Ontario GDP by Industry Outlook:

Shifting into Lower Gear

Rishi Sondhi, Economist | 416-983-8806

- Category:

- Canada

- Provincial & Local Analysis

Highlights

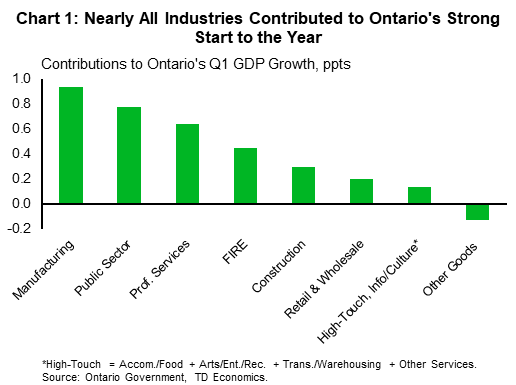

- Ontario’s industries enjoyed a solid first-half performance, keyed by output gains in several sectors. The manufacturing and public sector industries played particularly important roles in supporting growth. The former benefitted from healing auto supply chains while growth in the latter is consistent with government spending plans.

- We see this resilience giving way in the second half of the year and into 2024, although most industries are still likely to record positive (albeit modest) growth, on average, over the two years.

- Rising borrowing costs will likely weigh on discretionary spending, impacting activity in several services sectors. Meantime, a weaker external backdrop is set to weigh on manufacturing. Output growth in the professional, scientific, and technical services industry and public sector is also set to slow.

- In contrast, construction could pick up some modest steam this year and next after a weak 2022, supported by non-residential projects. Retail spending, meanwhile, could also increase in the near-term, as household incomes are padded by a federal government rebate, and in 2024 owing to rising auto sales. We also see improved output growth in Ontario’s sizeable finance, insurance, and real estate industry next year (after a modest performance in 2023) as housing markets improve.

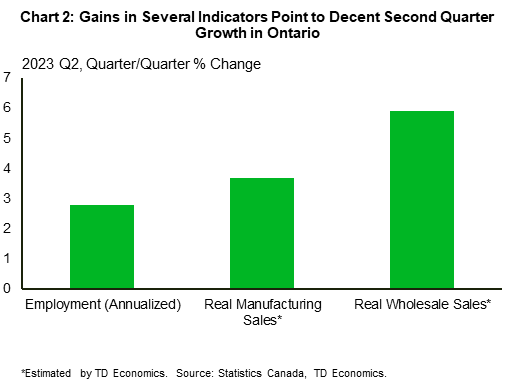

Against all odds, Ontario’s economy managed to build on last year’s sizzling growth performance with further solid gains so far in 2023. Indeed, industry-based GDP surged 3.4% in the first quarter, clocking in well above estimates of a sustainable rate and surpassing Canada’s increase by 0.7 ppts. And early indications are that the second quarter marked another decent 1.5% aggregate advance in provincial real output, led by widespread gains across goods and services.

Interest rate hikes and other brewing headwinds are likely to put this display of resilience increasingly to the test in second half of 2023 and into 2024. On the one hand, we expect to see a notable downshift in growth trajectories. On the other, we still expect the majority of the province’s key industries to remain in expansion mode, even if only narrowly. Construction is one notable exception to the broad rule, as it likely picks up some modest steam this year and next after last year’s significant setback.

Ontario Enjoyed a Solid First Half Performance

Nearly all sectors contributed to Ontario’s heady first quarter growth performance (Chart 1). However, the largest contribution came from the manufacturing sector, where auto production surged 56% (annualized) thanks to improved supply chains unlocking the ability to boost output. Public sector industries (i.e., healthcare, education, public administration) also supported growth in a meaningful way, which was in line with the sturdy gain in program spending for the FY 2022/23 year baked into fiscal plans by the Ontario government. Elsewhere, output in professional services maintained its healthy growth trend and production was also higher in Ontario’s outsized finance, insurance, and real estate (FIRE) industry.

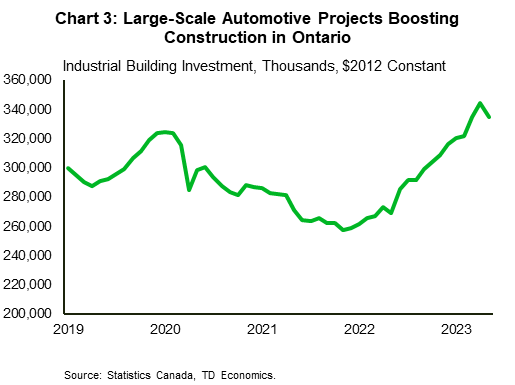

Although we don’t yet have second quarter GDP figures, other data point to another firm, though more moderate, gain in real output. Employment and hours worked expanded at a healthy pace. While retail sales have softened, the wholesale and manufacturing sectors turned in another quarter of firm sales (Chart 2), as these areas benefitted from a further easing in automotive supply constraints and healthy demand for machinery and equipment. Although residential construction declined in the second quarter, overall construction is receiving a lift from the new Electric Vehicle (EV) battery plant in Windsor (Chart 3). That project made national headlines for being temporarily halted in May, before a July agreement between governments and Stellantis allowed construction to resume. Home sales and prices also surged in the second quarter, boosting activity in the real estate sector. These developments leave us forecasting a second quarter real output gain of around 1.5% (annualized), in line with our tracking model which considers several of these indicators.

Swirling Headwinds to Touch Down in the Second Half

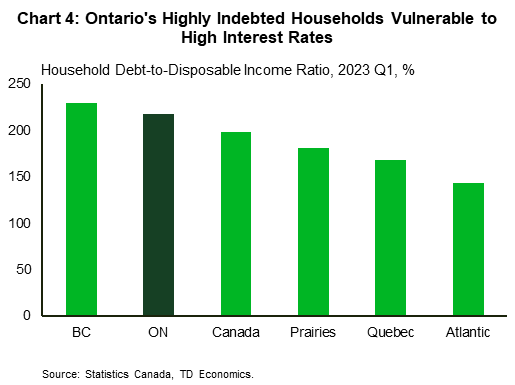

The second half of the year should mark a notable downswing in Ontario’s economic and sector fortunes. We are forecasting real GDP growth to slow significantly, and this sub-trend performance should persist through 2024, causing the unemployment rate to increase from its current level of 5.6% to around 7% by the end of next year. Our expectations for this relatively weak economic performance are conditioned on several factors. Firstly, Ontario’s households are highly indebted (Chart 4), meaning that they’ll have to dedicate an increasingly large share of their incomes towards debt servicing due to high borrowing costs, crowding out other areas of consumption. We are already seeing evidence of this softening, with our internal data tracking debt and credit card spending showing a 2% monthly decline (on average) over June and July.

In particular, we think that households will cut back on discretionary spending. Accordingly, output growth in high-touch industries, like accommodation and food services and travel, should moderate significantly moving forward, culminating in declines in 2024 (see Table 1). That said, services spending should receive some near-term support from the federal government’s $2.5 billion Grocery Rebate, which was delivered to lower income households in July, alongside a payment of the enhanced Canadian Workers Benefit. Retail spending, meanwhile, is likely to decline this year, notwithstanding the likely short-term boost from government supports, weighed down in part by a second quarter pull-back. However, in an interesting twist, output in this industry could post a small gain in 2024 on the back of higher sales of automotive products. Notably, motor vehicle sales account for about 25% of retail spending, and they are likely to increase at a near double-digit pace next year as pent-up demand is satisfied.

Table 1: Ontario GDP Growth by Industry

| Annual Average % Change | 2022 | 2023 | 2024 |

| Manufacturing | 4.5 | 1.4 | -3.4 |

| Construction | -2.7 | 1.2 | 1.6 |

| Other Goods Industries | 2.4 | -3.4 | 2.4 |

| Retail & Wholesale Trade | 1.5 | -0.5 | 1.7 |

| FIRE | 0.8 | 1.0 | 2.2 |

| Professional Services | 8.6 | 2.8 | 1.7 |

| High-touch + Info/Culture | 10.7 | 4.4 | -0.3 |

| Public Sector | 3.6 | 2.0 | 0.0 |

| Overall GDP | 3.6 | 1.6 | 0.5 |

The impact of higher interest rates will also be felt on residential construction, which we expect will continue to fall this year, after back-to-back quarterly declines in the first half, and in 2024. Elsewhere, commercial construction is likely to see a soft year in 2024, held back in part by a beleaguered GTA office market that is contending with double-digit vacancy rates. At the same time, however, the government’s hefty infrastructure spending plan, alongside large-scale automotive sector construction projects, should keep overall construction growth in the positive column in both years. This should also impart some support to Ontario’s professional, scientific, and technical (PST) services industry via increased demand for architectural and engineering services. However, the broader PST sector should see easing output growth, consistent with cooling economic activity.

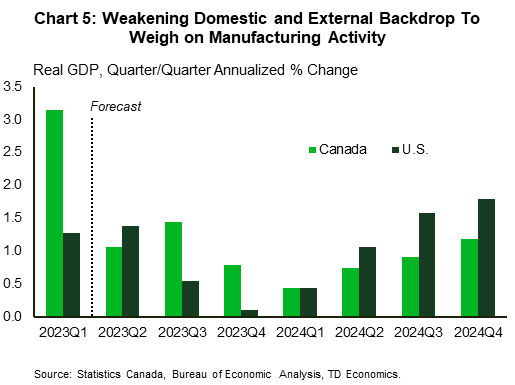

Manufacturing production is set to be a big drag on growth going forward. Weaker demand in Ontario, across Canada and the U.S. should combine to slow activity outside of the automotive sector (Chart 5), despite some offset coming from a competitive exchange rate. Within the automotive industry, motor vehicle production should remain above year-ago levels in the second half of this year on the back of continued improvements in global supply chains. Next year is a different story, due to output being taken offline at a few key plants in order to retool for EV vehicle production. Automotive parts manufacturing, meanwhile, is slated to increase in both 2023 and 2024, lifted this year by rising production of motor vehicles, and next year as the Windsor EV battery plant comes online.

Agricultural production is likely to be a notable drag on overall economic growth this year, despite only accounting for about 1% of the economy. Output in this industry declined by 12% annualized in the first quarter and agricultural employment dropped in Q2. For 2024, this forecast assumes a moderate gain in production although how the weather evolves will ultimately dictate growing conditions.

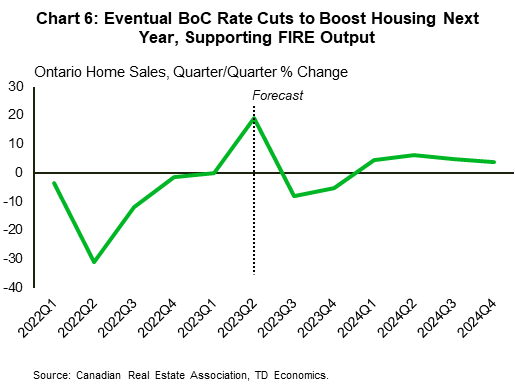

The public sector and the finance, insurance, and real estate (FIRE) industry both carry a large weight in Ontario’s economy. Combined, they account for nearly 45% of GDP. As such, their evolution is crucial to Ontario’s outlook and on this front, we expect that government spending growth will ease through the remainder of the year, followed by a more pronounced slowdown in 2024. This is consistent with program spending plans imbedded in the latest provincial budget. In contrast, we see growth in the FIRE sector roughly matching last year’s subdued figure and improving somewhat next year amid rising household incomes and eventual rate cuts by the Bank of Canada that support rising housing market activity (Chart 6).

Bottom Line

Ontario’s impressive first-half growth performance is set to fade, as a weaker external backdrop and higher interest rates weigh on several sectors of the economy, while cooling government spending growth weighs on the province’s sizeable public sector. Notably, these headwinds will play a big role in offsetting population growth, which is expected to remain strong through next year.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: