An Equity Market Check-Up

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: June 8, 2021

- Category:

- Canada

- Financial Markets

Highlights

- Equity market momentum has come off the boil. While corporate earnings continue to improve, a high bar has been set. At the same time, economic data surprises have become fewer and farther between. Investors are patiently waiting for the path forward to become clear.

- Though downside risks are always present, the economic recovery is likely to be supportive of corporate earnings and financial conditions should continue to support investor sentiment. This provides a favorable backdrop for risk assets.

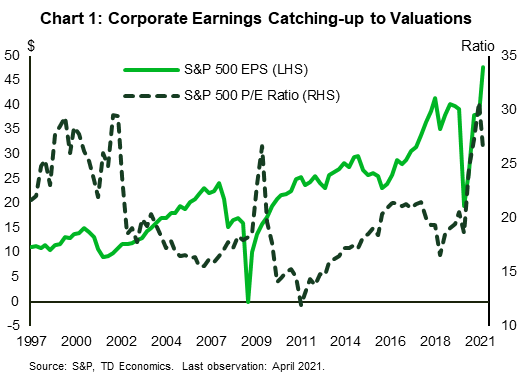

With the price of everything from running shoes to washing machines rising on high sales volumes, the profits of large corporations are surging. This has resulted in the earnings per share of S&P 500 companies reaching new all-time highs, more than double what they were a year ago. At the same time, the equity price advance witnessed over the last year has slowed. The S&P 500 and the Global Dow (ex-US) indexes have leveled out over the last two months, though they are still up approximately 10% over 2021. The trend is even more apparent in the NASDAQ Composite, which has been range-bound for all of 2021, after outperforming in 2020. Though investors might bemoan the relative stability in equities, this has allowed earnings to catch-up to high equity prices. This dynamic has led to an improvement in equity valuations (Chart 1).

The long-term driver of equity prices is corporate earnings. With a robust economic recovery, the outlook for corporate profits is encouraging. The consensus call for earnings per share of the S&P 500 is expected to be 50% higher by the end of 2022 than it was at the end of 2020. That suggests the growth rate in profits could be triple that of nominal GDP growth over the same time period.

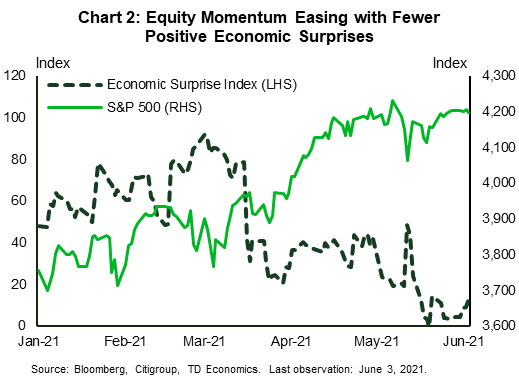

The economic narrative is compelling, but stock prices have largely priced this outcome. In other words, the bar for profits has been raised. A significant move higher in equities will require expectations for corporate earnings to move even higher. Though earnings for the first quarter have been solid, real-time economic data has been more settled, and largely come in at or below admittedly buoyant expectations (Chart 2).

This has resulted in a number of clients voicing concern about the vulnerability of equities. They wonder whether flat equities are in for a Wile E. Coyote moment – waiting to fall once investors realize that the economic growth narrative is crumbling beneath their feet. To that point, equities typically drop 10% to 15% once a year and it has been a solid 16 months without a retracement. There is always a risk of a correction, but it is unlikely to persist for long. Today's employment report, which showed strong wage gains, along with the beat in ISM manufacturing and services this week, should assuage fears on this front.

The bottom line is that the current economic recovery is in its early innings and has a long way to run. The economy is set to grow well above its trend-pace over the next two years, supporting even stronger growth in earnings. Additionally, loose monetary policy is still in place and will be for some time. In spite of the risks and recent slowing in equity momentum, the fundamental backdrop still favors equities and risk assets in general.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: