Lessons for Canada From The European Delta Experience

Sri Thanabalasingam, Senior Economist | 416-413-3117

Andrew Hencic, Senior Economist

Date Published: September 2nd, 2021

Highlights

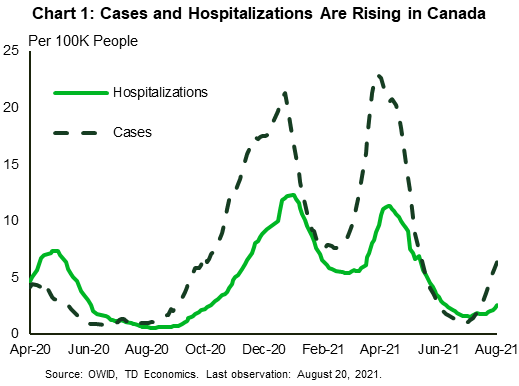

- After a summer filled with optimism, the rise of the Delta variant is clouding Canada’s near-term economic outlook. Cases and hospitalizations have ticked up recently and could move higher as we enter the fall season.

- European nations have achieved vaccination rates roughly in line with Canada’s and are further ahead in battling the fourth wave. As such, this country can once again look to them for some guidance.

- Canadian governments are following their European counterparts by favouring more targeted approaches – including vaccine passports and prioritizing booster shots for more vulnerable segments – over widespread lockdowns. This should help to mitigate the hit to economies during the fourth wave relative to earlier waves.

- While near-term growth prospects in Canada have dimmed somewhat in recent weeks, partly reflecting the Delta outbreak, we remain confident that the economy will record above-trend expansion during the second half of this year.

After much optimism through the summer months, clouds are forming for the Canadian economy, and COVID-19 is once again the culprit. The hyper-contagious Delta variant, which has spread like wildfire through much of the world, has established a foothold in Canada. Daily caseloads have started to trend up, and hospitalizations appear to be following suit (Chart 1). The country, in no uncertain terms, has entered the fourth wave of the COVID-19 pandemic.

As has been the case throughout the pandemic, Canada can look to international experience for some guidance. In Europe, the variant struck earlier in the summer, sending cases and hospitalizations higher across the continent. European countries have been pushing ahead with vaccine passports, booster shots and increased testing to avoid the need to reimplement widespread lockdowns. Canadian provinces have begun to take similar steps, but more stringent restrictions may still be required this autumn if these measures prove inadequate and capacity is tested again within Canada’s challenged hospital system.

Whether it’s direct restrictions like in previous waves, or less intrusive policies like vaccine passports, both will weaken the economic recovery. However, the former pose the greater risk to Canada’s near-term economic outlook, potentially representing yet another setback for high-touch industries. In any event, lower consumer and business confidence prompted by the fourth wave could limit growth more broadly. The road to recovery is uncertain, but as long as the pandemic is here, it’s bound to be bumpy.

Delta Making Its Way Through Europe

The European experience with Delta, along with those of Israel and the U.K., is an important reference point for Canada. For one, Europe’s vaccination rates are similar to that of Canada, creating a useful preview of possible outcomes depending on policy choices.

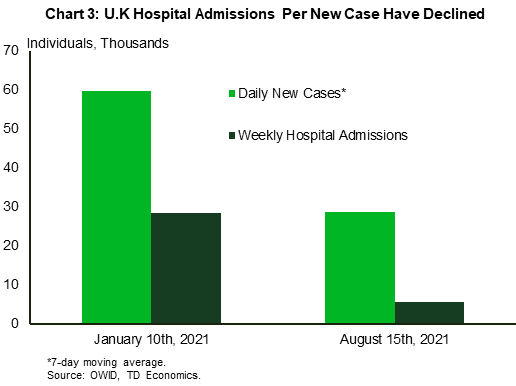

The most important fact to emerge in the past months in Europe and other countries further ahead in battling Delta, is that while the effectiveness of vaccines at preventing symptomatic disease has waned, they still provide good protection against severe disease and hospitalizations1. This has given strained hospital sectors a measure of protection and allowed countries to use this new latitude to replace the harshest restrictions with alternative methods to slow the virus.

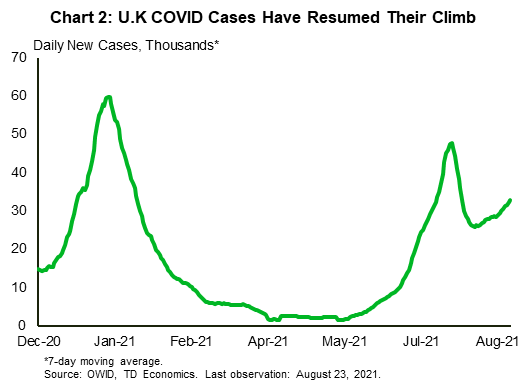

The U.K. is providing the test case of how Delta evolves in a highly vaccinated jurisdiction that has elected to remove most restrictions. With 62% of the nation fully vaccinated, not far off Canada’s 66%, the U.K. government lifted many of the remaining limitations on movement and gathering on July 19th. COVID-19 cases skyrocketed, and after a brief reprieve have resumed their climb – now averaging over 33,000 cases per day (Chart 2). Higher cases have meant more hospitalizations, and past waves have forced hospitals to cancel non-urgent operations to make room for COVID-19 patients. Prior to the Delta wave, this had driven median waiting times for routine operations and procedures in the U.K. from 6.9 Weeks in March 2019 to 10.8 weeks as of May 20212.

European Union nations have been more careful in lifting pandemic containment measures, with many keeping some restrictions in place through the summer. Even still, the Delta variant sent cases spiking. Some countries, like Spain, saw rapid rises in cases that are now slowing (cases are down to 10,000 per day from over 25,000 in late-July). Others, like Germany are just now beginning to see an increase. The virus spread as activity shifted indoors last fall and winter, so with cooler temperatures in the months to come, infections could surge yet again.

Most nations have been hesitant to renew the harshest pandemic restrictions. There are exceptions though, such as the Netherlands shutting down nightclubs in mid-July after reopening them at the end of June. But the Dutch government, like its European counterparts, have a significantly lower appetite for widespread lockdowns similar to the ones mandated in previous waves.

So, in order to ward off another acceleration in new cases, authorities are implementing alternative approaches to limit the spread. Israel, France, Italy and other jurisdictions have moved to introduce vaccine passports or health certificates. In France, for instance, the initial phase of the new health pass rules took effect in August. The new rule limits access to domestic transport services, restaurants, and cafes to those that can show proof of vaccination, a negative COVID test, or recent recovery from COVID. The announcement of the measures also appeared to have momentarily rejuvenated a waning vaccine campaign as jab appointments surged in the wake of the announcement.

Access to ample vaccine supplies has also led to a campaign of booster shots being rolled out in some nations. Most of Europe is targeting vulnerable populations with additional doses, but Israel and the U.S. have already stated that booster shots will be available to those over 12 and over 18, respectively. The goal is that this added protection for vulnerable populations will add another layer of defense for hospitals.

The hope is that, combined with vaccinations (and boosters), these more targeted strategies will help preserve hospital systems and avoid the economically damaging effects of full lockdowns. The benefits of vaccination are readily apparent in the U.K. where despite a steady rise in COVID cases over the past few weeks, the number of people in hospital has remained relatively stable – after an initial run-up. Indeed, Public Health England estimates that, through August 8th, vaccination averted some 80,000 hospitalizations3. The decoupling of cases and hospital admissions appears to be holding through August 15th (the last available data point as of writing) as cases were 52% below their January peak, yet new hospital admissions were down 81% compared to that point in time (Chart 3). Israel (another highly vaccinated country) shows a similar pattern with cases near prior highs, but a significantly reduced number of hospital patients.

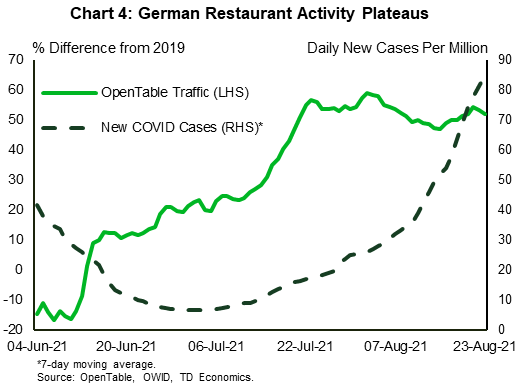

Vaccine adoption and health certificates represent defenses for healthcare systems against the threat of overwhelming viral spread. However, for the economy, even if the hospital system is protected, souring consumer sentiment due to news about viral spread can have a material impact. We might be seeing the early signs of this in the U.K. where the GFK Consumer Confidence survey ticked down in August to -8, the first pullback since January 2021. The move is marginal for the time being with the general sentiment trending in the right direction. Still, it is worth monitoring as expectations of the economic situation over the coming year have deteriorated since May – slipping back into negative territory.

In the Eurozone, monthly PMI data continue to show Europe is benefitting from the ongoing economic reopening. Other high frequency indicators also are displaying no explicit signs of stress yet, but a gradual slowdown might be on tap if things get worse. For instance, OpenTable data of seated diners in restaurants, an industry emblematic of the economic effects of the pandemic, appears to have plateaued through August in Germany (Chart 4), despite declining stringency measures. Close monitoring of sentiment and foot traffic continues to be the name of the game, as exponential growth of cases or hospitalizations can cause circumstances to change quickly.

Cases and Hospitalizations On The Rise in Canada

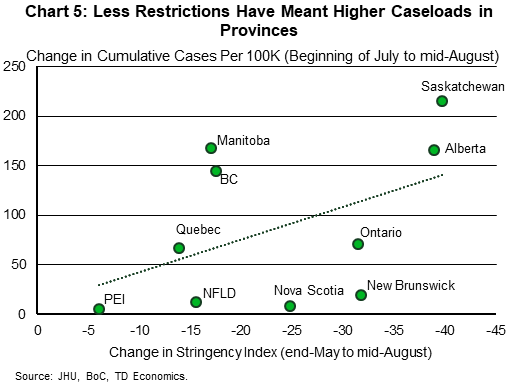

Similar to European nations, the Delta variant is the chief variant of concern in Canada. By mid-July, it accounted for 85% of weekly cases, and this share has likely grown in recent weeks given the highly contagious nature of the virus. Despite its presence, case counts have so far remained relatively low in Canada compared to past waves of the pandemic. But as measures were gradually lifted during the summer months, cases have started to move higher. The provinces that have gone the farthest in easing COVID-19 protocols since the end of May, have seen the greatest uptick in cases (Chart 5). Indeed, the spread of the virus has accelerated in Alberta and Saskatchewan, the two provinces that have lifted almost all public heath orders.

This is leading to increased pressure on hospitals. Since the trough in late July, hospitalizations per day have been rising, and the European experience suggests this is just the beginning in the fight against the Delta variant.

Unvaccinated individuals are likely to form the bulk of hospitalizations. With 35% of the Canadian population not protected against the virus, back of the envelope calculations suggest that if the fourth wave lasts for three months as it did in the third4 up to another 3,400 people may be hospitalized even without accounting for breakthrough cases among the vaccinated population. For reference, the number of COVID hospital patients peaked at about 4,500, and nearly 1,500 people were admitted to intensive care units (ICU) during the third wave. Latest modelling by the Public Health Agency of Canada indicates that hospital capacity could come under pressure again later this year as the weather cools and people spend more time indoors.

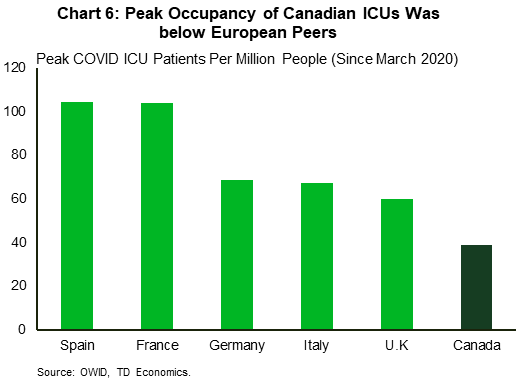

Canada’s lack of hospital capacity has been a weak point throughout the pandemic. Compared to European countries, Canada has considerably fewer resources to treat severely ill patients, resulting in tighter restrictions to battle the virus. Taking observed ICU admissions as a measure of capacity, it is clear that Canada ranks well below European countries in its ability to treat patients (Chart 6), indicating that tougher public health measures are still a possibility come the fall season.

That being said, Canadian governments and businesses are already responding to the Delta threat, with many following the path forged by European nations:

- Some provinces are delaying further reopening of the economy. Ontario, for example, has paused at stage three of its reopening plan, maintaining capacity limits on high-touch businesses. Alberta reversed its decision to end nearly all public health measures, and instead will keep them in place due to the Delta variant.

- More provinces and businesses are adopting policies like vaccine passports, and mandatory vaccinations or testing. As in France, these steps are likely to boost vaccination rates. Indeed, vaccine bookings have jumped in Quebec, and B.C., where passports will be required to engage in high-touch activities. In addition, younger people are now more enthusiastic in receiving the vaccine, lessening the risk flagged by health experts that this population could drive hospitalizations later this year.

- Ontario has rolled out booster shots for vulnerable groups, while other provinces are deliberating on this avenue. Israel has already taken this step, and evidence is emerging that it lowers the risk posed by the Delta variant.

- With schools reopening, and children under 12 still not eligible for the vaccine, rapid testing is becoming available across various jurisdictions. While cases are likely to still rise, increased testing could stem the spread of the virus.

- Targeted restrictions are also an option. B.C. has retightened restrictions in its Interior Health region to combat outbreaks.

The effectiveness of these measures will become increasingly clear in the coming weeks and months. As of now, widespread lockdowns are likely to be a last-resort measures for provincial and local governments. Even in the case where lockdowns may be necessary, provinces are likely to opt for temporary “circuit breakers” as opposed to extended business closures.

Economic Recovery Could Lose Momentum This Fall

Notwithstanding these measures, the Delta variant still poses a downside risk to our June forecast, especially for the fourth quarter this year. Our outlook had imbedded a strong 6% annualized advance in the October-December period on the heels of a jump in activity in the third quarter. This was with the expectation that the economy would continue to make robust improvements as COVID-19 becomes less of a worry to Canadians.

Still, the experience in Europe (and other regions) is that rising caseloads are likely to contribute to weaker consumer confidence while also increasing uncertainty for businesses. In addition, vaccine passports may mean some drop in demand for businesses that require the credentials.

This projection is now looking ambitious, but it is important to note that we haven’t abandoned our view of continued solid, above-trend growth in the quarters ahead. We remain optimistic that governments will continue to favour alternative more targeted approaches to limit the spread than widespread lockdowns and that those efforts, in turn, achieve success in taking pressure off health care systems.

End Notes

- Public Health England, Week 33 "COVID-19 Vaccine Surveillance Report".

- NHS Referral to Treatment Waiting Times Data, May 2021

- Public Health England, Week 33 "COVID-19 Vaccine Surveillance Report".

- Daniel Hererra-Esposite, Gustavo de los Campos, (2021) "Age-specific rate of severe and critical SARS-CoV-2 infections estimated with multi-country seroprevalence studies". medRxiv 2021.07.29.21261282; doi: https://doi.org/10.1101/2021.07.29.21261282 Pre-print Paper

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: