2025 Ontario Fall Fiscal Update:

Still Eyeing Balanced Budgets

Rishi Sondhi, Economist | 416-983-8806

Date Published: November 6, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

- With the province rolling out a bevy of supports for the economy in Budget 2025, Ontario’s fall fiscal update contains little in the way of marquee measures. However, the province is pledging to cut the HST on new homes valued at under $1 million – a move that should support demand and, ultimately, homebuilding activity.

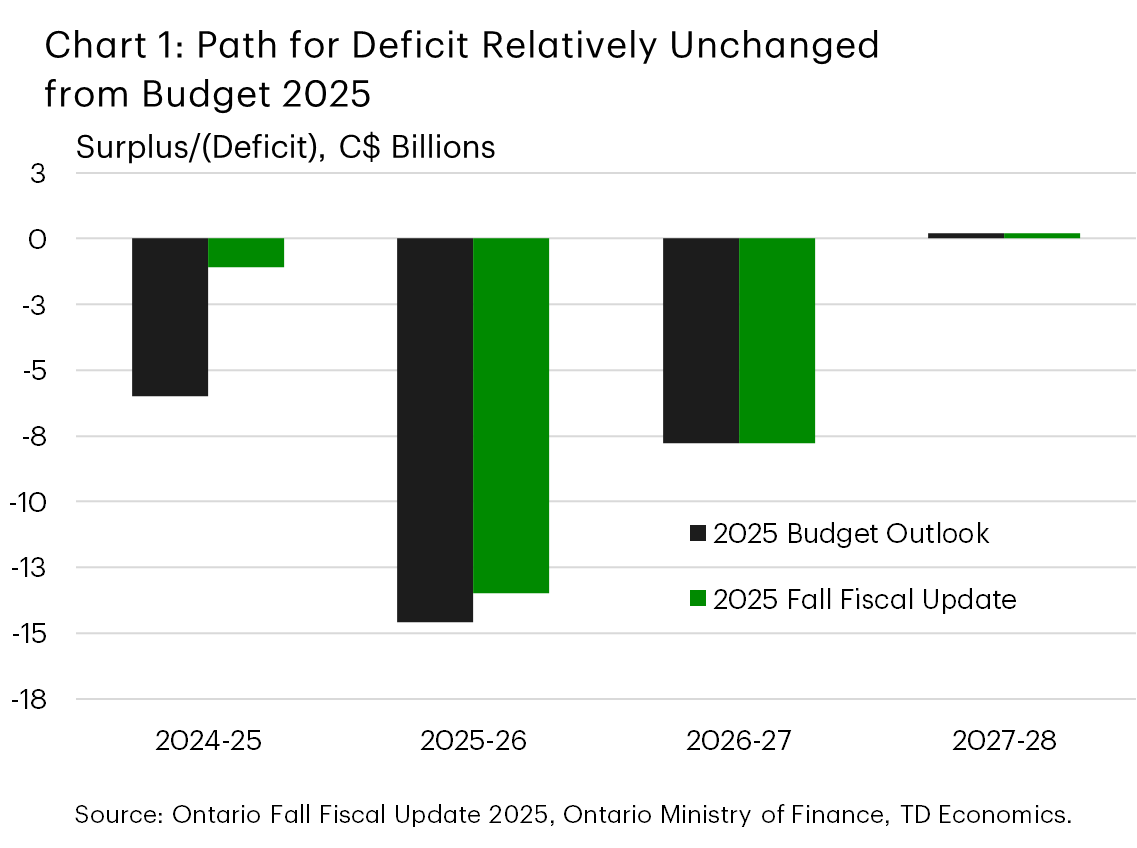

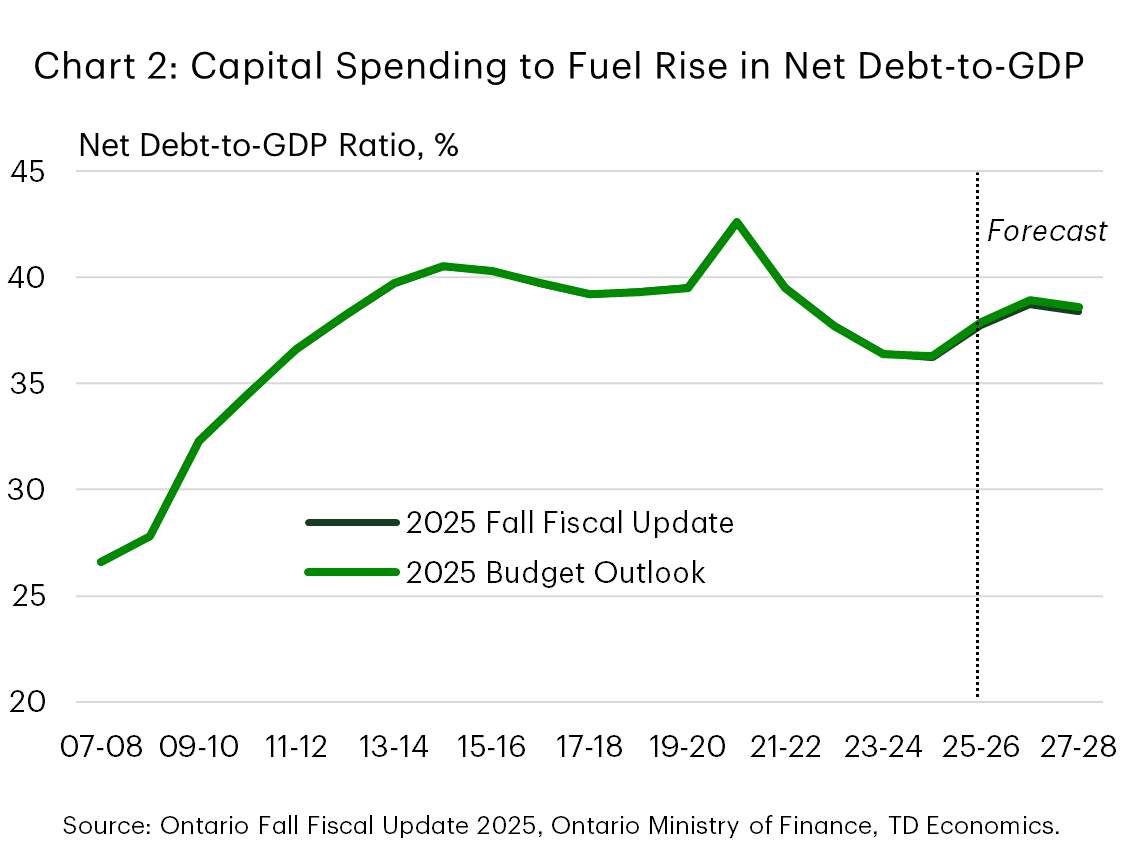

- Ontario’s anticipated fiscal situation is only slightly changed compared to Budget 2025. The FY 2025/26 deficit is seen at $13.5 billion, about $1 billion lower than expected in the spring budget. Net debt-to-GDP is also slightly lower but is projected to climb over the medium term. Still, policymakers see it remaining below the self-imposed 40% sustainability target.

- Ontario is retaining its goal of balancing the budget by FY 2027/28. However, this view leans heavily on spending restraint, which may be difficult given the demands of an aging population. Plus, a weaker-than-expected economic backdrop could prompt more spending from policymakers.

Ontario’s fall economic statement contains only modest tweaks to the province’s fiscal path. Policymakers didn’t announce many new marquee measures but reiterated their goal of balancing the province’s budget by FY 2027/28.

Ontario’s deficit for this fiscal year is expected at $13.5 billion (about 1% of GDP), an improvement compared to the $14.6 billion shortfall expected in the spring budget (and subsequent quarterly fiscal update). This follows a FY 2024/25 deficit that was also shallower-than-expected, partially on the back of a revenue boost coming from payouts to the province from the tobacco sector. The province will net $7 billion in compensation from tobacco companies over time. Meanwhile, at 37.7%, FY 2025/26 net debt-to-GDP is tracking a bit lower than what was expected in the spring budget.

Weak Economic Growth over Forecast Horizon

The government is expecting meek real GDP growth of about 0.85%, on average this year and next, translating to a below-trend gain in nominal GDP of around 3.1% in both years. Ontario has slightly downgraded its real GDP forecast relative to Budget 2025, partly on the back of weaker assumed housing market activity. However, it’s worth noting that the nominal GDP projections follow upwardly revised activity in 2023 and 2024. It’s 2025 and 2026 nominal GDP forecasts are (on average) a touch softer than ours, suggesting some modest revenue upside if we’re more on the mark.

The government also takes the prudent step of presenting scenarios where the economy is both weaker and stronger than expected. Under the weaker growth scenario, real GDP growth is basically flat, on average, in 2025 and 2026, before picking up to 1.7% in 2027, while in the stronger scenario, real GDP growth averages about 1.7% over both years. In the milder growth scenario, the province’s deficit averages $13 billion through FY 2027/28, while in the more robust growth scenario, Ontario’s deficit is effectively eliminated next year, and Ontario books a $10.2 billion surplus in FY 2027/28.

FY 2025/26 revenues are upgraded by $3.2 billion relative to the spring budget, driven by a stronger taxation intake. However, Ontario is forecasting their revenues to decline by 1% this fiscal year, weighed down by a steep drop in other non-tax revenues, reflecting a pullback after FY 2024/25 was lifted by the tobacco settlement. However, corporate tax revenues are also anticipated to be lower, consistent with the weak economic backdrop. In contrast, personal income tax revenues are forecast to grow strongly over the next three years, reflecting employee compensation. However, with Ontario’s unemployment rate likely to remain elevated through next year, there may be some downside risk to this view.

Notably, the government plans to match the federal government’s intention to cut taxes on the purchase of new homes. Provided the federal government follows through with its own pledge, Ontario will remove the provincial portion of the HST on new homes valued at up to $1 million dollars (with the cut phased out when the cost of the home reaches $1.5 million). This is anticipated to cost the government $35 million this fiscal year. The cost rises to an estimated $245 million by FY 2027/28. Ontario will also undertake a couple of small measures to attract foreign investment and establish a beneficial ownership registry, at little cost.

Economic Forecasts

[ Percent change unless otherwise noted]

| Economic Forecasts | 2024 | 2025 | 2026 | 2027 | 2028 |

| Real GDP | 1.4 | 0.8 | 0.9 | 1.8 | 1.9 |

| Nominal GDP | 5.3 | 3.2 | 3.0 | 4.0 | 3.8 |

Modest Spending Growth Anticipated

On the other side of the ledger, spending growth is forecast as 3.3% this fiscal year, supported by a $2 billion top-up of the province’s contingency fund. However, total spending advances at a modest 0.8% pace, on average in FY 2026/27 and FY 2027/28. Declining spending on post-secondary education and relatively flat education spending restrains total spending growth in both years, while spending will rise more rapidly for healthcare. Notably, the federal government is planning to cut its targets for non-permanent residents admitted into Canada over the next three years, which, if passed would weigh on revenues in the post-secondary space.

Interest costs are seen as totaling $16.2 billion this year, versus a $15.1 billion tally in FY 2024/25. As a share of revenues, these costs are pegged at 6.4% this year, below the long-run average and well shy of the threatening levels observed in the 1990s.

Net debt-to-GDP to Creep Higher over Medium Term

The province is tracking a modest improvement in its debt burden. In FY 2025/26, it’s pegged at 37.7% – a slight 0.2 ppts below what was expected Budget 2025, and shy of the 40% sustainability target set by the province. For context, the ratio has averaged about 39% since the Global Financial Crisis.

Net debt-to-GDP is projected rise over the medium term, owing to a hefty capital spending plan. Indeed, the delivery of major infrastructure projects remains a key plank in the government’s fiscal plan. Some $33 billion in infrastructure expenditures are expected this fiscal year, as part of a 10-year $201 billion infrastructure plan.

In terms of the Ontario’s other sustainability targets, net debt-to-operating revenue is forecast at 208% this fiscal year, above the province’s 200% threshold. Meanwhile, at 6.4%, interest costs as a share of revenues are well below Ontario’s 7.5% target.

Long-term borrowing requirements for this fiscal year are expected to total $42.5 billion (with 76% of this requirement fulfilled so far), down slightly from what was expected in Budget 2025.

Bottom Line

With the rollout of several measures earlier this year meant to buffer Ontario’s economy from the impacts of the trade war, Ontario’s fall update contains few new measures in comparison. One of the marquee measures – the plan to cut the HST on new builds – could stimulate some demand for new homes, ultimately boosting housing starts in a few years. The government is retaining its heavy focus on infrastructure spending, which can pay dividends in terms of near-term economic growth support and a productivity boost over the longer-term.

The shallower-than-anticipated deficit for this fiscal year is a welcome development and forms a slightly more supportive starting point for the government to reach its goal of balance by FY 2027/28. This goal does lean on significant expenditure restraint after this fiscal year, which will likely be a tall order, given the spending demands of an aging population. What’s more, the province may need to dole out even more support, should the economy underperform. However, the province has built in significant reserves into its fiscal plan, which can be used to shore up its fiscal position.

Government of Ontario Fiscal Plan

[ C$ billions unless otherwise noted ]

| Fiscal Year | 2025 Fall Fiscal Update | |||

| 24-25 | 25-26 | 26-27 | 27-28 | |

| Revenues | 226.2 | 223.1 | 229.6 | 240.0 |

| % Change | 9.9 | -1.4 | 2.9 | 4.5 |

| Expenditures | 227.3 | 234.6 | 235.3 | 237.8 |

| % Change | 10.0 | 3.2 | 0.3 | 1.1 |

| Program Spending | 212.1 | 218.4 | 218.5 | 220.1 |

| % Change | 8.7 | 3.0 | 0.0 | 0.7 |

| Interest Charges | 15.1 | 16.2 | 16.9 | 17.7 |

| % Change | 32.5 | 7.3 | 4.3 | 4.7 |

| Reserve | - | 2.0 | 2.0 | 2.0 |

| Budget Balance | -1.1 | -13.5 | -7.8 | 0.2 |

| % of GDP | -0.1 | -1.1 | -0.6 | 0.0 |

| Net Debt | 426.6 | 458.5 | 484.7 | 500.2 |

| % of GDP | 36.2 | 37.7 | 38.7 | 38.4 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: