The Loonie's Rise

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: April 30, 2021

- Category:

- U.S.

- Financial Markets

Highlights

- The Canadian dollar has been an outperformer in global currency markets. This has occurred alongside strong commodity prices and a hawkish Bank of Canada.

- The move higher parallels closely with past run-ups in the loonie, signalling that further upside in the currency may be limited

The Canadian dollar has been on a spectacular run. Since the start of the year, the loonie has appreciated over 3% against the greenback, ranking it as the best performer amongst G10 currencies. At 81 US cents, this is the highest level the loonie has been since early 2018.

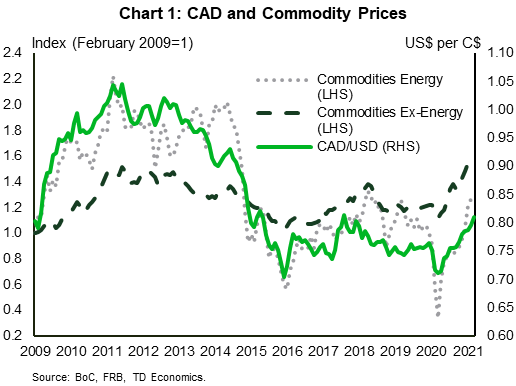

The rise in the Canadian dollar has occurred on the back of two strong narratives. The first is the run-up in commodity prices. With global manufacturing accelerating, everything from lumber to oil is in high demand. As Canada is a global leader in the production of commodities, as prices rise, more money flows into Canada through the export channel, leading to a strong correlation between commodities and CAD (Chart 1). The last time CAD appreciated to current levels, it happened alongside a similar move higher in commodity prices.

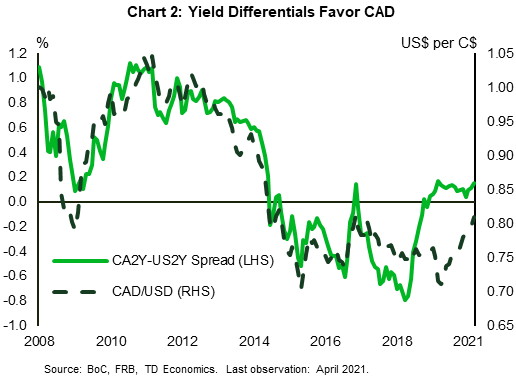

The second factor driving CAD has been the Bank of Canada (BoC). Due to the resilience of Canadian businesses and consumers in the face of the pandemic, the economy is expected to be running at full capacity by the middle of next year. The BoC acknowledged the same last week when it upgraded its outlook and signaled earlier than expected rate hikes. The bond markets have started to price this outcome. Importantly for CAD, the same cannot be said for the Fed and US yields. In Chart 2, we show the Canada-US 2-year government yield differential. With Canadian yields rising more than US yields, there is greater demand for higher yielding Canadian assets, and in turn, Canadian dollars.

These same yield differentials appeared back in late 2017 and early 2018. In the face of an overheating economy, with house prices threatening financial instability, the BoC turned hawkish. In July 2017, it hiked its policy rate for the first time in seven years and followed that up with another surprise rate hike in September 2017. Market were taken off guard and started pricing in expectations that the BoC would hike faster than the Fed. Though that outcome didn’t come to fruition, the event temporarily pushed CAD to a closing high of 83 cents.

So, what's next for CAD? Another leg higher in the exchange rate would require even higher commodity prices and a Bank of Canada that significantly races ahead of the Fed. We saw that happen right after the Global Financial Crisis, when WTI reached a cycle high of $114 a barrel and the BoC raised its policy rate to 1% (while the Fed firmly kept its rate at the floor). We are not expecting either of these events to happen again. The supply/demand balance in commodities supports current prices, but not a return to historical highs. Additionally, the Bank of Canada may be poised to raise rates within the next two years, but with the U.S. economy surging, the Fed won't be far behind the BoC, if at all. All of this supports the Canadian dollar somewhat above 80 US cents, but not much more than that.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: