Meeting Canada’s Innovation Challenge Through Targeted Investment & Competition

James Marple, Director & Senior Economist | 416-982-2557

Date Published: July 15, 2021

Highlights

- Canada lags its peers in innovation and productivity growth. A dearth of investment, especially in research and development (R&D) and information and communication technology (ICT) among Canadian businesses is a perennial source of underperformance.

- Raising the bar on innovation may require a further shift in policy focus to the regulatory and competitive landscape. Removing barriers to trade and investment, especially across provincial borders, should help raise innovation outcomes.

- The jury is still out on initiatives to support superclusters and invest in digitization, but the focus on these areas as potential drivers of innovation is warranted.

- Transitioning the economy away from fossil fuels will require a central role of government. Carbon taxes are an innovation policy in their own right, but direct investments in basic research and emerging technologies will be required to promote the innovation in green technology necessary to get to net zero.

- Policy can help facilitate private investment by committing the government to investments whose profitability will depend on the success of climate change mitigation and a continued increase in the carbon price.

The unique shock created by the pandemic has shown the potential for the rapid adoption of digital technology that could have permanent effects on the structure of the Canadian economy. It has come at a time when the need to address climate change with concerted efforts to reduce carbon emissions will require a deft hand and central role for government policy. Alongside the longstanding challenge of population aging, the need for Canada to raise its innovation game has never been clearer.1

Raising innovation has been a focus of federal policy, with recent initiatives ranging from support for superclusters to the adoption of digital technologies among small and medium sized businesses. There is still room for improvement, but Canada performs relatively well in the strength of its political institutions and public support for innovation. It does less well in turning these strengths into innovation outputs, in the generation of new technologies, intellectual property, and fast-growing new companies.

As global competition heats up, the bar needs to be raised on innovation outcomes, which may require a shift in focus. There are no silver bullet solutions, but there are areas where further progress could be made. Ensuring that start ups can develop and grow into fast growing companies in Canada will require patience on future returns. Policy should aim to reduce uncertainty around these potential returns, especially in areas related to new or emerging developments in climate change mitigation. Second, the regulatory and competitive landscape must be addressed with concrete actions to remove barriers to trade and investment, especially across provincial borders. Finally, a continued focus on the needed skills of the workforce will remain central to raising innovation.

Where Canada uses public funds to invest in innovation directly, it should focus on investments in public infrastructure that level the playing field and reduce barriers to entry. These are likely to yield the highest returns. Research suggests the power of the public purse is more likely to be leveraged efficiently if it is used alongside private capital and with sufficient independence from the political process.

Where We Stand

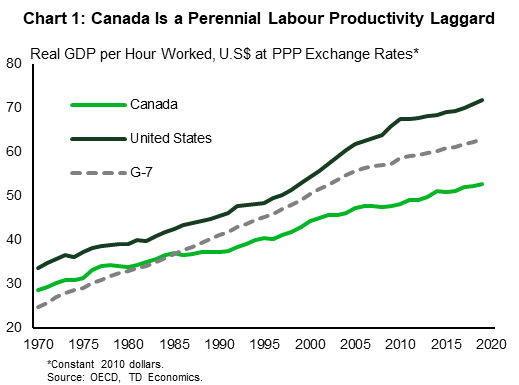

Canada’s productivity challenge is well established. The overall level of economic output per hour worked – the standard measure of labor productivity – is low relative to peer countries (Table 1) and has, unfortunately, deteriorated over time on a relative basis (Chart 1).2

Table 1: Labour Productivity

in Select OECD Countries*

| Countries | Level (2019) | Growth (1999-2019) |

| Norway | 84.3 | 0.9 |

| United States | 71.8 | 1.5 |

| Sweden | 69.9 | 1.4 |

| France | 67.5 | 1.0 |

| Germany | 66.4 | 1.0 |

| G-7 | 63.0 | 1.2 |

| Finland | 61.6 | 1.1 |

| United Kingdom | 58.4 | 1.0 |

| OECD Average | 54.5 | 1.2 |

| Italy | 53.4 | 0.2 |

| Canada | 52.7 | 1.0 |

| Spain | 52.5 | 0.8 |

| Japan | 46.6 | 1.1 |

| Israel | 42.3 | 1.4 |

| South Korea | 40.5 | 3.8 |

The causes of Canada’s poor performance have been the subject of myriad volumes of economic research over the past several decades. Canada has even implemented many of the recommendations of critics over the years – reducing corporate income and capital taxes, incenting reductions in greenhouse gases with a price on carbon, and (up until the pandemic), reining in public debt and deficits. Canada’s overall political and macro-economic institutions rank relatively highly in international comparisons. Canada has increased its public support for research and development (R&D), and while it could do more, direct public support for R&D is higher than both the United States and the OECD average. When it comes to the measurement of the inputs to innovation – the institutions, infrastructure, and market sophistication necessary for it – Canada ranks ninth in the world according to the Global Innovation Index and is closely clustered with countries like Finland, the United Kingdom and Hong Kong, which rank highly overall.3

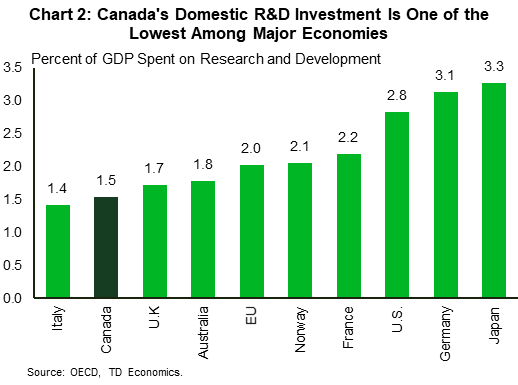

Unfortunately, Canada’s innovation performance slips considerably on the “output” side, falling to 22nd in the global index and moving behind several emerging market economies.4 Despite generous tax credits for R&D, total investment in R&D is low relative to other countries. Overall Canadian businesses and governments spend just 1.5% of GDP on research and development (R&D), ahead only of Italy among major advanced economies (Chart 2). Since the Global Financial Crisis, Canada’s R&D investment has dropped more than any other advanced economy. Italy’s R&D spending, in contrast, has been on an upward trend. Canada has particularly low levels of private-sector R&D. Just over 50% of R&D spending is within the private business sector in Canada, well below the average of OECD countries at over 70%. In Israel and South Korea, the ratio is 88% and 80% respectively.

Canada’s poor record of private sector R&D also extends to the adoption of information and communication technology (ICT). Countries with high rates of ICT adoption report higher productivity growth. Canada again lags its competitors, contributing to its weak performance.

Reduce Barriers to Firm Growth

Access to start up capital and an ability to scale up operations have long been identified as contributing to Canada’s innovation challenge. The first is showing improvement. Venture capital funding has tripled relative to the size of the economy over the past ten years in Canada. While the level of venture capital funding relative to the size of the economy is one-third of the level as the United States, it is higher than peer countries in Europe. Venture capital has increased substantially during the pandemic and is on track for its highest year on record in 2021.5

Less progress is evident in the ability for companies to scale-up. The Business Development Bank of Canada (BDC) notes persistent issues in scaling up start up businesses that receive venture capital funding and that when they do reach critical size, they are more likely to acquired by a larger company than to IPO.6 Late stage funding is less prevalent in Canada than in Israel or the United States.

Even when funding can be secured, a number of implicit policy barriers may dissuade companies from expansion. Canada’s small business tax exemption, for example implies high marginal tax rates on growth of companies above the $500,000 income threshold. Given evidence of higher productivity among larger firms, this may hold back economic dynamism.7 Small firms in Canada also have low export penetration, which may partly reflect a desire to stay local and/or a lack of resources and sophistication to navigate international rules and markets.

Competition and Productivity Go Hand and Hand

Another explanation for Canada’s poor productivity record vis-à-vis peers is a relatively higher level of restrictions on business activity and trade across regions and provincial borders. There is no escaping Canada’s geographical or linguistic reality, but in addition to these natural barriers, differences in regulation, government procurement (especially at the provincial level), and professional certification requirements create roadblocks to trade and mobility across the country, that inhibit business expansion and reduce the innovation imperative.

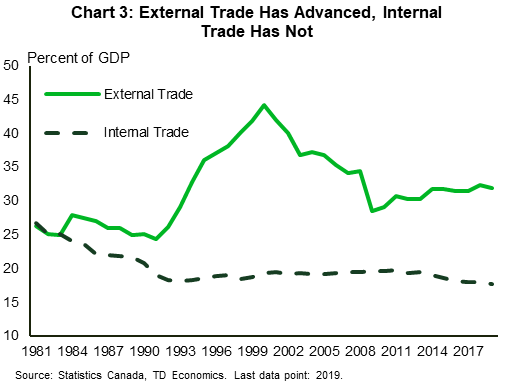

The relationship between productivity and trade is well established and has been a motivating factor for Canada’s pursuit of international free trade agreements. But while international trade has increased relative to GDP, interprovincial trade has not (Chart 3).

A study by Statistics Canada showed that controlling for other influences (like geographical distance), barriers to interprovincial trade are equivalent to a 7% ad valorem tariff on goods traded within Canada.8 In other words, restrictions amount to another GST on all goods bought and sold in Canada. This is unique. Using the same methodology, the study found no evidence of such an added cost to trade across American states. Researchers at the IMF estimate that removing internal barriers to trade could raise the level of GDP per capita in Canada by 4%, with much of this increase coming from higher productivity.9

Textbox 1: Getting the Right Kind of Investment

One of the outcomes of the COVID-19 recession to surprise economists is the speed at which investment has bounced back following the plunge during lockdowns. In both Canada and the United States, overall fixed investment is higher than its pre-pandemic level and even higher than forecasts anticipated prior to the pandemic.

However, the type of investment is also important. Canada’s investment rebound has consisted entirely of residential investment, which has jumped by 25% since the start of the pandemic. Business investment in equipment and intellectual property, on the other hand, has continued to lag and is still 5.6% below its pre-recession level. In the United States, by contrast, equipment and software is 6.5% above its pre-recession level. Canada’s relative underperformance in investment in equipment and intellectual property is a longstanding problem and explains much of the continued deterioration in relative productivity between the two countries..

Building on the Canadian Free Trade Agreement (CFTA)

To get to this end point, free trade within Canada has to be treated with the urgency it deserves among provincial and federal leaders. The good news is that Canada has made steps to make internal trade freer. In 2017, provinces and the federal government signed the Canadian Free Trade Agreement (CFTA), updating the previous Agreement on Internal Trade (AIT) of 1995. The CFTA is a notable improvement on the AIT on several fronts. Perhaps most notably it broadened the scope of the agreement by changing the basis of the agreement from a “positive list” of identified trade barriers, to a “negative list” that liberalizes trade in all areas except where provinces explicitly exempt it. This increases transparency and puts the onus on provincial governments to justify maintaining barriers to trade. The agreement also has a dispute resolution process that gives jurisdictions a way to challenge barriers to trade.

Still, it is not perfect. All provinces maintain a number of exemptions to free trade across industries and while a handful have reduced them, several have increased them since the signing of the CFTA.10 Improvements to the dispute resolution mechanism that make it more binding and give recourse to businesses for meaningful barriers to trade could go along way in further reducing barriers.

Reconciliation of regulations is another area where progress should continue. One simple way for governments to reduce these barriers quickly is simply to recognize the qualifications of other jurisdictions within the country. Alberta has already unilaterally recognized the regulations of other provinces. More action on this front could go a long way to reducing barriers to trade and increasing innovation across the country.

Carbon Tax is a Great Promotor of Green Innovation

Canada does not just need more innovation, but it especially needs innovation that helps it achieve goals of drastically reducing greenhouse gas emissions and reorienting the economy away from fossil fuels. A key tool toward this end is a transparent price on carbon that allows companies to understand their current operating framework, but also how it will change moving forward. This promotes innovation by incenting companies to invest in technology now to get ahead of a higher carbon price in the future.

However, as with any policy, uncertainty about its future state may inhibit these investments from taking place. If companies believe carbon pricing may be reduced in the future, they will be less likely to make investments today. This is an area where the Canadian government could do more. One recently proposed policy solution is to have the Canadian Infrastructure Bank (CIB) partner with firms looking to invest in capital-intensive, low-carbon technologies.11 If carbon prices rise, the CIB stands to benefit from the investment, and if they fall, the CIB can be the shock absorber on the loss. This commits the government to its carbon price plan and by reducing uncertainty around it, should help to incent greater investment and innovation.

Picking Winners is Hard, but Competitive Market Signals Can Help

The need to transition away from a carbon-based economy has led governments to make a number of direct investments. This is clearly needed. Only 10% of businesses included in Statistics Canada’s Survey of Innovation and Business Strategy used clean technologies. There were 57% more heavy-duty diesel vehicles on the road in 2018 than in 2005.12 Emissions from commercial buildings are again on the rise. While there are differences across firms within these sectors, progress so far has not been great.13

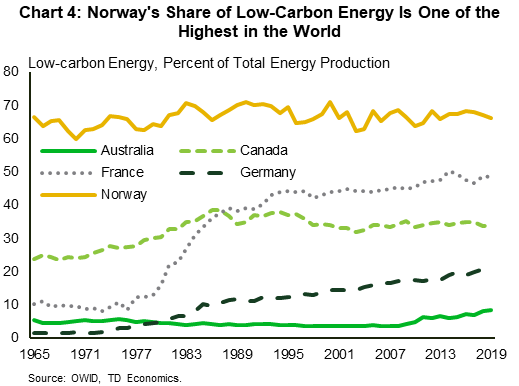

Norway, by contrast, has one of the highest shares of low-carbon energy production (Chart 4). In the 1990s, Norway set up a sovereign wealth fund to help prepare the country for a time when their oil and gas reserves run out. More recently, the sovereign wealth fund has been actively trying to wind down fossil-fuel investments. The country’s divestment comes as government pension funds face mounting political pressure to exit fossil fuels and realign their strategies around green businesses and clean energy to meet the goals of the Paris Agreement on climate change.

Norway offers an example of how government funding can assist in the move away from a carbon-based economy. Still, picking which companies and industries to invest in is not an easy task and fraught with political risk. Literature in this area tells us that the direct effects of industrial policy are mixed and the indirect effects quite often negative – increasing market distortions and reducing competition. At the same time, the economic literature is broadly in agreement on the benefits of competition for productivity and innovation. Successful industrial policies reinforce competition, suggesting that competition policy and certain types of industrial policy can be crafted as complements.14

There is an urgent need for the government to invest in decarbonizing the economy, especially at the early stage. Government should direct its energy at basic research, areas where the private sector is less likely to invest since the outcomes are most uncertain and risks greatest. Once a technology is established, market mechanisms should be used to the greatest extent possible. Where governments must pick winners, its goal should be to identify industries that will offer the most bang-for-the-buck while also maintaining a level playing field.

Investments in Superclusters Shows Promise

In this vein, governments are increasingly re-orienting the focus of policy from looking at Canada as one innovation ecosystem to a series of local ecosystems that foster the development of “clusters.” Clusters are geographically proximate groups of interconnected companies, suppliers and service providers and associated institutions and related actors, such as post-secondary institutions. Firms gather to benefit from efficiencies from labour market pooling, knowledge spillovers and supplier specialization, which create a reinforcing economic ecosystem. Cluster success is commonly considered synonymous with innovation and growth.

In 2017, the federal government started its “Innovation Superclusters Initiative,” investing $918 million over five years in five different so-called superclusters: the Digital Technology Supercluster in British-Columbia, the Protein Industry Supercluster in the Prairies, the Next Generation Manufacturing Supercluster in Ontario, the AI Supercluster in Montreal and the Ocean Supercluster in the Atlantic provinces. The project is expected to generate spending by non-federal partners of $1,087 million over the same 5 years.

Analysis by the Parliamentary Budget Office shows a slow roll out of the program, but still its potential for progress in attracting private capital, which has so far has kept pace with public investments.15 This is promising. Research suggests that having the private sector share in the risk of innovation tends to lead to a better allocation of investment, as does putting decision making in the hands of professional managers.16

Bottom Line

Canada’s economy has a lot going for it – an openness to international trade, a much-lauded immigration system, and a competitive tax regime. Despite these advantages, Canada lags its peers in one area that really matters – innovation. As a result, productivity growth and increases in Canadian living standards have suffered. The innovation imperative has never been more pronounced. In order to meet the challenges of climate change, population aging and high debt levels, Canada must raise its innovation game.

Achieving better innovation outcomes will require both carrots and sticks. By carrots, we mean targeted policies to directly support research and development (R&D) and its commercialization, especially within low carbon technologies that will pay off further in the future. By sticks, we mean policies that increase the imperative for businesses to undertake innovative strategies. Competitive forces that tend to spur innovation can be enhanced through government policies for example, opening the door to greater flows of trade and investment across provinces.

Canada can take lessons from countries abroad in terms of supporting greater investment in information and communication technologies, clean energy, but it must also combine these with policies to promote competition and reduce internal barriers to trade, in order to succeed.

Textbox 2: Budget 2021 is Innovation Friendly on Paper

Budget 2021 includes important allocations to tackle some of the issues outlined above. For businesses, the budget broadly focuses on providing investment incentives and support for technology adoption. There is also a hiring incentive and additional funds for aerospace and life sciences; a fund for research, innovation and entrepreneurship; and new spending on green infrastructure and broadband internet. In total, $16.3 billion is committed to these initiatives.

Education, reskilling, and retraining is another important long-term focus of the budget. The federal government plans to make notable investments in helping employers recruit and train workers to meet the growing demand in the skilled trades sector and includes a new service to help connect apprentices with employers.

The budget also includes $17.6 billion in investments in the green economy. This includes up to $8 billion over seven years for its “Net Zero Accelerator”. This funding is intended to spur Canada’s shift to innovate net-zero technologies and attract large scale investments.

As the old adage goes, the proof of pudding is in the eating. These commitments will have the intended impact only if the government gets the design, prioritization and implementation of this spending right. The government is faced with the tough task of recovering from the pandemic, while at the same time ensuring robust long-term growth that enhances productivity and makes Canada an attractive destination for investors. As the earmarked spending is financed with debt, without the growth enhancing benefits of these investments, higher taxes and/or cuts in spending will be required in the future.

End Notes

- Special thanks to Sohaib Shahid for his help in researching and preparing this report.

- Multifactor productivity growth measures the growth in output achieved without adding more inputs (more labor or capital). This measure is analogous to the pace of innovation and is similarly middling.

- World Intellectual Property Organization Global Innovation Index 2020 https://www.wipo.int/global_innovation_index/en/2020/

- Ibid.

- https://www.theglobeandmail.com/business/article-booming-canadian-tech-sector-set-to-smash-venture-capital-records

- Canada’s Venture Capital Landscape: Challenges and Opportunities, June 2017 https://www.bdc.ca/en/documents/analysis_research/venture-capital-landscape-paper-en.pdf

- Ben Dachis & John Lester (2015) Small Business Preferences as Barrier to Growth: Not so Tall After All. https://www.cdhowe.org/public-policy-research/small-business-preferences-barrier-growth-not-so-tall-after-all

- Bemrose et al (2017). “Going the Distance: Estimating the Effect of Provincial Borders on Trade when Geography Matters. Statistics Canada https://www150.statcan.gc.ca/n1/en/pub/11f0019m/11f0019m2017394-eng.pdf?st=kjXqJhN1

- Alvarez et al (2019). Internal Trade in Canada: Case for Liberalization. IMF. https://www.imf.org/-/media/Files/Publications/WP/2019/WPIEA2019158.ashx

- Internal Trade Provincial Leadership Index – 2021 Edition https://www.iedm.org/internal-trade-provincial-leadership-index-2021-edition/

- Beugin, Dale and Blake Shaffer (2021). “The Climate Policy Uncertainty Gap and How to Fill It” CD Howe Intelligence Memos, June 4, 2021 https://www.cdhowe.org/intelligence-memos/buegin-shaffer-%E2%80%93-climate-policy-certainty-gap-and-how-fill-it

- Statistics Canada Survey of Innovation and Business Strategy, 2017 to 2019 https://www150.statcan.gc.ca/n1/daily-quotidien/210426/dq210426a-eng.htm

- Drummond, D. and Rachel Samson, (2020). “Three big ways Canada can succeed at low-carbon growth” https://climatechoices.ca/three-big-ways-canada-can-succeed-at-low-carbon-growth/

- Connon, D. and Georgiana Pop, (2020). “Industrial Policy Effects and the Case for Competition” https://openknowledge.worldbank.org/handle/10986/34536

- Bergeron, Étienne and Salma Mohamed Ahmed (2020). The Innovation Superclusters Initiative - A Preliminary Analysis. Parliamentary Budget Office. https://www.pbo-dpb.gc.ca/en/blog/news/RP-2021-024-S--innovation-superclusters-initiative-preliminary-analysis--initiative-supergrappes-innovation-analyse-preliminaire

- Lerner, Josh (2020). Government Incentives for Entrepreneurship. NBER Working Paper https://www.nber.org/papers/w26884

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: