The $500 Billion Opportunity – Critical Minerals Development and Economic Reconciliation with Indigenous Peoples

Francis Fong, Managing Director & Senior Economist

Likeleli Seitlheko, Economist

Mekdes Gebreselassie, Research Analyst

Date Published: June 4, 2024

- Category:

- Canada

- Future Ready Economy

Highlights

- Critical minerals will play a crucial role in powering the clean technologies needed to decarbonize the economy. Canada fortunately sits on significant reserves of many of these minerals.

- We estimate the potential gross value at a minimum of $300 billion just for 6 priority critical minerals cited in provincial, territorial, and federal strategy documents. Developing these resources alone will contribute over $500 billion in GDP over the life of these potential mines and can help support economic reconciliation with Indigenous communities across the country.

- Step one in realizing this potential is establishing partnerships and ongoing collaboration with the hundreds of Indigenous communities in which these critical mineral deposits lie. While consultation is a nuanced subject, a model is emerging that allows communities to take equity stakes in projects, while impact assessments emphasize Indigenous knowledge and ongoing, meaningful consultation that obtains their free, prior, and informed consent.

The unprecedented heatwaves and extreme weather of the past year and a half has once again highlighted the need to fast-track action to reduce global greenhouse gas emissions. While the rapid increase in renewable energy deployment and electric vehicle adoption has helped to slow the growth of emissions, global energy-related carbon dioxide emissions reached their highest level in 2023.1 Bending the emissions curve downwards will require accelerating investment in the clean energy sector – from expanding manufacturing capacity to boosting end-user adoption of green technologies to reducing demand for unabated fossil fuels. These measures’ success will depend on an ample and affordable supply of minerals required to produce the various clean energy technologies.

Canada has a once-in-a-generation opportunity to play a key role in supplying the global economy given significant reserves of almost all minerals that are identified as critical to the clean energy transition and economic security in provincial, territorial and federal Critical Minerals Strategy documents. We estimate the gross value of known reserves for only the 6 highest priority minerals, cobalt, lithium, copper, rare earths, graphite, and nickel, at a minimum of $300 billion. Developing the current proposed projects of these minerals could bring nearly $80 billion of capital expenditures and contribute $63 billion in GDP impact during the construction phase and add an additional $460 billion in GDP over the production life of the mines.

Core to attaining this potential is acknowledging that many of these critical mineral deposits lie in proximity to Indigenous communities and ensuring their full participation in these resource development projects. Meaningful consultation and obtaining Indigenous communities’ free, prior, and informed consent are not only a legal imperative, but the best way to ensure the sustainable realization of this once-in-a-generation opportunity for Canada.

Green technologies expected to continue driving demand for minerals

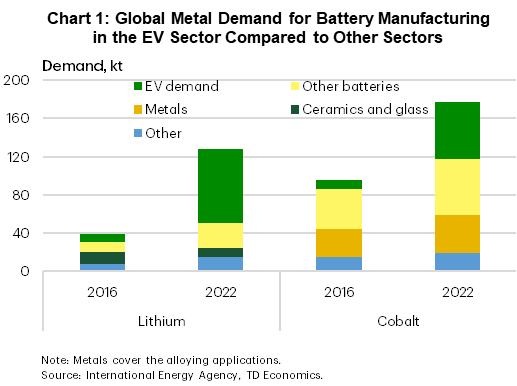

The clean energy sector’s demand for minerals such as copper, cobalt, lithium and nickel has risen significantly in recent years in line with increasing adoption of clean technologies, including renewable energy in the power sector and electric vehicles. This is because green technologies are more mineral intensive than their fossil fuel-powered counterparts. As examples, electric vehicles use six times more minerals per car than internal combustion engine vehicles, while solar PV panels and wind turbines use 7-15 tonnes of minerals per megawatt of generating capacity compared to just one tonne for a combined cycle natural gas plant.2,3 In addition, the clean energy sector has become the leading driver of demand for critical minerals as technologies such as wind turbines, solar photovoltaic cells, and long-duration battery grid storage replace fossil fuel-based alternatives, and amidst broader efforts to electrify heavy industry. Taking lithium and cobalt as an example, electric vehicles were responsible for more than half of the increase in demand between 2016 and 2022 (Chart 1).

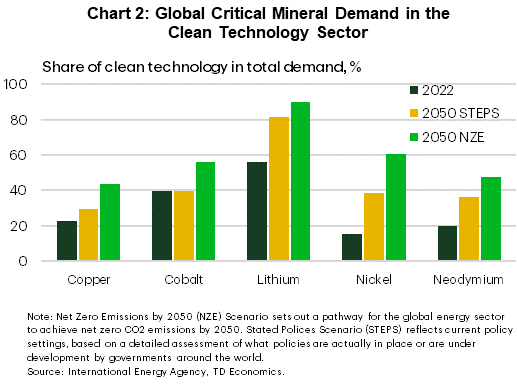

Global annual demand for critical minerals could increase five-fold by 2050 under net-zero pathways aligned with the Paris Agreement. However, even under a slower energy transition, demand could still double by 2050 based on current policies. Regardless of the pace of decarbonization, clean energy technologies will continue dominating the growth in demand for many critical minerals. This is especially the case for lithium. By 2050, around 80% of the metal could be used to produce green technologies under a business-as-usual trajectory, and this share could jump to 90% should countries successfully implement measures that reduce global emissions to net zero (Chart 2).

Canada well positioned to seize the economic opportunity from rising mineral demand

For many minerals, supply could fail to keep up with demand without additional investment to increase production and improve recycling efforts. As an example, the expected supply of copper from existing mines and companies’ expansion plans could be about a fifth lower than projected demand in 2031.4 These projected supply shortfalls present opportunities for countries like Canada which are rich in natural resources to become key producers in the global supply chains of energy transition minerals and value-added products. Moreover, the production of essential energy transition minerals like cobalt, lithium and graphite is highly geographically concentrated globally. Boosting production of these minerals from current small/non- producers could help improve the security of supply at the global level.

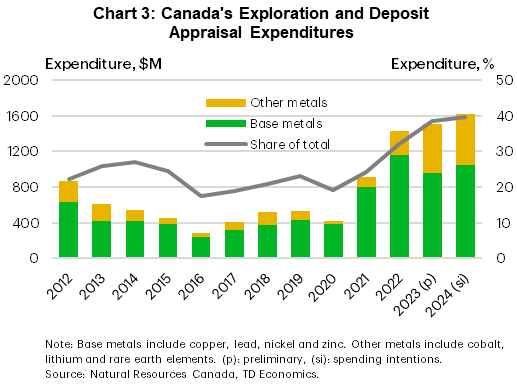

Canada has several advantages that could enable it to increase its market share of the growing critical minerals sector. The country has a well-established mining industry and already produces many of the energy transition minerals. Almost all provincial and territorial governments and the federal government have released critical mineral strategies in the last several years aiming to further expand this advantage by prioritizing development and providing funding support, such as the federal tax credit for critical minerals exploration. Of the 31 critical minerals listed in the Canadian Critical Minerals Strategy, which was developed by the federal government in consultation with industry experts and provincial and territorial governments, six (cobalt, copper, graphite, lithium, nickel and rare earth elements) will be prioritized for support including under the infrastructure fund for critical minerals project. Mining companies have also demonstrated growing interest in Canada’s mineral resources. The country has seen a substantial increase in exploration and deposit appraisal expenditures going towards critical minerals (Chart 3), which could potentially boost reserve estimates and eventually production for these minerals.

Reserves of the six priority minerals have a gross value of more than $300 billion

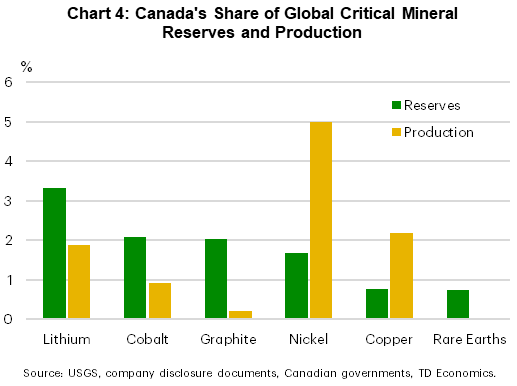

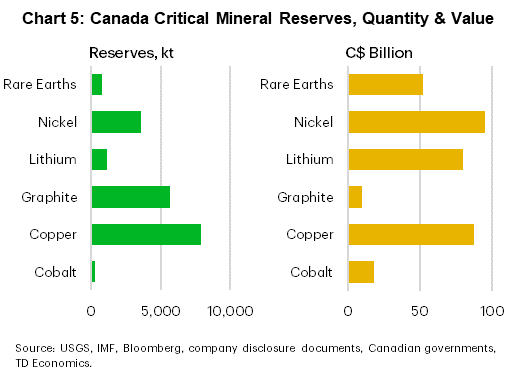

Focusing on the six priority minerals, Canada’s reserves of cobalt, graphite, lithium, nickel and rare earth elements rank in the top ten globally while copper reserves are the 13th highest in the world.5 The country accounts for about 3 percent of global lithium reserves, around 2 percent of reserves of cobalt, graphite and nickel and almost 1 percent of copper and rare earth elements reserves (Chart 4). Based on average prices from the past five years, these reserves are collectively valued at more than $300 billion (Chart 5). This represents a small portion of the potential gross value of the reserves of all the critical minerals in Canada. Including the remaining 39 minerals on the provincial, territorial and federal critical minerals lists would naturally push the total value significantly higher.

Clearly, these reserves are not worth anything if left unproduced. To seize the full economic opportunity presented by the energy transition, Canada needs to move faster on getting exploration and appraisal projects to development and commercial operation. Among other things, this will require improving timelines for approval processes for new projects while still being mindful to not sacrifice meaningful Indigenous consultation and environmental protections.

Developing deposits of the six priority minerals could bring $80 billion in capital investment

Mining is a capital-intensive industry. Developing mine complexes, specifically the costs associated with construction and machinery and equipment, account for most of the capital spending for mining projects. Based on public information for around 40 proposed projects that have reserves or resources of the six priority minerals, capital costs of building new mines, expanding existing ones or restarting formerly producing mines range from $75 million to more than $8 billion, and average over $1 billion per mine. Bringing these projects into commercial operation could result in nearly $60 billion in capital investment during construction, as well as an additional $20 billion in sustaining capital expenditures to maintain and replace assets during the production years.

There is potential for the projects to contribute over $500 billion in GDP

The current proposed projects of the six priority minerals could bring many economic benefits to Canada including employment income and government tax revenue. The domestic businesses that supply mining companies with services and products also benefit from the increased sales. While mining projects contribute to the economy throughout all phases – exploration and appraisal, mine construction, production, and closure and reclamation – our estimates will focus on the direct, indirect and induced economic impacts that could be derived from the mine construction and production activities.

During the development phase, the projects could add $63 billion to Canada’s gross domestic product (GDP) and generate 95,000 full-time equivalent jobs and around $12 billion in tax revenue. Additionally, the projects could contribute a further $460 billion and $85 billion to the country’s GDP and tax revenue, respectively, over the production life of the mines.

Free, Prior, and Informed Consent and Economic Reconciliation

No discussion of developing critical minerals can occur without addressing the core imperative of consultation and reconciliation with Indigenous Peoples. As shown in exhibit 1, critical mineral deposits across Canada overlap significantly with First Nation, Inuit and Métis communities and lands covered by treaties and agreements. Developing these resources could impact local ecosystems, watersheds, or communities themselves. Thus, core to realizing the potential for critical minerals development will require collaboration and partnership with Indigenous communities. This includes meaningful consultation that obtains their free, prior, and informed consent (FPIC).

But what does that mean exactly? Canada’s history with consultation is long and complicated and the country itself is a patchwork. Some parts of Canada are covered by historical and modern treaties and agreements which document and try to balance how the land is to be shared and how the rights of Indigenous Peoples are to be protected. Yet, historically, the outdated and vague language in those documents has been loosely interpreted to avoid consultation or to exploit Indigenous Peoples. Often, consultation has historically been a rubber-stamping exercise rather than meaningfully done to ensure a community’s full participation. Meanwhile, other parts of the country are completely unceded territory with a checkered past of economic development encroaching on the traditional territories of Indigenous Peoples in the region and impacting their protected rights to use the land as they have for thousands of generations, whether that be traditional, cultural or economic activities such as hunting and fishing, the protection of sacred ground, or even more basically, protecting a community’s water or air from contamination. A classic example of the consequences suffered by Indigenous Peoples who were not properly consulted is the Giant Mine – a gold mine within the Yellowknives Dene First Nation that continually released arsenic trioxide that contaminated the surrounding air and water for nearly six decades before closing in 2004. Its legacy is still felt by the community today due to long-term health consequences of arsenic exposure. The federal and Northwest Territorial governments are still on the hook for remediating buried arsenic trioxide waste that was left behind.

Examples like Giant Mine underscore the importance of meaningful and ongoing consultation. Yet, achieving alignment on FPIC among governments, industry and the general public with Indigenous communities requires addressing a deeply rooted skepticism about the need for consultation and what it entails. These perceptions are often due to a lack of awareness of how Indigenous Peoples have been treated historically, the legal imperative based on legislation and supreme court rulings, and what Indigenous Peoples are even asking for when it comes to consultation.

The ongoing evolution of consultation

None of these, however, provide much insight into what consultation specifically means. What is the process for consulting with impacted communities? What does consent entail? Consultation has historically been, and remains, an opaque and confusing process with unclear roles for industry and governments. Federal and provincial processes and timelines may also not align and may differ greatly across jurisdictions. Many Indigenous communities may not have the capacity to handle the sheer amount of consultation requests that they receive, particularly if they are smaller. Anecdotal evidence suggests that communities may be burdened with thousands of consultation requests annually, putting even the most well-resourced Nations in a difficult place. This confusion has largely foisted much of the responsibility of consultation on industry itself, in which there have emerged both leaders and laggards. The leaders have, by their own accord, established deep relationships with the communities in which they operate, but these are the exception rather than the rule.

Previous to the current model that prioritizes partnership and equity stakes in projects, if consultation has occurred, what comes out of this process is most commonly an impact and benefit agreement (IBAs), also called a benefit sharing agreement. This may include financial compensation, local hiring and sourcing clauses, environmental remediation requirements, or requirements to divert or reshape projects to secure protection for certain geographic areas. However, one of the many challenges with IBAs is that it largely concludes a consultation period. Should project parameters change, or unforeseen circumstances arise, but an IBA is already in place, there is little recourse for communities outside a lengthy and costly legal battle that many communities may not be able to afford. This has led many Indigenous communities to be fundamentally skeptical about consultation because it is often unclear whether agreements are being done in good faith and so consider ongoing consultation as preferable.

Even the ‘who’ of consultation is complex. Our current system relies mainly on reserve and treaty/agreement boundaries, as shown in Exhibit 1. But these are relics from an era that displaced Indigenous Peoples from their traditional territories and forced a governance structure that many use but do not necessarily support or accept. Because this has been the status quo for several centuries, reserve and treaty boundaries are used mainly as a function of convenience.

All of these consultation elements are now evolving. Some Indigenous communities have for the past several decades begun stepping up to reclaim traditional territories from where they were displaced centuries prior and to develop their own land use codes in accordance with their pursuit of self-determination and self-governance. Others continue to retain reserve and treaty boundaries as formal geographic structures, due to either a lack of capacity or a lack of faith in crown institutions to return traditional territories. Even so, a growing movement of Indigenous Peoples and governments exercising their self-determination, particularly around land use, is driving a similar shift in views around the parameters of necessary consultation.

As all communities continue to reclaim lost territory, language, arts, and culture, the nature of consultation is increasingly being led by Indigenous Peoples, with more focus on the unique relationships that each Nation has with their land and the way in which they want it to be used or developed.

Exhibit 1: Canada’s Critical Mineral Deposits, Indigenous Communities and Lands Covered by Treaties and Agreements

Note: The interactive feature of the map gives more information about the resource and reserves of individual mineral deposits

. According to the Canadian Institute of Mining, Metallurgy and Petroleum: A resource is a concentration or occurrence of solid material of economic interest in or on the earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. Resources are sub-divided, in order of increasing geological confidence, into inferred, indicated, and measured categories. A Reserve is the economically mineable part of a measured and/or indicated Mineral Resource. Reserve amounts are aggregates of Probable and Proven Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve.

For some projects measured and indicated resources maybe inclusive of stated reserve amounts.

Source: Company disclosure documents, Canadian governments, TD Economics.

A new partnership model emerging

On the surface, these developments give the impression that consultation is getting murkier rather than clearer for industry. In fact, the opposite is happening. The formation of grouped representation such as the First Nations Major Projects Coalition (FNMPC) or the BC First Nations Energy & Mining Council (FNEMC) is an important signal that a plurality of Indigenous communities is open to partnership. Part of that signaling has been the release of a new wave of strategy documents and consultation toolkits developed by Indigenous Peoples that educate industry and Canadians on impact assessments, consultation standards and, ultimately, what is needed for FPIC to be given.

Both groups mentioned above, for example, have released critical minerals strategy documents6,7 that support the economic opportunity for minerals development in Indigenous communities. The FNMPC has, more broadly, tallied $525 billion across 470 capital projects8 in minerals, clean energy, transmission, and other infrastructure projects where the coalition represents the participation of over 155 Indigenous communities. They have also released the Spirit of the Land9 Toolkit that helps to educate and inform the impact assessment process through the lens of Indigenous Peoples and communities. This speaks to the growing movement among the governing bodies of Indigenous Nations to take charge in the consultation process itself and self-determine that consultation with their nation is needed.

From Canada’s perspective, both the federal and provincial governments have different vehicles for how they carry out their duty to consult, but mostly are included as part of project assessments. At both levels of government, assessments may include a list of communities that must be consulted, with consent received before projects are approved as part of the social impact assessment. Those lists are becoming far broader than consultations that would have occurred in decades past. Federal processes, in fact, are increasingly deferring impact assessments to the governing bodies of each Nation, which toolkits like the Spirit of the Land are made for. However, governments may not always step up – in these instances, often industry and financial institutions leverage their own processes to ensure consultation occurs, which again, leaves tremendous gaps between leaders and laggards.

These shifts are leading to an emerging model of consultation that emphasizes full partnership and collaboration with Indigenous Peoples, while leveraging their knowledge on impact assessments. This model is increasingly being used by industry leaders and has 3 key elements.

Core to these 3 elements is that Indigenous communities are no longer simply stakeholders that need to be consulted, but equity partners that have exposure to the economic upside through the entire life of a project. That naturally includes consulting as widely as possible, including both elected and hereditary leaders, community members, and representative groups, but would also include the inclusion of impact assessments led by Indigenous Peoples.

Equity stakes and partnership are already becoming the model for many successful natural resource and clean energy projects. The 250 MW Oneida Energy Storage project in Ontario, for example, was developed by Six Nations of the Grand River Development Corporation (SNGRDC) via a 50:50 partnership with an energy storage project developer. The project was successfully financed with the federal government, clean energy and construction sector partners, and is now in construction. The project is expected to be one of the largest clean energy storage facilities in the world. This is just one example of how equity ownership and early and broad consultation has led to success in delivering energy and infrastructure projects from which critical minerals projects can draw insight.

Still more to be done

There are, however, still challenges in the consultation process that policy can help address if we are to seize the enormous economic opportunity standing before Canada and Indigenous communities and meet the world’s collective climate objectives in the short timeframe that remains.

- The question of who to consult is still an evolving process, as territories and land use codes mature further.

- While consultation toolkits provide insight, industry will still be looking for clarity on the question of ‘how’ to consult.

- The availability of capital that communities can draw from to be able to take equity stakes needs to be thoughtfully and meaningfully expanded to accommodate the potentially hundreds of projects that could involve Indigenous Peoples.

All of these have been areas of focus for the federal and provincial/territorial governments in recent years. In 2022, Natural Resources Canada began consultations on a National Benefits Sharing Framework that would support Indigenous communities in building the technical and negotiation expertise while providing a framework for building financial capacity. The most recent addition to this framework was the creation of a $5 billion Indigenous loan guarantee fund in the 2024 Federal Budget that would explicitly back capital provided to communities taking equity stakes, while also providing $16.5 million to assist eligible communities in drawing from the program. This follows in the footsteps of previous provincial efforts, including the Alberta Indigenous Opportunities Corporation which will see its seed funding for loan guarantees increased to $3 billion this year following an increase to $2 billion in 2023, the Ontario Aboriginal Loan Guarantee Program, and the Saskatchewan Indigenous Investment Finance Corporation.

But there is more to be done in capacity building. The Spirit of the Land recommendations, for example, include cultural use density mapping that would help streamline consultation by having a mapped database of how the land is used by Indigenous communities. This is an initiative that federal and provincial governments could help develop that could align with existing efforts by the federal government to create a land registry led by Indigenous Peoples as part of the Framework Agreement on the First Nations Land Management Act. A collaborative effort in this area could help delineate further the ‘who’ and the ‘how’ of consultation that would help expedite impact assessments and would also provide a more rigorous backing for governments to facilitate a more structured consultation process rather than leave the process to industry and Indigenous groups to establish solely on their own.

To be clear, the economic opportunity for critical minerals development is massive for both Indigenous Peoples and Canadians. But if we are to realize that opportunity to meet both our interim emissions reduction targets in 2030 and the net zero target by 2050, the consultation and assessment process needs to be shortened. Natural Resources Minister, Jonathan Wilkinson, recently suggested as part of the revised Impact Assessment Act legislation that government aims to halve the assessment and permitting timelines from a decade or more, to 4-6 years, by streamlining federal-provincial processes and reducing red tape. This could be achieved while still recognizing that Indigenous consultation is a core responsibility. Finding that balance is going to be key to meeting both objectives and the only path forward.

Appendix

| Units of measure and abbreviations | |

| Ag | Silver |

| Al | Aluminum |

| Al2O3 | Aluminum trioxide |

| Be | Beryllium |

| BeO | Beryllium oxide |

| CaF2 | Calcium fluoride (fluorite) |

| Cg | Graphitic carbon (graphite) |

| Co | Cobalt |

| Cr | Chromium |

| Cr2O3 | Chromium (III) oxide |

| Cs2O | Cesium Oxide |

| Cu | Copper |

| DTR | Davis Tube Recoverable |

| Fe | Iron |

| g/t | gram per tonnes |

| HREO | Heavy Rare Earth Oxides |

| In | Indium |

| K | Potassium |

| K2O | Potassium Oxide |

| KCl | Potassium Chloride (sylvite) |

| La2O3 | Lanthanum(III) oxide |

| Li | Lithium |

| Li2CO3 | Lithium Carbonate |

| Li2O | Lithium Oxide |

| LREO | Light Rare Earth Oxides |

| Mg | Magnesium |

| Mg(OH)2 | Brucite |

| MgCO3 | Magnesium carbonate (magnesite) |

| MgO | Magnesium oxide |

| Mn | Manganese |

| MnO | Manganese Oxide |

| Mo | Molybdenum |

| MoO3 | Molybdenum oxide |

| MoS2 | Molybdenum Sulfide |

| Mt | Mega tonnes |

| Nb | Niobium |

| Nb2O5 | Niobium pentoxide |

| Nd2O3 | Neodymium(III) oxide |

| Ni | Nickel |

| Pb | Lead |

| Pd | Palladium |

| ppm | parts per million |

| Pr2O3 | Praseodymium(III) oxide |

| Pt | Platinum |

| Rb2O | Rubidium oxide |

| REE | Rare Earth Elements |

| Sc2O3 | Scandium(III) oxide |

| Si | Silicon |

| SiO2 | Silicon dioxide |

| Sn | Tin |

| Ta2O5 | Tantalum pentoxide |

| ThO2 | Thorium dioxide |

| Ti | Titanium |

| TiO2 | Titanium dioxide |

| TREE | Total Rare Earth Elements |

| TREO | Total Rare Earth Oxides |

| U | Uranium |

| U3O8 | Triuranium octoxide |

| V | Vanadium |

| V2O5 | Vanadium(V) oxide |

| W | Tungsten |

| WO3 | Tungsten trioxide |

| Zn | Zinc |

| ZrO2 | Zirconium dioxide |

End Notes

- Rachel Millard, Emissions reach record high despite growth in clean energy, IEA says, Financial Times, March 1, 2024

- International Energy Agency, Minerals used in electric cars compared to conventional cars, May 5, 2021

- International Energy Agency, Minerals used in clean energy technologies compared to other power generation sources, May 5, 2021,

- McKinsey & Company, Bridging the copper supply gap, February 17, 2023

- U.S. Geological Survey, Mineral Commodity Summaries 2024, January 2024

- BC First Nations Energy and Mining Council, First Nations Critical Minerals Strategy, March 2024,

- First Nations Major Projects Coalition, Critical Mineral Roundtables: Summary of Participant Discussions and Findings

- First Nations Major Projects Coalition, Projects

- First Nations Major Projects Coalition, Spirit of the Land: The Indigenous Cultural Rights and Interests Toolkit

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: