Canada's Manufacturing Sector:

One Step Forward, Two Steps Back

Omar Abdelrahman, Economist | 416-734-2873

Date Published: July 19, 2021

- Category:

- Canada

- Commodities and Industry

Highlights

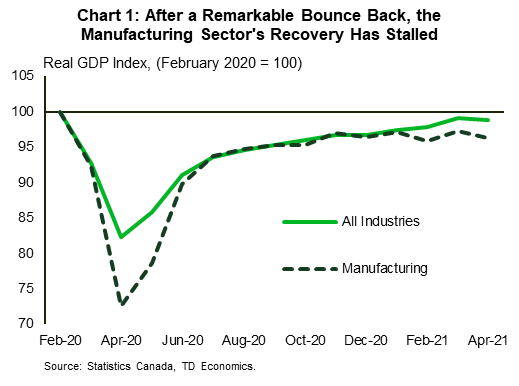

- The recovery in Canada's manufacturing sector has hit a standstill since the fourth quarter of 2020. Output has been moving sideways after staging an impressive rebound from the depths of the pandemic.

- A wedge has emerged between sentiment, which remains solid, and sales and new orders, which have been choppy. The increase in infections and restrictions during the fall and winter months may have dealt a blow to a number of manufacturing industries, reinforcing the K-shaped nature of the recovery.

- Supply disruptions have also been a key obstacle to firms' ability to keep up with demand. In particular, the global semiconductor chip shortage has weighed heavily on motor vehicle and parts output. Supply constraints have been evidenced across a broader swath of industries in the form of higher prices and lower inventory/sales ratios.

- Demand should see better days ahead as the reopening of economies spurs activity in previously beleagured manufacturing sub-industries. Restrictions and lagging vaccinations in some economies may continue to weigh on global supply chains, but survey responses suggest that these disruptions will be temporary.

Canada's manufacturing sector had staged a robust output recovery last year from the depths of the pandemic. Fiscal policy was at the forefront, with China and the U.S. front-running the recovery process and sending global manufacturing sentiment higher. Meanwhile, restrictions on the service sector led consumers to shift their spending towards household goods, sending demand skyrocketing for a large number of products. However, since November, the recovery in Canada's manufacturing output has practically hit a standstill (Chart 1).

This recent stagnation has materialised despite markedly upbeat manufacturing PMI sentiment. Some industries, impacted by restrictions during the second and third waves, saw their recoveries flatline or even take a U-turn in the fourth quarter and have struggled since. These included petroleum products, textiles, printing, and aerospace manufacturing. As this year has gotten underway, growing shortages of inputs and transportation bottlenecks globally have become a more pressing constraint on manufacturers' ability to keep up with demand. And while output in many industries (e.g. chemicals, plastics, non-metallic minerals) was still able to grow robustly and surpass pre-pandemic levels, production took a sizeable hit in the all-important auto industry.

The manufacturing industry should see better days ahead in the coming quarters. Manufacturing sales are expected to start picking up, even as spending patterns shift from goods towards the service areas of the economy that have struggled mightily over the past 18 months. Indeed, there are still several industries that should benefit from a ramp up in tandem with relaxed restrictions and increased mobility. At the same time, this pendulum swing towards service spending should take some pressure off global supply chains. Though much uncertainty remains, survey responses suggest that firms are expecting these supply chain disruptions to be temporary. And indeed, some auto manufacturers have already begun to gradually restart production. Importantly, one of the world's largest semiconductor manufacturers has recently announced that that output will ramp up in the third quarter of this year. This should offer some respite to auto manufacturers.

Robust Sentiment Masking Choppy, K-Shaped Recovery

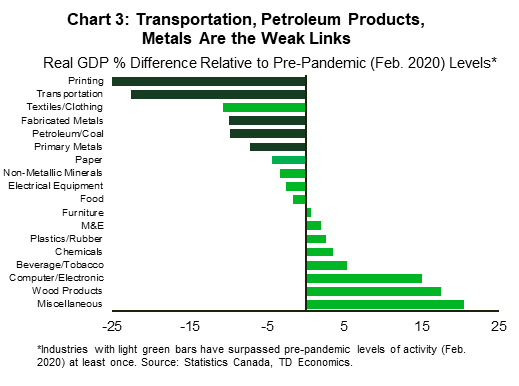

A striking feature of the COVID-19 recession was the swift rebound in global manufacturing sentiment (Chart 2). Indeed, growth in industrial production – namely in China and the U.S. – has been a key catalyst for the world recovery so far. Manufacturing sentiment surveys have consistently remained in expansionary territory for most major economies. For Canada, the Markit PMI has remained firmly above 50 since July of last year. Still, like the shape of the overall economic recovery, some industries were left behind (Chart 3).

Demand was initially propped by consumer-led industries (see report). For instance, food and beverages and household items (e.g. computer equipment, furniture, and wood products) saw surging demand at the onset of the pandemic. These products were supported by changing household behaviours, resilient incomes, and low borrowing rates. More recently, some business-focused industries, including the chemicals, plastics and rubber products, and nonmetallic mineral products industries also gained some traction.

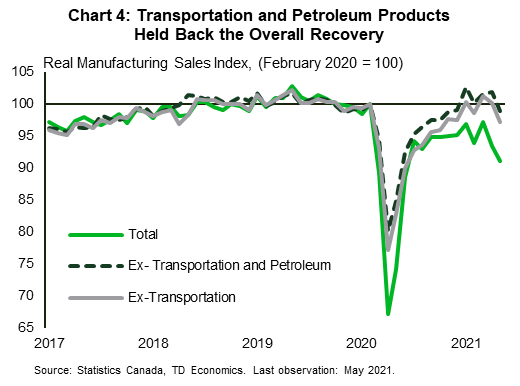

Meanwhile, areas of the manufacturing sector where sources of demand were more heavily impeded by health measures or supply impediments have lagged behind. In fact, real manufacturing shipments appear to have progressed decently and exceeded pre-pandemic levels after excluding the petroleum and transportation equipment industries (Chart 4). Aerospace manufacturing saw order cancellations, while petroleum products was heavily impacted by suppressed mobility trends. Other industries, including printing services and paper, were likely hit hard by work-from-home trends.

Semiconductor Chip Shortage Weighed Heavily on Output

But a flatlining or reversal in demand in some industries has not been the sole reason for the stalling of the recovery. In fact, supply issues may have been an even bigger driver in dampening the recovery prospects in the industry since the fourth quarter of 2020. Since September, real GDP in the motor vehicles and parts manufacturing industry has fallen by 26.8%. This was driven by auto plant shutdowns that were impacted by the global shortage of semiconductor chips. The constraints seen in the auto industry are not limited to Canada – the U.S. also saw a drop in output as a result of auto plant shutdowns. Since June, most auto manufacturers in Canada have begun a gradual return to production. Though caution remains warranted, plans to ramp up chip output by one of the largest semiconductor manufacturers should support a gradual easing in these supply chain disruptions in the coming quarters.

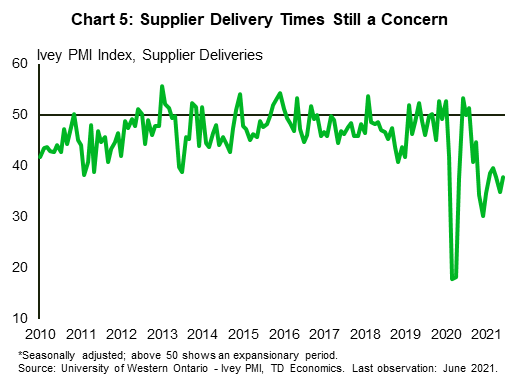

Other Sub-Industries Also Facing Supply Pressures, but Impact on Output Difficult to Disentangle

To what extent overall output has been impacted by supply chain disruptions beyond the auto sector is a difficult question to untangle. To be sure, bottlenecks have been widespread across many industries. Global shipping costs have spiked, in tandem with surging demand for goods, border closures, and port capacity constraints. Material shortages and longer supplier delivery times (Chart 5) have been repeatedly cited in PMI surveys. The impact of this can be seen clearly in the industrial product price index– which has approached the highest year/year increase since the 1970s.

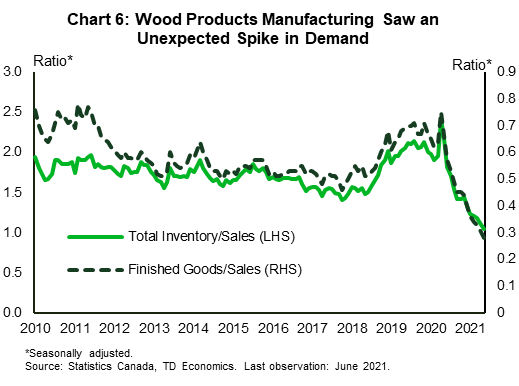

While output was able to continually expand in some industries, there are some industries where these constraints appeared more acute. The overall inventory/sales ratio in manufacturing is broadly consistent with pre-pandemic trends. Some industries had seen notable declines in the metric in tandem with higher output and in some cases, higher unfilled orders (nominal). This has included the nonmetallic minerals, chemicals and plastics manufacturing industries. Howeve, the ratio appears to have increased for the latter two in May. The wood products industry stands out the most – with lumber prices breaching all-time highs earlier this year before retreating, and inventory/sales ratios dropping to the lowest levels on record (Chart 6). This is partly due to a lagged supply response to an unexpected surge in demand. However, this was also partly driven by pre-existing structural changes in the lumber industry within Canada, where production in B.C. had been declining prior to the pandemic.

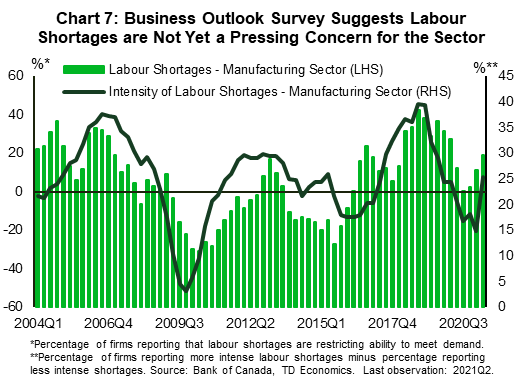

Labour Shortages Are Not Pressing…Yet

Labour shortages are starting to feature prominently in the recovery south of the border. This does not appear to be a concern in Canada yet. Recent responses to the Bank of Canada's Business Outlook Survey suggest that firms in the manufacturing industry are not facing notable difficulties in sourcing workers (Chart 7). If anything, wage growth (year/year) in the industry has been in negative territory in recent months, according to recent Labour Force Survey data. This stands in stark contrast to the U.S. experience, where wage growth has been more robust and where the JOLTS (Job Openings and Labour Turnover Survey) data shows a spike in vacancies within the manufacturing industry. The continued reopening of provincial economies will likely support a further recovery in employment and wages within the industry. However, labour shortages similar to those seen south of the border may be less likely. Income support payments are slated to decline over the coming months, and Canada's labour force participation rate is much closer to pre-pandemic levels than it is south of the border.

A Reshuffling of Growth Drivers Should Still Keep the Industry on Solid Footing

Although some headwinds within the manufacturing industry are anticipated to remain, the overall outlook for the industry is still robust. The expected shift to services spending should still benefit a number of manufacturing industries. Mobility trends have also turned the corner, pointing to higher gasoline/petroleum sales, while other beleaguered industries, including clothing see demand gain traction. It will also keep demand for the food and beverage industry solid as the hospitality industry welcomes back visitors. At the same time, sales of other manufacturing industries that have enjoyed gangbuster performances will likely ease (namely, wood products, appliances and furnishings), but any scope for a pull-back should be limited by continued strength in the overall economy. Though short-lived, the appreciation in the Canadian dollar may have acted as a modest drag on some exports in the second quarter of the year. The recent moderation in the loonie could add a potential modest tailwind going forward.

On the supply side, capacity pressures remain the biggest wild card. The most pressing of them, the semiconductor shortage, is likely to start dissipating in the coming months, consistent with the recent reopening announcements in the auto sector and announcements from semiconductor manufacturers. A global rotation towards services spending may ease pressures on supply chains more broadly. We are already starting to see this reflect in a downtrend in some commodity prices. Still, caution remains warranted on this front.

Importantly, recent sentiment indicators all point to continued resilience in the industry in Canada, and have remained in expansionary territory in other countries despite a recent softening of momentum. Although only cautiously optimistic, a recent uptick in business investment sentiment, as indicated by the Bank of Canada Business Outlook Survey, is supportive for demand prospects. Small business confidence is also holding up well, as per the latest CFIB small business barometer readings.

Bottom Line

Canada's manufacturing industry has staged an impressive rebound from the COVID-19 recession. The recovery has more recently hit a standstill due to a combination of peaking caseloads and renewed restrictions during the autumn and winter months, but more importantly, due to supply chain disruptions in the auto sector. The reopening of economies in Canada and abroad should support demand going forward. The hope is that supply chain disruptions dissipate such that the industry is able to meet new demand.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: