Canada: Gearing Up for Provincial Budget Season

Marc Ercolao, Economist | 416-983-0686

Date Published: February 17, 2026

Provincial governments are readying their 2026 Budgets. The tone across provinces is likely to be cautious as governments face ongoing fiscal deficits, rising debt burdens, and economic outlooks shaped by slower growth, trade uncertainties, and spending pressures. Outlined below are some key, high-level themes that we expect to be present in the spring budget season. British Columbia will be first out of the gates, set to release on February 17th. Additional announced release dates include Alberta (February 24th), New Brunswick (March 17th), and Saskatchewan (March 18th) – other provinces are expected to follow with announcements in the coming weeks.

1. Wide Deficits with a Gradual Path to Improvement

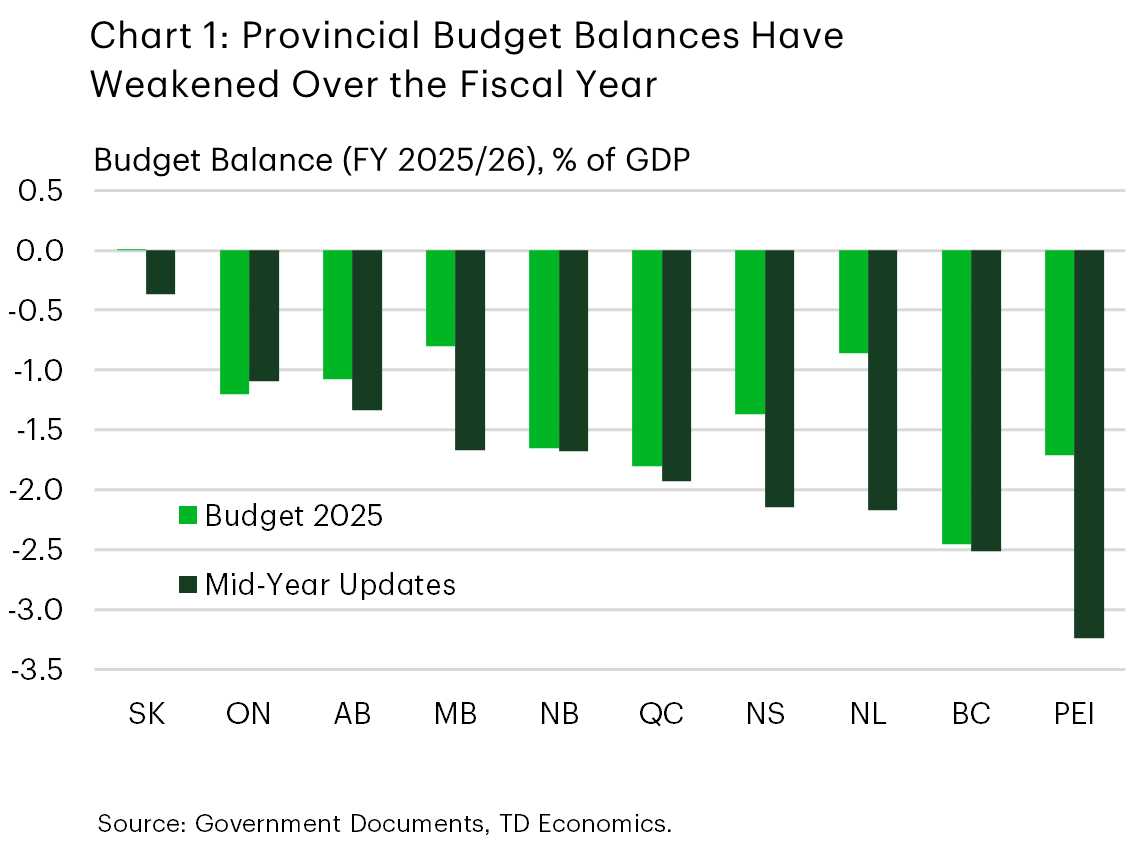

A weak backdrop in 2025 is expected to have widened the aggregate provincial budget to roughly $49 billion (-1.5% of GDP) in FY 2025/26, the largest shortfall outside of the pandemic since 2009. Recent deficit forecasts suggest a modest improvement in the upcoming fiscal year to around -1% of GDP. As of the mid-year fiscal updates, all provinces are expected to start the year in red ink, with some provinces potentially emphasizing “path back to balance” plans. Across jurisdictions, deficit estimates for the current fiscal year range from a low of -0.4% of GDP in Saskatchewan to a high of 3.2% of GDP in PEI (Chart 1).

2. Revenue Risk From Weaker Economic Growth

Provincial revenues are expected to face near-term headwinds from weaker economic growth and commodity price volatility. In line with the consensus view, economic growth nationally is likely to slow in 2026 – to just over 1% on an annual average basis from 1.7% in 2025. Factors likely to put a damper on near-term growth include slower consumer spending gains, still-weak business investment due to trade uncertainty as well as a near-zero population gains. Across most provinces, economic growth will take a step back in 2026, though we do expect some regional variation. The Prairies and some Atlantic provinces are expected to outperform, while Quebec, Manitoba and Ontario will likely lag behind.

Mid-year updates showed that revenue momentum is heading into the budget season on a weaker footing than expected last spring. Aggregate provincial revenue growth is currently expected to shrink by 1.5% in FY 2025/26, down from a roughly flat growth expectation last spring. A modest rebound in revenue growth is projected in the outer years of the forecast horizon as growth returns back to trend. These “status-quo” estimates will shift depending on updated economic assumptions as well as new budget polices. Provinces will likely also continue to build in contingencies, scenario planning and buffers for trade disruptions and lower commodity prices. Federal transfers (health, social and equalization payments) will also provide important support.

3. Total Spending Moderation, Capital Spending Domination

Aggregate provincial program spending growth likely cooled to 3.7% in FY 2025/26, following a multi-year stretch of gains above 5%. Further spending moderation amid ongoing fiscal pressures is potentially on tap, with emphasis on value-for-money spending, protecting essential services, and avoiding broad tax hikes.

Provinces will likely continue to lean on large, multi-year capital programs, mainly focused on health care, education, and transportation infrastructure. In fact, the bulk of provinces are entering the budget season with large capital plans already locked-in, meaning near-term spending levels should remain strong. In total, planned infrastructure spending in FY 2025/26 will eclipse $100 billion, its highest point on record and up by roughly 20% from last year’s levels. Statistics Canada will release the results of the 2026 survey of non-residential capital and repair expenditures (a.k.a., the CAPEX survey) on February 25th, which will help inform year-ahead expectations for public sector spending growth.

4. Debt and Credit Pressures Rising (But Not Yet Alarming)

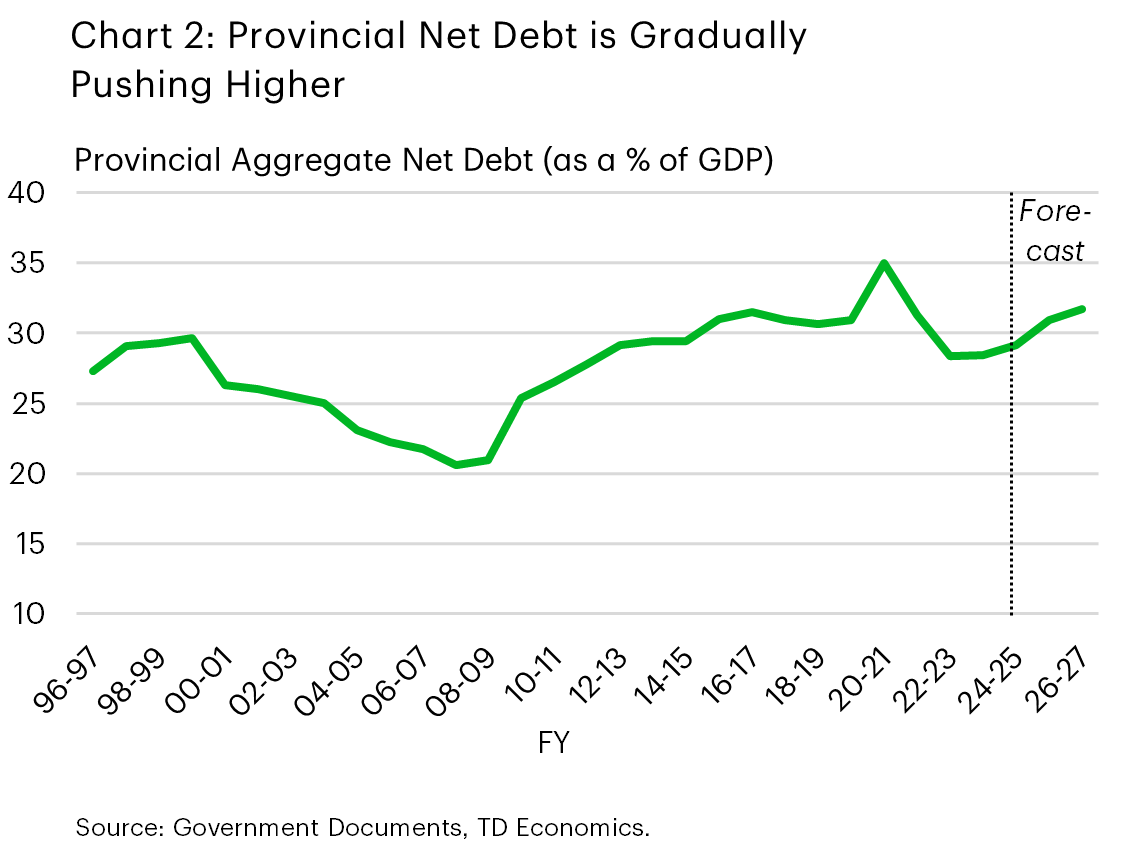

Net-debt (as a share of GDP) is increasing across nearly all provinces, with aggregate ratio currently projected to rise from ~29% in FY 2025/26 toward 32% by FY 2028/29. Past fiscal blueprints have pointed to the largest increases taking place in B.C., Nova Scotia, and PEI. Meanwhile, debt-to-GDP ratios in Alberta (8.7%) and Saskatchewan (15.1%) remain low. Higher aggregate debt-servicing costs (rising modestly as a share of revenues) and credit rating pressures will likely remain a theme. On the latter, rating agencies have highlighted risks from persistent deficits, elevated capital spending, and trade shocks/commodity volatility. While provinces are generally in good standing across the board, recent credit rating downgrades to B.C. and Nova Scotia have provided a signal of caution to other provinces. Comparatively, provinces like Ontario (~37% debt-to-GDP), Quebec (~40% of GDP) and some Atlantic provinces face higher relative debt burdens and per-capita debt. With these dynamics, adhering to fiscal guardrails will likely remain a focus of analysts and credit rating agencies.

5. Trade Uncertainty and Tariffs Will Still Shape Fiscal Planning

Tariff and trade uncertainty is a key new structural risk. Most provincial budgets from last year explicitly incorporated formal tariff scenarios and bottom-line impacts. This will likely feature again in 2026 Budgets, not least as Canada, U.S. and Mexico enter the early stages of the complex USMCA review mid-year. Provincial exposures vary. Ontario and Quebec carry outsized exposure to autos and manufacturing, B.C. in lumber, Prairies in energy and agriculture, and the Atlantic in forestry and fishing. Watch for budgets to highlight targeted business support measures, sector-specific relief, and economic diversification language.

Provincial Budget Tones

Alberta: The February 26th budget is anticipated to be challenging, with deficits driven by weaker oil prices. Instead of raising taxes or making substantial service cuts, Alberta will likely plan disciplined spending. Even with these challenges, the province maintains the lowest debt of all provinces and continues to have the strongest fiscal standing.

British Columbia: Releasing its budget on February 17th, B.C. is expected to focus on public sector efficiency measures, administrative reductions, and controlled spending in response to an $11.2 billion deficit (2.5% of GDP), one of the deepest shortfalls on record. Investments will continue to target trade and infrastructure.

Manitoba: The last budget had Manitoba aiming to stabilize its finances and work toward a balanced budget by FY 2027/28. The province’s deficit was worsened by wildfires, hydro-related droughts, and uncertain trade. The government has kept tight-lipped in recent months, leaving no indication of potential measures for the coming budget.

New Brunswick: Faced with a moderate deficit, New Brunswick is considering options such as reducing civil service numbers while increasing operational efficiency; as of now, tax hikes are off the table. Health and infrastructure spending will continue to dominate a robust capital spending plan.

Newfoundland: The new government’s first budget will likely prioritize health care enhancements and tax relief even as it tries to manage a sharply higher deficit. With a government debt-to-GDP ratio nearing 45%, Newfoundland still has the highest debt among the provinces.

Nova Scotia: A significant deficit for FY 2026/27 could be on tap, prompting lean government actions including service and program cuts, while protecting essential services. A recent downgrade in the province’s credit rating warrants diligence in the coming budget.

Ontario: Ontario is likely to report ongoing, though slowly improving, deficits over the projection horizon. The budget will likely stress economic competitiveness, protection for trade-exposed sectors (manufacturing), and careful spending as the province aims for eventual balance. The province may also go further in trying to stimulate investment.

Prince Edward Island: Under new leadership, PEI’s budget could take steps to address its largest nominal deficit ever and its significant debt growth. Spending discipline could be emphasized, alongside efforts to support healthcare, education, and economic expansion. We’ll be watching to see if the Island’s relatively rosy past GDP growth forecasts are maintained.

Quebec: Quebec’s budget is projected to show a considerable but gradually shrinking deficit, maintaining a path to balanced books by FY 2029/2030 through cost-saving initiatives and increased efficiencies. Health, education, and support for the economy will remain key priorities.

Saskatchewan: Saskatchewan is entering budget season with a small deficit, something likely to persist in the near term. The province is likely to manage resources prudently in the face of economic challenges and volatility. Saskatchewan continues to carry one of Canada’s lowest debt ratios.

Budget Balance and Net Debt (Fiscal Year 2025/26*)

| Province | Budget Balance (CAD Millions) | % of GDP | Net Debt-to GDP (%) |

| British Columbia | -11,200 | -2.5 | 26.4 |

| Alberta | -6,400 | -1.3 | 8.7 |

| Saskatchewan | -427 | -0.4 | 14.8 |

| Manitoba | -1,660 | -1.7 | 38.2 |

| Ontario | -13,500 | -1.1 | 37.7 |

| Quebec | -9,900 | -1.5 | 39.7 |

| Nova Scotia | -1,465 | -2.1 | 34.6 |

| New Brunswick | -835 | -1.7 | 26.8 |

| Newfoundland | -948 | -2.2 | 45.6 |

| Prince Edward Island | -368 | -3.2 | 32.9 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: