 | 206 | 211 | 216 | 221 |

| % Of GDP | 42.4 | 39.9 | 38.6 | 38.6 | 38.2 | 37.8 |

| Gross Debt | 210.1 | 220.4 | 230.9 | 237.3 | 242.6 | 248.3 |

| % Of GDP | 46.8 | 44.3 | 43.3 | 43.4 | 42.9 | 42.5 |

| Accumulated Deficits | 108.7 | 112.3 | 114.6 | 114.7 | 114.5 | 114.1 |

| % Of GDP | 24.2 | 22.6 | 21.5 | 21.0 | 20.3 | 19.5 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: