Highlights

- Data from the Labour Force Survey shows that Canada’s job market has pumped out nearly +200k net new jobs since summer’s end, defying expectations. However, these gains have been met with some skepticism given weaker signals in other key job survey (payrolls) not to mention the broader GDP data.

- To help sort through any noise from signal, the BoC also tracks a wide range of other job market indicators, including the vacancy rate, job finding rate, separation rate among others.

- The signals from the metrics aren’t uniform, but collectively present a more subdued picture of job health relative to the LFS hiring data.

- Based on the BoC’s own assessment in last week’s Monetary Policy Report, the market remains in excess supply, even as the degree of slack may have eased slightly in recent months.

After stumbling through much of last year, Canadian hiring has been on an impressive run since the autumn. Over the final four months of 2025, the economy pumped out almost +200k net new jobs based on figures from the Labour Force Survey (LFS). This turn-out has not only blown expectations out of the water but is well above estimates consistent with a stable unemployment rate.

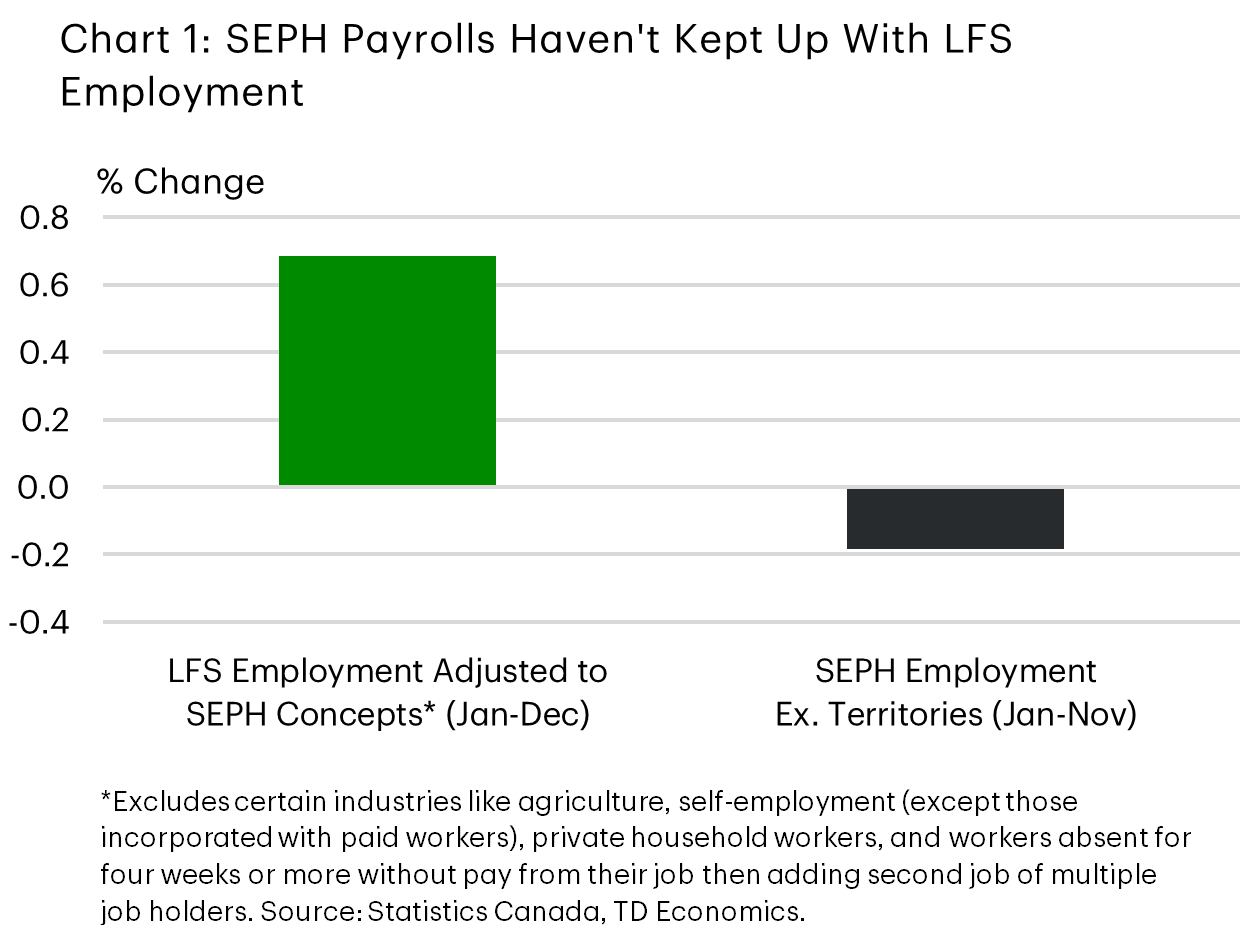

The extent of the strength has been met with skepticism by many analysts – and justifiably so. The LFS employment data tends to be noisy at the best of times, but even more so during periods of rapid demographic shifts. Indeed, very different signals have emerged from the other key Canadian job market report – the establishment-based Survey of Employment, Payrolls and Hours (SEPH). Adjusting for differences in measurement between the two surveys reveals a far softer picture for employment growth in the SEPH (Chart 1).

Given these uncertainties around measurement, the Bank of Canada leverages a wide range of other indicators in driving its assessment of labour market conditions. The BoC’s dashboard contains 8 key metrics. Most of these datapoints are ratios, and hence, tend to be more stable indicators of job market performance than absolute hiring changes.

In its last annual review in June 20251, the BoC judged the job market to be in a position of modest excess slack. In its January Monetary Policy Report released last week, the central bank noted that the market remained in oversupply, even as the degree of slack “may have eased slightly”.

In this report, we provide a status update on the BoC’s metrics of job market health. The signals aren’t uniform across the indicators, but overall they present a more subdued picture relative to the LFS hiring data.

Consulting the Magic 8 Ball on Canadian Job Market

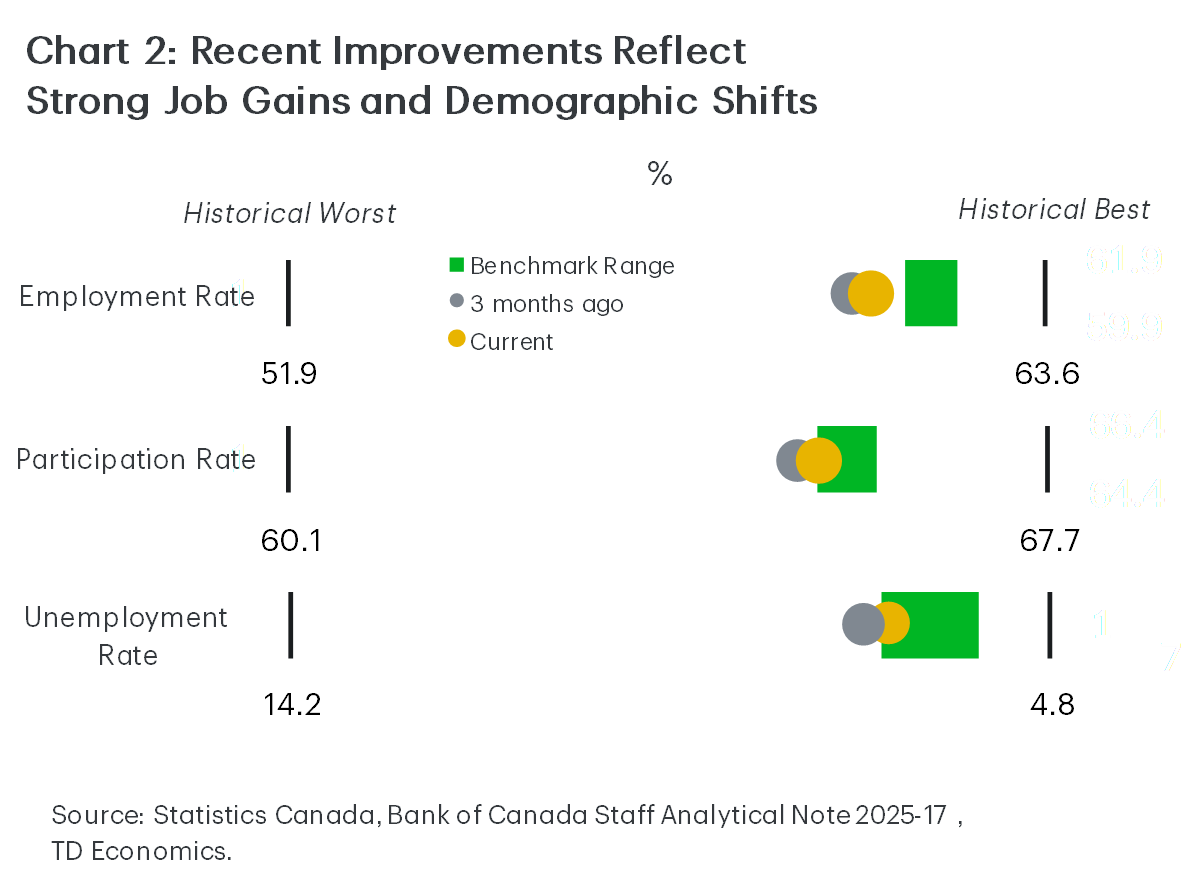

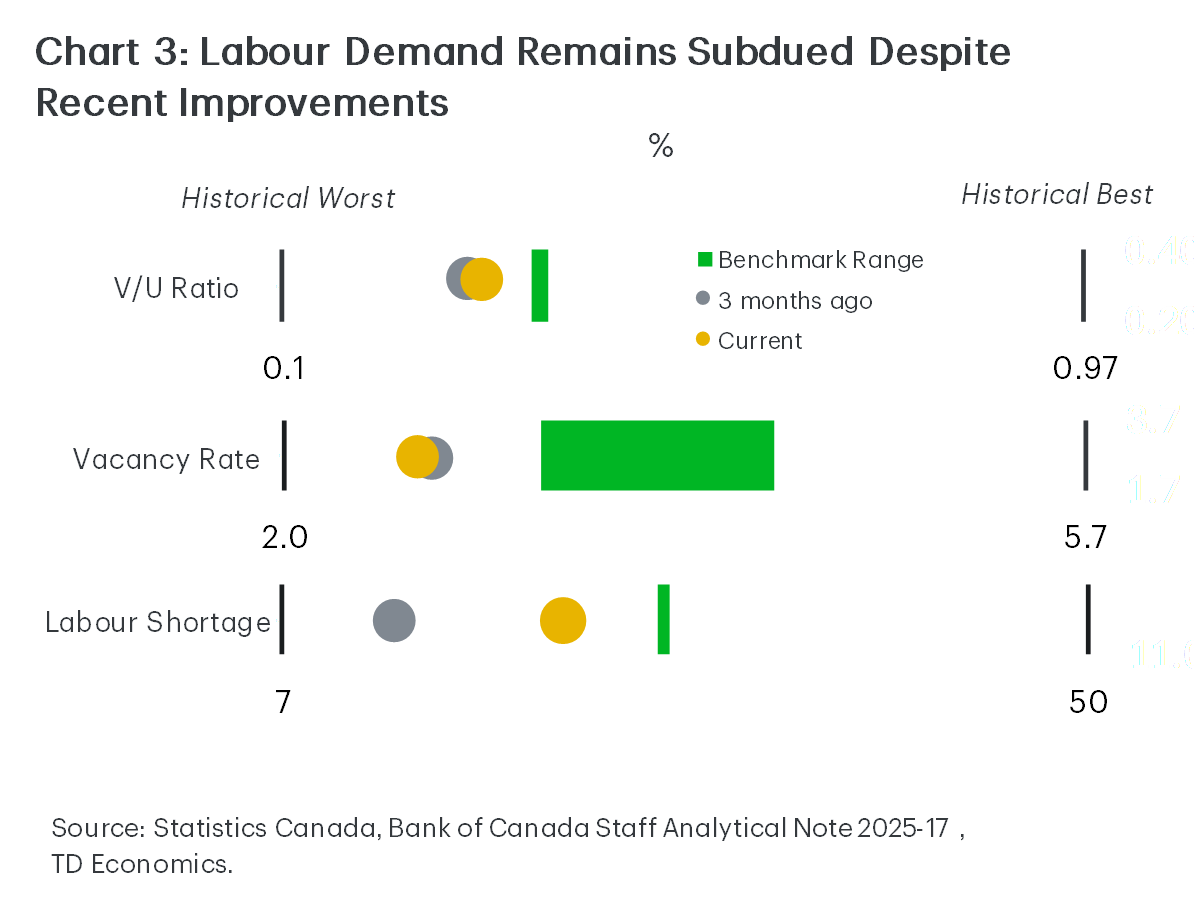

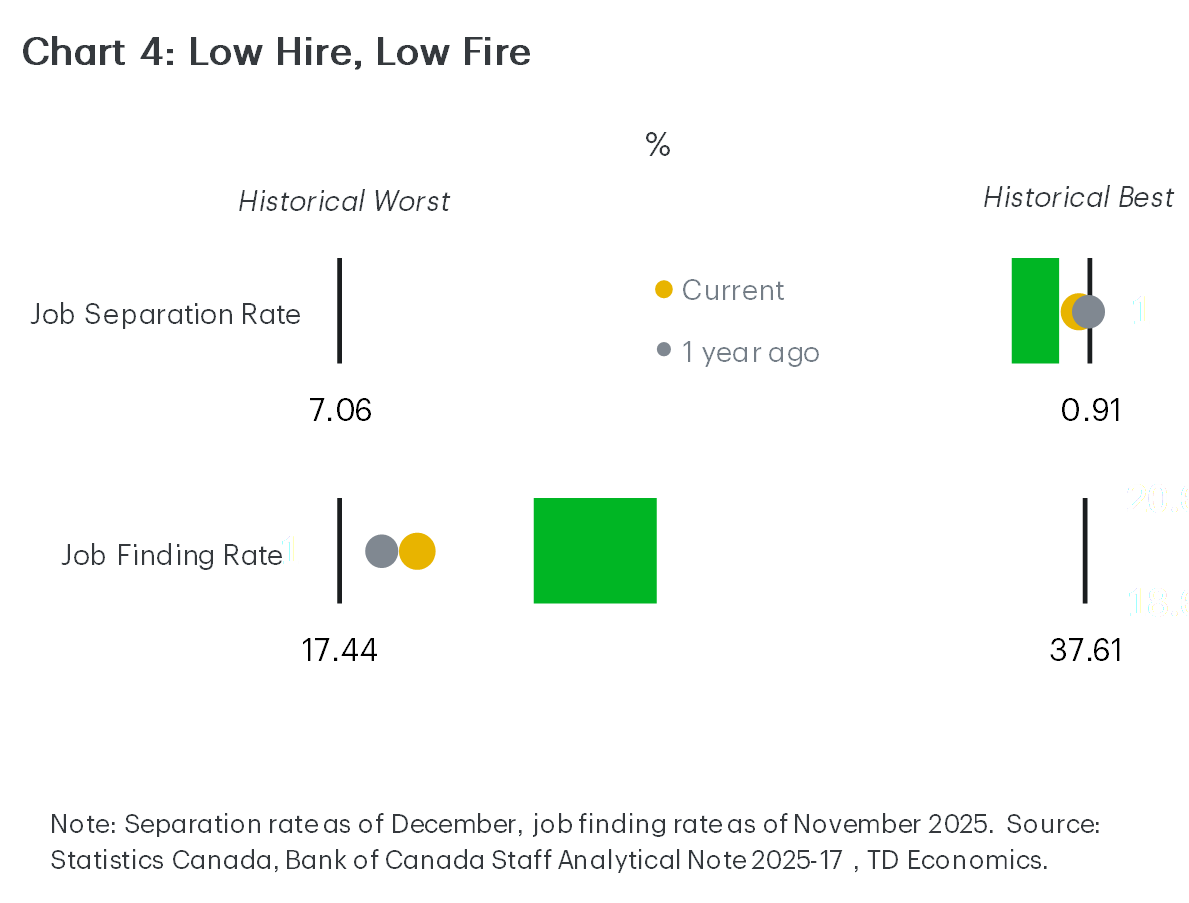

The accompanying set of charts (2-4) show the latest readings for each measure relative to their historical lows and highs, with green bands representing the central bank’s estimates of a “normal” or “healthy” range. If a datapoint sits to the left (or right) of the band, it points to relatively loose (or tight) job market conditions. We also include the comparable readings three months prior to flag the direction of recent momentum.

- After rising to a peak of 7.1% in early autumn, the unemployment rate has dropped to 6.8% (as of December 2025). The improvement came on the back of the recent uptick in job gains, but also a significant moderation in labour force growth (as tighter immigration policies have started to bite). With this recent move lower, the unemployment rate has managed to slip within the BoC’s estimate of a “normal” range, but only narrowly. By comparison, TDE’s longer-term “point” estimate of the jobless rate (consistent with full employment) is 6%.

- The labour force participation rate (or share of the 16+ population either working or seeking work) tells a similar story. The rate has been oscillating more or less in a sideways trend over the past year, and currently resides at the low end of what the BoC deems as healthy (65.4%-66.0%). From a demographic angle, a slow improvement in in prime-age participation rate (88.8% in December) has offset declines in youth participation (63.2%). As an aside, December’s month-to-month dip in the youth labour force marked the first of its kind since September.

- The employment rate measures the proportion of the working-age population with jobs, providing one of the broadest gauges of job market utilization. This rate has improved from September, but perhaps less than one would have expected given the recent strength of job creation. This is because the LFS population – while slowing from its breakneck peak in 2024 – has continued to expand at a relatively sturdy clip. The modest uptick in the employment rate since autumn has left it well below the normal band. This is one check mark under the column of “significant slack.”

- Another cautionary flag on degree of slack emerges from the ratio of job market vacancies to the number of unemployed (V/U) or the number of jobless Canadians available for each vacant position. This measure hit a post-pandemic peak of 0.96 in summer of 2022 – at a time of unusually tight job markets and soaring labour demand. Since then, it has been a one-way ticket down to levels of around 0.3, overshooting the range in what the BoC would dub ideal. For reference, the 2015-19 average was closer to 0.40. On the plus side, this metric has stabilized over the past few months, as both numerator and denominator have hit firmer ground.

- Telling a different story than the hiring data recently is the job vacancy rate (or number of vacancies as a percentage of total labour demand). That ratio has continued to deteriorate since last summer, albeit only moderately. At around 2.6%~2.7%, this ratio currently stands about one percentage point below the historical average of 3.5%. At one point during the post-pandemic job market boom in 2022, the ratio reached its historical record of 5.7%, which is unlikely to be tested anytime soon.

- Once a quarter, the Bank of Canada asks in its Business Outlook Survey whether businesses are facing a labour shortage problem. It is typical to see more businesses reporting difficulties finding workers when the labour market is very tight, as was the case in 2022. During that time, the share soared as high as 46%, far above the pre-pandemic average of 32%. In contrast, only 22% of businesses report labour shortage as of the BoC’s last survey in January, highlighting the seismic shift in worker demand stemming from a persistent output gap and the economic uncertainty weighing on business decisions.

- Job finding rate and job separation rates are also useful metrics in explaining the degree of friction in Canada’s job market. The job finding rate captures the share of job seekers that found a job in a given month, while the separation rate captures the share of workers that either quit or were laid off. On one hand, Statistics Canada reports that the job-finding rate has improved to 19.6% in November (modestly above last year’s 18.6%), which is still far outside of its normal range and at the low end of historical rates. On the other hand, we estimate the current separation rate to be around 1.0%2, close to its historically tight levels. This divergence is consistent with a “low hire, low fire” backdrop.

A Market Still on the Loose Side, But Slack Moderating

The results of our updated snapshot depict an slightly improving backdrop. More than half of the indicators have seen marginal improvements over the past 3 months, while few others have slightly retreated. This is consistent with the BoC’s latest assessment in its January MPR.

The good news, bad news storyline around the job market is yet another reason to expect the BoC to stand pat on monetary policy in coming rate decisions. At its December fixed announcement, the central bank indicated that it was prepared for an extended move to the sidelines barring “a shock or an accumulation of evidence materially changing the outlook.” This was reiterated at the January rate decision.

Looking ahead, we don’t anticipate large changes in the overall job market assessment. Job growth is likely to slow sharply in 2026 and 2027 – from last year’s 300k annual average clip to around 75k-100k. This softening partly reflects continued soft demand, with only a muted recovery expected in the vacancy rate. But a further loosening in labour market conditions is expected to be contained by a parallel softening in labour supply measures. Accordingly, we expect the unemployment rate to continue to hover at close to current levels in H1-26 before gradually easing to 6.2% by the end of 2027.

Bottom Line

An examination of 8 key job metrics on the BoC’s dashboard points to a market that has remained broadly stable, with some indicators suggesting easing labour market slack heading into 2026. The assessment complements our view that the central bank will remain on hold for the foreseeable future.

End Notes

- https://www.bankofcanada.ca/2025/06/staff-analytical-note-2025-17/

- Embeds latest official estimates from Statistics Canada. Not adjusted for seasonality. https://www150.statcan.gc.ca/n1/daily-quotidien/251205/dq251205a-eng.htm

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: