Canadian Inflation: A New Vintage

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: April 27, 2022

- Category:

- Canada

- Financial Markets

Highlights

- Consumer prices continue to rise at rates not seen in decades. With fuel, food, and housing prices leading the way, many of us are reminded of the double-digit inflation of the 1970s and early 1980s.

- Though there are worrisome similarities between what we are currently experiencing and what happened in the past, we are not expecting inflation to return to those historical highs.

- One factor that we expect to provide a counterweight is the Bank of Canada. It has started to aggressively hike interest rates and will continue to do so until inflation decelerates. This direct approach to target inflation wasn't implemented in the 70s/80s until inflation was out of control.

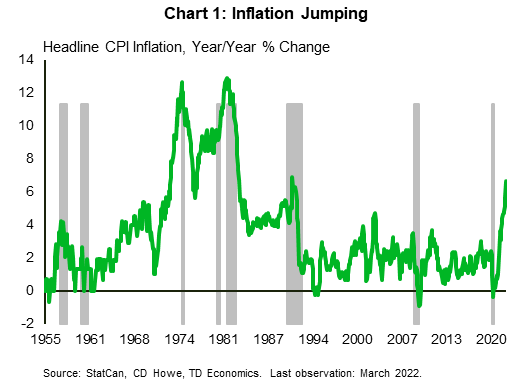

Canadian inflation continues to surge higher. With prices growing at 6.7% year-on-year (y/y), inflation has gotten to levels not seen in decades (Chart 1). The rise in prices has broadened to all facets of the economy. From the impact of supply chain bottlenecks to the current commodity price shock, the inflation dynamics have all been moving in the same direction. This has Canadian's expecting that elevated inflation will remain a part of their lives for quite some time. As we grapple with this reality, we are left to wonder how much higher inflation will get.

A Classic (Rock) Inflation Example

Outside of attending the occasional Eagles reunion concert or listening to classic rock on the radio, it was rare to hear people talk about what life was like in the 1970s and 1980s. But this has changed recently. And, here, I'm not referring to all the good stuff – like how long hair is going to come back in to style or how your friend just bought a new Gibson Les Paul – but rather how today's inflation experience is mirroring that earlier time period.

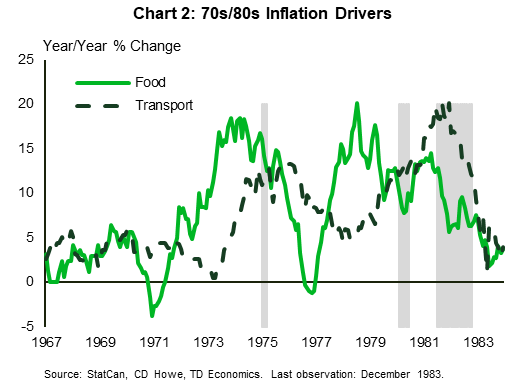

In the 70s and 80s, there were two distinct inflation episodes that led to double-digit price increases in Canada. One from 1971 to 1976 and another from 1977 to 1983 (Table 1). In both cases, food and energy price shocks were the trigger. In the first episode, adverse weather in 1973 caused food prices to jump 18.4% (Chart 2). And following the Yom Kippur war in that same year, a quadrupling in the world price of oil caused a massive rise in gasoline prices. By December 1974, with Canadian inflation hitting a peak of 12.7%, the economy entered recession.

The second inflationary spike was an echo of the first. In 1978, meat prices skyrocketed by 70%, causing the overall food index to rise by 20.2%. Then the Iranian Revolution caused the 1979 Oil Crisis, which was followed by the Iran-Iraq war of 1980. This resulted in another doubling in the price of oil. Canadian gasoline prices ended up rising by 45.5% in 1981, which pushed Canadian CPI to an all-time high of 12.9%.

Table 1: Inflation in Perspective

During that time, the Bank of Canada decided to join Federal Reserve Chair Paul Volcker's war on inflation. The BoC ended up hiking rates to a high of 21% in 1981, causing the 5-year fixed term mortgage rate to reach a high of 21.5%. This lifted the shelter component of CPI to 15.9% in 1981, led by a 25% rise in the cost of mortgage interest payments. With soaring inflation and extremely tight monetary policy, the economy fell into recession on two separate occasions - during the first half of 1980 and once again in mid-1981.

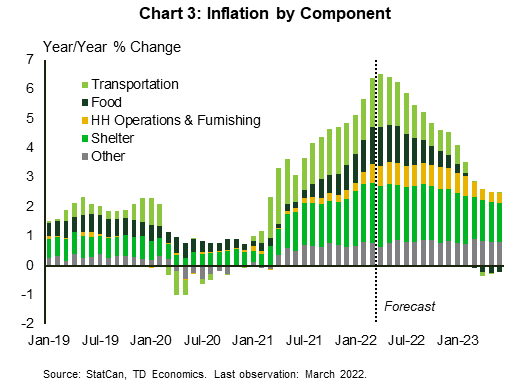

New Song, Same Tune

Current inflation is just like today's music, it sounds a lot like the older stuff, but it is different. As we show in Chart 3, the drivers of inflation over the last two years are the same as those in the 1970s and 80s. Indeed, shelter (housing), transportation (including gas prices), and food are responsible for nearly 80% of current inflation, though they constitute only 62% of the CPI basket. In other words, they are punching above their weight.

The fact that these components are driving inflation is important. Even though there remains considerable runway before inflation matches the rates recorded in the 1970s and 1980s, it certainly doesn't feel that way for many Canadians. Behavioural scientists note that people remember things that they encounter often and those that elicit an emotional reaction. This is the reason I can still remember all the words to Bohemian Rhapsody. For inflation, there are certain products that we purchase often, and thus they have a greater impact on our perception of inflation. This is why we feel the impact of rising food and fuel prices to a greater extent than other purchases we make less often. Over the last year, Canadians have seen food prices jump 7.7%, with beef prices up 14.1%. Heck, even butter is up 16%. On the transportation side, we have seen the index jump 11.2% in the last year, with gasoline prices up 39.8%. Though international oil prices have come down from their peaks following the start of Russia's invasion of Ukraine, an easing in gasoline prices hasn't been as swift.

Layering on, the biggest contributor to inflation in Canada is also the biggest risk to the Canadian economy: Housing. It makes up 30% of the CPI basket, and with the run-up in house prices and increasing cost of maintaining a home over the last two years, the shelter component has been a primary driver of inflation (up 6.8%). And this has happened even as rental prices have lagged (up only 4.2%) and mortgage interest cost inflation has been negative. Both of these areas are poised to increase, with rent prices just starting to show signs of life and mortgage interest costs set to jump on the BoC's aggressive rate hiking path.

And Now For What's Different

That leads us back to the question we posed at the beginning of the paper: how much higher will inflation go? Now that inflation is no longer just a pandemic-induced surge, nor a commodity price shock, the broadening of inflation across other expenditure components means that high inflation will be more persistent. As a result, we have upgraded our inflation forecast for 2022 and 2023. In addition, the peak of inflation is now expected in Q2, a quarter later than anticipated in March (see Chart 3 above).

Though our forecast infers that inflation will be more persistent, it also indicates that we are not headed for a 1970s/80s redux just yet. For this to happen, a number of ducks need to line up. This includes a cool down in global energy prices, an easing in global supply chain disruptions, and only a moderate acceleration in wage gains.

Regarding energy, we have already seen a massive increase in the price of gasoline and natural gas, with most of this rise coming from a heightened risk premium. Over the month of April, energy prices have pulled back from their peaks, removing a significant amount of the supply disruption risk premium. Assuming no new supply threats, oil prices should continue to migrate lower over 2022. Furthermore, as supply chain issues continue to ease, the overall transportation component could actually start to move into negative territory. This will have wide ranging impacts, which could lead to a deceleration in food and durable goods prices.

Additionally, we have a domestic demand counterweight to high inflation coming from the Bank of Canada. It has clearly stated that it needs to make sure that higher inflation today doesn't unmoor expectations that it will return to the 1%-3% range over the coming years. The fact that the BoC is now so willing to squash inflation by using its interest rate hammer is also one of the main differences between the current episode and that of the 70s/80s. In 1971, CPI rose from 1% at the beginning of the year, to 4.9% by the end of the year. Though inflation continued to rise, the BoC didn't raise its policy rate until April 1973 and the pace of rate increases was so slow that it took another three years for it to get its policy rate to restrictive levels. By that point it was too late. Inflation expectations adjusted upwards, resulting in even higher inflation over the subsequent years.

We believe the Bank of Canada has learned from history. In fact, it was all the way back in 1991 when the Bank implemented its inflation targeting framework. The focus toward fighting inflation as a top priority was extremely successful and brought the Bank credibility. For this reason, even though businesses and consumers see inflation above 3% over the next year, they still think it will come down to target within the next three years. The Bank wants to maintain that credibility, which is why it is going to be more aggressive now than it was in the last period of high inflation. Just as low interest rates caused spending and inflation to accelerate, the BoC's move towards high interest rates should limit demand and rein in inflation.

Bottom Line

Back in the day when a band would produce a record (yes, a physical piece of music), there would be two sides. There was the A-side of the record that had all the tracks that would be marketed to radio stations. Then if you flipped it over, there was the B-side, which was full of extra songs from the recording sessions. Though the band was clearly betting that the A-side songs were going to be hits, on occasion the B-side tracks would end up becoming more famous. For the economy, we all thought we would remember this business cycle for its speed of recovery and overwhelming strength. But now, the inflationary by-product is getting all the attention.

With inflation consistently moving higher on food, fuel, and housing, this has many of us reminded of the classic inflation cycles of the 1970s and 80s. Though the drivers are similar, there are differences. For one, current inflation is nowhere near the rates from that time period. And two, long-term inflation expectations are still well anchored. Most of our belief that inflation isn't going to return to levels from the 70s/80s is that we believe the BoC will hike rates to a high enough level that calms demand and slows the pace of inflation. The Bank of Canada will have to be careful as it attempts to do this. With inflation so high, there is growing risk that the Bank goes too far with rate hikes and ends up pushing the economy into recession.

This makes us think of one of our favourite B-sides from the Rolling Stones: You Can't Always Get What You Want.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.